Are You Unintentionally Driving Away Prospective Buyers for Your SaaS Company?

It’s exciting when a private equity investor or strategic buyer shows interest in your company, but it’s essential not to get carried away, especially early in the courting process. Simply put, a potential buyer will scrutinize every action you make, and just one crucial misstep can result in a lost opportunity.

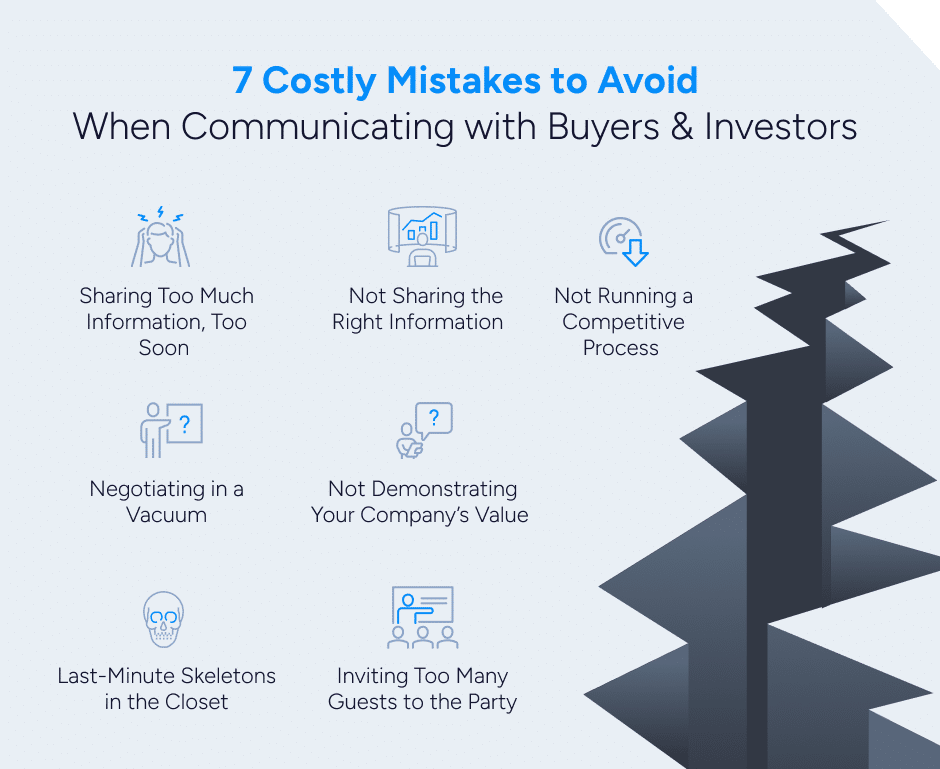

Here are seven common and costly mistakes SaaS and software leaders make that may drive away prospective buyers.

1. Sharing Too Much Information with Prospective Buyers

Expect there to be a “feeling out” process when you first engage with a potential buyer. Until you fully understand the prospective buyer’s motivations for engaging with you, you can’t be sure what factors drive their agenda. Have they invested in one of your competitors? Are they simply gathering market intelligence for a future buy? Until you know for sure, it’s risky to disclose particular confidential information about your business.

It’s natural to feel nervous when you schedule your first meeting with a potential investor, and a common mistake we see is the need to overshare, hoping to make a strong first impression. However, that can be a big mistake early in the process, as premature information sharing can deter potential buyers. Even worse, you may inadvertently give away valuable intelligence that can be used against you later.

Guidance from an M&A Advisor: For instance, your advisor might suggest not sharing detailed financial information at the beginning. Doing so too soon could weaken your position in negotiations or cause misunderstandings. Instead, they may recommend highlighting other aspects, saving detailed financial data for later stages of review.

2. Not Sharing the Right Information with Prospective Buyers

Sharing too much information too early is one common mistake. Another is sharing the wrong information.

Avoiding this is where a “data room” comes into play. A data room is a secure, centralized location for storing and sharing information buyers need to conduct due diligence on a potential transaction. It streamlines the due diligence process while ensuring that only authorized personnel can access sensitive data relating to your company. Today, most data rooms are virtual, cloud-based platforms that allow individuals on both sides of the transaction to have authorized access to privileged information on your company.

Deciding what information to share through the data room is critical. Typical documents exchanged during the due diligence phase of an M&A transaction include documents such as the CIM, financial models, customer analysis, employee census, vendor agreements, sales contracts , intellectual property such as trademarks and copyrights, and so on. Review and segment your data files before uploading them to the data room, ensuring that you only provide information prospective buyers need to see to make an informed decision—and nothing more.

Guidance from an M&A Advisor: Your advisory team will typically oversee this intricate process for you, given its complexity. Nonetheless, they will collaborate closely with you, relying on your provision of accurate information.

3. Not Running a Competitive Process

Not running a competitive process when considering potential investors in your SaaS or software company can be a mistake for several reasons. To begin, without competition, you may not be able to accurately gauge the true market value of your company. By engaging with more than one prospect in parallel, you open the door to potentially receiving multiple offers, which in turn offers valuable insights into what different parties are willing to pay. This intelligence is vital in helping you negotiate better terms and maximize your company’s value.

