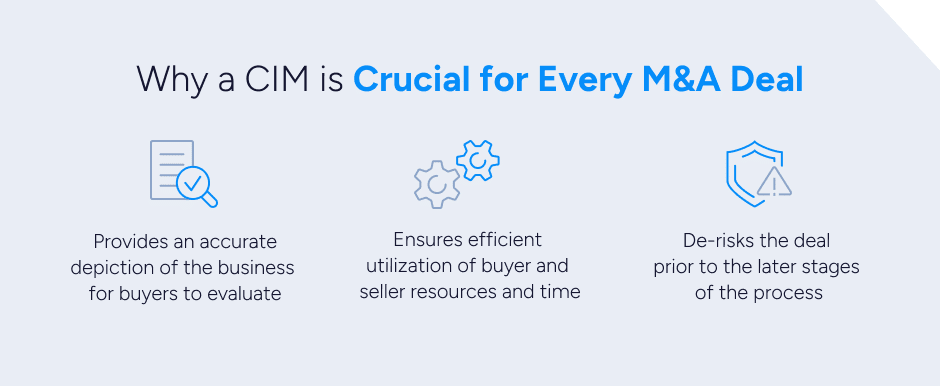

If you’re a software CEO looking to sell your business or raise capital, it’s crucial to understand the importance of a confidential information memorandum, or CIM, a critical step in the preparation phase for any liquidity event.

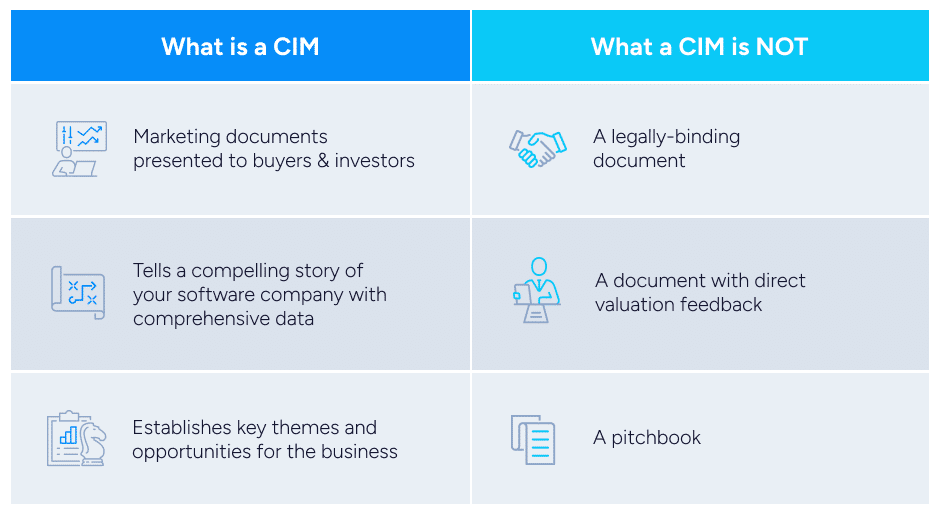

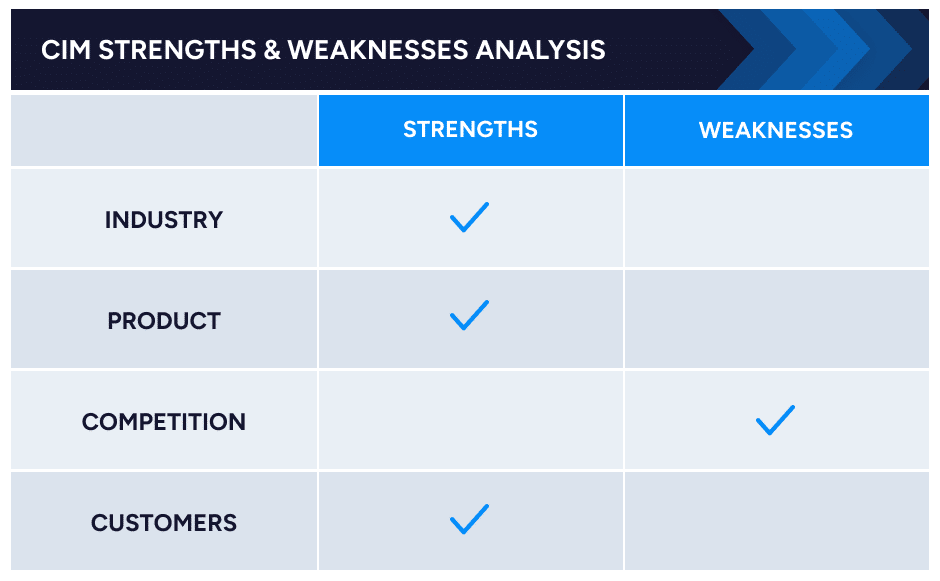

The CIM tells the story of your business: where it came from, what it is today, and what potential it has for the future. It highlights your company’s strengths and opportunities and makes the case, quantitatively and qualitatively, for why the business is an exciting opportunity. Investors and strategic acquirers alike use it to evaluate opportunities and assess their level of interest. In short, the CIM is an essential marketing document that helps position your company and establishes the key themes and opportunities for the business that will guide the rest of the process.

Of course, every business is unique, and the CIM should reflect that. CIM structures vary by sector, product category, and financial profile, among other variables. They are also time-consuming to produce, and properly positioning a business is difficult, especially if you’ve never previously done it. It’s not uncommon, for example, for sellers to think that they can simply repurpose the messaging they use for their customers, not realizing that they need to position themselves specifically for a buyer audience. That’s why having a trusted M&A advisor to guide you through the process is vital for ensuring your company is best positioned to be best received by the buyer community, ultimately leading to a strong outcome.