COGS for SaaS Companies Explained: Formula, Calculation, and Tips

While Cost of Goods Sold (COGS) seems straightforward on its surface, Software Executives often miscalculate this important accounting formula.

COGS is a key metric Private Equity investors and Strategic Buyers use to evaluate software companies for a liquidity event. Specifically, investors use the Cost of Goods Sold formula as an important factor in assessing a company’s scalability and financial stability.

The components of COGS vary by industry, and companies often must determine which expenses to include on their own. For software companies in particular, the costs incurred to deliver their solutions to their customers can seem hard to pin down.

Read on to learn all you need to know about SaaS COGS.

What is Cost of Goods Sold?

In layman’s terms, COGS is simply the sum of all the costs a company incurs to deliver its product or service to its customers. For most types of businesses, COGS is a variable cost that grows as it sells additional units. In a business selling a physical product, for example, the amount spent on raw materials increases as more units are sold.

However, one factor unique to software companies is that COGS does not necessarily increase proportionally with sales growth. Because of the subscription-based business model of most SaaS companies, they typically don’t have to produce anything new each time a subscription is sold. Therefore, there may be little to no increase in COGS each time the company gains a new customer.

Expenses to Include (and Exclude) in COGS

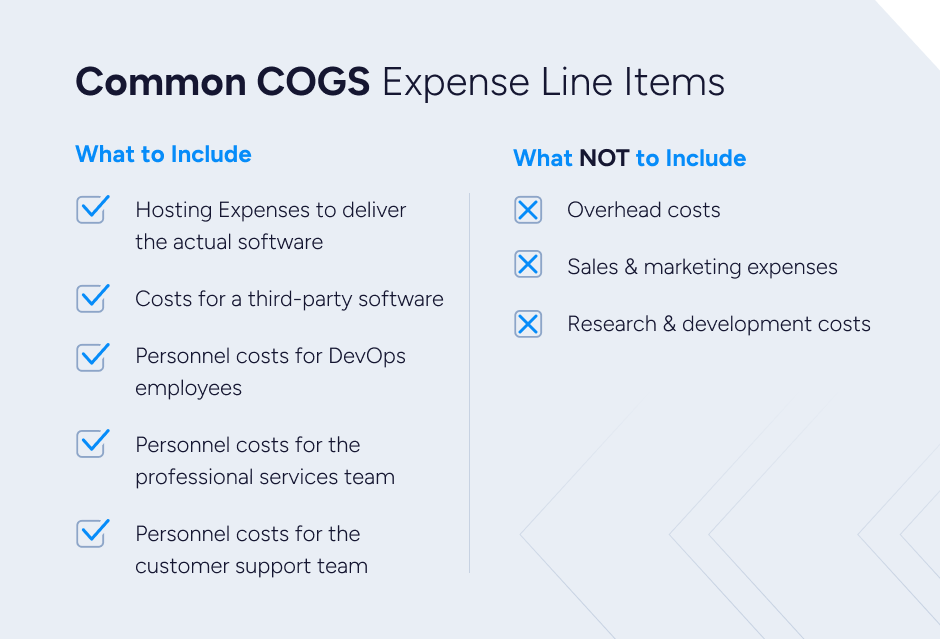

It’s important to distinguish between COGS and operating expenses (OPEX) like overhead, marketing, and other general administration costs. COGS should include only those expenses directly attributable to the production and delivery of the goods or services sold.

Software companies include different types of expenses in their COGS calculations than brick-and-mortar shops. Common COGS expense line items for software companies include:

- Hosting expenses to deliver the actual software: These include the costs of cloud-based application subscriptions like Rackspace or AWS.

- Costs for third-party software included in the product: For example, this category may include the expense of a third-party reporting application used in the company’s solution and delivered to the customer.

- Certain personnel costs: The salary and benefits expense for certain categories of employees responsible for the production and delivery of the software solution should be included in COGS. Specifically, COGS should include the expense of DevOps employees responsible for managing and running the servers and data center delivering the SaaS application to customers. It should also include the compensation of the professional services team responsible for implementing the solution for a customer, as well as for those members of the customer support team responsible for providing ongoing servicing to customers live on the application.