You also risk settling for a deal that may not be the most favorable in terms of price, structure, or alignment with your company’s strategic goals. A competitive process incents potential buyers to sharpen up their pencils, potentially leading to a more streamlined due diligence cycle, faster deal execution, and reduced risk of renegotiation or deal failure later.

Finally, by engaging with multiple parties, you increase the likelihood of finding a buyer or investor who not only offers favorable terms but also brings valuable expertise, resources, or synergies to help grow your SaaS or software company post-transaction. Overall, not running a competitive process can limit your options, decrease your negotiating power, and potentially result in leaving value on the table.

Guidance from an M&A Advisor: It’s best to engage with multiple parties to maximize your opportunity to receive a competitive offer that reflects current market dynamics. Ask your advisor to offer strategies for identifying and soliciting the best candidates.

LEARN MORE: Why Software Companies Choose Software Equity Group

4. Negotiating in a Vacuum

Negotiating with prospective buyers of your SaaS company is as much art as science. Luckily, you can put yourself in a better position if you’re prepared.

Effective negotiation begins with understanding your firm’s value in the current market and in the eyes of prospective buyers. Research their past deals—the types of firms they’ve invested in, the metrics they value, and the terms they offer. Make sure you understand the importance of intellectual property, company culture, revenue growth, and other factors in their buying decision and valuations. Then, make sure you speak to these exact concerns in your pitch.

It’s also essential to go into any negotiation with a pre-defined range of desired outcomes to give yourself flexibility. Don’t view the sale of your firm as a zero-sum game. The best result is for both sides to be satisfied that they have received value in the transaction. There are many ways to accomplish this, but they all include a mix of creativity, compromise, and an understanding of your negotiating partner’s needs and goals.

Guidance from an M&A Advisor: Your sell-side M&A advisor can offer a range of time-tested strategies for handling negotiations. Avoid speaking with an investor or buyer without an advisor to avoid negotiation mistakes.

5. Not Demonstrating Your Company’s Value to Prospective Buyers

To effectively position your company for sale, you need to present your best case to prospective buyers, and that begins with understanding what factors they consider in valuing your company. These factors aren’t stagnant—they change over time based on market dynamics, the performance of past acquisitions, and macroeconomic trends. Your role is to position your company in the best possible light based on the metrics and indicators buyers use to measure value.

Today’s buyers of SaaS most value growth, retention, and profitability when researching a potential acquisition. According to SEG’s 2023 State of SaaS M&A: Buyers’ Perspectives survey, 75% of private equity investors and strategic buyers placed revenue growth among the top three most crucial factors for consideration. Retention came in as the second-most important metric after growth. But today’s buyers consider profitability a critical factor in determining whether a deal is a “go” or “no-go.” Gone are the days when the high-burn, growth-at-all-cost model was considered an attractive asset.

Guidance from an M&A Advisor: Knowledgeable advisors possess a keen understanding of the factors influencing today’s valuations. They thoroughly examine your company from all angles, aligning it with the expectations of buyers and investors.

6. Inviting Too Many Guests to the Party

Another common error made early in the “feeling out” process is involving too many members of your team. Typically, your executive team doesn’t need to be involved during the courting period. Inviting them to early-stage buyer meetings only increases the likelihood of leaks within and outside your company, and that someone will inadvertently share confidential information or make a faux pas that could potentially jeopardize the deal.

A roomful of participants can also send the wrong message to the prospective buyer—signaling that the CEO or founder is not engaged in the firm’s day-to-day operations, among other issues.

Guidance from an M&A Advisor: Leave negotiations only to those who need to be involved, including you, your co-partner (if you have one), and your M&A advisor.

7. Last-Minute Skeletons in the Closet

As mentioned, it’s in your best interest to provide prospective buyers with the right information at the right time. This also means that if there are significant issues under the covers, it’s better to disclose them early than not at all.

Be upfront about the challenges your company faces, whether a product problem or an underperforming market. If there’s truly something you don’t want prospective buyers to see during early-stage meetings, you may need to seek guidance on whether it’s a deal-breaker or not. Remember, you will need to address the issue eventually because it will likely come to light during due diligence.

Guidance from an M&A Advisor: Prospective buyers have every right to walk away from the deal if they don’t like what they see. A scenario like this is where an advisor can give you guidance on how to manage any issues you are concerned about will end a deal.

Prepare Now for a Successful M&A Transaction

These are the common mistakes we often see when SaaS companies meet with interested buyers. Remember, a lot is on the line when selling your business, so be careful not to push prospective investors away.

If you’re considering selling your SaaS company at some point, now is the time to take proactive steps to enhance your company’s attractiveness. Start by completing a thorough review of your company’s key metrics. Look at your data, processes, offerings, and operations critically. What data will investors need as they consider a sale? What improvements can you make to bolster recurring revenues or improve gross margin? Implement a plan to address holes and present your company in the most attractive light possible.

Figuring out what to address and in what order can be complex. Fortunately, you don’t have to do it alone. At Software Equity Group, we have the entire M&A process nailed down. Contact us to learn more about how we can help you identify potential pitfalls, position your company for success, and help you navigate every aspect of a sale.

Related Articles: