Understanding the Rule of 40: A Key Metric for SaaS Success

The “Rule of 40” in SaaS valuations is a rule of thumb used to assess a company’s financial health and growth potential. It suggests that the sum of a company’s top line year over year growth rate (annual recurring revenue growth percentage) and its EBITDA margin should ideally be at least 40%. This rule helps buyers and investors evaluate whether a company is effectively balancing growth with profitability.

The Rule of 40 caught the attention of the SaaS industry when Techstars’ Brad Feld, author of the popular blog Feld Thoughts, outlined how “the minimum point of happiness” for maturing companies is a 40% growth rate. He essentially announced a community baseline—anything at or better than 40% is great.

Read more to discover the components, characteristics, and safeguards of the Rule of 40, and understand its impact on your company’s valuation and exit multiple.

Defining the Rule of 40

To put it simply, the Rule of 40 is a benchmark used by private equity investors and strategic buyers to measure the performance of SaaS companies. Measuring the trade-off between profitability and growth, the Rule of 40 asserts SaaS companies should be targeting their growth rate and profit margin to add up to 40% or more.

Note that while the rule of thumb is set at 40%, indicating a combined growth rate and profit margin, your company may exceed this threshold, potentially resulting in a “Rule of 50,” “Rule of 60,” and so forth.

The Importance of the Rule of 40

The Rule of 40 is crucial for valuations, serving as an indicator of sustainable growth and effective cost management. Achieving a Rule of 40 score at or above 40% signals to prospective buyers that the company has long-term potential.

In the current M&A climate, the ideal profile is a company with profitable or break-even growth and a Rule of 40 score above 40. For example, a company with 40% revenue growth and a 0% EBITDA margin is much more attractive than one growing at 80% YOY but with a -40% margin

Calculation Tips for SaaS Companies

The calculation considers two key financial metrics: growth rate and profitability margin.

Growth rate: For a SaaS business, growth rate is measured by comparing YOY changes in ARR or MRR.

Profitability: We prefer EBITDA as the standard measurement here. The EBITDA margin strips out differences in interest expense, tax treatment, amortization, and depreciation, making EBITDA margin the best indicator for profitability when comparing SaaS businesses. However, you may find that some use net income or cash flow as other measures of profitability.

Even though these two metrics can be measured in different ways, revenue growth and EBITDA margin are most commonly used to gauge a company’s profitability and growth, making this simple equation the best way to calculate the metric.

READ MORE: Correctly Calculating EBITDA for Software Companies

When to Use the Metric

While the Rule of 40 assesses the health of SaaS companies by considering revenue growth and profitability, in addition to merely measuring each component individually, this metric is also a normalizing factor.

Some companies may sacrifice profitability to grow, while others may be very profitable but have not made investments in sales and marketing. This calculation allows buyers and investors to normalize these factors across acquisition or investment targets.

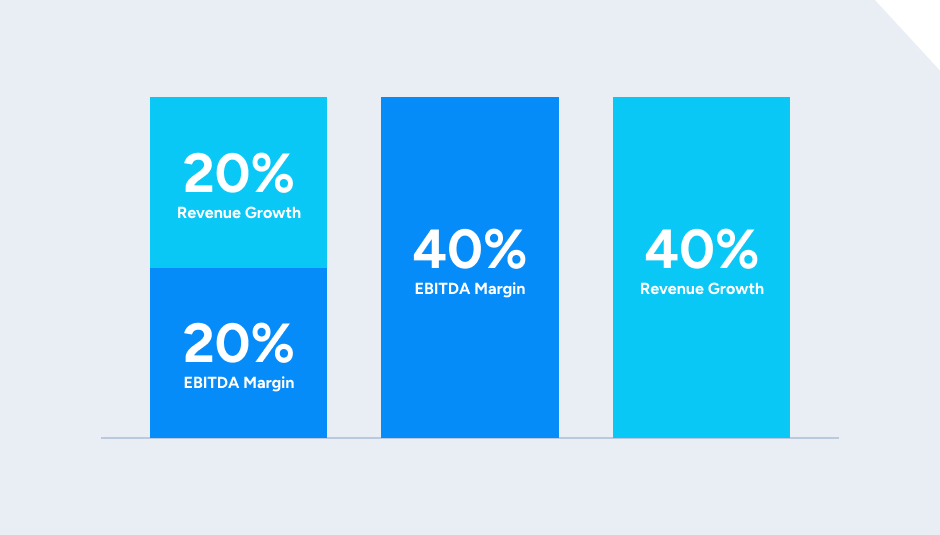

A company can reach 40% on a Rule of 40 basis in many ways. Let’s run through a few examples:

