Quality of Earnings (QoE) for B2B Software Companies: A CEO’s Guide

You are at the helm of a dynamic business as a software CEO. As a result, you need the right tools to make strategic decisions with clarity and confidence, and a Quality of Earnings (Q of E or QoE) report can be one of them. A QoE report can not only help you evaluate the strength of your business, but it can play a critical role in helping you realize a rewarding exit opportunity.

In this article, we will discuss what a QoE report entails and why we recommend that our clients get one before exiting.

What is a Quality of Earnings Report?

A QoE report is a document from a third-party accounting firm that objectively presents the company’s financial position after a comprehensive analysis. Think of it as a magnifying glass that zooms in on your financials and helps you assess the reliability and sustainability of your earnings.

This report will scrutinize your various revenue streams, examine operating expenses, and assess your working capital and cash flow. It may also reveal trends across income statements and balance sheets that can shed light on the business’s trajectory.

A common question is whether a QoE report is the same as an audit, and the answer is complicated. If the client has had an audit done, we would be less likely to push for a QoE, as we would expect fewer surprises. The reason for a QoE is to avoid said surprises and ensure proper representation of the company’s numbers, thereby also avoiding possible re-trades during exclusivity. Note, most buyers will have one completed these days, we want one to ensure inaccuracies are discovered prior to exclusivity.

Why Invest in a QoE Report?

QoE reports have become a standard component of due diligence leading up to an M&A transaction. Prospective buyers typically commission a report to better understand the financial performance of the business they’re targeting for acquisition.

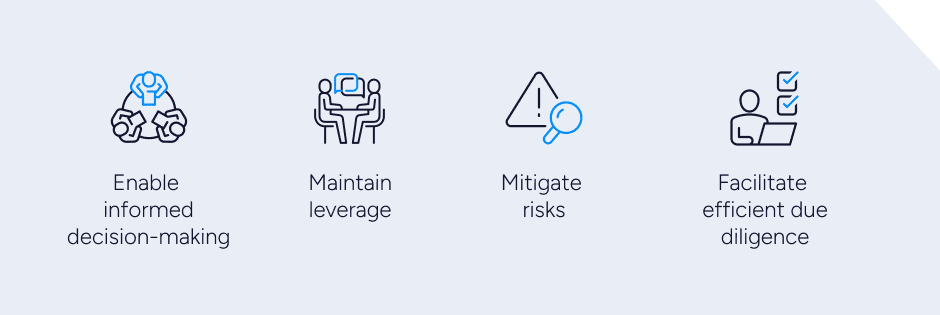

However, it’s usually a good idea for sellers to commission their own QoE before the M&A process begins. Here are several reasons why:

- Enable informed decision-making: A QoE report provides a holistic view of your company’s financials, so it helps make smart strategic business decisions, regardless of whether you’re selling the company. Outside parties, including investors, lenders, and buyers, will gain confidence from reliable financial data that an accounting firm has confirmed.

- Maintain leverage: When a seller conducts a QoE (Quality of Earnings), they maintain the leverage. However, when a buyer conducts a QoE, it typically occurs during exclusivity, giving the buyer leverage. During this phase, small issues can escalate, risking the deal or leading to a retrade. It is advantageous for the seller to identify and negotiate any issues upfront, while multiple buyers are still in play and leverage is on the seller’s side.

- Mitigate risks: Just as homeowners may hire an inspector before putting their home on the market, the sell-side QoE can help the seller identify and proactively correct (or at least disclose) certain issues that could deter potential buyers or prolong the M&A process. For example, a QoE might uncover irregularities in financial statements or aggressive accounting practices that need to be addressed.

- Facilitate efficient due diligence: In the deal-making process, having your own QoE can help streamline the due diligence process, reducing friction and saving time and resources. The buyer may use the seller’s QoE as a starting point to create its own report, or they may even rely entirely on the seller’s report.

What Should a QoE Report Include?

