What Does a Successful Due Diligence Timeline Look Like?

Without the right team behind you, going into an M&A due diligence process can feel like being thrown into the boxing ring for the first time against a heavyweight champion — without a coach.

Just as you wouldn’t step into a professional boxing ring without prior training, real-time coaching, and years of expertise, you shouldn’t risk going into due diligence on your own. Diligence is arduous and involves juggling many moving pieces from communication to documentation to keeping your business afloat in the meantime.

In this blog, the M&A experts at SEG draw on over 30 years of experience to share what diligence actually entails, key moments during a due diligence timeline, and why successful diligence is a team effort.

What Happens During Due Diligence?

Due diligence is the audit a potential buyer performs in order to move forward with a merger or acquisition. At this point in the process, buyers can request additional information from sellers to confirm every aspect of the business, can renegotiate the terms of the deal if something comes up, and can even pull out of the transaction if something goes awry.

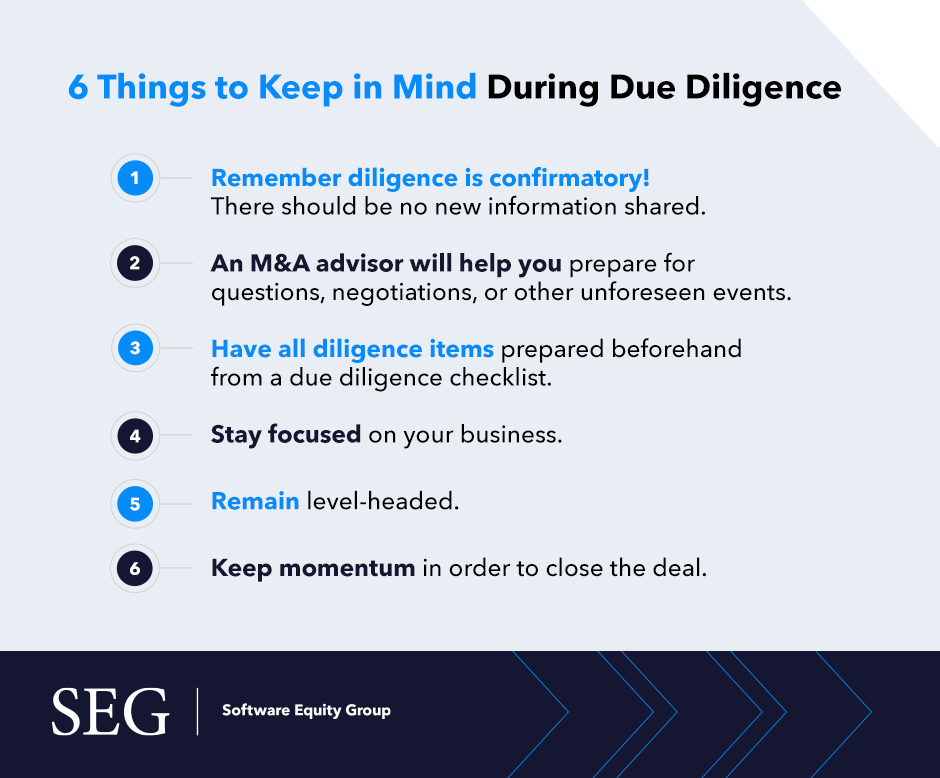

Here are six things to keep in mind about the due diligence stage of an M&A process for software companies:

1. Remember diligence is confirmatory! There should be no new information shared.

The most important thing to remember about any due diligence process is that the steps leading up to diligence are far more important than diligence itself. Diligence is a confirmatory stage — at this point you are dotting i’s and crossing t’s, not disclosing new information that is material in nature.

It is paramount no surprises come up during diligence. By doing the work beforehand to compile and disclose necessary information, software companies can ensure diligence goes as smoothly as possible.

2. An M&A advisor will help you prepare for questions, negotiations, or other unforeseen events.

Buyers want to get the best deal, and they have experience and teams behind them working to make that happen. Therefore, portions of diligence can become opportunities for buyers to negotiate if not properly handled. This is a reality most software companies aren’t prepared to face going into diligence.

For example, if a deal is set at $100 million, there are ways that the price can be adjusted based on what happens in diligence. Net working capital is typically what buyers negotiate, but there can either be an upward or downward adjustment on closing. Coming to an agreement on net working capital comes down to calculations made during diligence.

At SEG, we actively help our clients minimize these types of last-minute negotiations by including definitions of net working capital in process letters during bids and before diligence ever happens. This is where expertise and prior experience can go a long way.

3. Have all diligence items prepared beforehand from a due diligence checklist.

Preparation is key during diligence. By referencing a due diligence checklist, companies can prepare for the massive flood of documentation that buyers will request at the diligence stage. Without this prior preparation, diligence can become delayed and stall the deal.

4. Stay focused on your business.

Unless founders want to be working two full-time jobs at once, this is where it’s extremely important to have a team of M&A advisors behind you during diligence. If business performance slips up leading up to or during diligence, the deal might be affected. Founders need to keep their eyes on their business during diligence.

5. Remain level-headed.

After weeks of meetings, documentation exchange, and buyer negotiations, remaining level-headed during the diligence process is harder than you think. At the diligence stage, it’s all about endurance to cross the finish line.

