How Net Retention Impacts Valuation for Public Software Companies—and What Private Companies Can Learn

In today’s economic climate, retention is everything: Software companies with Net Revenue Retention (NRR) rates above 120% are trading at a remarkable 63% premium over the market median. Why? Because in a world where growth is uncertain, retaining and expanding existing customers is the ultimate competitive advantage.

As desirable as growth is, it is important to remember that not all growth is equal. While rapid customer acquisition can boost top-line numbers, new customer acquisition can be costly and unpredictable and possibly mask underlying retention issues. Growth driven by expanding revenue from existing customers, on the other hand, is often more valuable, as a high NRR indicates product stickiness, customer satisfaction, and efficient scaling.

The difference pays off in higher valuations: Companies that can retain and grow within their customer bases, particularly in the face of a recession, are rewarded with higher multiples.

Understanding and optimizing NRR has become crucial for software companies looking to drive sustainable growth and attract buyer and investor interest. In this article, we will explore NRR in depth, examining its role in public software companies and sharing takeaways for leaders and executives.

What is Net Revenue Retention Rate?

NRR rate is the percentage of revenue retained from existing customers over a specific period (typically a year), including upsell and cross-sell revenue, downgrades, and cancellations/churns. By enabling companies to measure their YOY change in recurring revenue, it provides insight into customer loyalty and the overall health of a business.

A critical KPI, NRR indicates a software company’s ability to both retain its customers and keep them engaged by expanding their usage and adoption of the product. A high NRR is evidence of strong customer relationships, predictable revenue, and the potential for compounding growth, all which appeal to buyers and investors.

A low NRR, on the other hand, raises concerns about customer satisfaction, product-market fit, and future growth prospects. It also indicates that a company will need to expend more resources just to maintain its growth rate, let alone increase it.

For a useful visual, imagine two companies as boats on a lake. Each boat holds the same number of people, and each rests at the same water line (ARR growth). In Boat A, however, the crew is frantically bailing water to stay afloat. Boat B, on the other hand, maintains its buoyancy while the crew goes about its normal business. Boat A represents a company with poor net retention, always struggling to replace lost customers just to stay at the same level of growth. Boat B represents a company with strong net retention, easily maintaining its customer base.

For buyers and investors Boat B is the clear favorite: It is less risky and more likely to provide returns.

WATCH NOW: Craft a Winning Pricing Strategy to Maximize ARR Growth and Valuation

Net Retention in Public Software Companies: Insights from the SEG SaaS Index

We recently began tracking Net Revenue Retention information in our SEG SaaS Index™, which tracks the performance of 120+ publicly traded software companies. The Index is updated quarterly to reflect changes in business models, acquisitions, IPOs, and financial data availability.

Leaders and executives can use our online SEG SaaS Index™ tool to analyze various financial and operational indicators that provide insights into market trends and company performance.

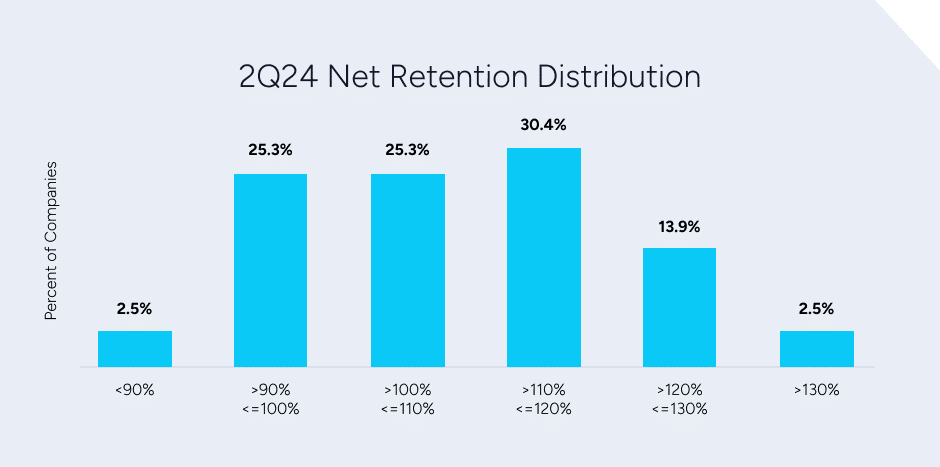

Currently, 67% of companies in our Index report their Net Retention figures, making NRR the most commonly shared retention metric among public software companies—and a valuable addition to our research. All the charts below are representative of companies that have shared their NRR.

