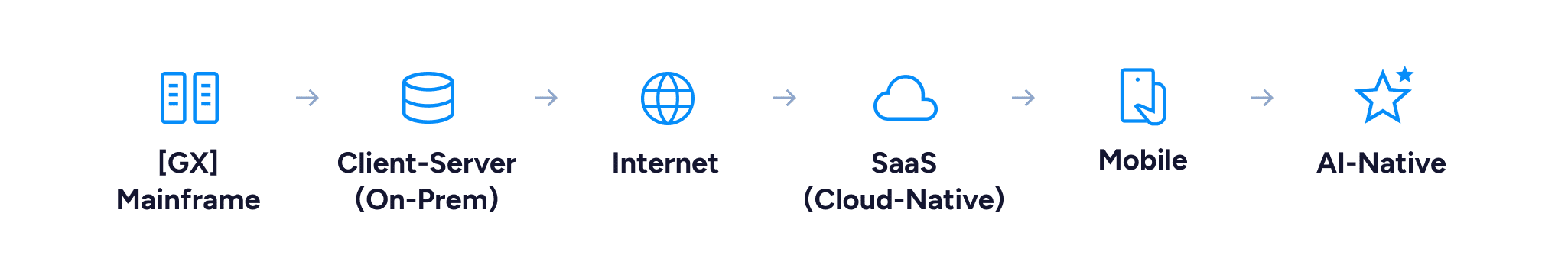

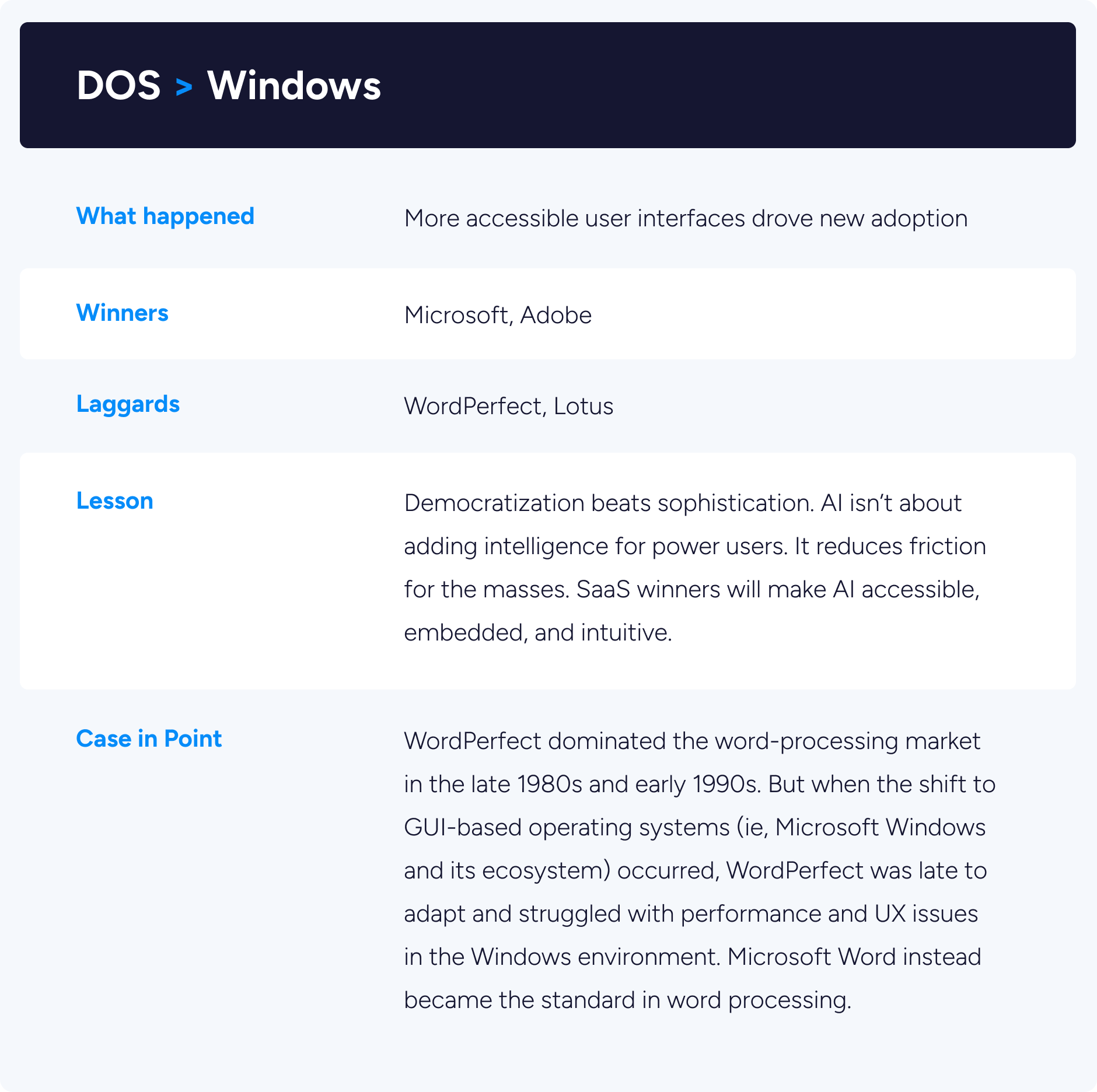

Every software era has a moment when the rules change faster than the players expect. This is that moment.

