Selling Your SaaS Company? How to Think Like Software Investors & Buyers

The following content has been updated as of January 2024.

You may think pitching your business to potential customers on a regular basis provides the experience needed to win over strategic buyers and private equity investors in an M&A process. As ambitious and challenge-oriented leaders, you may feel capable of running an M&A process yourself. However, this is typically not the case, as selling a software company is vastly different than selling a product or service to customers.

The M&A process is undoubtedly complex, with multiple stakeholders, stages, and layers. It’s critical to approach an M&A transaction with the mindset of a software investor or buyer if you want an optimal outcome.

Viewing your company from their perspective helps you gain essential insights into how to position and market your business. This impacts how you go about staging information for a prospective buyer or investor, the timing of your deal, and more. Continue reading to learn how to think like software investors or buyers and determine what criteria they are looking for in acquisition targets.

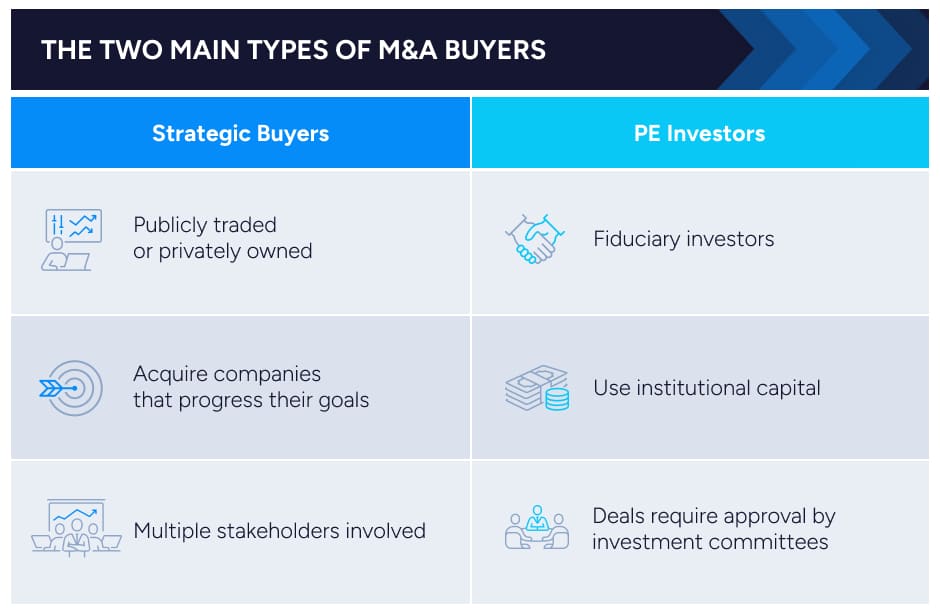

The Two Main Types of Buyers in the M&A Process

The M&A process is designed with multiple checks and balances. Most private equity firms and strategic buyers can’t simply buy or invest in whichever company they choose. They must go through a complex process with numerous gates to get their transaction across the finish line.

M&A transactions are “smart money,” meaning the capital involved comes from institutional investors and experienced financial professionals. As a result of putting their time and knowledge into the transaction, they must follow procedures in order for the deal to go through.

First, let’s look at each type of buyer and how they evaluate an M&A opportunity.

Strategic Buyers

These types of buyers run the gamut; they can be publicly traded or privately owned software companies. Strategic buyers are looking to acquire companies in a way that helps progress their own business goals. They may be weighing whether an acquisition will more efficiently help consolidate market share and reduce their competitive set, add onto or improve their product offerings, or extend into new product types or verticals.

Strategic buyers typically include boards and management teams that require buy-in, as well as a thorough post-transaction integration plan. The buyer’s advisors or backers, if there are any, must also agree to the deal since it involves their capital.

There are multiple, complex layers to a deal with a strategic buyer. It’s a multi-step, multi-stakeholder process. If any part of the M&A transaction is rushed or overlooked, it can be catastrophic. Even after initial approval, the strategic buyer’s legal and financial teams will have to review everything from their own perspective.

For example, the buyer’s product team thoroughly evaluates the selling company’s products, including the software code and tech. A deep understanding of the product is important, given that strategic buyers typically plan to integrate it into their broader offering.

As a seller, you have to clean up your finances, resolve legal issues, and develop a clear business strategy. Assess your technical architecture, code, and other products for any problems and resolve them as needed. Your house has to be in order before you sell your company, or you face complications that could hold up or crash your deal.

