The Secret to Building Relationships with SaaS Buyers Without Losing Leverage

What I’ve learned from working on both sides of the deal table is that early buyer relationships can be a huge advantage or a liability depending on how you manage them.

These conversations often start long before a SaaS founder is ready to sell. The most successful SaaS founders use that time to build trust and gather insight, not to negotiate or overshare. Done right, early interactions can strengthen your eventual M&A process. Done wrong, they can erode trust and hand buyers leverage you’ll need later.

This matters, especially because founders often find themselves fielding inbound offers years before they plan to sell. The catch is that these offers aren’t typically based on a full understanding of your business. Without context, they can leave founders asking:

- Why are we on buyers’ radar?

- Which conversations are worth having, and when?

- How much information should we share?

- What should we be asking potential buyers in return?

The way you answer these questions will shape how your relationships with buyers evolve, and how much leverage you preserve when it’s time to run a process.

Every Conversation Leaves a Trail

Strong M&A outcomes don’t happen by accident. The two biggest traps a SaaS founder should work to avoid when nurturing relationships are: giving away too much too soon, which weakens negotiating power, or staying so tight-lipped that buyers lose interest.

When I was a buyer, I remembered every detail a founder told me down to the revenue target they mentioned a year earlier. So, when I talk with founders now, I always advise them: Keep your own notes, too. Track who you spoke with, what they asked, and what you shared. Over time, those insights become your advantage. They help you separate serious buyers from tire-kickers, and understand who’s tracking you for the long term.

The best outcomes come from balance. By the time you launch a formal process, the most qualified buyers should already understand why your company matters: its position in the market, the strength of your product, and the caliber of your team. That knowledge motivates them to engage seriously once the process begins.

At the same time, it’s important to recognize that familiarity shouldn’t mean exclusivity. Early relationships are valuable, but they should be managed in a way that maintains optionality, fosters competitive tension, and protects your leverage.

What SaaS Buyers Are Most Likely to Ask You

When I was on the buy side of SaaS deals, I always looked for consistency, not just in the numbers, but in how a founder talked about their business over time. If a founder said last year they’d hit $10 million ARR and said the same thing this year, I immediately wondered what went wrong. It’s not about being perfect; it’s about being consistent and transparent enough that they trust your story.

Top of mind for strategic buyers is how your business fits into their existing portfolio, customer base, and technology stack. Private equity investors have defined investment horizons and return expectations, so their questions may lean more toward financial performance, scalability, and operational discipline.

Expect questions like these from buyers, depending on their end goals:

- Why do you want to sell?

- How do you value your company?

- What does your product roadmap look like for the next 12–18 months?

- Which industries or customer segments make up most of your revenue?

- What differentiates your product from competitors?

- How dependent is your company on a few large customers versus a diversified base?

- Are you looking for a minority or majority investment?

- How efficient is your customer acquisition?

- What is your current ARR, and how fast is it growing?

- How loyal is your customer base? What are your retention rates and churn metrics?

- How do you balance growth with profitability (Rule of 40 score)?

- What are your gross margins, and how have they trended over time?

- What KPIs do you use to measure operational efficiency and scalability?

- What role do you see for your leadership team post-transaction?

What Questions Should You Ask SaaS Buyers in Early Conversations?

One of the smartest ways to learn from buyers, however, is to flip the script. Ask them questions that reveal how they operate, not just what they think of you.

The first conversations buyers initiate often revolve around compatibility with their own goals. Use them to learn, position your story, and set the stage for stronger terms later.

A simple but revealing opener can be: “How did you find us?” The answer may point to a colleague who has been using your software, the fact that they view your capabilities as competitive to their roadmap, or perhaps an analyst scanned the market for promising companies. Either way, it gives you a clearer sense of how your business is being noticed and the signals that you’re sending into the market.

Other questions to ask include:

- How do you underwrite SaaS acquisitions?

- What are your typical deal terms?

- Where/how do you think my business fits into yours?