Artificial Intelligence is the most exciting and consequential development the software industry has seen in more than a decade. It represents a dramatic expansion in what software can do, not just store data or manage workflows, but reason across information, surface insight, automate decisions, and take action. AI is pushing software beyond access and into intelligence.

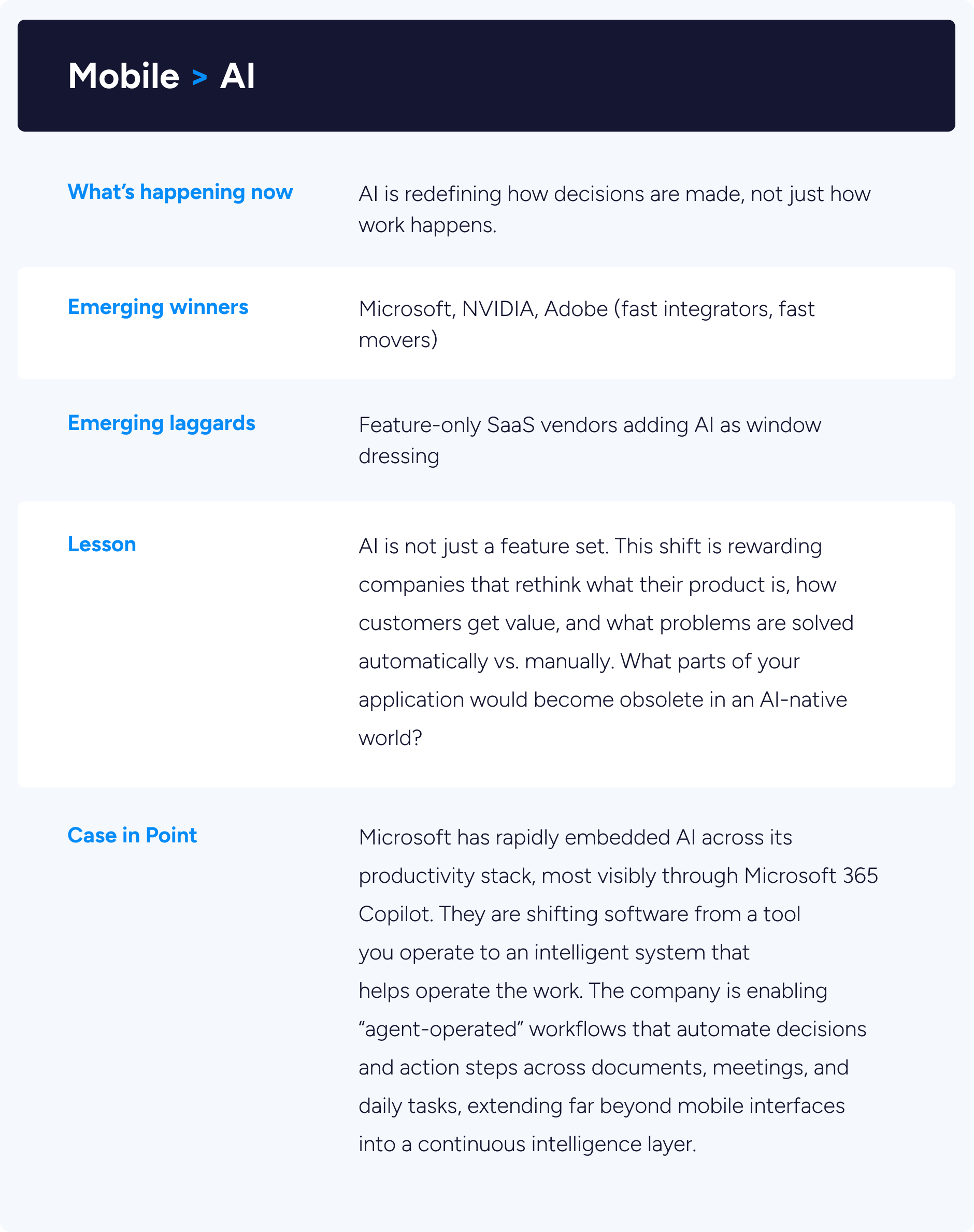

The cloud SaaS era transformed distribution, economics, and scalability. It digitized industries, centralized data, and created durable, recurring revenue models. AI builds on that foundation. It does not erase it. Instead, it introduces a new layer of capability; one that reduces cognitive overhead, increases operational efficiency, and embeds intelligence directly into the workflows customers already depend on.

This shift will create pressure. AI-first entrants can move quickly, experiment aggressively, and challenge established feature sets. At the same time, existing SaaS platforms offer significant advantages: trusted customer relationships, mission-critical workflow control, and rich first-party data generated within their systems. In many vertical markets, those assets are powerful starting points for intelligent evolution.