Private Equity Firms

The same is true for private equity firms, which are fiduciary investors. These firms aren’t relying solely on their own money to make investments. Instead, they use institutional capital to make investment decisions on behalf of others. PE firms use capital from university endowment funds, state educational investment trusts, pension funds, and high-net-worth individuals, all of whom act as limited partners. Acting as a fiduciary, a PE firm has a duty to perform due diligence for its limited partners. To ensure that they properly respect and adhere to their fiduciary duties, these firms have an investment committee whose sole focus is to screen investments.

This committee meets regularly to screen every potential deal the PE firm is looking at and examine it at every stage of the M&A process until the transaction is closed. The investment committee acts as a consistent gatekeeper throughout the process, and either gives the go-ahead or halts the deal. The committee has the power to strike down any transaction, even if a partner at the PE firm, an analyst, or an entire group at the firm wants to make a platform deal.

READ MORE: The 5 Types of M&A Deals for SaaS Companies

Even if the M&A deal gets through the investment committee, the limited partners still need to agree to fund it and sign off on the deal. PE firms face the pressure to over-perform and buy assets to return a certain amount of capital to their limited partners as part of their fiduciary duty. A PE firm can present an investment opportunity but can’t force the limited partners to agree to it.

Just because a potential strategic buyer or private equity investor likes your company doesn’t mean you can quickly get through all the checks and balances of an M&A process. Changing your perspective to see things from the buyer’s point of view can help you identify positives and negatives that may impact your deal. Strategically showcasing your positives and positioning any cons will help you get through all the gates to the finish line of your transaction.

Position with a Software Investor’s or Buyer’s Perspective in Mind

As a software company executive, you’re probably familiar with positioning your product offering when pitching to customers. Selling your business to an M&A buyer is an entirely different experience. You have to change your perspective and how you talk about your company. Instead of pitching your value proposition to end users, you’ll demonstrate your business’ growth opportunities to a PE firm or strategic buyer.

Buyers and investors in M&A are interested in the efficiency and scalability of your company, so positioning must involve data that demonstrates your sustainability and future growth potential. Key performance indicators (KPIs) like your churn rate, gross retention and profit, and customer lifetime value help you get this message across.

Telling your company’s story from the buyer’s perspective is critical for the success of your M&A transaction. Consider what the buyer/investor wants to know and develop a narrative that includes:

- Where your business came from

- How it’s performing today

- What you expect in the future

- Why you have staying power

- What makes your company different

- Your competitive advantage

Stakeholders and partners on their side must be comfortable with their investment before a deal can go through. They want assurances that the revenue won’t disappear in two years, and they know what kind of growth to expect. Understanding which KPIs demonstrate your efficiency and effectiveness and knowing how to position them in your narrative is essential during the complex M&A process. Knowing what prospective buyers (whether PE or strategic) may ask and having the answers for them keeps you on the right track.

M&A Advisor Tip: Know When and What to Share with Prospective Buyers

Knowing what information to share with potential strategic buyers or private equity investors and when the right time is to share it are critical to the success of your deal. You don’t want to share every detail of your company too early on. You’ll first want to relay your business narrative to potential acquirers. Let them know what you do and help them get comfortable with your industry and the customers you serve. Share the pain points your products or services solve and where your market opportunities lie through your company’s confidential information memorandum (CIM).

After they are familiar with your business, you can move to the second tier of information: financial and business data. This is when you’ll introduce KPIs and internal finances. Lastly, you’ll want to disclose your company’s backend tech details, including information about your tech stack, code, and intellectual property.

Why reveal information in this tiered manner? You won’t pique a PE firm’s interest by telling them every detail of your tech stack at the beginning. Showing them what your end market is, your performance metrics, the opportunity it presents investors, and your position with the software market is information they can use when pitching your business to their investment committee. Introducing potential buyers to information slowly and through tiers informs them in an efficient and predictable way.

How to Attain the Software Investor / Buyer Perspective

Selling your software company is highly challenging, with many different moving parts. Without understanding each distinct stage of the M&A process and the role each plays in your transaction, you’re less likely to meet the goals of your sale. While you might receive a bid from just your high-level P&L statement and a 10-page pitch deck, a strategic buyer or private equity investor won’t be interested in acquiring your business based on that alone.

Selling your company requires grasping the nuances of each M&A stage and providing the correct information. Comprehending why you need to go through the hassle of building your CIM, having an exit strategy, and staging information can make these stages more approachable and ensure you get the timing right.

Partnering with an M&A advisor like SEG means you’ll have someone who knows how to handle each stage of your transaction and can guide you through the process from a seller and buyer point of view. Our experienced advisors provide a non-obligatory strategic assessment for your company with the aim of showcasing how to position and market your company in a way that appeals to buyers. Connect with us to get started.