How to Sell Your SaaS Business: A Guide to Getting Started

You have probably entertained the idea of selling your SaaS company at least once during your tenure as an entrepreneur.

- You need help getting your business to its next phase of growth.

- You want to focus on a new venture.

- You are looking to minimize risk or increase liquidity.

- Or you may be ready to retire.

There are many reasons you could be preparing to step away, but if this is your first time exploring the world of mergers and acquisitions, it can be intimidating.

Many business owners shy away from exit planning because they think the SaaS M&A process is too complex. Those who do sell often leave money on the table simply because they didn’t understand the full value of their software business.

Don’t let that be you.

The more you understand the M&A process and strategically position your SaaS business, the more likely you are to attract top-tier buyers at a sale price that reflects your software company’s true worth.

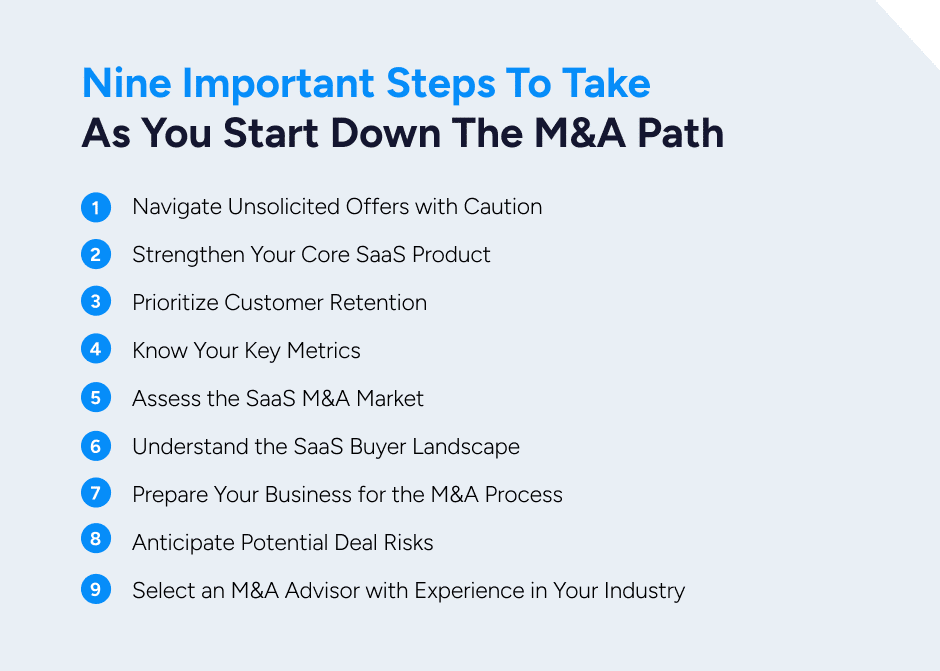

Here are nine important steps to take as you start down the M&A path.

1. Navigate Unsolicited Offers with Caution

You may be considering selling your software business because you received an unsolicited offer; we see this a lot. Receiving an offer out of the blue can be exciting. It’s validation that you’ve built something of value. But before you jump at the first offer you receive, set your emotions aside and conduct due diligence.

Vet the party that contacted you. Not every potential buyer approaches with genuine intentions. Some may be trying to capitalize on your enthusiasm and lack of experience. Others might engage in discussions without any intention of making a purchase, using the conversation to gather market insights. Unsolicited offers are also not usually a buyer’s best offer; they are rarely based on a complete understanding of your business. Reach out to an experienced M&A advisor like SEG to get a qualified third-party review of the offer and evaluate your options.

While you may ultimately pass on unsolicited opportunities, they can help you get a feel for the minimum you should be willing to accept. As you take the right steps to proactively prepare your financials and market your business, you’ll be more likely to secure attractive offers from reputable buyers.

Before I sold my SaaS business, Bigfoot, to Dude Solutions, we received several inquiries from parties interested in the company. We reached out to SEG to start the conversation and explore options to support Bigfoot’s growth. They taught us valuable lessons not only about the process but what we needed to focus on as an organization to get ourselves ready for the process, including what a possible acquirer would be looking for.

READ MORE: The Truth About Unsolicited Private Equity Offers (and What Founders Should Do Next)

2. Strengthen Your Core SaaS Product

The quality and usefulness of your software are what brought you to this point, but now is no time to rest on your laurels. As you consider selling your SaaS company, maintaining and enhancing product quality becomes more important than ever.