The opportunity in this reset is not simply to “add AI.” It is to determine how intelligence compounds within your existing architecture, workflows, and customer base. For some companies, that will mean reinvention. For others, it will mean selective enhancement. But across the market, the companies that thoughtfully integrate AI into the core of how value is delivered, rather than treating it as a surface feature, will define the next phase of competitive leadership. Buyer expectations, valuation frameworks, and competitive dynamics continue to evolve as AI adoption accelerates across software markets.

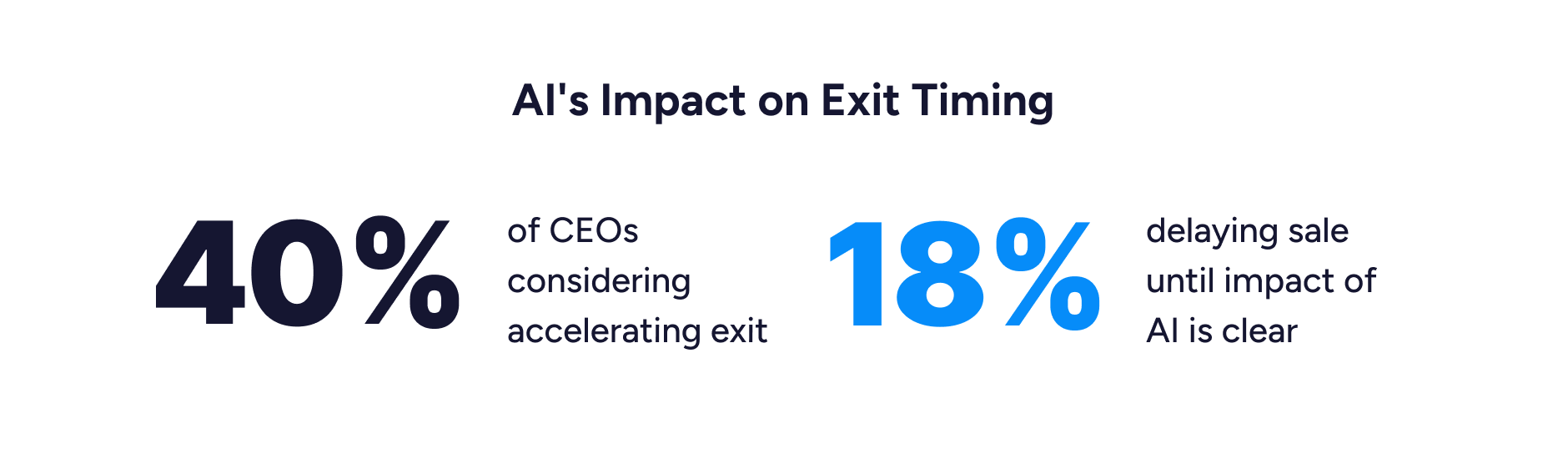

This gap is most evident in how risk is perceived. While 80% of buyers worry that AI will accelerate commoditization, only a quarter of CEOs cite it as AI’s biggest threat. Most leadership teams are prioritizing operational AI, sales efficiency, marketing automation, customer success, and data governance, while product-level AI differentiation remains a secondary focus. While many companies prioritize near-term operational ROI, buyers are placing growing emphasis on data infrastructure and system-wide intelligence as prerequisites for durable AI leverage. One commonly cited constraint among CEOs: 41% cite a lack of technical talent.

This gap is most evident in how risk is perceived. While 80% of buyers worry that AI will accelerate commoditization, only a quarter of CEOs cite it as AI’s biggest threat. Most leadership teams are prioritizing operational AI, sales efficiency, marketing automation, customer success, and data governance, while product-level AI differentiation remains a secondary focus. While many companies prioritize near-term operational ROI, buyers are placing growing emphasis on data infrastructure and system-wide intelligence as prerequisites for durable AI leverage. One commonly cited constraint among CEOs: 41% cite a lack of technical talent. Another is conviction at the execution level. Seventeen percent say they still don’t see a clear ROI or business case for AI, making it harder to justify deeper product investment even as buyers move ahead with those assumptions baked into valuation and diligence. That means many founders may not understand the potential applications of AI to make customers’ lives easier and their own operations more efficient.

Another is conviction at the execution level. Seventeen percent say they still don’t see a clear ROI or business case for AI, making it harder to justify deeper product investment even as buyers move ahead with those assumptions baked into valuation and diligence. That means many founders may not understand the potential applications of AI to make customers’ lives easier and their own operations more efficient.

AtonixOI applied predictive analytics to large volumes of operational data from physical assets, enabling early detection of shifts in equipment behavior that signal impending failure. AtonixOI helped operators move from reactive to predictive, reducing downtime and operational risk. Following the acquisition,

AtonixOI applied predictive analytics to large volumes of operational data from physical assets, enabling early detection of shifts in equipment behavior that signal impending failure. AtonixOI helped operators move from reactive to predictive, reducing downtime and operational risk. Following the acquisition,