Understanding SaaS P&L: Improving Operations and Reducing M&A Process Friction

The Profit and Loss (P&L) Statement is a universal fixture of business finance, but it takes on special significance for companies in the Software industry. With their recurring revenue models and unique cost structures, SaaS businesses, in particular, require more than a standard P&L to accurately convey their financial performance.

A well-constructed SaaS P&L can reveal insights executives need to fully understand their business performance and make well-informed strategic decisions. More than that, it plays a critical role in streamlining the M&A process by ensuring transparency and reducing friction with potential buyers.

In this article, we will touch on the nuances of P&L statements specific to SaaS companies and explore how thoughtful financial reporting can enhance both operational outcomes and long-term exit strategies.

Why an Accurate P&L Statement is Critical for Software Companies

When your SaaS company is still in its formative years, it’s understandable that your primary focus is on perfecting your product and winning customers; the nuances of finance and accounting may seem like unwelcome distractions. However, as time goes on, your operation must become more sophisticated to continue growing, requiring a more in-depth understanding of your software company’s financial fundamentals.

In conjunction with other financial statements, the P&L can help you decide which parts of your business are performing well and where adjustments may be necessary. Data from the P&L also forms the basis for other vital metrics, such as:

- Revenue Growth

- Gross Margin

If the P&L is unreliable, none of the other metrics can be trusted, and your ability to make confident business decisions is compromised.

Furthermore, poorly recorded data in your P&L creates drag in your business. In other words, it can overly complicate and delay financial reviews and other processes while your team works to sort out the numbers. In the case of a merger or acquisition, insufficient P&L data could disrupt the due diligence process or even derail the deal altogether.

The Three Key Components of a P&L Statement

While there is no mandatory structure for a P&L statement, it will generally include three main categories:

- Revenue. SaaS businesses should separate revenue into three buckets:

- Recurring Revenue (typically from contract-based subscriptions)

- Transactional Revenue (such as reoccurring revenue from usage-based pricing)

- Non-Recurring Revenue (obtained from one-time fees, services, or other non-core activities)

- Cost of Goods Sold (COGS). COGS should include any direct costs tied to delivering your software, such as the cost of servers, hosting fees, and support activities.

- Operating Expenses. This includes ongoing costs to run the rest of your business that are not directly related to producing and delivering your software. For example, operating expenses (OPEX) could include rent, marketing, and administrative expenses.

By meticulously recording income and expenses in their proper places, you can arrive at more accurate calculations of Gross Profit and Net Profit.

LEARN MORE: Accurately Calculating EBITDA can Uncover Hidden Profitability.

Avoiding Common Pitfalls in P&L Management

Beyond the need for meticulous record-keeping, Software Executives should also be careful to avoid some common missteps in accounting practices. In our work advising software businesses, there are two specific mistakes we see quite often:

1. Using Cash vs. Accrual Accounting

Cash-based accounting records revenue as it is received and expenses as they are paid out, and some private companies prefer this method for its clarity and simplicity. SaaS businesses, however, are usually better served by accrual accounting. As opposed to cash accounting, accrual accounting recognizes revenue when services are delivered (which may be well before or after payment). That difference can significantly impact the books of SaaS businesses that rely heavily on subscriptions. More than painting a clearer picture of the company’s recurring revenue and cash flow, accrual accounting (which is required for public companies) is also the method used by most potential buyers, so it’s what they will want to use in an acquisition scenario.

2. Failing to Exclude Pass-Through Revenue

Some SaaS businesses may have pass-through revenue because the income collected is automatically “passed through” to a third party, such as a business partner, and no margin is achieved. Including pass-through revenue on the P&L presents a less accurate depiction of the company’s profitability, making it appear as though the company has higher revenues but lower margins. In an acquisition, this may lead buyers to assign a lower valuation to the company.

3. Failing to Categorize Revenue Correctly

It’s critical to categorize revenue properly to reflect the true nature of the business’s income streams. For example, incorrectly labeling all revenue as recurring—without distinguishing non-recurring revenue—can create misleading financial statements. Buyers and investors expect a breakdown of recurring versus non-recurring revenue to better understand the business’s sustainability. Accurate categorization ensures the company is fairly represented, and it avoids complications in valuation or negotiations during a liquidity event.

4. Failing to Include Customer Support and Implementation Labor in COGS

One common mistake we encounter is the improper classification of labor costs related to customer support and implementation. Often, companies bury these labor expenses within operating expenses rather than correctly including them in COGS. Because these expenses are directly tied to delivering the product or service, they belong “above the line” in COGS to accurately reflect gross margins. Misclassifying these costs can inflate reported margins, leading to unrealistic expectations from buyers or investors and complicating financial analysis. Ensuring these costs are captured in COGS provides a clearer picture of the company’s profitability.