By continuing to innovate, releasing new features, focusing on growth and scale, and eliminating bugs, your team can increase your company’s value in the eyes of potential buyers. Make sure you’re optimizing your interface across device types and doing what’s necessary to minimize platform outages. Leverage key data to make targeted improvements.

You also need a plan for AI, which is playing a big role in M&A decisions today. Eighty four percent of buyers want SaaS companies to demonstrate and understand AI and Machine Learning’s potential impact on their operations and products, negative and positive, according to our annual Buyers Perspectives Report. While buyers don’t expect SaaS companies to have all the answers yet, they do need CEOs to have a clear and educated view on the technology.

3. Prioritize Customer Retention

A successful business is one that is not only good at winning new customers but can also hold on to the customers they have. Prospective buyers care about your customer retention rate (relative to your industry) because strong numbers signal a valuable product, strong demand, and solid customer support.

Buyers prioritize KPIs such as Gross Revenue Retention (GRR) and Net Revenue Retention (NRR). GRR measures how much existing revenue you retain over a period, excluding upsells, cross-sells, and new customers. Half of all buyers we surveyed in 2025 put gross revenue retention in their top 5 most critical KPIs.

NRR looks at the impact of upselling and expansion with your existing customer base. Both metrics are important to buyers: They demonstrate stability and low churn risk, as well as growth potential.

Improving your customer retention by just 5% can boost your profits by 25% or more, according to Bain & Company.

- To improve your customer retention rate:

- Proactively gather feedback from current customers.

- Create a strong customer success team.

- Track the right KPIs.

- Focus on customer experience, including customer onboarding and training.

READ MORE: How to Calculate Churn Rate Correctly

4. Know Your Key Metrics

To formulate an offer for your SaaS company, buyers will analyze important performance indicators, only one of which is customer retention. Others include quantitative factors like annual recurring revenue (ARR), customer acquisition costs, and gross margin.

The key is to research which metrics are most important for the type of business you run and to understand what baseline buyers consider “good” or “bad” for each metric.

Improving those metrics will make your company more attractive and give you a leg-up in negotiations.

The numbers only tell part of the story. Buyers also want to understand how you achieved those results and whether they’re repeatable. Your company’s narrative is important. You need to be able to clearly articulate your competitive advantage, market positioning, customer relationships, and growth potential.

A compelling story helps buyers see where your company has been and where it is going. It also tells them why you’re well-positioned to grow under their ownership. This is different than marketing your company to potential customers. Buyers care about different things.

Jeff Doose, Chairman of Best Transport, said SEG delivered “extraordinary outcomes” for their shareholders in two successful transactions, in part because of our ability to tell their story. “Their ability to distill the essence of each value proposition, effectively communicate that value to the buyer community, and negotiate and close a high-value transaction was second to none.”

SightPlan CEO Terry Danner also saw the value of the right positioning when the company was sold to SmartRent. “SEG was instrumental in strategically positioning our business to the market and helping us clearly convey the tremendous growth potential of SightPlan.”

For more on the metrics that matter most to buyers, see our report on 20 Factors to Track When Valuing Your Software Company.

5. Assess the SaaS M&A Market

Your company’s value is heavily influenced by external factors such as how badly customers need your product, how much the market is projected to grow, and how many other companies are offering similar solutions. It’s critical to understand these market dynamics and how they play into the M&A process.

If you’ve been thinking about pursuing a deal but are worried that you might need to wait for the right time to sell your SaaS business, you might miss out on prime opportunities. High-quality SaaS companies are always in demand. M&A volume for SaaS deals remain at some of the strongest levels we’ve seen since 2021, according to our Quarterly SaaS M&A Report. Recurring revenue, strong gross margins, defensible market positions, and customer stickiness make these businesses especially attractive.

Keep an eye on M&A transactions involving similar companies and how the current and projected economic climate might influence these moves. Explore trends by sector to understand the differences of each market.

With a firm grasp of these concepts, you can enter the M&A process with a better idea of who likely buyers might be and what type of offer to expect.

