The Truth About Unsolicited Private Equity Offers (and What Founders Should Do Next)

If you are leading a software company generating between $5 million and $50 million in revenue, there is a good chance you have received unsolicited outreach from private equity firms or strategic acquirers. These messages often arrive with a proposed valuation range or a vague invitation to explore strategic alignment. Founders are frequently flattered by the attention and intrigued by the implied value. But behind this wave of inbound interest lies a more complex reality: unsolicited offers are rarely based on a complete understanding of your business.

Private equity firms have over $2.5 trillion in undeployed capital globally. The pressure to identify and acquire quality businesses has driven these firms to build detailed market maps, study vertical SaaS subsegments, and reach out directly to founders. For companies with predictable recurring revenue, strong gross retention, and efficient go-to-market strategies, inbound interest is now the norm, not the exception.

Why You Are Getting Offers

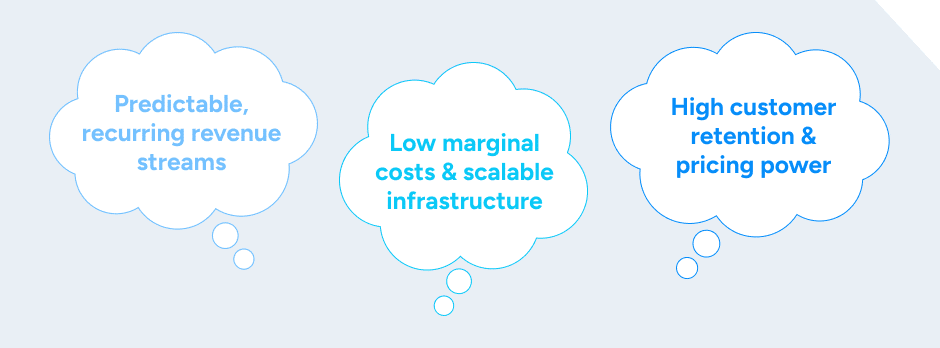

Private equity firms are not just looking for revenue growth. They are searching for durable business models with expansion potential. SaaS companies, in particular, are attractive because they offer:

This model aligns with investor mandates focused on risk-adjusted returns. A well-positioned SaaS business has the potential to generate meaningful returns through operational improvement, pricing optimization, or tuck-in acquisitions.

However, this same model also allows investors to make assumptions about your company based on limited public data or inferred benchmarks. Offers are frequently based on industry averages rather than your actual financial and operational profile. As a result, these offers may appear attractive on the surface but rarely reflect the true value of your business.

The Problem with Unsolicited Offers

A common rule of thumb is that most critical mistakes happen the first time you attempt something unfamiliar. That holds especially true for software founders navigating unsolicited buyer interest. In our conversations with hundreds of founders and CEOs, the vast majority who attempted to run their own process ultimately experienced a retrade, a reduction in valuation, or unfavorable shift in terms during diligence. This is not just anecdotal. In our advisory work, well over 80 percent of unsolicited offers end up materially revised when the seller lacks representation.

This is not necessarily a sign of bad faith. As buyers learn more about your customer retention dynamics, deferred revenue liabilities, TAM, market positioning, and product scalability, among other things, they update their models and adjust pricing accordingly. One common issue we see is around cost of goods sold (COGS). Many founders misclassify or understate their COGS, which inflates gross margins and creates a misleading impression of profitability. These financial discrepancies can alter how buyers assess the risk profile of your business, which in turn influences valuation. Once buyers review detailed financials, these inaccuracies can prompt pricing adjustments or raise questions around transparency, even if the intent was never to mislead.

The offer you received at the beginning of the conversation was an estimate. Without a structured process to frame your financials and tell the right story, that estimate will likely change.

A Founder’s Experience

Mark Smith, CEO of Core Sound, experienced the limitations of managing inbound interest firsthand. After receiving outreach from 12 different buyers, his team ran their own preliminary process and narrowed the field to four firms. Two of those submitted Indications of Interest. While the numbers were encouraging, Mark hesitated.

As he later reflected, “You make 80 percent of your mistakes the first time you do something, and I didn’t want to make a mistake on selling my company.”

At that point, he contacted SEG.

With a structured process led by SEG, the outcome exceeded the original IOIs by more than 50 percent. The shift was not just in valuation but also in clarity, control, and confidence. Mark’s experience highlights a truth many founders discover too late: initial interest is not the same as market value, and even a well-run internal process cannot replicate the benefits of experienced advisory.

