Why SaaS Companies Need to Increase Focus on Customer Retention

The pursuit of new customers often steals the spotlight at SaaS businesses, but many are leaking revenue through churned customers.

Real growth comes from doubling down on existing customers. SaaS companies with high retention rates grow more efficiently and command stronger interest and higher multiples in M&A.

Customer Retention vs. Acquisition in SaaS

Acquiring new customers is exciting; it grows your logo count, boosts ARR, and creates momentum. But if your customers are churning as fast as they come in, your business won’t be sustainable. Consider this:

- Cost: Servicing an existing customer costs far less than acquiring a new one.

- Time to value: When the customer already knows the product, they’ll see value faster. New customers require onboarding, education, and support ramp-up.

- Impact on valuation: While new customers add growth potential, retained customers prove product-market fit, increasing multiples.

- Revenue impact: New customers increase revenue; existing customers grow over time with renewals, expansions, and upsells.

- Investor perception: Adding new customers shows the effectiveness of your sales and marketing team. Keeping customers signals stickiness and future profitability.

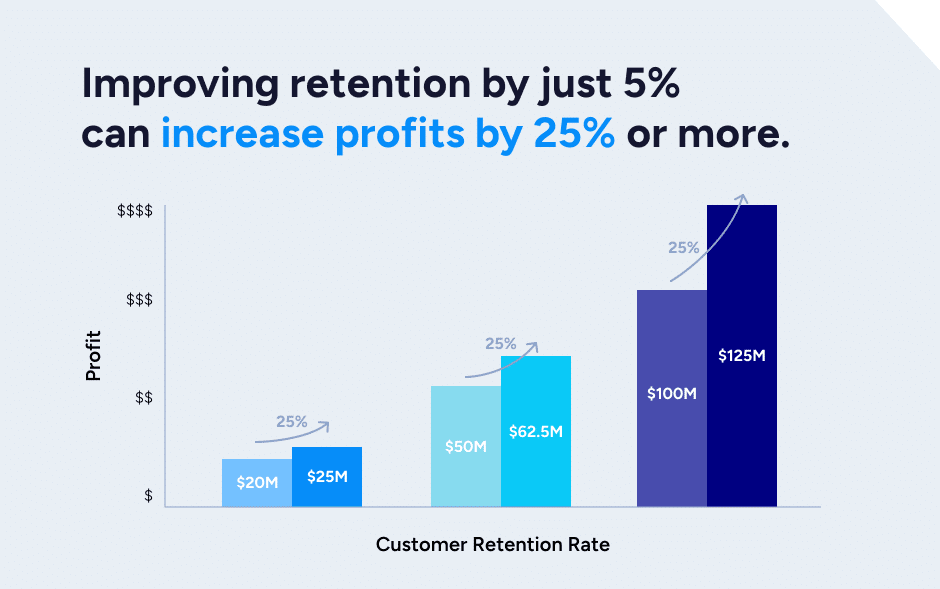

Improving retention by just 5% can increase profits by 25% or more, according to Bain & Company research. In M&A, a business with strong customer retention is considered less risky and more scalable.

So, while it’s important to invest in new sales, SaaS businesses need to give equal or more weight to customer retention. How can you improve customer loyalty and reduce churn? In this article, we share actionable strategies and insights from three experts:

- Annie Zelm, Content Department Director, Kuno Creative

- Alan Gonsenhauser, Principal and CEO, Demand Revenue

- Zach Luburgh, Principal Account Executive, Hubspot

SaaS Customer Retention Strategies

Create a strong customer success team.

Customer success teams often default to reactive support. But treated strategically, they can drive revenue, retention, and higher valuation.

Companies that treat customer success as more than a cost center see stronger renewals and deeper relationships. Those that don’t struggle with churn, weak customer relationships, and lower enterprise value. To get there, SaaS companies need:

- Clear customer success metrics tied to retention and revenue

- Segmented support models based on customer size and needs

- A standardized onboarding journey to help customers see value quickly

- Automation and tools that free CSMs to focus on high-value interactions

- Cross-functional alignment with product, sales, support, and marketing

“Ensure a culture of loving customers and have customer success folks be their advocates. Have an ongoing relationship, now just before renewal times. Ensure customers continuously use your applications and love the support they are receiving from your firm,” Alan says.

Track the right KPIs.

Zach recommends setting retention targets for renewal managers (such as 80%-90% gross renewal retention). But metrics matter across the board.

Key metrics include:

Net Revenue Retention (NRR): SaaS businesses with an NRR above 120% are earning valuations more than double the industry median, according to our Annual SaaS Report. It reflects upsells, cross-sells, and expansions. That means that your customers aren’t just staying; they’re also spending more.

Gross Retention Rate (GRR): A GRR strips out expansions and provides a purer view of churn than NRR. It gives direct insight into a product’s stickiness and mission-critical nature, two important attributes that strategic buyers and investors seek in M&A targets. But 28% of CEOs still don’t track gross revenue retention, a blind spot in today’s market.

Customer lifetime value to customer acquisition costs (LTV:CAC): The LTV:CAC ratio compares customer lifetime value (LTV) to the cost of acquiring them (CAC). A strong LTV:CAC signals healthy margins and efficient growth, both important to buyers and investors.

Customer churn: Churn is a measurement of the customers a company loses over a period of time. For software businesses, churn generally refers to when subscriptions are canceled or decreased (in dollars spent). A low churn rate signals that you’re meeting customer needs and keeping revenue steady or growing, while a high churn rate may indicate gaps in onboarding, support, product value, or competitive positioning.

ARR growth: Annual recurring revenue (ARR) reflects the strength of your subscription model and your ability to scale it.

Learn more about the metrics that buyers and investors look at when valuing SaaS businesses.

Focus on customer experience.

If you don’t know what concerns customers have after they buy, what’s stopping them from using more of your product or service, or why they may be canceling services, stop and find out, Annie says. Interview customers who renewed and those who left, and then compare themes.

“Have the customer service team or sales team check in with customers every 90 days,” Zach says. “Provide exceptional customer service to help your customers with whatever comes up, and turn them into promoters of your business.”

Customer experience should be part of your company’s DNA: “Ensure the culture is to love customers and ensure the entire post-sale customer journey supports that from the initial onboarding of new customers,” Alan says.

Net Promoter Score surveys, which ask how likely a customer is to recommend your product, can be a starting place. But Alan stresses the importance of understanding why customers churn. “Peel back the churn onion layers into controllable and uncontrollable elements, and work the controllable areas.”

Loyalty also deserves recognition. Consider referral programs, branded swag, mentions on social media, and personal thank-yous to reinforce the relationship.

SEG’s Commitment

At SEG, we know something about keeping clients happy. We have had an 93.8% first-pass success rate since January 2021, compared with an industry average of less than 30%, according to Exit Planning Institute. In fact, our clients are still seeing strong interest from buyers and investors.

If you’re thinking about an exit, now is the time to strengthen the retention metrics that buyers care most about. We’ll help you uncover what’s holding you back and guide you through improvements that will increase valuation. Reach out to our team.