- What sectors or product capabilities are you prioritizing this year?

- How do you evaluate cultural fit and leadership roles post-acquisition?

- What metrics matter most to you when assessing valuation?

- What kind of growth profile do you typically invest behind?

- Who else have you backed in this space, and what did success look like for them?

- How do you think about exits? Do you use a banker, or handle sales internally?

- If we decided to explore a process one day, which banks or advisors would you recommend we talk to?

Share Enough to Build Trust – Not Lose It

Many SaaS buyers won’t consider the numbers official until they’ve calculated the metrics for themselves. In some cases, they may ask for raw data, such as P&L statements or invoice files for the past several years.

But steer clear of oversharing information before they’re ready to run a structured process. If you reveal too much too soon, or wind up telling a story that isn’t consistently backed up by the numbers, you can undercut your ability to create competition.

This is where an advisor like SEG, with extensive experience managing the flow of information between buyers and sellers, can provide guidance to keep the process on the tracks.

Here’s what we recommend:

Focus on the big picture at the outset.

In the first conversations, focus on your vision, the market opportunity, and headline performance metrics. Hold back from customer-level or line-item financials. Give enough context to spark interest, but reserve the granular details for later when multiple buyers are engaged.

Use NDAs as a safeguard, not a free pass.

Secure an NDA before going beyond public information. But even then, treat disclosures carefully. Avoid sharing customer or employee names and vendor contracts until it’s necessary. Protect anything that feels sensitive or premature. Having an NDA in place is really designed to give you comfort that what you are sharing will stay private, it is not a right for the buyer to see everything.

Control the narrative.

Rather than handing over data in response to scattered requests, provide a structured company overview. This ensures buyers see a consistent story and prevents fragmented details from being misinterpreted. Just make sure what you share is backed up by reliable and consistent data across the board, avoid changes in historical information and always try to share data in consistent formats.

Stage the details over time.

Think of disclosure as phased. Early on, stick with your growth story, positioning, and high-level numbers. Deeper financial and operational details should only be released after you have real signals of buyer interest and multiple parties at the table.

Document every request.

Track who asked for what, and when. It keeps the process organized and makes sure no buyer gains an early edge by accessing information others don’t yet have.

Remember: An NDA doesn’t erase memory. That’s why consistency matters; your story should evolve, but your numbers should back it up every time. You don’t have to withhold everything, but you do have to stage it. Each layer of disclosure should match a stage of intent.

Trust Builds Value

Early discussions with buyers serve two purposes: They help you establish rapport while also setting up a foundation for a competitive process. Many founders miss the mark, giving away too much too soon under the banner of transparency or staying so guarded that no real connection is made. The real skill lies in doing both but doing it deliberately.

Buyers build conviction from familiarity. The goal is to create an advocate at the buyer or investor so that they will walk into their investment committee meetings and argue for higher valuations because they’d built trust with a founder years earlier. Make them feel confident in who they are buying and not just what. That conviction only comes from consistent, authentic engagement over time.

The right buyers will pay up for a company (and a founder) they already trust.

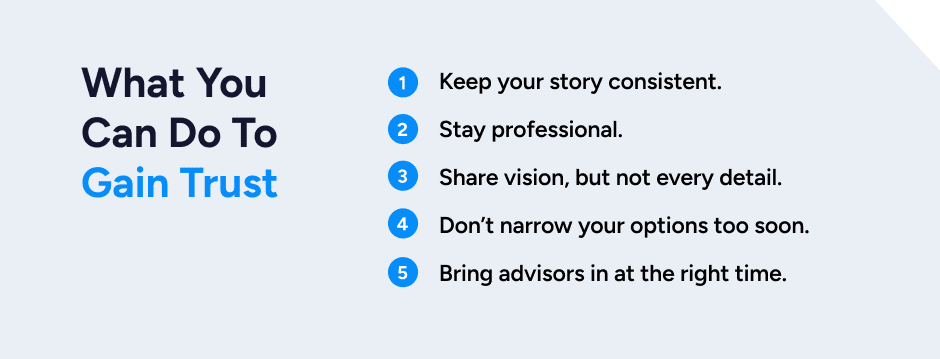

Here’s how:

Keep your story consistent.

