The Right Time to Enter Exclusivity (Hint: It’s Later Than You Think)

It can be exciting when a potential buyer submits a Letter of Intent and asks for exclusivity in an M&A deal.

That means they’re serious, right?

Buyers often push for exclusivity early in the process. They want to feel like they’ve got a serious shot at winning the deal before they invest resources in due diligence and finalizing terms.

At SEG, we believe exclusivity should be the final phase of that process: after a competitive market has been created, after buyers have done real work, and after terms have been fully negotiated.

Holding off on exclusivity ensures you maintain maximum leverage, attract the best possible terms, and stay in control of your outcome. This blog breaks down:

- Why exclusivity works best at the end of a competitive process

- The risks of entering exclusivity too soon

- And best practices for structuring exclusivity to protect your company and maximize your outcome

What Happens When a Seller Grants Exclusivity Too Soon

Consider this example.

Sarah, a SaaS founder, received an attractive $200 million offer from a private equity firm that had reached out to her. Along with the offer came a request for a 60-day exclusivity period — meaning she wouldn’t engage with other potential buyers while the PE firm completed diligence and worked toward finalizing terms.

Eager to keep momentum, Sarah agreed.

Four weeks in, the buyer flagged concerns about the total addressable market, something they hadn’t explored in detail before exclusivity. Because the buyer hadn’t done enough work up front, they were now using new information to push for a lower valuation and less favorable terms.

Sarah suddenly faced a difficult choice: accept a deal that looked very different from the original offer or walk away.

The real risk wasn’t exclusivity itself; it was the timing.

When exclusivity begins before a buyer has done meaningful work, sellers carry all the risk of new discoveries and have little recourse when the deal shifts.

This scenario is common. And preventable.

Why Exclusivity Belongs at the End of a Process

Everything SEG does in an M&A process is designed to achieve one thing: multiple compelling options for our client, the seller. Competitive tension is what drives better valuations, stronger terms, and more control over the deal process.

That begins long before exclusivity is on the table. It starts with deep preparation: understanding your story, gathering materials early, and identifying what will create excitement (and what buyers may push back on). It includes knowing the buyer landscape, understanding how they operate, and tailoring the process to get everyone to key decision points at the same time.

When that process is run well, exclusivity isn’t a risk. It’s simply the last, efficient step to get a deal closed.

Risks of Entering Exclusivity Too Soon

- Loss of leverage: Without competition, you may be negotiating against yourself.

- Increased risk of retrades: Buyers may lower their valuation after diligence, knowing you have limited alternatives.

- Missed opportunities: Other potential buyers are sidelined.

- Wasted time: If the deal falls apart, you may have to start over from scratch.

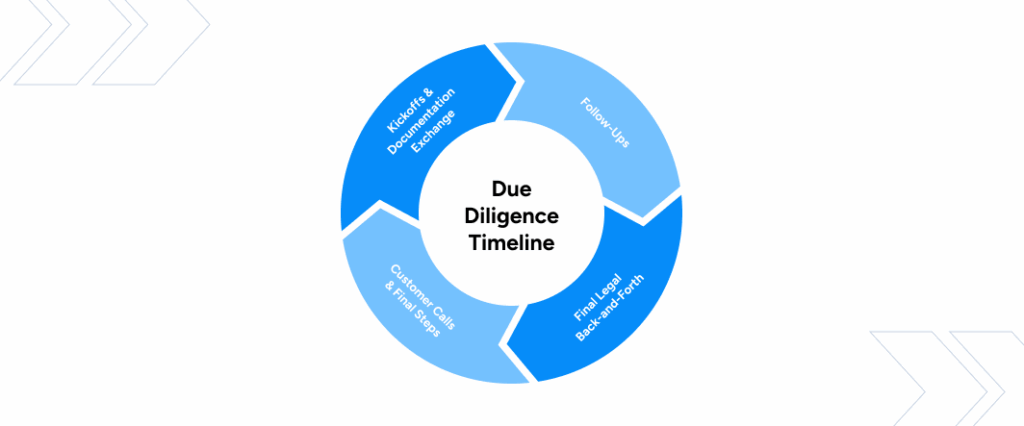

When and How to Negotiate an Exclusivity Agreement

To protect yourself from these pitfalls, make sure any agreements include safeguards. Wait to enter exclusivity until after running a competitive process so you can maintain leverage and retain other options. And enter exclusivity only after the period and provisions have been negotiated.

This is where exclusivity as a precision tool really comes into play. For it to lead to a true win, the timing and terms of the arrangement need to be carefully considered.

Here are the best practices for sellers entering exclusivity:

Grant exclusivity late in the process.

Don’t rush into exclusivity. Only consider exclusivity after confirming the buyer has done enough work upfront. Buyer work in exclusivity should be confirmatory – dotting I’s, crossing t’s. This means they will be less likely to result in a retrade or walk away.

Fully negotiate the LOI and exclusivity terms upfront.

The exclusivity period and associated provisions should be clearly defined before signing. This includes duration, exit rights, and required milestones. The more defined the terms, the less likely you are to be caught off guard by a retrade or delay.

Assess the buyer’s commitment.

It’s a red flag when buyers refuse to hire legal counsel early or delay spending money on third-party due diligence unless granted exclusivity. This may signal that they are not serious about a potential deal. Serious buyers will invest time and resources to win a competitive process.

Set clear milestones in the exclusivity agreement.

Exclusivity should be tied to specific commitments, such as completing specific due diligence items (issuing a draft purchase agreement, completing a quality of earnings, etc.) within a defined timeframe. Missing those milestones should trigger your right to terminate exclusivity.

Limit the exclusivity period.

It’s generally in the seller’s interest to keep exclusivity as short as can be reasonably negotiated. While 30–60 days is standard, the duration should reflect how much diligence has already been completed. In most of our deals, the buyer has done significant work upfront, so we negotiate a much shorter window, typically 15-30 days. Avoid open-ended agreements, and don’t immediately accept arrangements that include automatic extensions without careful consideration, which can keep you in limbo.

Preserve your optionality.

With a competitive process behind you, you have more leverage. You can get multiple potential buyers to do more work upfront, negotiate clear outs, and structure exclusivity on your terms. And if things change, you’re not starting over; you’re simply switching lanes.

How SEG Protects SaaS Operators During Exclusivity

Although exclusivity agreements can be a double-edged sword, the right guidance can help you navigate them strategically, maintain control of the process, and maximize the value of your deal. Ready to learn more?

- Download SEG’s 20 Factors Buyers Value Most guide to understand what buyers look for in your business.

- Schedule a free strategic assessment to explore how SEG can help you secure the best outcome for your company.