We slice the data to examine:

- Distribution of companies by Net Retention cohorts

- EV/TTM Revenue by Net Retention buckets

- Net Retention by company size

- Net Retention by product category

These insights offer valuable guidance for software executives in benchmarking their company’s performance and setting strategic goals.

Public Software Company Net Retention and Its Impact on Valuation

It should be clear by now: NRR is a key metric for evaluating software companies, as it reflects their ability to retain and grow revenue from existing customers. Companies with strong NRR demonstrate product stickiness and effective upselling strategies, which reduce investor risk and suggest the potential for sustained growth. These factors make high-NRR companies attractive to investors and buyers, often resulting in higher valuation multiples.

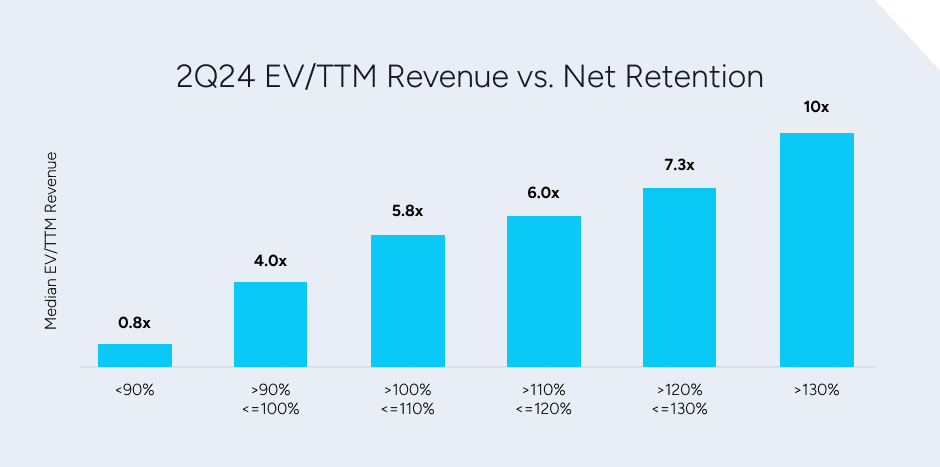

Our 2Q24 SaaS M&A and Public Markets Report reveals a strong correlation between Net Retention Rate (NRR) and company valuation in the public software market:

- 72% of the companies in the Index that reported NRR had Net Retention of >100%. In contrast, the 28% of companies with less than 100% Net Retention saw a paltry median EV/TTM revenue multiple of 3.1x, a 46% discount to the total Index median of 5.7x.

- Each subsequent cohort sees improving EV/TTM Revenue multiples as net retention increases. The 16.5% of companies with >120% net retention had a median EV/TTM Revenue multiple of 9.3x, representing a 63% premium to the total Index median of 5.7x.

Distribution of Companies by NRR Buckets

EV/TTM Revenue by NRR

EV/TTM Revenue by NRR

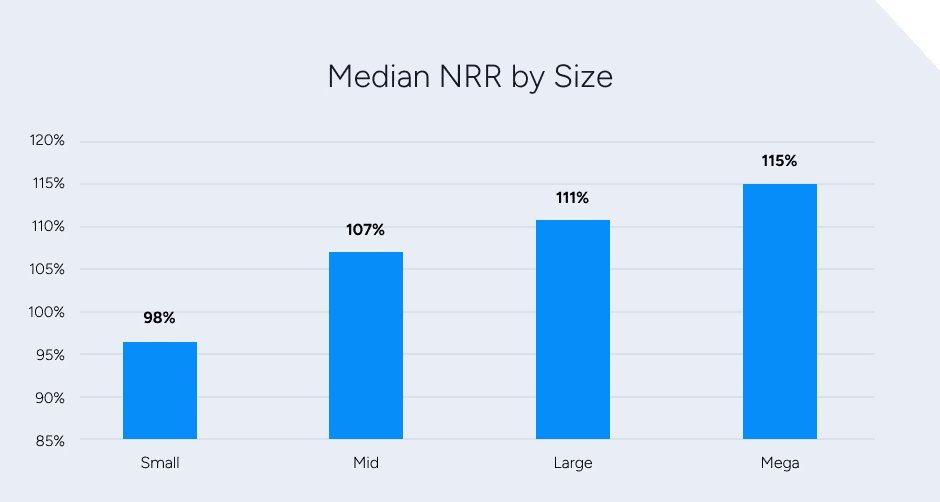

Net Retention by Company Size

Net Revenue Retention varies significantly by company size, reflecting differences in customer bases, growth strategies, and operational stage. NRR generally becomes more stable as companies grow, thanks to improved retention strategies, increased resources, and broader market presence.

