Competitive Tension: The Key to Maximizing SaaS Exit Valuations and Deal Terms

I’ve been on both sides of the table: as a buyer competing for deals and now as an advisor helping SaaS founders run M&A processes. The difference between a one-buyer process and a competitive one is night and day.

When competition enters the picture, everything changes: urgency, creativity, and even conviction from the buyer’s side. I’ve watched buyers stretch valuations or race to close, not only because they saw value, but because they couldn’t handle the idea of a rival winning the deal.

Too often, buyers approach a sale thinking that if they’ve got a single interested buyer, that’s enough to ensure a fair valuation. But the reality is that without competitive tension, they risk leaving significant money on the table.

Without it, you’re sacrificing leverage that can move the right buyers in your direction: the ones who will not only offer the best valuation and terms but also represent a better fit for your long-term goals.

Let’s explore what competitive tension is, how SaaS founders can create it, and how it leads to better outcomes.

Case in Point: Core Sound Imaging

In 2007, Mark and Lori Smith founded Core Sound Imaging to solve the problem of moving echocardiograms online so physicians could interpret them remotely. Although neither had backgrounds in deep medical imaging, they did have prior software and IT experience, and they succeeded by listening closely to customer needs.

Core Sound’s growth was steady but slow; they reached cash flow neutrality within three years.

When the Smiths began considering an exit, they initially tried to sell their company by running a small process on their own. They had two offers from private equity companies. Both offered reasonable valuations, but included conservative deal terms, long diligence timelines, and significant earnout provisions.

Fortunately, rather than settling for a less-than-ideal offer, the Smiths realized that they needed expert guidance to help them find the right path forward, so they turned to SEG.

SEG helped Core Sound run a competitive structured process. Within six weeks, the process generated nine interested buyers, including strategics and financial sponsors with strong sector expertise.

When competitive tension changed the atmosphere, it paid off:

- Valuation increased by 50% as buyers realized they were competing for the same asset.

- The terms of the deal improved significantly, with reduced earnout requirements and higher cash at close.

- The timeline accelerated because buyers knew delays would allow competitors to gain ground.

In addition to a higher sales price, one of the biggest benefits was that Core Sound’s founders had more and better options to choose from, with multiple offers that they could compare in terms of valuation, cultural fit, and post-close growth plans. That gave them the freedom to select the right partner for the company’s next phase: a buyer who was on the same page strategically, culturally, and financially.

What SaaS Founders Gain When Buyers Compete

From my time as a strategic buyer, I can tell you firsthand that competition changes behavior. When we knew another buyer, especially a direct competitor, was circling the same asset, our posture shifted. Deals that once felt “nice to have” suddenly became “must win.”

Competitors will justify paying a premium or moving faster, not just to acquire the business, but to protect their competitive moats. In some cases, companies will even acquire companies that aren’t essential to their roadmaps to keep a rival from gaining an edge.

That’s the power of competitive tension when it’s structured and intentional.

Competitive tension isn’t about recklessly pitting buyers against each other. Done right – balancing urgency with alignment – it creates win-win situations. As Core Sound’s experience demonstrates, a deal that benefits both sides ultimately pays long-term.

The right kind of tension sharpens the process, from timing to valuation to the founder’s decision-making. Here’s what that looks like in practice:

Negotiating from strength. When multiple qualified buyers are engaged, terms naturally improve. It’s not because of the pressure, but because of clarity. Competitive tension gives founders leverage without hostility and signals that the company has options. It also shows that the company deserves consideration.

Better timing. Dr. Jacquelyn Kung, founder of Activated Insights, says that SEG’s “mastery of timing” was key to helping her arrive at a successful deal, because it accomplished two important things:

“The first is signaling to the market that a process is being run and what the timeline is for that process. When you know all the dates in advance as a buyer, you know it’s a serious process. The second is that SEG creates a funnel effect and they have each stage, stage one, stage two, then to IOI, then to LOI, each stage, and then to close. That process in itself, with all the numbers behind it, indicates it’s also a serious process. ”

This helped her achieve 66% more than she would have on her own.