Just as importantly, SaaS companies should NOT include in COGS any expenses that cannot be directly attributed to software production, such as:

- Overhead costs. The amount spent on business operations, including general administration costs like rent, insurance, and utilities.

- Sales and marketing expenses. The expense of sales commissions, marketing campaigns, and product management should be excluded from COGS.

- Research and development costs. Specifically, R&D amortization costs should not be counted as COGS.

How COGS Impacts SaaS Company Valuations

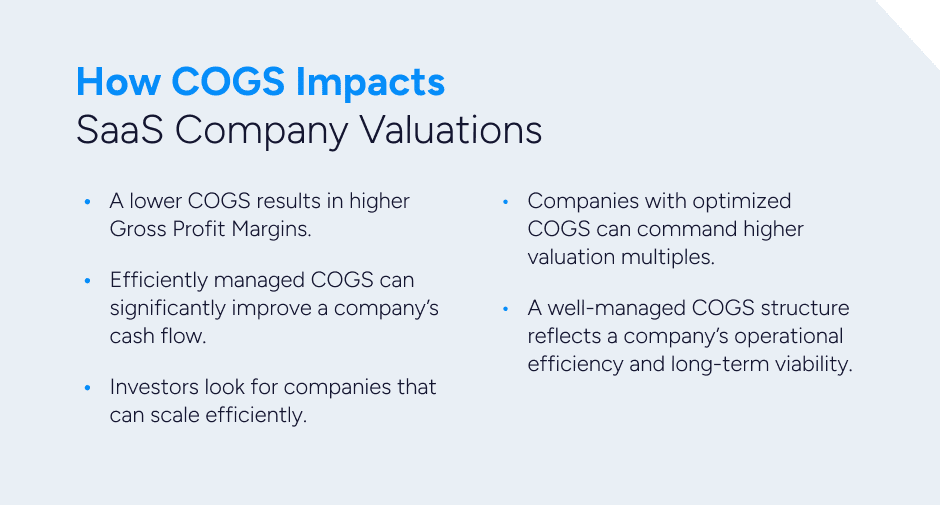

Understanding the intricacies of COGS is not simply about managing expenses—it’s about enhancing the overall value of your company. Private Equity investors and Strategic Buyers heavily scrutinize COGS when evaluating potential acquisitions. Here are five ways COGS impacts valuations:

- Gross Profit Margins: A lower COGS results in higher Gross Profit Margins. For example, a company with a 70% Gross Profit Margin versus one with an 85% margin will generally be valued higher because it retains more revenue as profit.

- Cash Flow: Efficiently managed COGS can significantly improve a company’s cash flow. This additional capital can then be reinvested into growth initiatives, product development, or improving customer experience—factors that make the company more attractive to investors.

- Scalability: Investors look for companies that can scale efficiently. If a SaaS company can demonstrate an ability to grow its customer base without proportionally increasing COGS, it signals the company has a scalable business model—a highly valued attribute.

- Valuation Multiples: Companies with optimized COGS can command higher valuation multiples. For instance, SaaS companies with high gross margins often achieve premium valuations in M&A transactions. A difference of even a few percentage points in gross profit margin can translate to significant differences in valuation.

- Long-Term Viability: A well-managed COGS structure reflects a company’s operational efficiency and long-term viability. Investors prefer companies that have a clear understanding and control over their cost structures as it indicates sound financial management.

