Can You Sell Your SaaS Company on Your Own? Tips from a Founder

As a software or SaaS founder, you are likely aware that merging with or being acquired by another company could offer an attractive exit opportunity for you, your shareholders, and your company.

I sold my first company without an advisor and was at a disadvantage from the get-go. Aside from not having the opportunity to leverage the extensive network of potential suitors an advisor brings; I didn’t have access to quality legal and financial advice to help with the transaction. This created various challenges throughout the process and very likely reduced our exit valuation.

As a former founder who has walked in your shoes, I’m sharing my advice and strategies to guide you through this process and ensure a successful outcome that leaves you happy. Here is my advice on how to sell your SaaS company now or later.

Assess Your Company’s Readiness

Begin with a realistic assessment of whether your company hits the right metrics to command a viable, “closeable” offer.

Just because you are getting lots of inquiries from Private Equity and other investors, it does not mean you are ready to sell. Being able to demonstrate solid business fundamentals is a critical factor in being ready to sell your SaaS company. To start, your company should have strong unit economics and maintain a balance between growth and profitability. Additionally, you should demonstrate excellent retention rates, appropriate customer concentration, and a focused product line with a solid market fit.

How do you know where these metrics should be or even how to look to improve? This can be a challenge, but an assessment with enough time to improve before going to market is very important.

How to Conduct an Assessment

The key is to research which metrics are most important for your business type and to understand what baseline buyers consider “good” or “bad” for each metric. Focusing your efforts on improving those metrics will make your company more attractive and give you a leg-up in negotiations. For more on this subject, see our 20 Factors to Track when Valuing Your Software Company report. This resource details what quantitative and qualitative aspects buyers prioritize when creating valuations.

If your numbers aren’t up to snuff, you’d be wise to wait. Keep doing your research—following the latest trends and best practices shared by your advisors—but recognize that just because private equity firms are reaching out to you doesn’t mean your company is in a sellable position. PE interest is flattering but temper your enthusiasm until you can obtain a fair evaluation by an unbiased advisor.

Founder Tips for Selling Your SaaS Company in Two or More Years

If there’s even the slimmest chance you may decide to sell your SaaS company at some point in the future, it’s never too early to align your long-term strategic planning with potential exit strategies.

Long-term exit planning begins with ensuring you offer the best and most useful software product on the market. You should continuously innovate, enhance product quality, and add new features to ensure you stay ahead of the competition and increase your company’s value in the eyes of potential buyers.

Optimize your interface across device types, minimize platform outages, and leverage key data points to make targeted improvements. Take the necessary steps to maintain the strength and competitiveness of your product offering, ensuring mutual benefits for all parties involved.

Some aspects of your business take years to move in the right direction. It’s like turning a big ship, it takes time. These improvements will not only help your org today, but you will also get a better exit valuation. Get an idea of your options by starting a conversation with an advisor now to explore and utilize their early-stage guidance. As a final note, this is also an excellent time to focus on the legal preparation that can be done well in advance to ensure a smooth exit down the road.

Founder Tips for Selling Your SaaS Company Within One Year

By now, you have improved all the metrics, tech-debt, and related things that you can do (won’t be everything)! Before preparing your company for a potential sale, you must be emotionally, strategically, tactically, and physically ready. Selling your company is a job on its own, and you must be able to squeeze that in between all the routine day-to-day tasks and responsibilities involved in running your business.

The last thing you want to do when preparing for a sale is to lose focus on your business operations, potentially putting your company’s valuation at risk. Below are some additional tips to prepare:

- All stakeholders must be completely aligned regarding the decision to sell. I recommend that all owners, founders, and the senior leadership team who will be aware and involved in the sale process be in lockstep.

- Communication among all key players is critical to ensuring that the selling process and day-to-day operations are managed effectively.

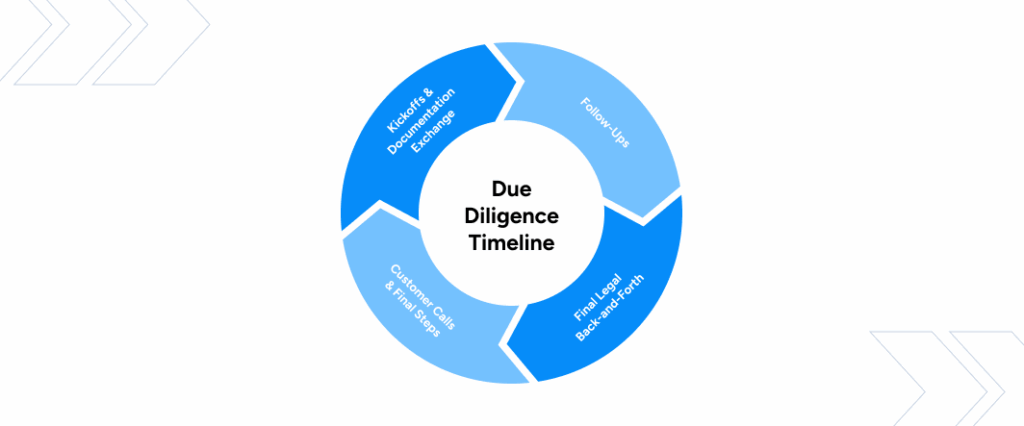

- Prepare for the due diligence process and the many issues that can crop up during this time.

- Preparing to sell is undoubtedly a grind, but it can be incredibly fun and exciting. However, you must make sure you are physically and mentally ready for this process.

- Timing is also essential. Attempting a sale amid a major software release or other significant business event is not for the faint of heart.

- Solicit the guidance and advice of a reputable M&A advisor early in the process to help streamline preparations. *I have personally sold two businesses in my career—one with the help of a professional and one without. There is no comparison between how cleanly and smoothly the process went with an advisor as opposed to without.

Beware the Pitfalls of Working a Deal Alone

You may be able to manage the arduous process on your own, but first, consider the potential pitfalls that first-time sellers often encounter when they attempt an M&A deal alone:

- Sharing too much information with prospective buyers

- Not sharing the correct information at the right time

- Engaging with only a small pool of potential buyers

- Negotiating with “blinders on”

- Not presenting your best case for a competitive valuation

- Including too many from your team too early in the process

- Not knowing how to create a captivating CIM

- Not disclosing significant issues upfront

The Difference an M&A Advisor Makes in a Deal

The benefits of engaging a sell-side M&A advisor are well-documented. An experienced software M&A advisor brings a wealth of expertise, experience, and knowledge of your market, serving as a vital resource to help you optimize your company’s valuation, leverage and expand your network of potential buyers, and manage the transaction process.

While it is technically possible to sell your SaaS company on your own, without a strong sell-side advisor, you will be at a disadvantage in accurately assessing your company’s value. Although you may have an offer in hand from a private equity or strategic buyer without any competing offers to compare, that doesn’t represent an accurate barometer of value, and you’re more likely to be selling at the bottom end of your range.

Without the guidance of a well-connected advisor, you will also limit your potential offers to only those private equity and strategic buyers that found you.

If you’re considering selling your SaaS company, don’t hesitate to reach out to us at Software Equity Group, your expert M&A advisors, before you field any offers.