EBITDA Calculations and Adjustments that Improve Financial Readiness

Now more than ever, private equity firms and strategic buyers prioritize profitability when analyzing potential acquisition targets. They want to know that your company can make money, operate efficiently, and make smart spending decisions to maximize financial gain.

But what many operators don’t realize is that profitability isn’t always as simple as revenue minus expenses. The way EBITDA is calculated, and more importantly, how it’s adjusted and presented, can have a meaningful impact on your company’s valuation. Small adjustments can swing enterprise value by millions of dollars, which is why many of the software operators we advise start preparing years before they intend to transact.

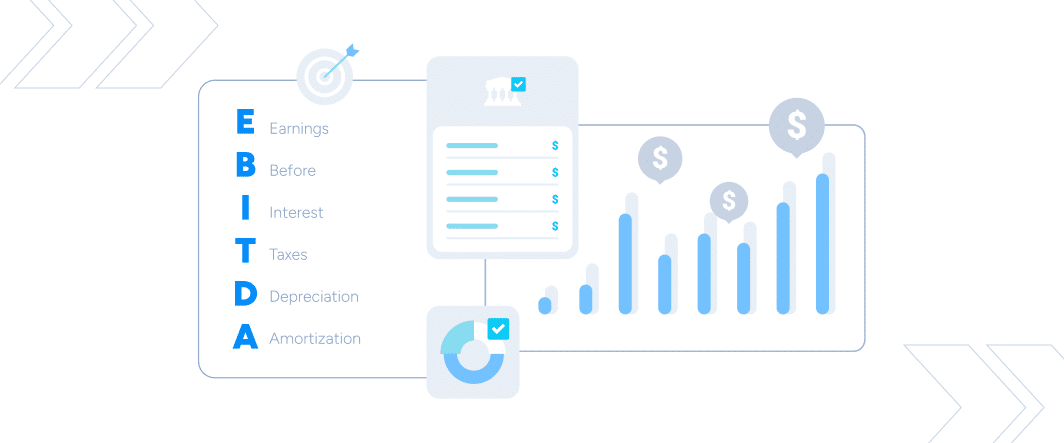

To get a sense of your company’s profitability, the most common metric buyers examine is known as EBITDA. It’s an accounting acronym that means Earnings Before Interest, Taxes, Depreciation, and Amortization (note: It is usually pronounced as a single word – Ee-bit-dah – rather than spelled out as individual letters). This metric is often used in conjunction with revenue, cost of goods sold/gross profit margin (see more about calculating COGS here), and net income to assess a company’s overall financial performance.

The more you learn about calculating EBITDA and the accounting practices behind it, you might find that your company is more profitable than you realized. Eventually, this can help you position your company for a more rewarding exit.

How to Accurately Calculate EBITDA (Including Add-Backs and Cash-Adjustments)

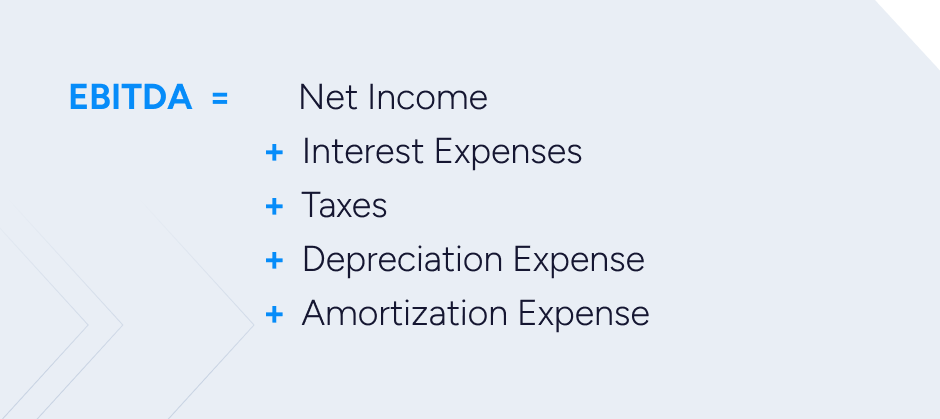

When it comes to calculating EBITDA, simply take the net income of the business and add the following:

- Interest expense

- Taxes

- Depreciation expense

- Amortization expense

This is the basic formula, but there are other variables, known as EBITDA adjustments, that can make things a bit more complicated. These adjustments are often where meaningful valuation differences emerge in buyer discussions.

