How to Bridge Current ARR to Your Year-End Target

You are reviewing your Q4 forecast. The plan shows $10 million in ARR by year-end, and you are currently at $7.5 million. The target feels achievable, yet slightly uncertain. You know the broad strokes of what needs to happen. The pipeline appears healthy, and your team is performing well. But when you ask yourself what specifically must occur between now and December 31 to make that number a reality, the answer is less clear.

Most SaaS founders and CEOs have felt this same uncertainty at some point in their growth journey. It is not a lack of confidence or ambition. It is the difficulty of turning instinct into precision. Many companies operate without a clear bridge between current performance and future goals. Forecasts are reviewed, numbers are discussed, but the mechanics that connect the two remain vague.

This is, first and foremost, an operational challenge that affects how you manage your business on a day-to-day basis. It also becomes a critical factor during M&A processes, where buyers will inevitably require you to produce and defend a detailed analysis of how you plan to achieve your forecast. Buyers scrutinize how you track and forecast revenue because clean revenue documentation is one of the most valuable assets in diligence. Companies that master this operationally are far better positioned when that moment arrives.

There is a better way to close this gap with structure and predictability. It begins with a framework called your Go Get.

What Is a Go Get?

Your Go Get is the amount of new ARR your company must secure within a defined period to achieve your forecast, after accounting for everything already contracted and expected churn. It is what you still need to go out and win that you do not have today.

This distinction matters because the gap between your current ARR and your target ARR is not your Go Get. Your Go Get is what remains after you factor in revenue that is already contracted but not yet recognized, as well as revenue you expect to lose through churn.

Consider a simple example:

- Current ARR (July 1): $7.5M

- Year-End Target (Dec 31): $10M

- Gap: $2.5M

However, this $2.5M is not your actual Go Get. Some growth may already be contracted but not yet realized. Some existing revenue may churn before year-end. Once you account for these factors, your true Go Get becomes clear. The framework helps you move beyond surface-level math to understand exactly what must still be secured.

The Anatomy of a Go Get: What’s In the Bag vs. What You Must Win

Every Go Get analysis begins by identifying your Contracted Annual Recurring Revenue (CARR). This represents revenue you have signed under contract but have yet to begin billing. Understanding CARR changes how you think about growth because it distinguishes what is already secured from what still needs to be earned.

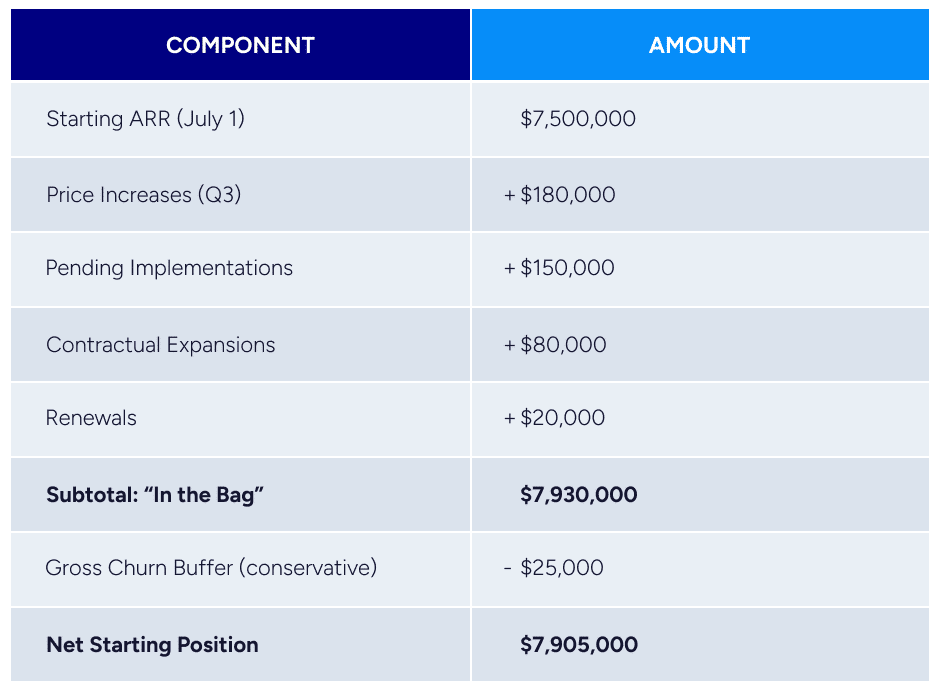

CARR typically includes four key components:

Price Increases Price increases that have already been communicated and accepted by customers are part of your CARR. For example, if you notified customers 90 days ago that pricing will increase by 10 percent upon renewal and those renewals occur later this year, that incremental ARR is already committed. The work is done, and the revenue is effectively secured. For more on optimizing your pricing strategy, see our guide to SaaS pricing models and our webinar on crafting a winning pricing strategy.

Pending Implementations Signed customers who are in the process of launching also fall within CARR if implementation is progressing well. For instance, if you signed a $150,000 ARR customer in May and they are expected to go live in October, that ARR becomes recognizable once implementation is complete. When historical success rates are high, this revenue can be treated as contracted.