Company Scenario: The Impact of COGS and Gross Margin on Valuations

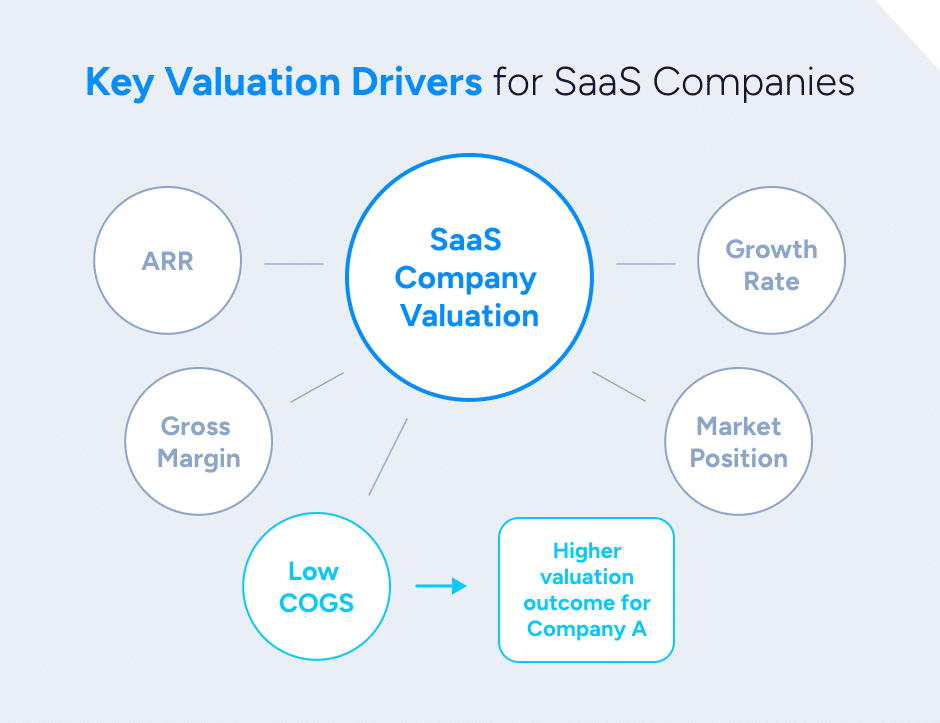

As mentioned above, Gross Margin is closely tied to COGS and valuation. To illustrate how COGS and gross margin can have a direct and material impact on SaaS company valuations, let’s consider a bootstrapped software company we’ll call “Company A.” Company A is a provider of project management software, and has achieved steady growth and an annual recurring revenue (ARR) of $6 million through strategic product development and customer-focused innovation.

Company A’s COGS is notably low due to its efficient use of cloud infrastructure and optimized implementation and support processes. By investing in scalable technology and automation, the company has managed to keep COGS at a manageable level, directly contributing to a higher gross profit margin. In its latest financials, Company A reported a gross profit margin of 75%.

This efficiency makes the company more attractive to buyers and investors, as it signals scalable operations and stronger potential for sustainable growth without a concurrent increase in costs.

PE Investors and Strategic Buyers view lower COGS as a positive indicator of a company’s financial health. Company A’s ability to maintain low COGS while generating ARR demonstrates strong cost management and effective business strategies. This financial efficiency enhances the company’s valuation by projecting higher future profits and lower risk and is typically associated with strong and efficient product & technology.

In addition, companies with lower COGS often enjoy higher valuation multiples. Company A’s favorable gross profit margins can lead to a higher EV/ARR multiple compared to peers with higher COGS. As of Q2 2024, the median gross profit margin of the 122 publicly traded software companies listed on the SEG SaaS Index™ is 72.9%.

For Company A, maintaining a lower COGS has not only bolstered its gross profit margins but also made the company more appealing to investors. This efficiency translates into higher valuation multiples and a more favorable position in the market. By focusing on cost management and operational efficiency, Company A exemplifies how controlling COGS can drive significant improvements in valuation and investor attractiveness.

Properly Forecasting the Cost of Goods Sold for a SaaS Company

Working with an advisor like SEG can help software entrepreneurs identify how to cut unnecessary expenses and determine a strategy to operate and grow more efficiently. Because a SaaS company’s COGS are always changing, working with an advisor can help you correctly forecast this important financial metric and make any necessary adjustments to increase the value of your business.

The experts at SEG are here to offer guidance on optimizing the resources you already have to increase your gross profit margin. If you have any questions about COGS, please don’t hesitate to reach out to our team.