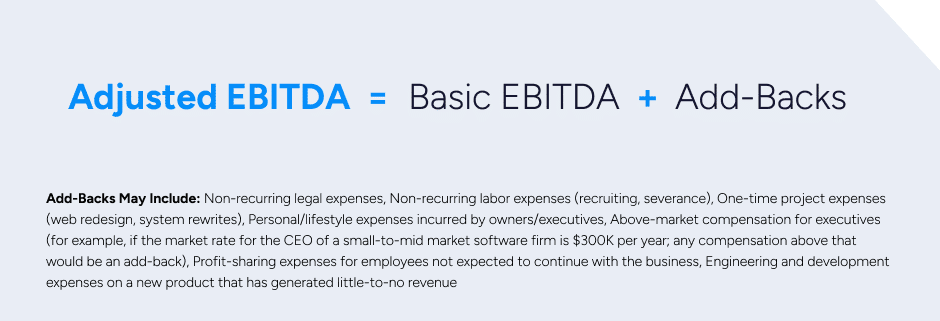

Calculating EBITDA Adjustments (Add-Backs)

One limitation of the EBITDA formula, when taken at face value, is that it may not account for certain one-time, non-recurring expenses. These anomalous expenses do not accurately represent the business’s true expense needs, so it makes sense to adjust the metric to get a clearer reflection of expected profitability going forward.

These EBITDA adjustments, commonly called “add-backs,” typically include (but are not limited to) items such as:

- Non-recurring legal expenses

- Non-recurring labor expenses (recruiting, severance)

- One-time project expenses (web redesign, system rewrites)

- Personal/lifestyle expenses incurred by owners/executives

- Above-market compensation for executives (for example, if the market rate for the CEO of a small-to-mid market software firm is $300K per year; any compensation above that would be an add-back)

- Profit-sharing expenses for employees not expected to continue with the business

- Engineering and development expenses on a new product that has generated little-to-no revenue

To arrive at the Adjusted EBITDA, one would simply take the basic EBITDA plus any add-backs. The adjusted number gives potential investors or buyers a normalized metric by which to make more standard valuations across multiple companies. In other words, it helps them compare apples to apples and can potentially make your company look like a more attractive target. It’s important to recognize that many founders, and even experienced internal finance teams, may unintentionally understate or overstate adjusted EBITDA without expert guidance. In many of the client engagements we lead, a careful diligence of add-backs often results in significant increases in valuation that CEOs hadn’t previously anticipated.

Cash-Adjusted EBITDA

Beyond the Adjusted EBITDA, software buyers may also be interested in knowing your company’s Cash-Adjusted EBITDA, which is a different calculation. By accounting for deferred revenue (cash you’ve collected in advance of delivering services), the Cash-Adjusted metric accounts for future changes that are not yet reflected in the original metric. In other words, it provides a preview for calculating EBITDA yet to come.

To arrive at Cash-Adjusted EBITDA, you first need to calculate two other numbers:

- The 12-month trailing EBITDA (the average for the previous 12 months)

- The year-over-year change in deferred revenue (change in deferred revenue from the beginning of a 12-month period to the current month)

The complete formula for Cash-Adjusted EBITDA is as follows:

12-month trailing EBITDA + YoY change in deferred revenue = Cash-Adjusted EBITDA

This calculation is especially pertinent for SaaS companies because they often collect payment in advance for year-long software subscriptions. Assuming current sales are strong for your company, Cash-Adjusted EBITDA may cast you in the best light in the eyes of potential buyers or investors.

However, buyers will scrutinize these adjustments during diligence. Having a well-prepared financial package that cleanly documents deferred revenue, capital expenditures, and one-time adjustments can reduce the likelihood of post-LOI re-trades that erode value late in the process.

Understanding how your EBITDA compares to market expectations is crucial, especially as buyers continue to reward efficient and profitable operators. According to our recent SaaS M&A and Public Market Report, SaaS valuations remained resilient, with an average EV/Revenue multiple of 5.4x. The data underscores how disciplined growth and margin expansion continue to reward sellers.

