What is a Term Sheet? Term Sheet Template and Negotiation for SaaS Businesses

A term sheet is often used in the early stages of negotiating a venture capital investment or M&A transaction. It can serve as an initial expression of interest or a more definitive declaration of intent, but either way, it lays a foundation for the potential deal.

Here’s what you should know about term sheets as a SaaS founder, including more about their purpose and components. Since SEG often helps facilitate term sheet discussions, we’ll also share some practical guidance on how to negotiate them and a term sheet template to show you what they look like.

What is a Term Sheet?

A term sheet is a document that outlines the terms of a proposed transaction. Often similar to an indication of interest (IOI) or a letter of intent (LOI), a term sheet serves as a basis for initial negotiations on critical issues like the target company’s valuation and the structure of the prospective deal.

Term sheets are mostly non-binding, but there are usually a few exceptions for provisions like confidentiality, non-solicitation, and exclusivity. Once both parties agree on the most significant aspects of a transaction as outlined in the term sheet, they can begin the due diligence process and draw up more detailed, binding contracts.

What Does a Term Sheet Look Like?

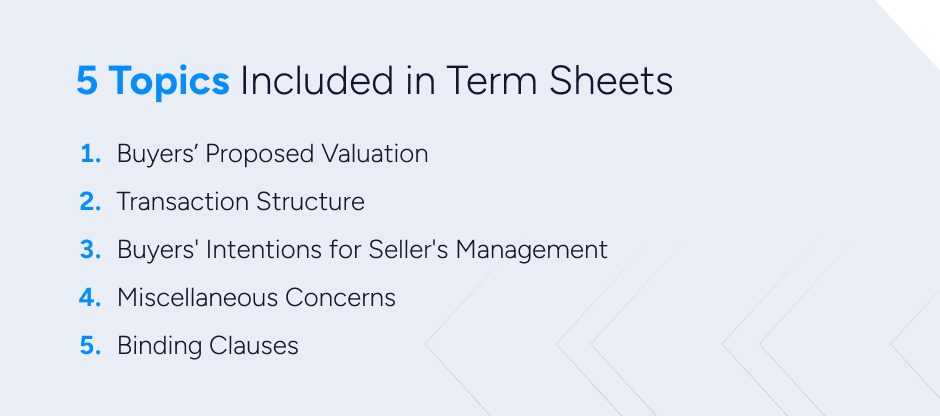

Here are the topics you should expect to see covered in a term sheet and the aspects most often subject to heavy negotiations. Since SEG specializes in helping SaaS founders navigate M&A exits, we’ll focus on term sheets in that context.

Valuation

A buyer’s proposed valuation of your SaaS company is one of the first and foremost items typically addressed in their term sheet. If the document functions like an IOI, it may only provide a range of valuations. If it’s more akin to a serious LOI, it’s likely to include a definitive valuation.

Beyond the underlying calculations and assumptions, valuation negotiations often revolve heavily around the definitions of indebtedness and net working capital. That’s because–assuming a cash-free, debt-free structure–anything defined as indebtedness reduces your company’s valuation dollar-for-dollar.

For example, if you receive a $100 million valuation, but the prospective buyer proposes that $20 million of your deferred revenue should be included in indebtedness, that would reduce your effective valuation to just $80 million.

Transaction Structure

Transaction structure is as important to address in a term sheet as your SaaS company’s valuation. In fact, it may need to be discussed in greater detail due to the sheer scope and complexity of the topic.

For example, term sheets typically address the following heavily negotiated issues in the transaction structure section:

- Consideration: Are you only getting cash consideration for the sale, or are you accepting some stock in the acquiring company? Sellers may prefer cash for liquidity, but buyers might prefer to offer stock to protect their capital reserves.

- Rollover equity: When private equity buyers want you to roll a percentage of your proceeds into equity, there’s often a lot of back and forth. Not just over the percentage, but also whether your class of stock is “pari passu”–the same class as the buyer’s–granting your claims equal preference in a potential liquidation.

- Tax optimization: M&A transactions have huge tax implications for buyers and sellers. Since the transaction structure affects them significantly, negotiations in this area are often extensive. For example, structuring the deal as an asset sale allows the buyer to benefit from a step-up in basis, but it can cause C Corporation sellers to get taxed twice.

