Don’t Leave Money on the Table: How to Get the Highest Offer for Your SaaS Business

When the time comes to explore strategic options – whether that’s selling, securing investment or divesting a business unit – every leader’s goal is to maximize valuation, not just price, but also the terms, structure, culture, fit, and vision.

To achieve the best outcome, you must first understand your company’s true value – and then show it.

This can be challenging. Most leaders know how to build and run a successful business — but that’s very different from knowing how to run and manage a successful M&A process to get the highest possible offer.

We’ve seen firsthand over hundreds of SaaS M&A deals what leads to the best results. Here’s how to maximize your valuation and secure the most favorable outcome.

1. Start With a Strong Narrative

Stories motivate people. They spark interest, hold attention, and involve listeners on a personal and emotional level. Prospective buyers for your business are no different. Buyers don’t just invest in numbers — they invest in your entire business. They also care about your product, people, history, and what makes you different.

That’s why taking the time to put together a compelling narrative for your business before the process gets under way should be a non-negotiable.

Andrew Carricarte, CEO and president of Tritan Software, embraced this part of process with SEG when he sold to Ideagen: “As someone who had exited businesses in the past, I quickly realized my engagement with SEG was different. The team is incredibly meticulous and knowledgeable; they quickly grasped very complex concepts and helped create digestible materials to convey our story accurately.”

You got where you are today because of a team with deep expertise who understand the challenges your customers are facing. You have deep roots in your industry.

- Your story should communicate what sets your product, team, or technology apart.

- It should spotlight your milestones, from customer wins to revenue growth. Even talking about how you’ve overcome any challenges you’ve faced can be positive for the buyer.

- And the buyers need to know how you are positioned to capitalize on opportunities. What is your vision for the road ahead?

At SEG, we spend substantial time upfront learning your story, knowing that money will be left on the table without crafting a compelling narrative backed by data.

2. Prepare for a Competitive Process

Competitive tension among buyers is often the single most important factor in maximizing valuation because it focuses buyers’ attention and compels them to put their best offers on the table.

We approach buyer selection with the same strategic rigor as business positioning. It’s not just about what we communicate — it’s about who we communicate with and how we shape the opportunity to align with a buyer’s investment thesis. This process is highly collaborative, ensuring the seller’s priorities align with the right acquirers for the best possible outcome.

Buyer type also matters. We consider how your business can complement a strategic buyer’s business through extended capabilities, market share, complementary solutions, and cross-selling opportunities. For them, it’s about synergy. For a private equity buyer, we focus on those who have experience in the broader space or with businesses whose business models are similar to yours.

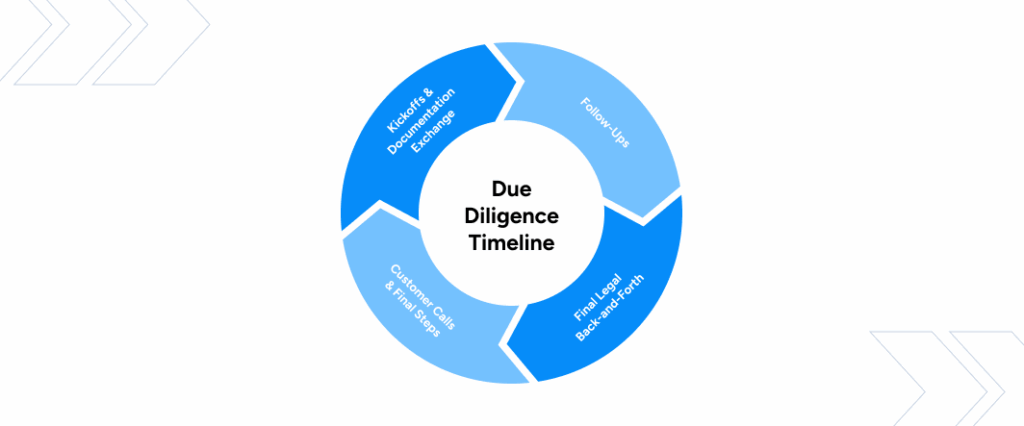

Once that buyers list is created, an investment bank like Software Equity Group helps you create competition to drive better terms, higher valuations, and more favorable conditions. A structured process can maximize leverage and prevent buyers from dragging out negotiations. The key is to strike the right balance, to apply pressure without deterring serious buyers, and to use exclusivity strategically.

