SaaS Multiples 2024: What Does the Future Look Like for M&A Market Valuation?

The following content has been updated as of December 2023.

While the software M&A market feels the impact of some of the same macroeconomic forces affecting public companies, it’s important to consider the two markets experience separate trajectories. As such, the software M&A market outlook is still strong overall.

Software Equity Group closely monitors M&A activity, historical trends, and insights from the investor and strategic buyer community to paint a more complete picture of what’s happening.

In our latest State of SaaS M&A: Buyers’ Perspectives survey report, private equity investors and strategic buyers gain further insight into the future of SaaS multiples. Overall, we are seeing that the market remains competitive for high-quality companies, with the caveat that investors are looking for a fairly specific profile.

Here’s a closer look at what the future looks like for the SaaS M&A market and its valuation multiples, with a particular emphasis on annual recurring revenue (ARR). ARR provides a ‘big picture’ view of revenues and the health of SaaS companies, making it a crucial metric for achieving higher valuations and attracting investors.

PE Investor and Strategic Buyer Predictions for SaaS Valuation Multiples in M&A

We asked private equity investors how they expect the M&A market for private SaaS companies to change in 2024. Forty-one percent said they’ve seen either no change or an increase in valuations since 2022 for the high-quality assets they are targeting, and nearly 50% said they expected to see valuations increase in 2024. Among strategic buyers, 76% expect to see valuations rise in 2024, with a third of them believing they will increase by 11–30%.

These expectations may be due to the fact that 75% of buyers and investors have seen a decrease in the number of high-quality assets on the market this year compared to 2022. For companies with the right profile, the market remains competitive. Our survey results indicate that companies with the right profile can still obtain strong outcomes in today’s M&A market —provided they meet the criteria that buyers and investors are looking for.

The Factors Investors and Buyers Say Lead to Higher Valuations

Just as the economy and other factors have changed, the way investors think about companies that will command the highest SaaS multiples in 2023 has also changed.

SEG Principal Austin Hammer notes, “Buyers and investors are looking for sticky, durable software businesses with a certain financial profile. For companies that fit that description, there is a competitive M&A environment that is driving robust valuations.”

Like last year, revenue growth is a top priority for strategics and PEs alike, with 90.5% and 76.7%, respectively, placing it in the top 3 positions for most important valuation considerations. Revenue retention is also crucial, with investors placing gross retention as the second-most important metric after growth. However, while revenue growth and retention are weighted strongly, there is little interest in businesses that are burning significant cash. Qualitative responses from investors and buyers alike indicate that profitability, strong cash flow, and the Rule of 40 are deal breakers—or makers.

LEARN MORE: Gross Retention & Gross Profit: What Our Survey Reveals About These 2 Key Metrics

When we consider why this has shifted, we believe that during times of greater uncertainty, the combination of strong growth and steady profit margins indicates both growth and stability.

As Diamond Innabi, SEG Principal, observes, “In 2023, we witnessed the ‘growth at all costs’ model fall out of favor quickly, seeing it noted by almost half of all buyers, confirming our belief in this new trend.”

Customer acquisition is another critical factor impacting SaaS valuations. Evaluating different acquisition channels, associated costs, and conversion metrics can significantly influence a company’s profitability and growth potential.

Most Active Verticals and Product Categories in SaaS M&A

In tandem with the shift toward strong growth and steady profit margins, we’ve seen an emphasis on M&A targets that offer mission-critical solutions to recession-resistant end markets. In 3Q23, vertically focused businesses comprised 48% of all SaaS deals, up from 42% in 3Q22 and 46% in 2Q23.

The most active verticals last quarter were Healthcare, Financial Services, and Government. Driven by the essential nature of its operations, Healthcare has remained the most active vertical (18%). Other verticals that increased YOY include Energy, Manufacturing, and Legal. Real Estate saw a slight decline, likely driven by concerns in the commercial real estate market and headwinds caused by high interest rates.

On the horizontal side, the highest-volume product categories include Sales & Marketing (17% of horizontal SaaS), Security (13%), and Human Capital Management (10%). Customer acquisition channels are crucial in attracting and retaining customers in these verticals, impacting competition, conversion rates, and overall company valuations.