Real-World Impact of Accurate P&L Statements on Valuation

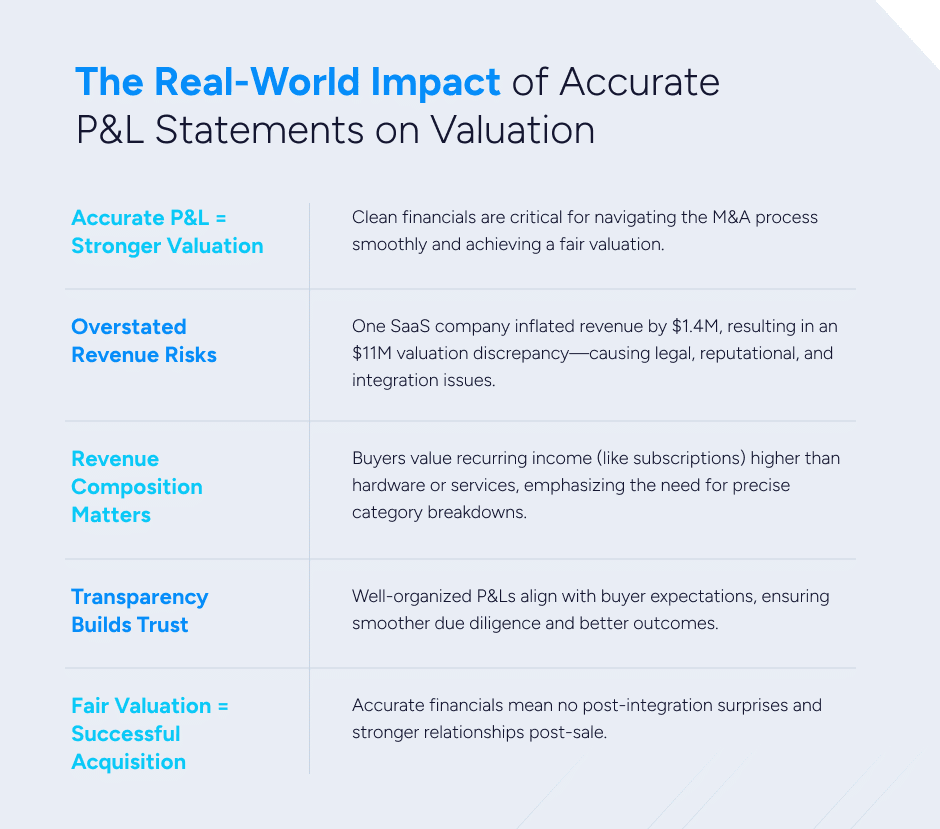

While a strong P&L certainly helps you run a tighter ship at any stage of the business lifecycle, it’s essential when it comes to valuing your business for a potential sale. Above all, a clean and accurate P&L lays the foundation for a successful M&A process.

Artificially inflated revenue numbers (whether done intentionally or not) could lead buyers to assign your company a higher valuation than they would have, given more accurate books.

In one example, a SaaS company was found to have overstated its revenue by $1.4 million, leading to an $11 million valuation discrepancy. While, at first, the higher valuation might not seem so bad for the acquired company, there can be consequences later in the form of strained relationships, legal challenges, reputational damage, and, ultimately, failed integration.

Potential buyers will also be interested in revenue composition, which is another reason an accurate P&L is important.

Not all revenue streams are considered equal in the eyes of buyers, as certain types of income will hold more value for different types of companies. For example, hardware and services sales are typically less valued than subscriptions and long-term contracts, which tend to provide more predictable income and better margins. Ensuring your P&L reflects your performance in each revenue category can make a difference in how much buyers are willing to pay for your company.

Buyers and third-party diligence providers will appreciate consistently well-presented information that is in line with their expectations and that will help make the proceedings as smooth and efficient as possible.

Ideally, your company will receive a fair valuation based on a realistic depiction of its financial health, and the buyer will get the new addition it needs with no post-integration surprises.

Need Guidance on Your P&L Before an Exit?

Preparing your P&L for an acquisition isn’t just about numbers—it’s about presenting the right story to unlock value. At SEG, we’ve spent over 30 years helping Software Executives optimize their financials, streamline operations, and position their companies for successful exits.

If you have questions or want an expert review of your P&L, let’s connect. We’re here to help you prepare for sustainable growth and a smooth M&A process.