Capital Expenditures (CAPEX)

An important caveat: Just as deferred revenue can raise your cash-adjusted EBITDA, any capital expenditures could lower it. Capital expenditures (CAPEX) are typically substantial purchases a company makes to acquire, upgrade, and maintain physical assets such as property, equipment, or technology (this is in contrast to operating expenses, or OPEX, which include day-to-day, recurring costs like rent and electricity).

Due to the nature of the software industry, most SaaS companies don’t have much CAPEX to speak of, but there are exceptions to that rule. For example, perhaps your company also has a hardware component to its offerings, such as cameras or sensors. If you purchase those assets and hold them on your books, you can amortize the expense over the assets’ useful life, which minimizes the impact on EBITDA. Nevertheless, from the perspective of potential buyers, those assets represent cash out-of-pocket at the time of purchase, and the full cost should be considered when calculating cash-adjusted EBITDA.

Example Scenario of Calculating EBITDA

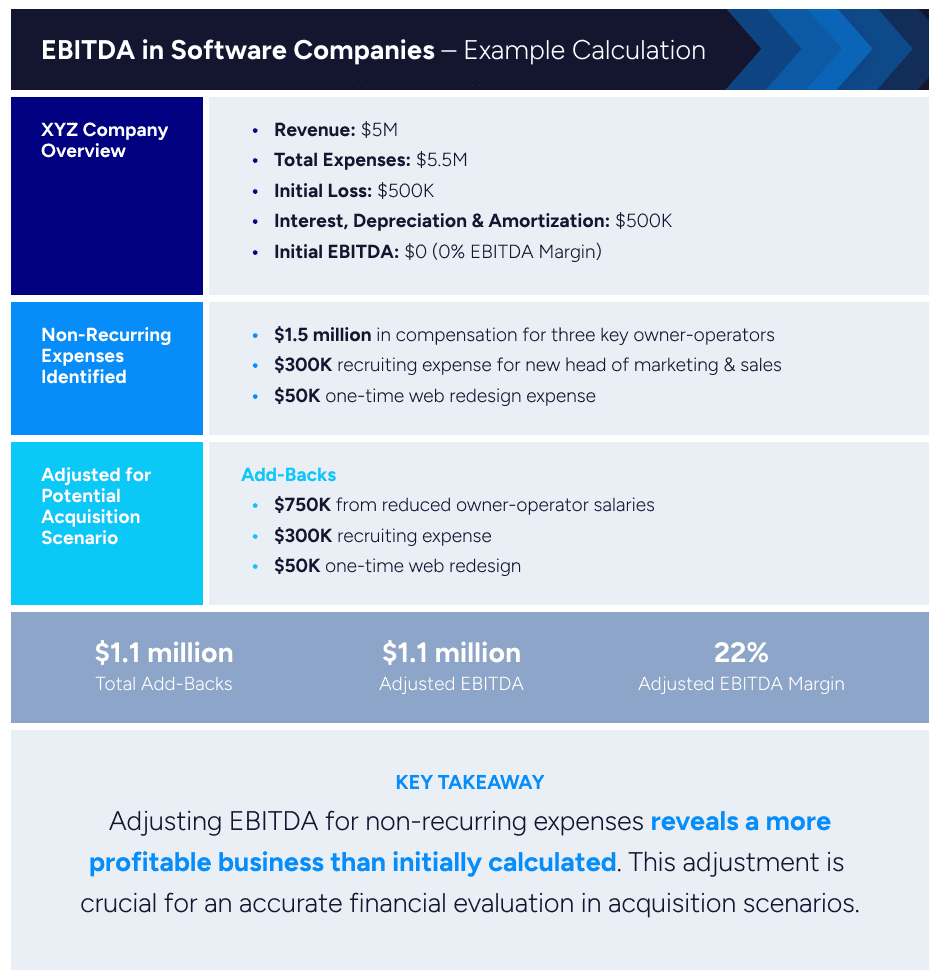

Say XYZ Company has $5 million in revenue and $5.5 million in total expenses, which equates to a loss of $500,000. However, the company has $500K total in interest expenses, depreciation, and amortization. This balances out to a calculation of $0. The EBITDA margin (EBITDA/revenue) would be 0%, indicating that the business is breaking even.