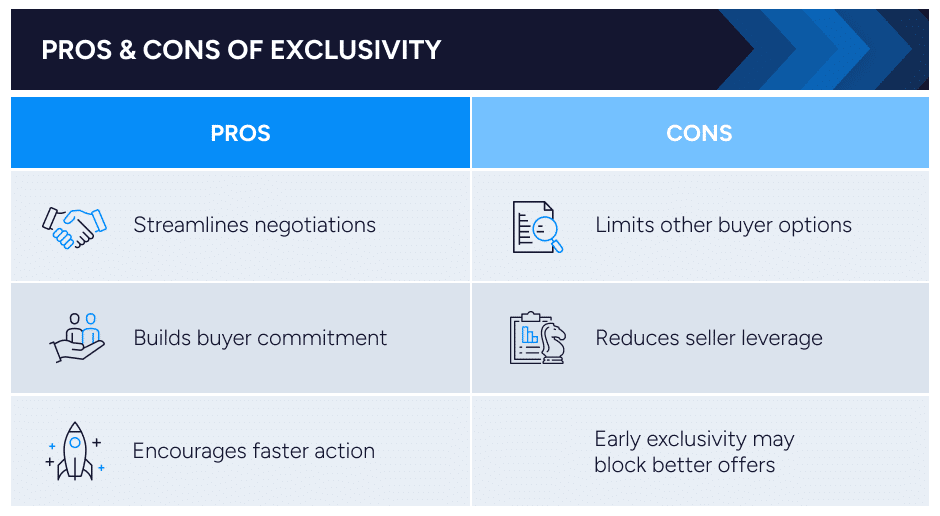

Exclusivity can simplify the process, demonstrate commitment, and incentivize action – but also has its downsides. Exclusivity can introduce restrictive clauses that make it difficult to pivot to other buyers, if necessary. Sellers lose some leverage with exclusivity agreements. So, while exclusivity can and should be used strategically, don’t enter an agreement too early in the process.

In the end, what both parties ultimately want is a win. Take it from Oren Rosen, co-founder of Cougar Software: “SEG is not about just getting another deal done, they are in it for the long term and strive for win-win outcomes from a place of honesty and integrity.”

3. Focus on Metrics That Matter

While many factors influence an offer, the specifics depend on the buyer and their reasons for interest in the business. However, most buyers evaluate key business metrics to assess performance, product-market fit, and risk. These metrics provide insight into the company’s growth potential, profitability, scalability, and long-term sustainability.

Be prepared with the numbers that back up your narrative, overcome doubts, and showcase your potential. Based on our survey of the topmost active software buyers, among other things, buyers will most likely scrutinize two key areas:

- Gross Retention Rate (GRR): GRR measures the percentage of recurring revenue retained from existing customers over time. It counts losses from customer churn but doesn’t include gains from new business or upgrades. What it tells potential buyers is how sticky your customer base is. A GRR rate showcases revenue stability, with the highest possible rate landing at 100%.

- Gross Profit: Based on our experience working with hundreds of software companies, we see average gross margins of around 70% and recommend aiming for a gross margin of 75% or higher. A strong gross margin shows a company can scale without significantly increasing costs, is efficient in how it delivers its product, and delivers value worth of the price. It also shows buyers how effectively you convert sales into profit.

