5 Types of Mergers and Acquisitions for SaaS Companies (& Examples)

With the digitalization of business and rapid technology adoption across multiple sectors, SaaS has become a thriving industry. What’s more, many other companies and investors quickly want to get a slice of the ever-growing pie that SaaS represents. Overall, this has resulted in a significant increase in software mergers and acquisitions in recent times.

If you are a software entrepreneur, you are probably aware that merging with or being acquired by another company could present an attractive exit opportunity for you, your stakeholders, and the business itself. Not all M&A deals are equal. However, be sure to understand your options and the different dynamics involved before pursuing a liquidity event. There are many types of mergers and acquisitions, each of which may be structured to achieve varying goals.

This blog post will clarify the most popular M&A transaction types in the software world. Knowing the differences between these approaches is essential as a business owner, as they can affect your company’s value and future operations.

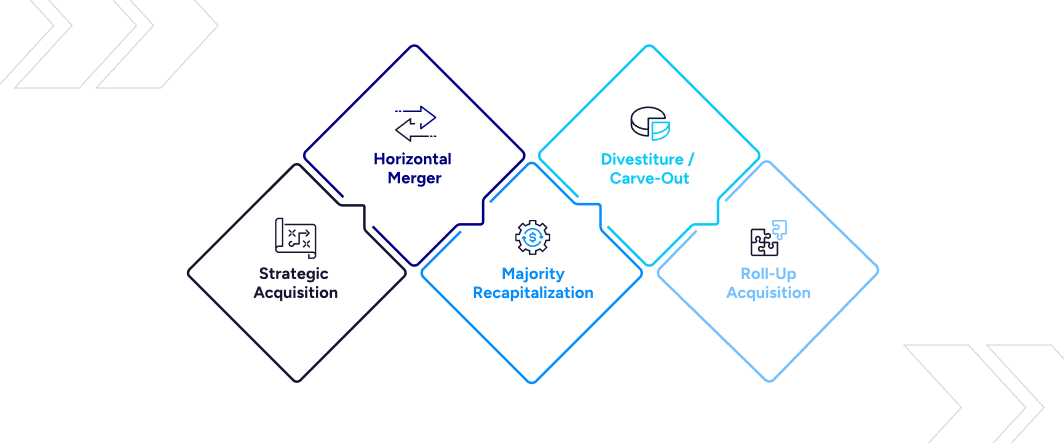

Here are some of the most common deal types we encounter at Software Equity Group.

1. Strategic Acquisition

While all acquisitions could be considered strategic, this term usually refers to when a company buys another business outright to access the target’s markets, customers, and technologies. It is the most straightforward type of M&A deal — a large company buys a product because it is faster and easier than building it organically.

We have advised on many such transactions. For example, Tyler Technologies acquired our client, Rapid Financial Solutions, for $68 million to improve the payment capabilities Tyler provides to government agencies. Effective financial management is crucial in such deals to ensure efficiency and security.

In some cases, the companies involved may call the transaction a “Vertical Merger” rather than an acquisition, though the distinction is subtle.

2. Horizontal Merger

When two companies in the same industry or market segment merge, they create a bigger company. In doing so, the goal is usually to eliminate competition and increase market share for the new entity, and monitor key metrics to gain insights into deal performance.

Among the five types of mergers and acquisitions, a horizontal merger is a popular route many companies take.

For example, some time after their acquisition by Thoma Bravo, iOFFICE (a former SEG client) and SpaceIQ were separate companies offering similar solutions in workplace experience and asset management software. They became the clear leader in their space when they merged into a single entity. The new company (now called Eptura) serves over 10,000 customers in 85 countries.

3. Majority Recapitalization by Private Equity Firms

Some software executives admit that growing the business beyond a certain point requires capital, additional expertise, or sometimes both.

One method to meet these needs is to sell a majority stake of the company to private equity firms. In addition to a potential capital injection, a majority recap provides optionality: shareholder liquidity, additional expertise and support from a new majority owner, and access to additional financial resources, all while enabling existing shareholders to retain some equity to participate in future upside.

A majority recap differs from an all-out sale of the company. In this scenario, the existing stakeholders maintain some level of involvement, equity, and interest. Assuming the company continues to grow and thrive under its new structure.

4. Divestiture/Carve-Out

While not a merger or acquisition per se, a divestiture is a related transaction in which a company sells off (i.e., divests) a piece of itself, such as a particular business unit, product line, or subsidiary. A divestiture occurs when the divesting company no longer sees that part of the business as strategic to its goals.

However, the same piece of business may be highly valued by other companies eager to acquire it for their own strategic purposes.

At SEG, we advise divested businesses to help them achieve maximum valuation in the open market. One example was when Priority Technology Holdings sold its RentPayment business (our client) to MRI Software in 2020.

Like a divestiture, a carve-out occurs when a company separates from a division or business unit but intends to create a new independent entity.

5. Roll-Up Acquisition

Sometimes, companies are in the fortunate financial position to go on an M&A ‘shopping spree.’ Rather than pursuing a single mega-merger, they may find more value in acquiring multiple smaller companies quickly. This type of exit plan is what is known as a roll-up acquisition.

By joining forces with several companies offering complementary capabilities and market presence, the business can become more extensive, powerful, and diversified.

An example of this type of acquisition includes Riverside, which Destiny Solutions an SEG client) acquired. Destiny, in turn, executed its strategic acquisitions, encompassing two other SEG clients’ first-of-its-kind cloud-based student digital engagement platform in the education sector.

Understanding Which Types of Merger and Acquisitions are Best for Your Company

Successful SaaS entrepreneurs have many potential exit strategies in the swiftly evolving software industry. Take advantage of the best opportunities for your business; start by researching which types of mergers or acquisitions would best fit your personal and business goals. Then comes the fun part: thinking about your life after your exit.

If you have questions about which type of M&A exit is best for your company, feel free to contact our team for a complimentary strategic assessment. After analyzing your business, we can provide you with the ideal exit path, timing, and potential valuation multiples.