Losing your cool or getting emotional about the diligence process can rock the boat. Again, this is where having an M&A advisor can help put you at ease about every moving part.

6. Keep momentum in order to close the deal.

Last but not least, momentum is a key component of any successful due diligence process in software M&A. Diligence processes run on run the risk of re-trades, deal fatigue, or buyers moving on. Keeping your due diligence timeline on track is key for a successful outcome.

Due Diligence Timeline

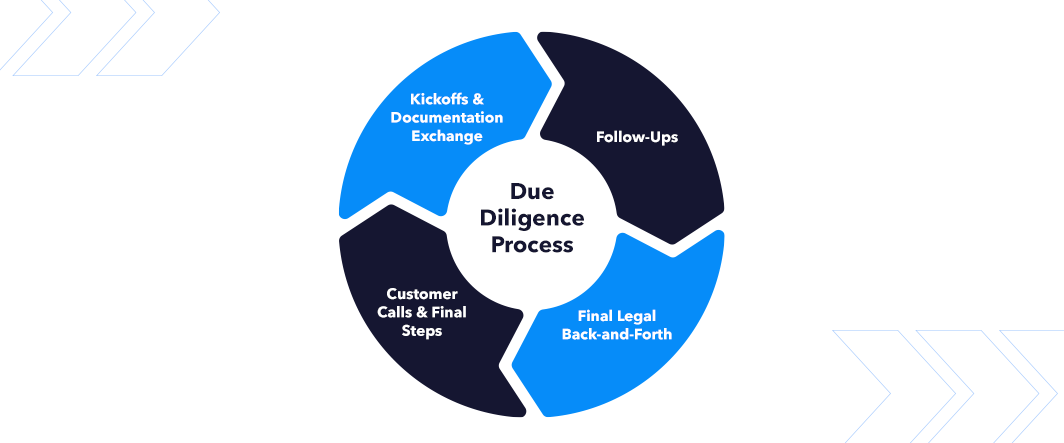

A successful due diligence timeline will vary depending on the company, buyer, and market climate. In the past, diligence took anywhere from 30-90 days. In our current seller’s market, SEG is helping clients close deals in as short as two weeks. However, a more typical timeframe is about five weeks.

To give sellers an idea of what to expect, we break down what happens during each week of the diligence process. Keep in mind, this outline follows an ideal M&A diligence scenario.

5 weeks to close: Kick-offs and documentation exchange

As mentioned above, the purpose of due diligence is to confirm all information a buyer has received up to the present is accurate. At the start of diligence, a buyer will kick off the process by sending a large list of items for the seller to provide. This typically includes:

- Financial, tax, and HR diligence: Including questions and documentation for finances, taxes, employee benefits, etc. Typically, a buyer will bring in a third party to conduct these areas of diligence.

- Business diligence: Since the buyer will either be incorporating the seller or has a vested interest in business operations accelerating after purchase, this portion is typically conducted by the buyer directly rather than a third party on their behalf. This area includes sales and marketing diligence.

- Tech diligence: In software M&A, technology diligence is crucial for any successful deal. Buyers will use third parties to verify systems, code, and intellectual property. If any issues are found with IP or IT during diligence, this is where deals most often fail.

- Legal request lists: Again, buyers will rely on third parties to send a list of required legal documentation about the business at the start of diligence.

2-4 weeks to close: Follow-ups

After the initial flood of requests, the middle part of diligence typically involves fielding various follow-ups and additional requests. During this phase, there is constant back and forth between buyer and seller and third parties involved on both sides.

This is where organizational expertise comes in handy, as well as having a third party to help sellers keep the flow of communication going. Remember, during the diligence kickoff the buyer can often request thousands of documents. Going through them and responding to additional requests is important to keep the deal moving.

1-2 weeks to close: Final legal back-and-forth

During the closing stretch of diligence, finalizing legal documentation such as purchase agreements, disclosures, etc., ramp up. It’s not uncommon for these documents to go back and forth every other day at this point.

1 week to close: Customer calls, final steps

During the final week of a diligence process, several key actions help bring a deal through diligence and to close. These are a few of the most common items, including:

- Customer calls: A buyer conducts calls with the seller’s top ten customers in order. While some buyers will push for these calls earlier in diligence, having a banker like SEG at your side can help companies push to wait until the seller is 99% sure the deal is closing. Having an M&A expert can help guide these crucial conversations by providing expertise like having a call script approved by the seller, giving warm introductions to the buyer beforehand, or framing the conversations as a market study.

- Lender call (if applicable): If a lender is involved, parties will conduct a call to educate the lender on the business and get their approval.

- R&W deal (if applicable): Similar to a lender call, a rep and warranty call presents diligence findings for approval for R&W insurance.

How an M&A Expert Can Change the Game for Due Diligence

In summary, due diligence in software M&A deals is all about prior preparation and finding the right partner to guide you through the process.

An expert helps you enter the metaphorical boxing ring with confidence, knowing that buyers have gone through this process before and will do whatever it takes to get the best deal. Not only can an M&A expert provide key advice, but they can keep the momentum going through diligence so the deal doesn’t stall or fail.

At SEG, we work tirelessly to prepare our software clients before diligence begins in order to get the best outcome possible. We field calls, hit deadlines, and guide our clients through meetings ahead of time. Don’t go it alone – rely on 30 years of experience. Learn more about what services we provide here.