20% revenue growth + 20% EBITDA margin = 40%

0% revenue growth + 40% EBITDA margin = 40%

40% revenue growth + 0% EBITDA margin = 40%

However, as helpful of a tool as this metric is, it can fail to guide management on how to best balance the often-competing priorities of rapid growth and increased profitability.

The Weighted Rule of 40

The Weighted Rule of 40 is a critical KPI for investors and strategics, as it gives twice the weighting to growth than profitability. Given buyers’ recent preference for growth over profitability, especially for smaller companies, there is an increasing shift toward a weighted Rule of 40. This is because, generally, revenue growth is a better driver of value than profit margins.

This new weighting aligns with the increased focus on growth, particularly for smaller SaaS companies, prioritizing growth over profitability as they work to achieve scale. It also provides better guidance on how management should think strategically about pricing and resource allocation.

Weighted Rule of 40 = (1.33 * Revenue Growth) + (0.67 * EBITDA Margin)

To learn more about today’s buyer preferences, download a copy of our State of SaaS M&A: Buyers’ Perspectives Report for insights on what is driving buyer and investor activity.

Weighted Rule for Public SaaS Companies

As evidenced by SEG’s 2024 Annual SaaS Report, investors favored SaaS companies with higher Weighted Rule of 40 percentages. For the most part, companies with a higher weighted Rule of 40 are rewarded with higher revenue multiples.

Public SaaS companies scoring greater than 40% on a Weighted Rule of 40 basis posted a median EV/Revenue multiple of 10.7x. A few of these high-performing companies include CrowdStrike, MSCI, and Toast.

Common FAQs: Rule of 40

As a recap overview, here are quick answers to the most commonly asked questions regarding the Rule of 40 metric.

How does the “Weighted” Rule differ from the standard calculation?

The Weighted Rule of 40 places different emphasis on revenue growth and EBITDA margin, typically weighting growth more heavily than profitability for younger companies and vice versa for mature companies. This adjusted weighting helps reflect the priorities at different stages of business development.

Is a higher total always better?

Not necessarily. While a higher Rule of 40 indicates a strong balance of growth and profitability, it’s also important to consider other factors such as market conditions, competitive landscape, and company-specific strategies.

How can a company improve its Rule of 40?

To improve its Rule of 40, a company can focus on increasing its ARR growth rate by expanding its customer base, upselling, and improving customer retention. Additionally, enhancing operational efficiency and reducing costs can improve the EBITDA margin, contributing to a better overall metric.

What are some common pitfalls when using this metric?

Common pitfalls include overemphasizing either growth or profitability at the expense of the other, ignoring the importance of sustainable business practices, and failing to adapt the metric to the company’s specific context. It’s crucial to use the Rule of 40 as one of several tools in performance assessments.

How does it impact company valuation?

Companies with higher Rule of 40 are often seen as more attractive to investors and buyers because they demonstrate a healthy balance of growth and profitability. This can lead to higher valuations and better acquisition terms. Public SaaS companies with strong Rule of 40 typically enjoy higher revenue multiples.

Can it be used in financial forecasting?

Yes, the Rule of 40 can be a useful tool in financial forecasting and strategic planning. By setting targets for growth and profitability that align with the Rule of 40, companies can develop more balanced and realistic financial plans.

Putting the Rule of 40 into Play

Weighted or not, this metric can serve as a handy measuring tool when evaluating the health of your business and establishing a plan to keep growing. If you have questions about this topic or want to discuss other KPIs in more detail, contact Software Equity Group today.