Contract Expansions Multi-year agreements often include scheduled expansions, such as additional seats or modules becoming active in a specific quarter. These expansions are contractually committed and should be captured in your CARR.

Renewals Some renewals include contracted expansions beyond the current ARR level. For example, if a customer currently paying $100,000 annually has committed to renewing at $120,000 with additional users, that $20,000 increase is part of your CARR. Note that the base $100,000 is already captured in your starting ARR, so only the incremental expansion belongs in CARR.

You must also account for expected churn. This includes any known customer departures as well as a conservative buffer based on your historical gross retention rate. This ensures your Go Get reflects the net new ARR you must generate after accounting for revenue loss.

With these elements identified, you can calculate what is “in the bag” and what remains at risk.

For example:

Once you understand this foundation, the true Go Get becomes clear.

- Year-End Target: $10,000,000

- Net Starting Position: $7,905,000

- Actual Go Get (New ARR Required): $2,095,000

What appeared to be a $2.5 million gap is actually a $2.10 million Go Get. That 16 percent difference matters. Precision at this level changes how you manage the business, allocate resources, and hold teams accountable. It creates visibility where uncertainty once existed and replaces general optimism with measurable progress.

Your Go Get is then compared against your weighted sales pipeline to assess coverage. Do you have enough high-quality opportunities in motion to realistically generate $2.10 million in new A? This comparison between your Go Get and your pipeline coverage becomes the foundation for confident forecasting.

Why This Framework Isn’t Standard Practice

In our experience advising hundreds of SaaS companies with $5 million to $100 million in ARR, very few have achieved this level of operational precision before engaging with us. It is not because founders lack discipline or analytical capability. More often, this framework is not well-documented or top of mind for founders who are focused on building their businesses and assume basic financial reporting is sufficient.

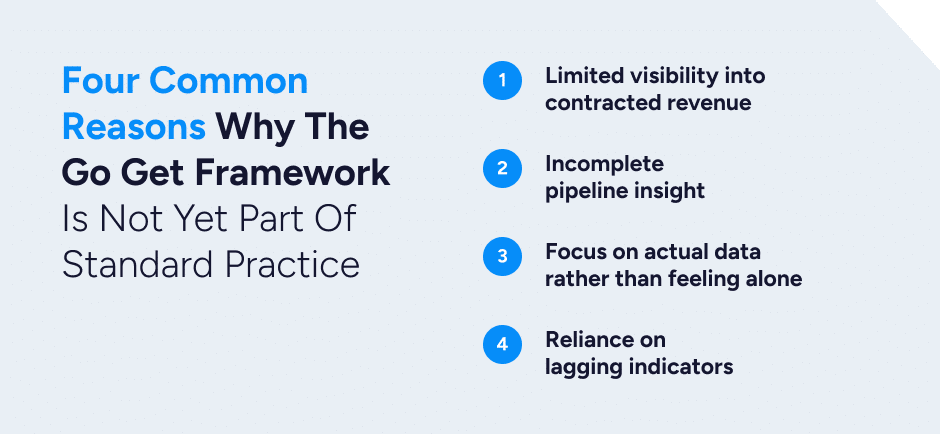

There are four common reasons why the Go Get framework is not yet part of standard practice.

1. Limited visibility into contracted revenue Most companies track recognized ARR closely because it is visible in their financial statements. However, contracted revenue that has not yet been billed often resides across disconnected systems, such as spreadsheets, Slack messages, or informal notes. Without a consistent method to capture price increases, implementation backlogs, and scheduled expansions, a true view of CARR remains hidden.

2. Incomplete pipeline insight Many leadership teams monitor total pipeline value and deal stages, but they stop short of weighting those deals by probability or pressure-testing close dates against historical patterns. A $5 million pipeline may appear strong, but if the company’s historical win rate is 15 percent and half those deals will not close for nine months, the actual impact on near-term ARR is far smaller than it seems.

3. Focus on actual data rather than feeling alone A full pipeline or a busy sales team can create a sense of momentum, yet activity alone does not equate to results. Without understanding how pipeline creation, sales velocity, and conversion rates interact, it becomes difficult to predict outcomes accurately. Many sales leaders learn this through experience rather than through structured frameworks.

4. Reliance on lagging indicators Revenue growth and churn are lagging indicators. By the time they move, the outcome has already been determined. A Go Get analysis shifts attention to leading indicators such as pipeline coverage, stage-specific conversion rates, and sales velocity. This proactive approach allows leaders to identify risks earlier and adjust before performance is impacted.

The result of these gaps is that even well-run companies often operate with less predictability than they realize. A Go Get framework brings structure and accountability to what can otherwise feel like instinct-driven decision-making. It aligns leadership teams around measurable progress, creates a shared understanding of what must be achieved, and builds the foundation for more confident planning, both operationally and strategically.

Bridging to ARR vs. CARR

There is one additional complexity worth noting, particularly for businesses that do not begin billing recurring revenue until customer go-live (successful completion of implementation). In these businesses, you are effectively bridging to year-end CARR (contracted ARR) rather than recognized ARR.