Informed decision-making. Founders who can compare deal structures, cultural fit, and strategic vision side by side make stronger, more confident choices. Robert Johnson, founder of TeamSupport, cited the expert insight SEG supplied that made it possible to manage a competitive, multi-buyer process:

“As a CEO, I know how to market our product. However, marketing a company for an exit is a different challenge. SEG built the narrative, the materials, the CIM and told our story in a way that made buyers lean in and compete. They saw value where we hadn’t, and that changed everything.”

Terry Danner, founder of SightPlan, was able to weigh buyer narratives side by side and compare the pros and cons of each suitor. That level of preparation and choice structuring is what lets founders negotiate from informed conviction vs. reacting to the first term sheet.

Multiple offers on the table. Danner said the number of interested buyers that SEG brought to the table improved valuation and terms:

“There were more than a hundred candidates that SEG had put forth as potential suitors for SightPlan. As we went through the process and began to pare it down, SEG was extremely helpful in understanding why we were paring it down, why we were selecting certain groups. It was that competitive process at the end of the day that contributed to the ultimate sale price, which was important to us because all our company team members are option holders. So, this was a reward for all of them, as well.”

Avoid the Exclusivity Trap: Why One SaaS Buyer Isn’t Enough

The flip side is what happens when a founder is stuck in a process with only one buyer. Founders often underestimate how much power they can lose once they’ve granted exclusivity (the agreement to narrow to a single potential buyer), because it limits their options if negotiations stall or terms change late in the process.

The reality is that exclusivity should come only after multiple offers are on the table and competitive tension has pushed valuation and terms to their peak. It’s also best to avoid granting exclusivity until the buyer has demonstrated that they’re serious enough to invest in performing diligence on the business.

Here are some of the risks of too-early exclusivity arrangement or a simple lack of multiple suitors.

- Valuation ceilings. Minus competition, buyers aren’t motivated to stretch on price, which means that the first number often becomes the ceiling rather than the opening bid for negotiations.

- Slow timelines. In contrast to Dr. Kung’s experience with Activated Insights, when there’s no pressure from other interested parties, timelines can slow to a crawl. Buyers can draw out diligence, pile on contingencies, or drag their feet waiting for market conditions to improve. Meanwhile, founders are left with the day-to-day burden of running the business, but the extended timeline doesn’t necessarily benefit them because there’s no guarantee that overperforming expectations will lead to a better sale price.

- Unfavorable terms. Earnouts, escrows, and post-close obligations tend to lean toward the buyer when they know the founder has no alternatives.

- Loss of leverage in diligence. Sharing sensitive data too early without a structured process can weaken the founder’s position in negotiations.

Competitive tension gives founders the freedom to walk away from a deal that doesn’t align with their goals.

Creating a Competitive M&A Process Buyers Respect

Competitive tension doesn’t happen by accident. It requires structure, discipline, and a clear strategy, which SEG has refined through hundreds of successful SaaS transactions.

We think of competitive tension as a positioning strategy. When buyers know there are other serious contenders and that a seller’s advisor is running a structured, fair, and fast-paced process, they stay engaged. That structure can add weeks of urgency and millions in valuation.

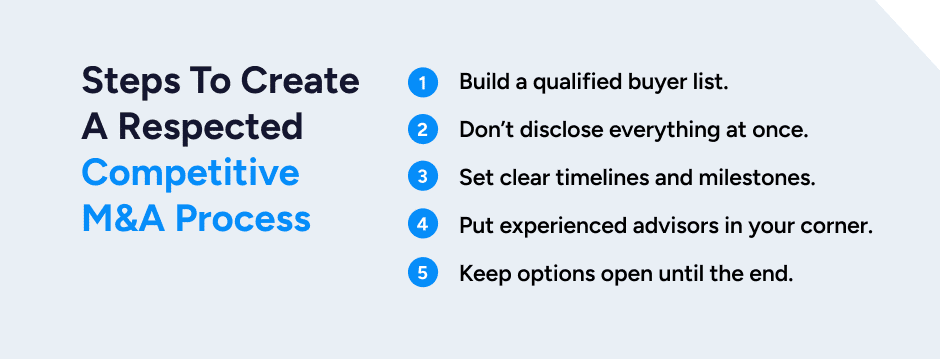

1. Build a qualified buyer list.

Terry Danner’s experience with SightPlan underscores the value of casting a wide, but intentional, net. You don’t need a hundred suitors, but you do need a carefully curated mix of strategic acquirers and private equity firms aligned with your company’s size, sector, and growth profile. Every buyer on your list should have the interest and capability to close at the valuation and structure you’re targeting.

