Behind the Scenes of Your SaaS M&A Process: How a Strong Foundation Helps You Exceed Your Goals

M&A isn’t as simple as signing a deal and cashing in. Without the right strategy, SaaS leaders may leave millions of dollars on the table because they may not have the nuanced SaaS M&A experience in negotiating, driving competitive tension, or properly positioning the business.

That’s where an experienced M&A advisor comes in. They not only mitigate these risks but turn them into advantages. But here’s the catch: The market is flooded with firms that promise the moon — but often aren’t willing to put in the deep work to deliver results.

Managing a successful sell-side M&A process may not be rocket science, but it does require careful planning, strategy, expertise, experience, and preparation to ensure you attract the best buyers, command the strongest valuation, and ultimately, drive the best outcome.

Here’s a great example of what we’re talking about. David Durik, CEO of Indatus (acquired by RealPage), had this to say:

“We figured if we didn’t do a whole lot of work, we could probably sell our company for $30 million-$35 million. But the process, the fine-tuning, distilling the message and marketing to the right folks, that is what got us from, say, $35 million to $50 million. And that’s all a byproduct of the work that SEG did.”

In other words, a structured M&A process driven by Software Equity Group helped Indatus exceed its original goal by more than 40% — significantly above what it thought possible. Here’s a behind-the-scenes look at how we structure your process to get that kind of liftoff.

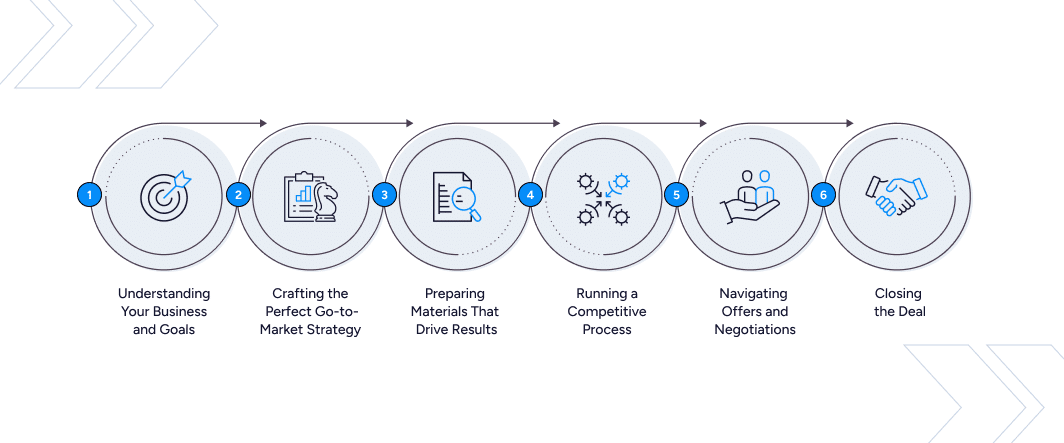

Step 1: Understand Your Business and Goals

There’s no substitute for the learning time that we invest at the beginning of the process, because it sets the stage for everything that follows. We spend time getting to know your organization, so we understand not only where you are now but where you’d like to go — and ultimately, what’s possible in terms of the value of your company.

Putting in that level of diligence early in the process is a little like yeast — it eventually makes the whole loaf bigger for everyone. The first step in an M&A process is to:

- Analyze your financials, operational metrics, and market position.

- Understand your history, product, and key differentiators for the transaction.

- Identify your ideal buyer profile — one who aligns with your vision for the business.

Software Equity Group has identified 20 critical factors that can be used to evaluate software companies and assess their readiness for exit. Prioritizing these factors helps SaaS companies boost their success rates.

Taking the time to understand your business from the ground up feeds the kind of narrative that resonates with potential buyers — and positions your company as a must-have opportunity.