Every buyer should feel like they’re getting a fair look. Share the same high-level narrative and performance metrics with all interested parties, and share updates in the same format; try to avoid changes to historical information that has already been shared. This not only builds credibility but also prevents favoritism that could undercut your leverage.

Stay professional.

Timely responses, clear organization, and a controlled approach to communication show buyers you’re disciplined. Companies that manage the pace and tone of interactions are taken more seriously than those that appear reactive or disorganized.

Share vision, but not every detail.

You can establish trust without handing over the key to the data room on day one. Focus on explaining your growth plans, market perspective, and strategic direction. Hold back specifics until due diligence.

Don’t narrow your options too soon.

Putting your energy into one suitor early on weakens your position. Maintaining multiple conversations fosters healthy competition and shows buyers they’ll need to put their strongest terms on the table.

Bring advisors in at the right time.

After talks move past initial interest, engage a sell-side advisor like SEG to show buyers you’re serious about running a structured competitive process. The right advisor strengthens your hand with buyers and allows you to keep doing your most important job.

York Bauer, CEO of MoxiWorks, encourages other sellers not to overestimate the difficulty of juggling potential buyers in an M&A process:

“The analogy I would give is the sale of a home or the purchase of a home. Same idea. That’s an incredibly high stakes emotional thing that you go through, and you know over 90% of consumers have an agent for that reason. So why wouldn’t you do that with the sale of a company?”

Dr. Jacquelyn Kung, Founder and Former CEO of Activated Insights, agreed: “It’s very difficult being directly in touch with a group of buyers. Not only does it derail your day-to-day work and what you’re doing, but also, there’s no buffer between you and the buyer in terms of some of these negotiations.”

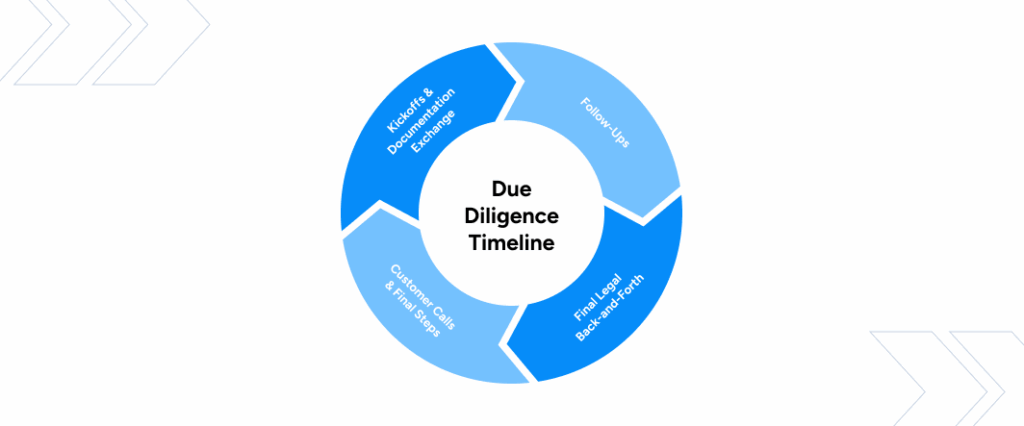

How Early Discipline Pays Off in Late-Stage Leverage

Early discipline doesn’t mean distance; it means control. The founders who do this best treat every conversation as an opportunity and a rehearsal. They learn how buyers think, what matters to them, and how to tell their story with clarity.

Those early touchpoints can pay off years later when the founder finally decides to sell. Buyers who already understand and trust the team are quicker to act, more confident in their bids, and more likely to push for a win internally.

That’s the dynamic we help our clients create at SEG, strategic familiarity that strengthens competitive tension when it matters most.