Upon further examination, the company also had the following non-recurring expenses in the past year:

- $1.5 million in compensation going to three key owner-operators

- $300K recruiting expense to hire a new head of marketing and head of sales

- $50K one-time web redesign expense

If we assume that, in a scenario where the business is acquired, the three key owner-operators will exit and can be replaced at salaries of $250K each, then the metric is adjusted by:

- Adding back $750K of above-market compensation (1.5 million – ($250K x 3))

- Adding back $300K recruiting expense

- Adding back $50K one-time web redesign expense

Total Add-Backs: $1.1 Million

Adjusted EBITDA (EBITDA + Add-Back Amount): $1.1 million

EBITDA Margin (1.1 million / $500K in revenue): 22%

Key takeaway: By carefully analyzing the company’s expenses and adjusting EBITDA with the appropriate add-backs, the company appears much more profitable than its original EBITDA suggested.

How to Improve Your Software Company’s EBITDA

While appropriate adjustments can help position your business more attractively, true EBITDA improvement requires operational optimization. Growing revenues faster than costs, controlling expenses, and improving gross margins all drive sustainable EBITDA growth.

Initiatives like accelerating product innovation, expanding into new markets, or streamlining cost centers can help improve underlying performance over time, strengthening your eventual valuation.

Our Take on Why EBITDA Isn’t Everything

To reiterate, EBITDA is certainly an important metric that strategic buyers and private equity investors use to evaluate a company’s profitability. However, it’s just one piece of a much broader story buyers will evaluate. Factors like growth rate, customer retention, market positioning, and buyer fit often carry equal or greater weight in determining valuation.

We often speak with founders who assume their company’s EBITDA multiple alone determines valuation. In reality, thoughtful positioning, buyer targeting, and proper preparation of financials can be just as influential in driving premium outcomes. This is one reason many of the companies we advise engage us years before a transaction, allowing time to structure and optimize these factors properly.

Common FAQs about Calculating EBITDA

Here are some quick answers to some frequently asked questions regarding EBITDA in a software business.

1. What is the ideal EBITDA margin?

The ideal EBITDA margin varies by industry and the company’s maturity, but for software companies, a margin of 20-40% is often considered healthy. High-growth or early-stage SaaS companies might see margins lower than this due to significant reinvestments in growth.

2. Is EBITDA the same as gross profit?

No, EBITDA is not the same as gross profit. Gross profit is calculated as revenue minus the cost of goods sold (COGS), whereas EBITDA also accounts for operating expenses but excludes interest, taxes, depreciation, and amortization.

3. Why is EBITDA important in valuations?

EBITDA is a key metric in valuations because it provides a clearer picture of a company’s capital efficiency and operating performance. Investors and buyers often use EBITDA to assess the profitability and cash flow potential of a business.

4. What is EV/EBITDA?

EV/EBITDA is a commonly used valuation multiple that compares a company’s enterprise value to its trailing twelve months of EBITDA.

5. What is Adjusted EBITDA?

Adjusted EBITDA refers to EBITDA that has been modified to exclude one-time, irregular, or other expenses or revenues that are not representative of normal due-course business. This gives a more accurate picture of a company’s ongoing operational performance.

6. What is Operating Profit vs EBITDA?

Operating profit, also known as operating income or EBIT (Earnings Before Interest and Taxes), includes depreciation and amortization. Calculating original EBITDA, on the other hand, excludes these non-cash expenses, offering a view of profit from operations without accounting for capital expenditures.

We Can Help Calculate Your Company’s Metrics

To recap, EBITDA is one of many critical metrics buyers will analyze as part of a much broader diligence process. For founders and CEOs considering a future transaction, whether that’s one year or five years from now, early preparation of financials, adjustments, and positioning can make a significant difference in both valuation and deal certainty.

At SEG, we’ve guided hundreds of software founders through this process, helping them prepare properly, avoid common diligence risks, and maximize value when the time is right. If you have any questions about EBITDA or how buyers evaluate SaaS companies, our team is always happy to have an early conversation.