6. Understand the SaaS Buyer Landscape

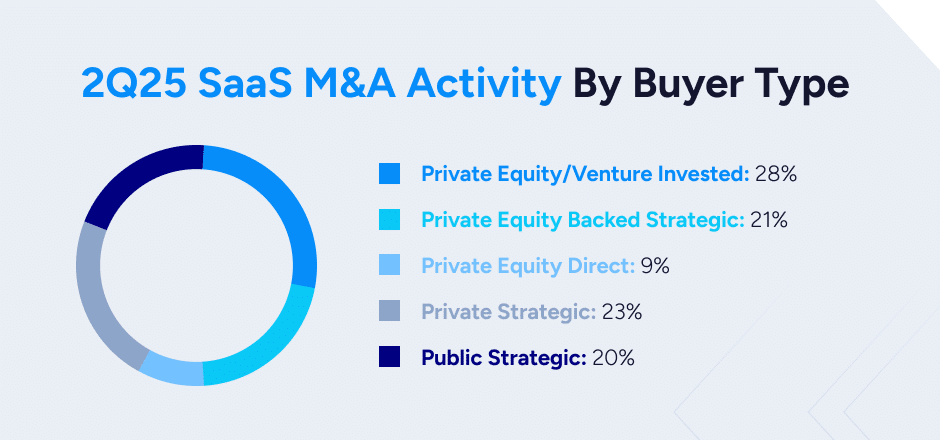

The SaaS M&A landscape includes several key buyer types, each with different goals:

- Public strategic acquirers: Publicly traded software companies often pursue acquisitions to grow beyond what they can achieve organically. They may want to expand product lines, enter new markets, or acquire specialized technology and talent. Public strategics are expected to increase their focus on acquisitions as inflation and interest rates continue to decline. In 2024, publicly traded strategic buyers accounted for 22% of SaaS M&A activity, according to SEG’s 2025 SaaS Report.

- Private strategic acquirers: Privately held software companies also acquire for strategic reasons such as product fit, customer overlap, or access to new markets. They tend to be targeted in their approach. They made up 17% of SaaS M&A deals in 2024.

- Private equity platforms: PE firms build platform companies by acquiring a profitable and scalable SaaS business as a foundation. These platforms are used for add-on acquisitions. As the interest rate environment becomes more favorable and deal volume continues its uptick, PEs will continue to target platform investments to deploy the record-breaking dry powder they have on hand. Platforms accounted for 10% of all SaaS M&A activity in 2024.

- PE-backed strategic buyers: PE firms want to grow their portfolio companies through strategic add-ons that expand product capabilities, increase market share, or drive efficiencies. PE-backed strategic buyers accounted for about half of SaaS M&A activity in 2024.

- Minority investors and growth equity: Not all deals involve full acquisitions. Growth equity firms or minority investors provide capital in exchange for partial ownership. However, these deals come with pitfalls. We often speak with operators who have already taken on a minority investor and later realize those early decisions limited their ability to exit on their terms. SEG is exclusively focused on helping our clients seek majority investments.

Investors and strategic buyers want businesses with balanced Rule of 40 profiles and clear paths to profitability. Gross retention rates above 90% are critical, with both private equity investors and strategic buyers emphasizing their importance. Buyers want SaaS businesses that are maintaining steady, scalable growth to mitigate risk.

Having a mix of strategic and private equity buyers in your pool drives competition and increases valuations. SEG’s goal when we work with SaaS companies is to identify strategic buyers that complement your existing products and investors that fit your business and goals.

About a fourth of the deals we execute are with buyers the seller did not know before engaging with us.

- View our list of 10 private equity firms to watch in software M&A.

- Meet the top strategic buyers acquiring software companies.

Get a personalized map of the buyers in your SaaS sector. Let’s talk.

7. Prepare Your Business for the M&A Process

It will take more than just a great product to sell your company. Before making a serious offer, buyers want to know that the “hot” software they’ve heard about is backed by a well-run business. The more prepared you are, the smoother the process will go, and the stronger the valuation.

Preparation typically includes:

- Financial preparation: Sound accounting and finance practices reduce friction and build buyer confidence.

- Operational readiness: This could include an experienced management team, structured operational systems and processes, and clearly defined strategies for marketing for a more strategic and technical approach. The easier it is for a buyer to acquire and continue growing your business without making major improvements, the more they will be willing to pay for it.

- Positioning and storytelling: Frame your growth story in a way that highlights recurring revenue, defensibility, and market opportunity. An advisor like SEG can help turn your metrics into a story that resonates with buyers.

- Technology and product: Buyers will dig into whether your product can support long-term growth without major reinvestment.

Also consider whether you’ll stay on during a transition period and under what terms. Consider your personal and financial goals. Selling can be incredibly personal. It can bring up unexpected emotions; after all, your company is the product of years of sacrifice, risk-taking, and long hours. While going through the process, you’ll need the support of not just an advisor, lawyers, and accountants, but mentors who understand the M&A journey.