For example, if your business typically takes 60 days to implement new customers and you only begin billing upon go-live, a deal signed in November will not contribute to your December 31 ARR even though it is contracted. This means your Go Get is not just about winning $2.10 million in new business. It is about winning $2.10 million in new business and getting it live by year-end.

This introduces the importance of tracking average implementation timelines and understanding what percentage of newly signed business can realistically go live within your target period versus what will remain in your implementation backlog. For businesses that bill only upon go-live, this distinction significantly affects how you assess pipeline coverage and plan your sales efforts.

How Go Get Analysis Changes Your Operating Rhythm

Once you begin managing your business through a Go Get lens, the way you discuss performance and make decisions changes. Conversations move from general confidence to measurable clarity. Instead of saying, “We should hit our number,” you can say, “We need $2.24 million in new ARR. We have $4.5 million in weighted pipeline. With a 50 percent win rate, that gives us two times coverage. We are on track, but if two of our top five deals move to next quarter, we will fall short.” That level of precision changes how leadership teams communicate and make decisions.

It also enables you to identify challenges much earlier. If it is October 1 and you still need $600,000 in new ARR by year-end, but your weighted pipeline only supports $400,000 and your average sales cycle is 90 days, you already know the risk of missing your goal. That insight allows you to take action today rather than react when it is too late. You can accelerate late-stage opportunities, shift resources to higher probability deals, or reset expectations with your team or board based on real data.

Resource allocation decisions become more strategic as well. Should you invest in another account executive, add a new marketing program, or expand into a new vertical? The Go Get framework provides a quantitative foundation for those decisions. If you already have three times pipeline coverage and consistent conversion rates, additional sales capacity makes sense. If coverage is low, the focus should shift toward pipeline creation and lead quality.

Perhaps the most meaningful benefit is the credibility it creates with your board and investors. A well-defined Go Get demonstrates control, transparency, and predictability. Boards do not expect certainty, but they value discipline and evidence-based decision-making. When you can walk them through your forecast, show what is already contracted, what is in play, and how coverage ratios align with historical performance, you build confidence in both the numbers and your leadership.

Over time, this discipline compounds. Companies that adopt a Go Get mindset tend to forecast more accurately, allocate resources more efficiently, and manage growth with less volatility. The same precision that improves near-term execution also strengthens long-term value, because predictability is one of the qualities buyers and investors value most.

How to Build Your Six-Month Rolling Go Get

Building a six-month rolling Go Get is one of the most effective ways to turn this framework into a repeatable management practice. It ensures that you are always looking forward, aligning near-term goals with long-term growth, and maintaining visibility into how each decision affects your forecast. The process is straightforward, but it requires consistency.

At the start of each month, create a bridge to your six month target. Begin by establishing your current ARR using a consistent measurement approach. This typically includes monthly recurring revenue multiplied by twelve, plus annual contract values normalized to an annual rate.

Next, identify the components of your CARR. Document all price increases scheduled to take effect within the next six months and the customers they apply to. List signed customers currently in implementation, along with expected launch dates and ARR values. Include contractual expansions that will activate during this period, and review expected churn by applying your historical retention rate to estimate the likely outcome.

Once your CARR is complete, set your six-month target based on your internal forecast or board-approved plan. Subtract your current ARR, add your CARR components, and adjust for expected churn. The result is your Go Get, the exact amount of new ARR you must win to stay on plan.

Finally, compare your Go Get to your pipeline. Assess both total and weighted pipeline values for deals expected to close within the period. Divide your weighted pipeline by your Go Get to calculate your coverage ratio and evaluate whether that coverage is sufficient given your historical win rates and sales cycle length. This step turns your forecast into a living, data-backed operating model.

While a six-month horizon is a good baseline for many businesses, others may find a shorter or longer period of time more appropriate based on their sales and implementation cycle length. Regardless of frequency, the key is consistency. Regular updates allow you to spot trends, identify problems early, and adjust your approach before issues compound.

Leaders who make this a regular part of their rhythm gain visibility that extends far beyond a single quarter. They are able to identify trends earlier, forecast more accurately, and make resource decisions with greater confidence.

What’s Next in This Series

Understanding your Go Get is the foundation. The next step is building the infrastructure to manage it consistently.

In Part 2, we will explore how to properly weight your pipeline, determine coverage ratios, and understand how sales cycle length affects predictability.

In Part 3, we will focus on data infrastructure—what to track in your CRM, how to measure conversion rates, and how to build templates that make ongoing analysis easier.

In Part 4, we will connect this framework to valuation and M&A outcomes. Predictable growth does more than help you hit your number; it creates confidence, credibility, and optionality when the time comes to evaluate strategic opportunities.

Founders who master this discipline lead with greater precision and achieve outcomes that reflect the strength of their operations. They build companies that not only grow consistently but also command a premium because they can prove exactly how their growth engine works.

At SEG, we help software founders bring this level of precision to every stage of growth. Our work combines operational insight with M&A expertise to help companies not only understand their numbers but translate that understanding into enterprise value. Whether growth is the near-term goal or a potential transaction is on the horizon, the discipline behind a Go Get framework creates the clarity needed to make informed, strategic decisions.