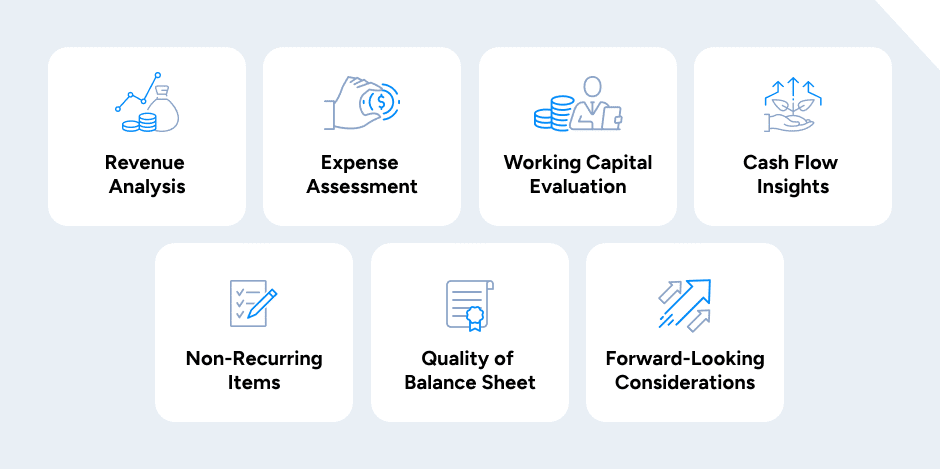

The scope of work for a Quality of Earnings report may vary from one accounting firm to the next and may also depend on your budget. However, we typically recommend that SaaS businesses pay for at least the following components in a QoE report:

- Revenue analysis: A breakdown of your revenue sources (including subscription, licensing, and services), as well as metrics such as ARR retention and details of revenue recognition policies and contractual obligations impacting revenue and customers.

- Expense assessment: An in-depth analysis of cost of goods (COGS) sold, gross margin, and operating expenses such as R&D, sales, marketing, and administrative costs, as well as a look at historical expense trends and their impact on earnings.

- Working capital evaluation: Review liquidity metrics (receivables, payables, and inventory) and working capital calculations to assess liquidity health.

- Cash flow insights: An examination of cash generated from core operations and a “proof to cash” which verifies cash inflow and outflow activity. Plus a look at other investing and financing activities.

- Non-recurring items: Identification of one-time or non-recurring items affecting earnings, followed by normalization adjustments to provide a clearer picture of ongoing operations.

- Quality of balance sheet: An analysis of the value of assets (which can include physical property, goodwill, and other intangibles) and liabilities such as current debt and contingent liabilities.

- Forward-looking considerations: Growth projections and potential risk factors that could impact earnings quality in the future.

How to Get a Quality of Earnings Analysis Report

QoE reports are typically prepared by third-party accounting firms or financial analysts specializing in due diligence for M&A transactions. They have the experience, training, and, importantly, the objective point of view required to analyze your company’s earnings and flag any potential issues related to your financial performance.

As a sell-side M&A advisor, SEG maintains relationships with multiple firms that offer expertise in QoE reports. For most of our clients, we recommend a medium-sized firm with the experience and resources necessary to conduct a comprehensive analysis while providing affordable rates for small- and medium-sized businesses.

Before the research process begins, discuss the scope of work with your chosen accounting firm in detail to ensure the report will align with your unique business needs. To help the firm produce the report, you’ll need to grant them access to financial books and records and supplementary information about the business. Be prepared to provide a detailed invoice listing, employee PTO reports, bank statements, bank reconciliations, and payroll reports. It helps to designate a point person to take calls from the accounting firm, provide requested documents, and find answers to their questions.

The Value of an Advisor Beyond a QoE Report

The B2B software landscape is ever-evolving, and it’s more important than ever for CEOs to have a clear understanding of financial statements and their implications.

If you are interested in exploring exit opportunities, it’s essential to understand that the accounting firm hired to prepare a QoE report is not an M&A advisor. While the QoE report provides critical data and verification of your financials, a sell-side M&A advisor can help your firm initiate and manage the QoE process, interpret the results, and make strategic business adjustments before taking your company to market.

At SEG, we have spent over 30 years advising software companies on M&A strategy, leading them through due diligence, and ultimately landing their dream deals. Get in touch with us to determine your company’s opportunities in today’s M&A landscape.

If you want more resources on maximizing valuation, making the most of the process, or understanding market trends, check out our extensive research library. This section of our website features all of our resources sharing proprietary data, research, and insights for Software founders – click here to see SEG’s research.