Year after year in our State of SaaS M&A: Buyers’ Perspectives Report, we see that GRR and gross profit are top priorities. Knowing where you stand on these metrics — and improving them ahead of the sale — can boost the offers you receive.

Preparation is key to maximizing value; allow yourself the necessary lead time. Ideally, you should start preparing your SaaS business for a sale 12–24 months before going to market. This gives you the time you need to improve key metrics, address potential red flags, and position your company for success.

4. Negotiate Beyond the Headline Price

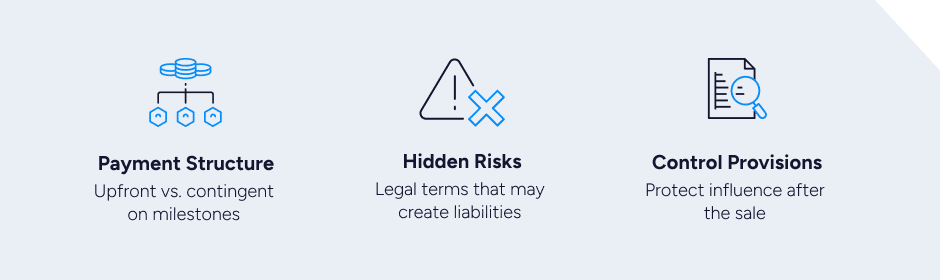

A valuation grabs your attention, but it’s only one part of the deal. Don’t let it distract you from important details. The terms and structure of the offer can wind up having an even greater impact on the total value you walk away with. This is another area where SEG’s experience pays off, as our team analyzes every detail.

Here’s what we watch for:

- How much of the valuation will be paid upfront versus being contingent on future milestones. For example:

- Earnouts are contingent on hitting revenue, profit or other milestones post-sale that you may not have control over. This can introduce risk to your deal.

- Seller financing should only be considered if you’ve assessed their ability to repay.

- Stock vs. cash payments: If part of your payment comes in the form of equity in the acquiring company, carefully evaluate the company’s prospects.

- Hidden risks. These are typically buried in legal terms that could leave you exposed after a deal closes, including:

- Indemnities that dictate how much responsibility you bear if issues arise post-sale.

- Escrow and holdbacks, where a portion of the sale price could be held to cover potential post-sale risks.

- Debt and other liabilities: If a buyer is assuming the company’s debt, make sure that’s in the agreement.

- And, finally, control provisions that allow you to retain influence after a sale can protect your interests. These outline decision-making power, board seats and voting rights, and any non-competes and restrictions you may face in starting a new venture or work with competitors.

The best deal is one that maximizes your payout while minimizing unnecessary risk and restrictions.

5. Choose the Right Buyer

The buyer you choose can influence more than just the financial aspects of the deal; it can also affect your company’s legacy, your employees, and your opportunities.

Here are three important lenses through which we work with you to evaluate potential buyers.

- Strategic Considerations: Some buyers may offer synergies including cross-sell and product/service extension opportunities that boost your company’s long-term value.

- The Role of Private Equity: Private equity firms can add a lot of value to your business by streamlining processes, expanding market reach, or implementing efficiencies that increase your profitability. But they may also have stricter terms or higher expectations that you’ll need to factor into your decision, such as performance, control provisions, and structured exit strategies.

- Cultural Fit: We recognize that buyers need to align with your values and vision for the company. A misalignment between can lead to friction, loss of key employees, and damage to customer relationships.

SEG’s extensive buyer network is a valuable asset. We work to match you with the right partner, one who brings more than just a check to the table.

Learn more about how an M&A advisor can help.

Your Next Step

Too many SaaS founders try to navigate the unfamiliar waters of the M&A process alone only to discover too late that they’ve left value on the table. We’ve seen it time and time again. SEG is ready to help. With decades of experience in M&A for SaaS, we know what it takes to secure the best offers for founders like you and our track record speaks for itself.

Reach out to us today to learn how we can help you maximize value and achieve your goals.