Roles and Responsibilities

Term sheets typically address the buyer’s intentions for the seller’s management team and employees. Buyers may plan to retain some existing managers to help operations continue smoothly and let go of a certain percentage to cut costs after the deal closes. This part of the term sheet should explain what that’ll look like.

For example, the section might outline the retained managers’ compensation packages, including any additional equity or performance incentives designed to align their interests with the success of the newly integrated business.

These sections typically don’t get negotiated during the initial term sheet phase. Instead, that often happens in the later stages of the deal, such as during the due diligence process.

Miscellaneous Concerns

Term sheets may also cover miscellaneous points of concern that sellers like to understand. For example, they will commonly disclose the source of the prospective buyer’s financing, such as whether they plan to raise debt for the purchase or withdraw funds from their existing cash reserves.

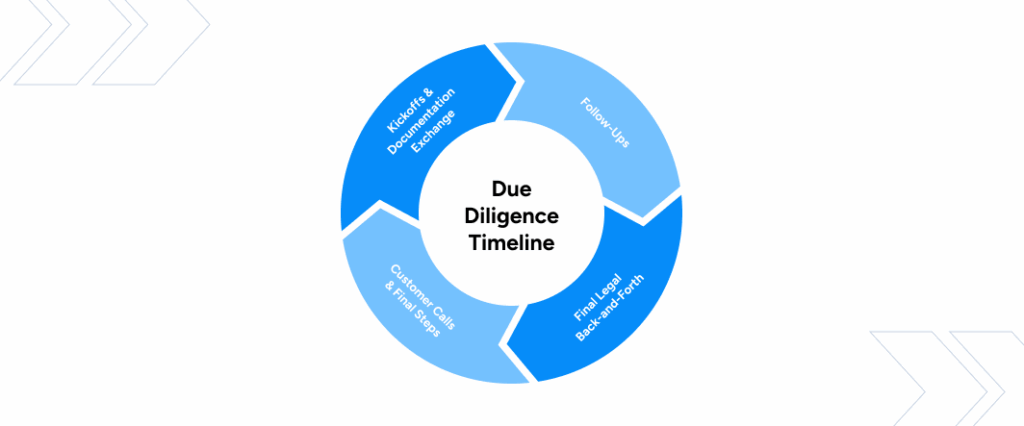

These issues aren’t always subjects of negotiation, but some can be. As a notable example, term sheets often include an outline and an estimated timeline for the due diligence process. A buyer might ask for 60 to 90 days to research, such as completing customer calls or performing a market survey.

As a seller, you might not be willing to wait that long, especially if you have an offer from another buyer with a much shorter timeline. In that case, you might negotiate the removal of certain due diligence steps or request the buyer complete them faster.

Binding Terms

Term sheets usually contain a few binding clauses that provide protection for both buyer and seller. They’re generally in place to ensure both parties operate in good faith during the negotiation process.

For example, that may include clauses regarding:

- Confidentiality: Buyer and seller typically agree not to share prospective transaction details with third parties, such as the consideration amount or the identity of the other party involved.

- No-shop: A seller may agree not to seek out or entertain other offers for a time, ensuring some degree of exclusivity as you negotiate with a prospective buyer.

- Non-compete: Sellers usually agree not to solicit employees acquired in the M&A transaction or start a new business that competes with the acquired company for three to five years. Laws banning non-competes generally don’t prohibit these due to “sale of business” exemptions, including the recent FTC final rule.

- Termination and Expiration: Term sheets should include confirmation that the document expires on a given date, is generally non-binding except for certain clauses, and is cancelable by either party if they give sufficient notice.

How to Negotiate a Term Sheet

Here are some tips to help you negotiate a term sheet from a prospective buyer based on previous M&A transactions that SEG has helped facilitate.

