A great product is only part of what drives success in Education Software M&A. To achieve a strong outcome, you also need insight into EdTech market trends, buyer behavior, and timing. SEG combines sector-specific advisory experience with proprietary research and benchmarking to help you make informed decisions, effectively position your business, and navigate the sale process with confidence.

Why Education Software is Attracting M&A Attention

The education software industry is experiencing steady consolidation, with 339 M&A deals recorded between 2019 and 2024. However, the market’s true potential lies in its rapid growth trajectory. In 2023, the global educational software market reached $23.4 billion and is projected to grow at a robust 8.2% CAGR, soaring to $98.7 billion by 2030.

Education Software M&A Deals (2019 – 2024)

339

Companies on SEG’s Education Software Market Maps

597

Global Educational Software Market Size (2023)*

$23.4B

Global Educational Software Market CAGR by 2030*

8.2%

Projected Global Educational Software Market Size by 2030*

$98.7B

*Source: Future Data Stats

Education Software M&A Activity

Yearly

*Education Software M&A activity above includes B2B software deals where the target’s primary vertical serves the education space.

EdTech Unpacked: K-12 vs. Higher Education

For market analysis, the Education sector is typically divided into two broad categories of B2B software: K-12 and Higher Education (colleges and universities). Many of these markets extend beyond the physical classroom and encompass administrative roles, support services, and a wide range of online and non-traditional learning platforms.

Education Software

K-12 Education Software

This category focuses on tools that support schools, districts, and educators in enhancing student outcomes and streamlining operations. Software solutions include learning management systems (LMS), classroom management platforms, assessment tools, and parent-teacher communication apps. Examples comprise platforms for personalized learning, virtual classrooms, and administrative software that simplifies compliance and reporting.

Higher Education Software

Higher education software addresses the needs of colleges and universities, focusing on both student success and institutional efficiency. Solutions in this space include enrollment management, career readiness platforms, campus operations tools, and advanced analytics for improving retention and graduation rates. Typical examples are student information systems (SIS), financial aid software, and learning analytics platforms.

Continuing Education Software

Continuing education software supports adult learners and non-traditional education pathways, such as professional certifications, online courses, workforce development, and corporate training programs. This segment consists of platforms for course creation, employee training, credentialing, and lifelong learning solutions.

The Types of Buyers and Trends Driving EdTech

The software market is diverse, with each sector having its own set of buyers and trends. Whether you’re looking to exit now or later, being informed about these dynamics will help you determine potential partnerships to propel your company’s growth.

2024 Education Software M&A Activity by Buyer Type

Historical Education Software M&A Activity by Buyer Type

*PE Direct includes private equity firms making platform acquisitions, while PE-Backed Strategic includes all strategic buyers backed by a private equity firm.

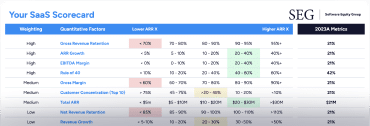

What Drives Higher Valuations in EdTech M&A

Education Software companies that align with what buyers value consistently achieve higher multiples. Factors include strong revenue retention, scalable models, and clear differentiation. Understanding how your business compares to recent deals can reveal opportunities to improve positioning and increase enterprise value. With the right preparation, you can turn market interest into a premium outcome.

Our Track Record in Education Software M&A

It’s time to talk about your company’s future.

Fill out the form and we’ll discuss…

- Multiples and interest

- Buyer dynamics and priorities

- Valuation insights