2. Don’t disclose everything at once.

Early conversations should center on high-level metrics, your growth narrative, and strategic fit. Save detailed financials, customer data, and contracts for later stages, once multiple buyers are engaged. This phased approach keeps sensitive information secure while giving serious buyers enough context to compete for deeper access.

Founders can also prepare for diligence early. Organized financials, metrics, and customer data not only prevent delays but signal readiness, reinforcing buyer confidence and sustaining momentum through deal’s close.

3. Set clear timelines and milestones.

Deadlines create momentum. A well-defined schedule with clear dates for outreach, indications of interest (IOIs), management meetings, and final offers ensures buyers know they’re part of a disciplined competitive process. Structure signals credibility and keeps the process moving forward.

4. Put experienced advisors in your corner.

Founders consistently tell us that SEG’s guidance shifted the competitive dynamic in their favor. Experienced M&A advisors manage communication, coordinate timelines, and maintain that critical balance of transparency and tension so buyers stay engaged and founders stay focused on running the business.

5. Keep options open until the end.

For competitive tension to work its magic, maintain the perception that multiple buyers remain active until final offers are submitted. That awareness motivates bidders to put forth their strongest valuation and terms.

What Competitive Tension is Really About in SaaS M&A

The benefits of creating competitive tension in a SaaS M&A process go beyond a higher valuation. It shapes the M&A journey. It helps founders maintain leverage, stay in control of the process, and ultimately choose the best partner for their goals and vision.

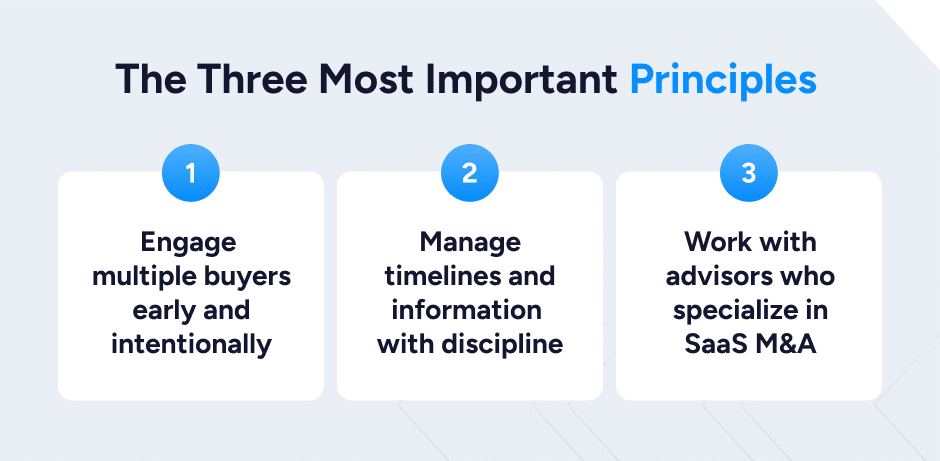

For SaaS founders, these three principles matter most:

- Engage multiple buyers early and intentionally. Build structured competition before any one buyer gains control. Understanding each buyer’s motivations, including what they value and why, will tell you how they’ll approach valuation and deal structure.

- Manage timelines and information with discipline. A well-paced process creates momentum and clarity. Controlling what is shared and when ensures buyers stay engaged and motivated to compete.

- Work with advisors who specialize in SaaS M&A. SEG brings the market perspective, process management, and buyer relationships to keep competitive dynamics healthy and productive. That allows you to focus on leading your business while we position it for the best outcome.

After years of watching deals unfold from both sides, I’ve learned that competitive tension keeps everyone honest and focused. It’s turns a sale into a strategic match.

My job now is to help founders create the kind of process that makes great buyers show up and compete for all the right reasons.

Ready to take back control? Check out our SaaS M&A Buyers’ Perspectives Report for insights from nearly 200 active buyers on what they value most. And then reach out to talk.