Here is a quick look at how size impacts NRR:

Small Public Companies (<$250M TTM Revenue)

Smaller software companies typically experience more volatile NRR. In part, this is because their smaller customer base means each customer has a larger impact on overall retention. A relatively small number of lost contracts can disproportionately impact NRR.

In addition, smaller companies are often in the earlier stages of growth and may prioritize rapid customer acquisition over retention, which can lead to fluctuating retention rates. They may also lack refined upsell and retention strategies, further contributing to NRR variability.

Mid-Sized Public Companies ($250M – $500M TTM Revenue)

NRR typically begins to stabilize as companies scale up their operations and expand their customer base. At this stage, companies often start to implement more structured retention and customer success strategies, including dedicated teams and automated processes to drive upsells and reduce churn. However, they may still face challenges in scaling these efforts efficiently across diverse customer segments.

Large Public Companies ($500M – $1B TTM Revenue)

Thanks to a broader and more diversified customer base, large companies usually have a more predictable NRR. Companies in this range typically have mature customer success programs and refined strategies for upselling and cross-selling to existing customers. The larger volume of customers means that losses are more likely to be offset by expansion within the existing customer base, resulting in a more stable NRR. Their size allows for more resources to be dedicated to retention efforts.

Mega Public Companies (>$1B TTM Revenue)

Mega companies tend to enjoy the highest NRR stability. These companies often have a well-established market presence, strong brand loyalty, and extensive resources dedicated to customer retention and growth. They also tend to benefit from economies of scale, which allow them to offer more competitive pricing, product enhancements, and dedicated support. This leads to high levels of customer satisfaction and minimizes churn, further boosting NRR.

NRR by Size (Small, Mid, Large, and Mega)

* Note: Small = Less than $250M in TTM Rev, Mid = $250–$500 TTM Rev, Large = $500M–$1B in TTM Rev, and Mega = $1B or greater.

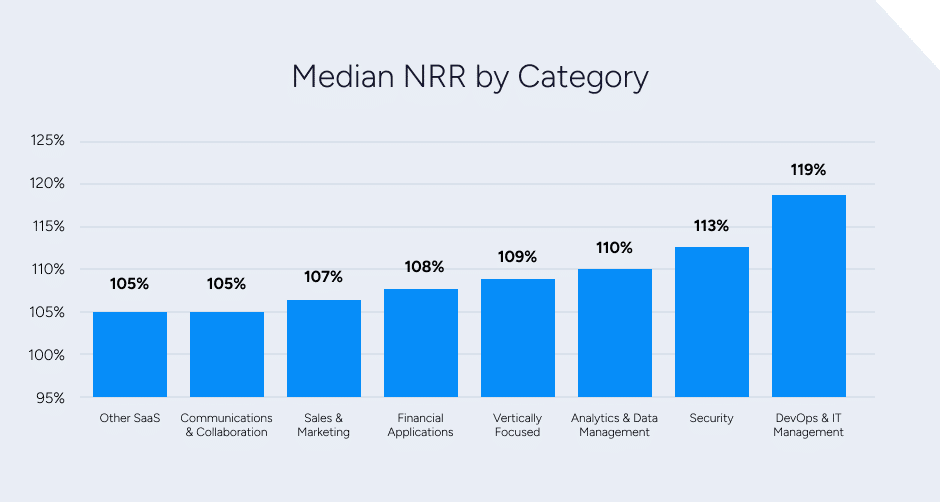

Net Retention by Product Category

Due to varying business needs and market conditions, NRR varies across software product categories. Products crucial for daily operations tend to have higher, more stable NRR, while products with strong competition or frequent changes in customer needs often have lower, less stable NRR.

By examining NRR across categories, we can better understand which types of software products are more likely to retain and grow their customer base, and why.

Note that Human Capital Management (HCM) and Enterprise Resource Planning (ERP)/Supply Chain categories are excluded from this analysis due to limited data points.

DevOps & IT Management

DevOps and IT management tools are increasingly critical for maintaining and scaling modern IT infrastructure, particularly as businesses accelerate their digital transformation efforts. The mission-critical nature of these tools, which are essential for operations and security, contributes to strong customer retention and expansion revenue.

