The Impact of Gross Margin on SaaS Valuations

“Gross margin” is likely a term you’ve heard floating around the SaaS industry, and for a good reason: it serves as an essential metric for businesses in the software space. Sometimes referred to as gross profit margin (GPM), gross margin on sales, or gross margin percentage, gross margin serves as an important means of evaluating your business’ growth potential.

Read more to learn about SaaS gross margin and what it means for your company’s valuation.

Defining SaaS Gross Margin

SaaS businesses consider gross margin an important measuring tool because it simply looks at gross profit as a percent of total revenue.

In short, GPM is the amount available to pay operating expenses and reinvest back into the business. GPM serves as a good indicator of scalability for SaaS businesses and is an important metric investors consider to determine valuation – but more on that later.

SaaS gross margin varies by industry. For example, SaaS businesses produce no physical product, so there is relatively little cost associated with production. This leads to a generally high gross margins for SaaS companies. Conversely, any business that produces a physical product will likely have a lower GPM, as their development expenses are higher as a result of needing raw materials to produce that product.

The cost the company incurs to deliver its solution to its customers is the Cost of Goods Sold, commonly referred to as COGS. COGS is essentially the sum of expenses that come from creating a product or delivering a service. And because of their lack of physical products, SaaS companies are less likely to incur many expenses in their COGS, which in turn affects their gross margin.

Calculating Gross Margin

Gross margin is a function of revenue and COGS and can be calculated with a straightforward formula:

Gross Margin = (Revenue – COGS) / Revenue

GPM is the percent of revenue that exceeds COGS. More specifically, gross margin is the revenue remaining after the direct costs to deliver a company’s product.

Gross Margin as a Signal for Scalability

Gross margin is an indicator of a SaaS company’s financial health and growth prospects. As GPM increases, more money (i.e., gross profit) is available for reinvestment into a company’s operating expenses.

SaaS gross margin differs from profit margin because of its focus on the expenses a company incurs producing and selling an additional unit of its offering. Gross margin helps companies break down the specifics of what it would cost to produce each individual item of its output. Additionally, the formula provides visibility into where SaaS companies might be over-or under-spending so they can stay competitive.

A company with strong unit economics may choose to invest more cash into sales and marketing. A company with customers clamoring for additional modules may decide to invest more into research and development. It’s no surprise valuation is positively correlated to gross margin.

Though it is good at reflecting the overall profitability of an organization, because the cost of producing a product is more concentrated up-front on the R&D side of things for SaaS companies, net profit margin is less likely to show its true scalability.

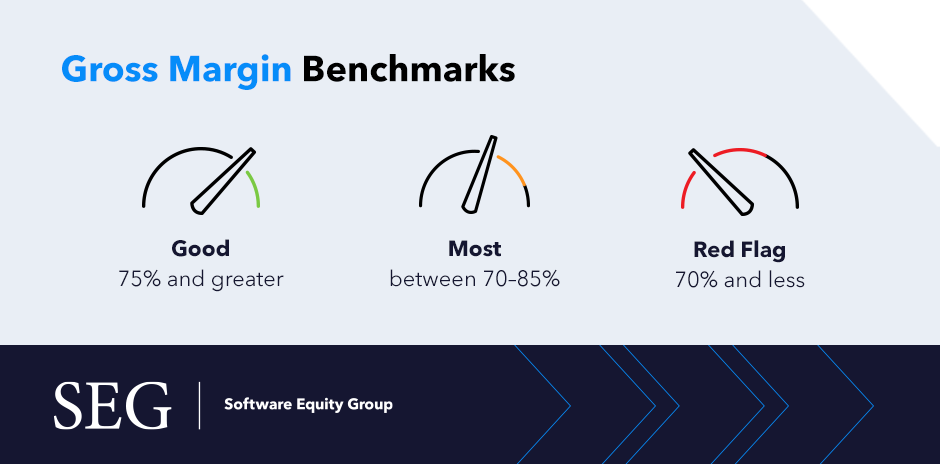

What is a Good Gross Profit Margin?

Gross profit margin is a very important metric financial buyers and PE investors look at when evaluating a business. Based on our experience, a good benchmark gross profit margin for a SaaS company is over 75%. Typically, most privately held SaaS businesses we work with have GPM’s in the range of 70% to 85%. Anything below 70% begins to raise a red flag for us and prompts us to do a deeper dive into several other metrics.

Ben Murray of The SaaS CFO writes that it’s important for SaaS entrepreneurs to understand how and which revenue streams are contributing to a company’s gross margin. “The blend between services, recurring, and any other revenue stream is important.”

It is also important to note we occasionally see SaaS businesses incorporating ongoing services into their business models. While this causes us to look deeper into the company’s scalability, we do often see a favorable tradeoff resulting in exceptionally strong gross retention and net retention.

As expected, public SaaS companies in our SEG SaaS Index with higher gross profit margins continue to be well rewarded by investors.

How GPM Impacts SaaS Valuations

When assessing a SaaS company’s value, investors often talk in multiples of ARR or multiples of revenue. These investors also likely assume a GPM in the range of 75% to 80%.

What happens if an investor compares two similar businesses, except one has an 80% gross margin and the other a 60% gross margin? Hopefully, the investors will toss the ARR or revenue multiple into the trash and focus on a gross profit multiple.

Consider the two SaaS companies below. Assuming all else equal, what is GPM’s impact on valuation?

| Company A | Company B | |

| Revenue | $10M | $10M |

| Gross Profit | $8M | $6M |

| Gross Profit Margin | 80% | 60% |

| Enterprise Value (EV)/Gross Profit | 9.0x | 9.0x |

| Enterprise Value (EV) | $72M | $54M |

Assume Company A is purchased for $72M. As a multiple of revenue, this would be 7.2x. As a multiple of gross profit, this would equate to 9.0x.

Along comes Company B. Because Company B has the same revenue, the belief is the 7.2x comparable multiple is appropriate, so Company B is also worth $72M.

But not so fast! Company B has significantly less gross profit. For every dollar of revenue Company A generates, 80 cents are available for operating expenses. In contrast, only 60 cents of every dollar of revenue generated by Company B is available for operating expenses. Because these are materially different, the better comparable for Company B to use is Company A’s 9.0x gross profit multiple. Doing such yields Company B a valuation of $54M. Not what the shareholders of Company B want to hear! However, if Company B had a gross margin of 95%, it’s likely these shareholders would be more than happy to use a gross profit multiple.

If you have any questions about your SaaS business’ gross margin or COGS, don’t hesitate to reach out.