Founders Often Ask the Wrong Questions

Instead of asking, “Is this offer fair?” a better question is: “Is this offer based on a complete understanding of my business, and how does it compare to what I might receive in a competitive process?”

Private equity firms understand this dynamic well. That is why, when they exit their own portfolio companies, they retain M&A advisors to run competitive processes, manage timing, and drive maximum valuation.

If they use advisors to sell, why should you consider going without one?

The Case for a Staged Process

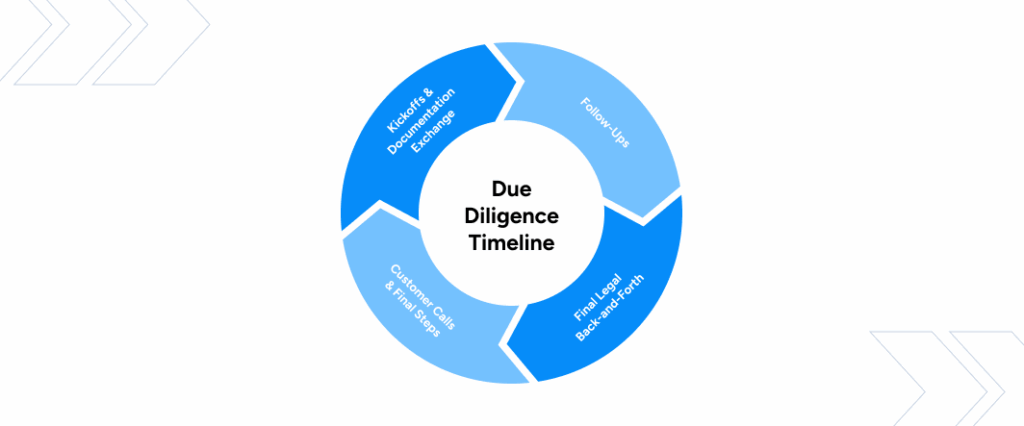

At SEG, we guide founders through a multi-stage process designed to preserve leverage and drive the best possible outcome. Here is what that looks like:

1. Control the Release of Information

Begin by preparing a curated data set under NDA. The goal is to share enough detail for buyers to submit an informed Indication of Interest (IOI) without compromising leverage. This phase sets the tone for the relationship and allows you to gauge seriousness.

2. Narrow to Committed Buyers

After collecting IOIs, refine the pool to a small group of engaged buyers. Provide them with deeper access, including product demos, customer metrics, and growth plans. This step filters opportunistic interest from real intent.

3. Prepare for Diligence Early

Commission a Quality of Earnings report and prepare detailed data rooms across finance, legal, product, and HR. Completing this work early serves two purposes: it helps buyers submit more informed LOIs based on a clearer understanding of the business and shifts diligence from a discovery process into a confirmatory one. Third-party reports and clean documentation reduce uncertainty, increase buyer confidence, and streamline the path to close by having answers and materials ready before they are requested.

4. Create Competition and Accountability

Multiple buyers mean better terms. True competition forces buyers to put forward their strongest offers, increases speed to close, and reduces the likelihood of retrades. When buyers know there is competition, they approach the process with greater urgency and discipline.

5. Move to an LOI on Your Timeline

Select the buyer who demonstrates alignment and commitment. Negotiate not just valuation but structure, terms, and post-close considerations. Require markup of key legal documents and maintain optionality where possible.

More Than Just a Number

The right transaction is about more than enterprise value. It is about selecting a partner who will respect your team, protect your customers, and carry forward the culture and legacy you have built. Founders often prioritize valuation early in the process but realize later that long-term alignment matters more than incremental price.

Your legacy is not just the multiple you achieve. It is the future of the company, the people, and the product you built.

What to Do If You Have an Offer

If you have received unsolicited outreach, the first step is to pause. Do not assume that early interest reflects market value. Do not rush into exclusivity. Instead, take the time to understand your company’s true market position, identify potential alternatives, and consider whether a process might create more value than a single-buyer conversation.

SEG helps founders make that assessment. We work exclusively with software companies, bringing market insight, strategic positioning, and process rigor to every engagement. Our goal is not just to respond to inbound interest but to convert it into long-term value.

Start With Benchmarking

Founders can begin by evaluating their performance using the SEG SaaS Scorecard, a tool that benchmarks their key metrics against what buyers value most in today’s market. From there, we help founders decide whether the time is right and, if so, how to structure a process that positions their company to win.

Ready to Protect Your Valuation and Maximize Your Success? Contact SEG to learn how we help software company owners navigate the M&A process with confidence, precision, and clarity.