It is no surprise, then, to see this category’s essential role reflected in high NRR rates. At 119%, Dev Ops & IT Management boasts the highest category NRR, with companies like Cloudflare and Datadog leading the way.

Security Software

Security software’s average NRR is a robust 113%, underscoring its essential role in protecting organizational data and providing effective security measures in the face of ever-evolving cyber threats. The necessity for continuous updates, strong customer lock-in, and frequent upsell opportunities (such as new security features or compliance tools) drive higher retention rates in this category.

Financial Applications

Companies in this category experience steady retention rates due to their necessity for operations but can be impacted by price sensitivity and competition. Financial Applications play a crucial role in managing company finances, compliance, and transactions. However, they are also subject to competitive pressure from numerous players offering differentiated or lower-cost solutions. The category maintains an average NRR of 110%, indicating the tension between its operational importance and the realities of a crowded marketplace.

Analytics & Data Management

While Analytics and Data Management tools are crucial for informed decision-making, they face intense competition. Frequent innovation in this space can lead to lower retention rates if customers find more suitable or cost-effective alternatives. An average NRR of 108% demonstrates the balance between the growing demand for data-driven decision-making and the dynamic nature of the market.

Sales & Marketing Software

While these tools are important for driving growth, they are often seen as less mission-critical than core operational systems like ERP or security software. Additionally, companies may switch tools frequently due to changing strategies, new market entrants, or varying budget allocations. The category’s average NRR of 107% reflects this volatility, indicating lower retention compared to more stable, mission-critical categories, but still pointing to overall growth.

NRR by Product Category

*Note – does not include HCM or ERP/Supply Chain. HCM only has two companies with reported NRR in the data set, and ERP & Supply Chain only has one.

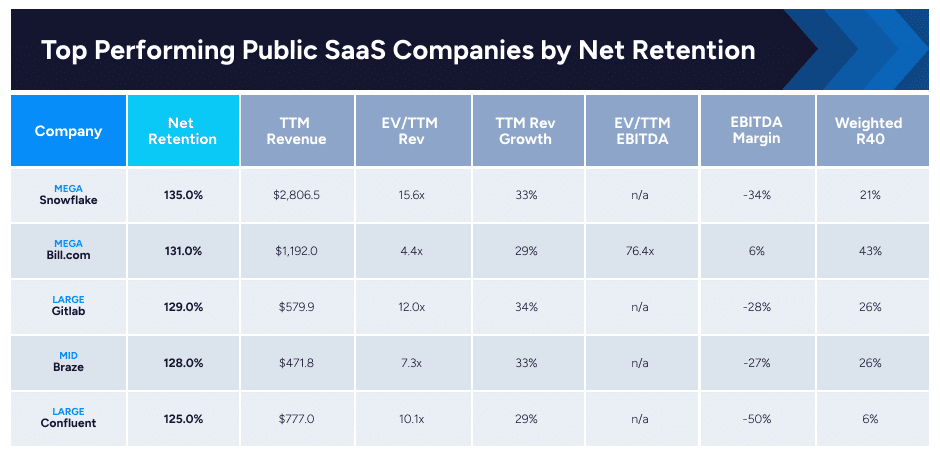

Top Performing Public Software Companies by Net Revenue Retention

The software industry’s elite performers showcase exceptional NRRs, demonstrating their ability to not only retain customers but also significantly expand revenue from existing accounts. Companies like Snowflake (135% NRR), Bill.com (131% NRR), and GitLab (129% NRR) lead the pack, followed closely by Braze (128% NRR), Confluent (125% NRR), and Adobe (125% NRR).

The market rewards these high-performing companies with premium valuations. Snowflake, for example, commands an impressive EV/TTM revenue multiple of 15.6x, significantly above the software market median. Similarly, GitLab enjoys a 12.0x EV/TTM revenue multiple. These elevated multiples reflect investors’ confidence in these companies’ ability to drive sustainable growth from their existing customer base.

The importance of a high NRR is further emphasized by market trends. According to our quarterly data, 56% of companies with over 120% net retention trade in the upper quartile of the Index, and more than 80% trade above the broader Index median. This underscores the premium buyers and investors place on companies demonstrating strong customer retention and expansion capabilities.

These top-performing software companies illustrate the powerful impact of high net retention on valuation and growth potential. Their success provides valuable lessons for other software companies aiming to improve their NRR and, consequently, their market position and valuation.