Prepare for tough decisions, which include tradeoffs related to earnouts, your team, or walking away from buyers. You’ll have a lot of conversations about your company’s future, your role, and the fate of your team and customers.

SEG works hard to find the right buyer that aligns with your personal goals, business objectives, and culture. You can sell on your own terms when you have the right support in place.

After guiding SaaS founders through diligence for 30+ years, we’ve seen that preparation is the difference between a smooth process and a stressful one. Whether you’re bootstrapped or venture-backed, taking the time to build this foundation pays off with more options, stronger leverage, and ultimately, a more rewarding exit.

8. Anticipate Potential Deal Risks

Buyers will look closely for issues that could affect valuation, integration, or long-term performance. An advisor like SEG can help you prepare for the risks that can cause deals to fall apart, including:

- Competitive or market risk: If the market is shifting quickly or competitors are well-capitalized, buyers may discount valuations. Advisors can help you position your growth story against any market headwinds.

- IP ownership issues: Are code, data, and product IP documented or assigned to the company? If not, buyers may question what they are acquiring.

- Security gaps: Poor data hygiene or inadequate security protocols may raise compliance or integration concerns.

- Customer concentration risks: Does your business rely heavily on one or two large customers? An advisor can help frame the risk or highlight diversification efforts for buyers.

- Pending legal disputes: Lawsuits or unresolved claims with customers, vendors, or employees may introduce uncertainty that causes buyers to walk away.

- Tax liabilities: Unpaid or miscalculated taxes become the buyer’s problem after an acquisition, so identifying and resolving them upfront can protect deal value.

- Key employees that are tied too closely to the business: If operations rely too heavily on founders or a handful of employees, buyers may worry about continuity.

- Immigration or work-authorization dependencies tied to key personnel: When critical leaders’ right to work depends on their status, continuity may be threatened if that status changes. Addressing this risk early can reassure buyers.

Identify and mitigate these risks before entering serious discussions. An experienced M&A advisor such as SEG can help you spot these issues and address them proactively. That means cleaning up IP documentation, creating customer and employee transition plans, or resolving disputes or liabilities before diligence starts. Mitigating these risks early on can prevent surprises that derail a deal in the final stages.

9. Select an M&A Advisor with Experience in Your Industry

A process can involve up to 200 targeted buyers, multiple lawyers, accountants, management teams, and other third parties. If you try to do this alone, the focus that you and your team pour into the deal can diminish its ultimate value. You risk unfavorable terms, lost leverage, damaged relationships, and missed opportunities.

Investing the time to aim carefully with smart positioning and expert guidance is what will help you reach the right target when you’re ready to sell. That’s where an M&A sell-side advisor comes into the picture. They help you navigate the M&A process, build a market for your company, and manage all the details so you can focus on running your business.

The best advisors have led dozens, often hundreds, of transactions, which gives them a critical edge. They know how to build a market of buyers and investors for your company.

The wrong partner, on the other hand, may spend less time on your deal and may lack the industry sector expertise needed to maximize valuation and find the right buyer. Advisors who have deep SaaS expertise also know how to present recurring revenue models, customer dynamics, and growth opportunities in ways that increase buyer conviction, as well as competitive tension.

For Chris Atkinson, choosing an advisor was one of the most important decisions he faced when selling IMS to RealPage.

“We spoke to a lot of potential partners, and we ultimately selected SEG for two primary reasons. One, their reputation inside of our industry was impeccable. We’re in the commercial real estate space and the de facto advisor who has led the most transactions and the most successful outcomes was SEG, so they came to us very highly recommended.

“But the second factor for us was the team within SEG sitting down with our team; it truly was a partnership. They wanted to understand our goals and concerns, and did we want to move quickly or did we want to take our time? They built a strategy around our goals. SEG was head and shoulders the right partner for us.”

SEG has helped hundreds of SaaS leaders like IMS achieve extraordinary outcomes. Learn why high-growth software companies trust SEG.

Is Now the Right Time to Seek Capital Raise or Sell Your SaaS Business?

If you’re uncertain about your company’s position, its value, handling unsolicited offers, or any other concerns about the M&A process, we are here to help. We can help you assess what your valuation could be today, things you could improve to increase that multiple in 12-24 months, buyers to build relationships with and more. Reach out for a complimentary assessment with no obligation.

Feel free to reach out with any questions.