Step 2: Craft the Perfect Go-to-Market Strategy

Once we’ve got the proper understanding in place, the next step is to develop a strategy that’s tailored to your business and the dynamics of the market. Important components include:

- Market Research: Leverage proprietary tools and data to identify trends and buyer demand in your sector.

- Buyer Outreach: Build a curated list of high-potential buyers who align with your goals.

- Drive Engagement: Know who to speak to and how to position business for a specific buyer.

- Positioning: Highlight the unique aspects of your business that command premium valuation depending on the buyer.

This part of the process ensures your company stands out even in a highly competitive market.

Step 3: Prepare Materials That Drive Results

Once the ideas and strategy are in place, it’s time to meticulously prepare the documentation that’s needed to attract serious buyers. This includes:

- Confidential Information Memorandum (CIM): A compelling, data-backed story of your business. It showcases your company’s strengths and potential — and it makes the case for why the business is an exciting opportunity.

- Financial Model: A summary of your company’s financial position that showcases your past performance while also forecasting its growth potential. Many founders and CEOs neglect financial modeling, which denies them an invaluable tool for making strategic decisions.

- Market Comparison: Using data to position your company among industry leaders. Accurate benchmarking is essential for understanding current trends and how your business measures up against competitors, so you can chart a successful growth strategy.

We design these materials to spark buyer interest and create the best possible framework for negotiations.

Step 4: Run a Competitive M&A Process

Another key objective is to create a competitive environment — one that motivates buyers to put their best offer forward instead of holding back. Here are some of the most important elements that go into shaping that landscape:

- Outreach Execution: Presenting your opportunity to the right buyers at the right time.

- Managing Interest: Coordinating buyer meetings, responding to inquiries, and maintaining momentum.

- Driving Demand: Leveraging multiple buyers to create competitive tension and maximize your valuation.

This is where SEG’s approach pays dividends, as our expertise combines with the learning and planning from earlier steps in the process.

Step 5: Navigate Offers and Enter Negotiations

It’s not enough to generate offers — making the most of them takes a surefooted understanding of the complex terrain. SEG will be by your side to guide you through the complexities of valuation, deal terms, and negotiations.

- Comparing Offers: Evaluating the financial and strategic aspects of each proposal.

- Negotiation Strategy: Making sure you achieve the best terms while mitigating risks.

- Final Selection: Helping you choose the best partner for your company’s future.

At this stage, the goal is not just to secure the highest valuation (although that’s essential) but also deal terms and a right fit that’s aligned with your vision. This is another way to go above and beyond initial expectations — by visualizing what long-term success looks like.

Step 6: Closing the Deal

The last mile of any process is often the most challenging, and M&A is no different. But closing on a high note is the culmination of the earlier steps in this process — and the reason we take such care to lay the right foundation.

Our work ensures that by the time due diligence begins, buyers are in “close mode,” not discovery mode—minimizing risk, preserving leverage, and preventing last-minute surprises that could derail the deal or erode value.

Key elements of this phase include:

- Due Diligence Support: Preparing documents, addressing buyer concerns, and ensuring transparency.

- Closing Coordination: Managing the timeline and processes to ensure a seamless transition.

- Celebrating Success: Handing over the keys to a successful transaction and your next chapter.

Throughout the process, we’re with you to anticipate challenges, provide clarity, and keep the process moving smoothly — so you’re never at a loss for your next move, and you have a deep well of experience to draw on.

Let Software Equity Group Take You Above and Beyond Your Expectations

Choosing to work with Software Equity Group is the first step toward a higher return. With an 87% first-time success rate, our M&A process outcomes speak for themselves.

But of course, there’s more to it than numbers. It’s not just that we move the process through to a successful closing — it’s the way we design the process to minimize stress even as we work to identify every opportunity to boost your options and return greater value. The goal is to make sure you walk away with the deal you deserve — so that the end of one path can lead you to the beginning of an exciting new one.

If you’re ready to start your M&A journey, let’s talk. Get in touch with us to find out how M&A can help you not just reach your goals but surpass them.