SaaS M&A Poised to Set Records

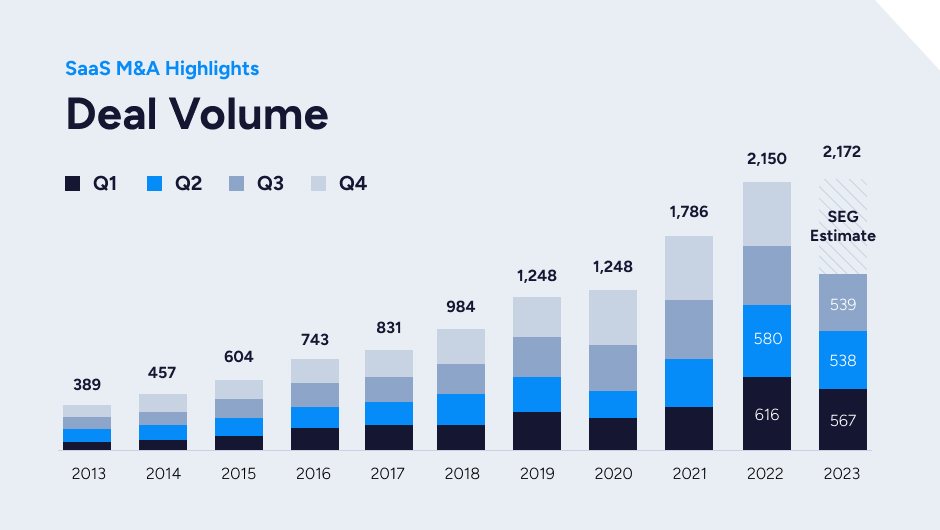

SaaS deal volume in the M&A market remains strong, and it’s likely that 2023 will set a record; it’s already on track to be the second consecutive year that SaaS comprises nearly 60% of aggregate software transactions.

For SaaS founders, this indicates a positive outlook, with the potential for high SaaS valuation multiples due to strong demand, among other factors.

The broader software industry (including on-premise, internet, mobile, and SaaS deals) saw 873 M&A deals in Q3, a 9% increase year-over-year. Private equity-driven deals continued to account for the majority of SaaS M&A, comprising 60% of deals in 3Q23, up YOY from 58% in 3Q22 and in line with the 61% in the prior quarter.

Despite those numbers, 75% of private equity investors say the volume of high-quality SaaS companies on the market has decreased, while 85% see the same or increased competition for assets.

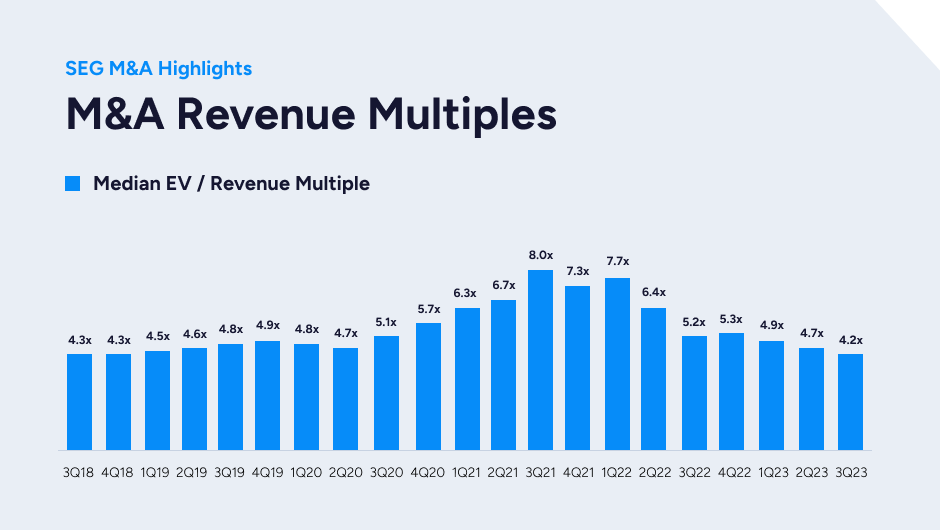

The average SaaS EV/TTM revenue multiple over the past four quarters prior to 3Q23 was significantly higher than the median, confirming that a high volume of low-multiple deals is occurring. Fewer high-quality companies are on the market, but they are achieving strong enough SaaS multiples to maintain the average. This is a direct result of the supply and demand issue caused by CEOs who are hesitant to enter the market.

Public SaaS companies can influence private company valuations, as their growth rates, profitability, and market trends may set benchmarks that influence investor expectations and valuation multiples.

Mission-Critical Companies with the Right Metrics are Seeing High SaaS Multiples

This is potentially great news for profitable companies in mission-critical industries with attractive metrics. Because investors expect fewer companies to meet these criteria for sale, those on the market may be more likely to command a high valuation.

Our team of experienced M&A advisors can offer guidance on maximizing your company’s valuation, determining the best time to sell, and positioning your company as an attractive opportunity for investors. Click here to schedule a time to meet with our team of experienced advisors.