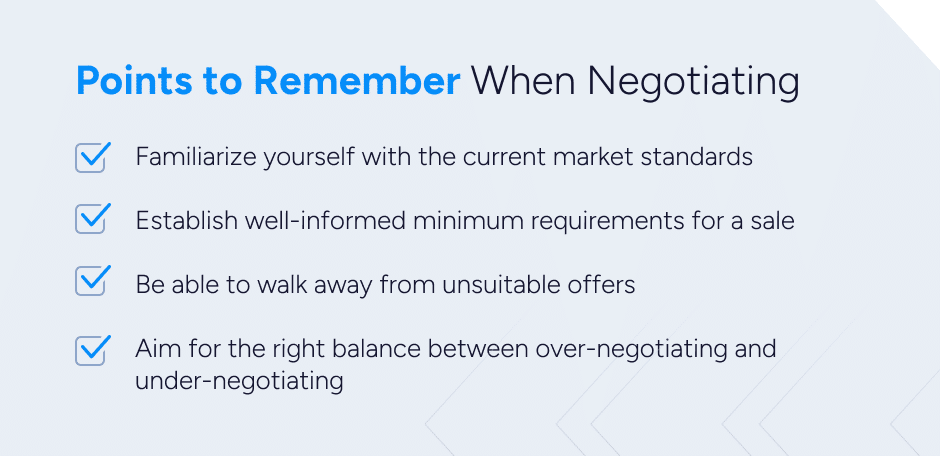

Familiarize Yourself with Market Standards

Experienced buyers will typically have a deep knowledge of M&A deal standards in the current market. If you don’t share that understanding, you’ll be disadvantaged when you begin negotiations.

As a result, it’s highly beneficial to familiarize yourself with current market standards. Not only does that help you recognize term sheet clauses that deviate from the norm, but it also enhances your ability to push back on them.

For example, some buyers try to include a clause that requires you to cover a portion of their transaction fees, such as legal or advisory support expenses. If you don’t know it’s standard for both parties to cover their own fees, you might incur significant extra costs. If you do know, it’s fairly simple to refuse by citing market practices.

Know When to Walk Away

Another good way to prepare for term sheet negotiations is to clearly define your non-negotiables. By establishing well-informed minimum requirements for a sale, you can feel confident in your decision to entertain or walk away from an offer.

Defining your limits before negotiations kick off can help prevent you from being tempted by unsuitable offers, but having an offer or two in hand provides valuable context that informs your expectations. Plan your boundaries in advance, but avoid being so rigid you risk losing a competitive offer due to misunderstanding the market.

Prioritize Key Issues

You must find a balance between standing your ground and making reasonable concessions when negotiating with prospective buyers. Accepting an offer as is could make you look desperate, but arguing every last point can make you appear belligerent.

Instead, it’s best to strive for a middle ground that leaves both parties satisfied. It can help to choose a handful of critical points to prioritize and then be willing to make fair-minded compromises on the rest.

For example, say, like many sellers, you care most about your enterprise valuation, cash and stock consideration ratio, and rollover equity liquidation preference. You’d like a 45-day due diligence and no-shop period, but you grant your prospective buyer’s request to extend them to 60 days since it’s less important to you.

Term Sheet Template

Term sheet contents vary depending on the deal, but their structures are fairly consistent. The National Venture Capital Association’s (NVCA) term sheet template for a Series A investment should give you a good idea of what term sheets look like. You can find the resource on the nonprofit organization’s website.

Get Guidance from Our Expert M&A Advisors

If you’re thinking about selling your SaaS business, hiring an experienced M&A advisor can be invaluable. Not only will we bring a wealth of experience in your market to bear as we guide you through the transaction process, but we’ll also significantly expand your network of potential buyers.

It’s possible to sell your SaaS company on your own, but you’ll be at a significant disadvantage, especially in determining your company’s value. Get in touch with our expert team, and we’ll help you avoid accidentally selling at the low end of your range.

FAQ

What is a Term Sheet in Venture Capital?

A term sheet in venture capital is a document that outlines the terms of a prospective VC investment, such as the proposed valuation and liquidation preferences. They serve as a basis for initial negotiations, and once both parties agree, they can draw up more specific contracts.

Is a Term Sheet Legally Binding?

A term sheet typically isn’t legally binding except for a few clauses that help ensure both parties act in good faith. For example, term sheets often include binding clauses that enforce confidentiality, exclusivity, and non-competition.

Term Sheet vs LOI: What’s the Difference?

A term sheet and an LOI are both documents that outline the terms of a potential transaction. Some use the terms interchangeably, and there is significant overlap between them.

However, term sheets are more likely to be associated with venture capital investments, while LOIs are more commonly involved in M&A transactions. Both are largely non-binding, but LOIs may be more likely to indicate a serious commitment.