Energy Software M&A Experts

Powering Success for Energy Software Businesses

The energy industry is undergoing a transformative phase marked by changing customer preferences and widespread challenges. Despite obstacles ranging from understanding customer needs to meeting regulatory expectations, the sector is primed for growth and innovation. With a proven track record of successful engagements, our dedicated team understands the unique challenges faced by both the supply and demand sides of the energy vertical. Specializing in providing best-in-class M&A guidance tailored for the energy software vertical, we are well-positioned to navigate the complexities of this dynamic landscape.

Energy Software Overview

The energy software sector has gained significant traction, mirroring the growing appeal of technology-driven solutions within the energy industry.

Long-term drivers of M&A activity include the critical roles played by AI, data analytics, and connecting SaaS to the physical energy infrastructure, emphasizing the demand for advanced decision-making tools. Sustainability and renewable energy solutions remain focal points, with a strong interest in technologies that enable energy optimization, demand response, and efficient resource management. Further, M&A is driven by regulatory compliance concerns propelled by the stringent regulations within this sector.

Notably, the sector has witnessed solid and consistent M&A activity, indicative of a market ripe for growth. With SaaS solutions only beginning to penetrate the market, there is anticipation of a surge in deal activity as more companies recognize the value of technology-driven solutions in the energy sector. Stay informed about the latest Energy Software M&A landscape trends by subscribing to our newsletter for the latest updates.

Energy SaaS

Quarterly M&A Deal Volume

The Energy Software Sector

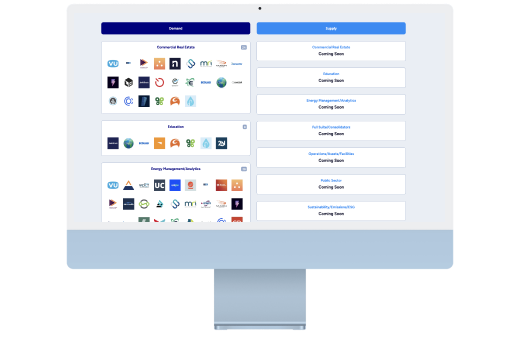

Demand

Energy demand software providers serve energy users across various sectors, such as education, government, real estate, industrial, and more. This category focuses on solutions tailored for energy users with functionalities such as ERP, financial, sustainability, operations/asset management, etc. These solutions ensure that energy consumers can access tailored software solutions that align with their unique demands and contribute to their energy efficiency and sustainability goals.

Supply

Energy supply software includes solutions designed to enhance the efficiency and optimization of energy production and distribution operations. From supply chain management to grid stability and resource optimization, this software category ensures seamless integration for energy producers and distributors.

Energizing the Future: The Strategic Allure of Energy Software Companies for Buyers & Investors

Strategic buyers and investors are increasingly drawn to energy software companies due to the critical role these entities play in driving technological innovation, operational efficiency, and sustainability within the broader energy sector. The foremost theme of the physical and digital world connection stands out as strategic buyers seek to integrate cutting-edge solutions that leverage data from the physical world, artificial intelligence, and automation. Such technological advancements enhance the competitiveness of energy companies by optimizing processes in areas like energy management, risk-based inspection, and digital simulation, ultimately leading to cost savings and improved operational performance.

The emphasis on renewable energy and sustainability reflects strategic buyers’ commitment to staying at the forefront of environmental responsibility, responding to global demands for cleaner energy solutions, and contributing to a more sustainable future.

As 2023 data shows a slightly larger share of deals being driven by strategic buyers (55%) compared to private equity (45%), it is evident that these entities recognize the strategic importance of energy software companies in shaping the industry’s future landscape. Unlike other verticals where private equity dominates, the energy software sector leans more towards strategic buyers, highlighting their focus on integrating and enhancing core operational capabilities. Yet, the near-even mix shows that both strategic buyers and private equity parties increasingly recognize the long-term value and potential returns associated with investments in the energy software sector.

2023 Energy SaaS M&A Activity by Buyer Type

Transformative Trends in Energy Software

Explore the energy software sector’s evolving landscape, driven by legislative changes and sustainability efforts amidst a global shift towards sustainability and renewable energy.

Governments and organizations implement measures to reduce carbon footprints and promote energy efficiency, reshaping the industry and fostering innovative software solutions. The Infrastructure Investment and Jobs Act (IIJA) is pivotal, allocating significant funds to sectors like sustainable transit, EV networks, and modern infrastructure. Sustainability initiatives drive investments in renewable energy, pushing for efficient energy use and comprehensive tracking. Existing and new infrastructures adapt to achieve carbon neutrality, increasing demand for advanced software solutions supporting sustainability goals, highlighting the critical role of energy software in the push towards a greener future.

Explore Key Trends:

Infrastructure Investment & Jobs Act: A $1.2 trillion bipartisan bill boosts sustainable public transit, EV charging networks, modern infrastructure, and power grid updates. It allocates $225 million for building energy code updates, $40 million for energy audits, and $250 million for energy efficiency measures, driving the need for software to manage energy use, track performance, and report sustainability goals.

Sustainability & Renewable Energy Initiatives: Emphasis on mitigating climate change has bolstered investments in sustainable and renewable energy. It pressures infrastructure to be carbon neutral or net-zero and drives the adoption of software that monitors carbon footprints, optimizes renewable resources, and supports sustainability reporting.

Focus on American Energy Independence: Geopolitical instability emphasizes American energy independence, necessitating renewable and alternative energy methods. Companies are increasingly moving towards digitization, IoT, and integrated technology solutions, fueling software development that supports energy independence and resilience.

Inflation and Competition Place Pressure on Costs: Inflation increases energy costs for companies and buildings, mandating minimizing energy costs and being efficient with spending. This benefits energy management systems, utility monitoring and bill metering, building management/smart buildings, and frontline worker technologies, all relying on advanced software solutions for efficiency.