These high-performing companies have several factors in common that contribute to their high NRR:

Product-Market Fit and Mission-Critical Offerings

When a product becomes integral to a customer’s core operations, it creates ‘stickiness’ that both enhances retention and opens opportunities for upselling and cross-selling. The result: low churn and high expansion rates.

Here are some examples of the essential services that top-performing companies provide:

- Snowflake provides an essential, scalable data platform for Analytics and Management.

- Bill.com offers critical financial process simplification for SMBs.

- GitLab delivers comprehensive DevOps solutions vital for software development teams.

- Adobe remains a leader in digital media and marketing, with products deeply integrated into creative and business workflows.

Effective Upsell and Cross-Sell Tactics

The top performers excel at expanding their footprint within existing accounts. Snowflake’s platform, for example, helps drive its NRR by naturally encouraging customers to increase usage over time. Adobe’s suite of creative and marketing tools helps boost its NRR by providing numerous cross-sell opportunities.

Strong Customer Success Focus

High-NRR companies prioritize customer success, often employing dedicated teams and data-driven strategies to ensure that customers extract maximum value from their products. This focus on customer success promotes long-term loyalty and account expansion.

How Software Executives & Leaders Can Use This Information

For private companies, public market valuation trends can serve as valuable benchmarks. A prime example is the strong link between NRR and valuation multiples, as investors across both public and private markets look for similar signs of growth, stability, and profitability.

Knowing that public software companies with NRR above 120% command a 63% premium over the median valuation multiple, for example, helps private company leaders understand the performance levels they need to achieve similar premiums. This alignment helps them prepare for potential future IPOs and makes them more appealing targets for acquisitions or private equity investments.

It is important to understand, of course, that private company valuations typically come at a discount to their public counterparts due to factors such as lower liquidity and higher perceived risk. Private companies should adjust their expectations accordingly when comparing themselves to public market benchmarks to account for company-specific factors and variables such as market conditions.

To better position themselves, private companies should focus on improving key areas that public markets value most. These strategic actions include:

- Optimizing NRR: Implement strategies to retain and expand revenue from existing customers.

- Improving Gross Margins: Focus on operational efficiency and pricing strategies to enhance profitability.

- Reducing Churn: Invest in customer success initiatives to minimize customer loss.

- Demonstrating Scalable Growth: Show the ability to grow efficiently while maintaining or improving key metrics.

Remember that while public market data provides valuable insights, private companies should use this information as a guide rather than an absolute benchmark. Executives & leaders should consider the unique aspects of their business and market position when setting goals and valuations.

Practical Steps for Software Leaders and Executives

The following are practical steps you can take to improve your NRR and align your company’s performance with that of top-tier public software companies.

1. Set NRR Goals

When setting NRR goals for your company, aim for a minimum benchmark of over 100%. This indicates that your company is not only retaining its existing customer base but also expanding revenue from these customers.

To truly stand out and align with the upper quartile of public software companies, target an NRR of 120% or higher. This level of performance demonstrates strong customer relationships, effective upsell strategies, and a product that delivers significant ongoing value to customers.

2. Balance ARR Growth and Retention Correlation

There is a complex yet strong correlation between ARR growth and NRR. Companies with higher NRR tend to experience stronger ARR growth, creating a virtuous cycle of expansion.

3. Set Sector-Specific Benchmarks

While general NRR benchmarks are useful, consider your sector when setting goals. Aligning your NRR goals with sector-specific benchmarks allows you to set ambitious yet realistic targets that reflect your market’s unique characteristics. This approach demonstrates strong performance to potential investors and acquirers familiar with your specific software category’s standards.

4. Adopt a Data-Driven Approach

Informed decisions are crucial for success. It is essential to leverage both public market trends and your company’s internal performance metrics to guide your strategic choices. Regularly monitor key benchmarks such as NRR, ARR growth, and sector-specific metrics for a comprehensive understanding of your company’s position in the market and to identify areas for improvement in your retention and expansion strategies.

5. Utilize SEG Resources to Drive Your Software Company’s NRR

As the market continues to evolve, companies that prioritize customer retention and expansion will be best equipped to thrive, attract investment, and achieve premium valuations. By understanding NRR and implementing strategies to improve their own retention rates, private company software executives and leaders can position their businesses for long-term success.

To stay ahead in the rapidly evolving software industry, it is crucial to stay informed about market trends. We invite you to check out SEG’s resources for executives and leaders. The SEG SaaS Index™, for example, provides insights into valuation trends, growth rates, and other key metrics for public software companies. Use it to benchmark your company’s performance and understand market expectations.