- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

What is the Rule of 40 and How to Calculate it Correctly

Just as with individuals, companies have their own definitions of achievement. The concept of success is nebulous, hard to regulate, and determine a consistent set of criteria for. In the world of software, establishing a standardized measurement system can get especially confusing. The technology landscape is ever-changing, and it can be challenging to strike a balance between doing what it takes to grow while also aiming toward profitability.

Enter the Rule of 40. In recent years, it has become a well-known and often-used rule of thumb for analyzing a company’s operating performance. It essentially distills a company’s profit margin and growth rate into a singular number as another benchmark to help investors and software entrepreneurs alike steer an organization to success.

The Rule of 40 caught the attention of the SaaS industry when Techstars’ Brad Feld, author of the popular blog Feld Thoughts, outlined how “the minimum point of happiness” for maturing companies is a 40% growth rate. He essentially announced a community baseline – anything at or better than 40% is great.

So what are the exact metrics considered when calculating the Rule of 40, and how and when can it be used? Gain some insight into this popular KPI.

Defining the Rule of 40

To put it simply, the Rule of 40 is a standard metric used by private equity investors and strategic buyers to measure the performance of SaaS companies. Measuring the trade-off between profitability and growth, the Rule of 40 asserts SaaS companies should be targeting their growth rate and profit margin to add up to 40% or more.

Calculating the Rule of 40

The Rule of 40 calculation considers two key financial metrics: growth rate and profitability margin.

Growth rate. For a SaaS business, growth rate is measured by comparing year-over-year changes in ARR or MRR.

Profitability. We prefer EBITDA as the standard of measurement here. The EBITDA margin strips out differences in interest expense, tax treatment, amortization, and depreciation, making EBITDA margin the best indicator for profitability when comparing SaaS businesses. However, you may find that some use net income or cash flow as other measures of profitability.

Even though these two metrics can be measured in different ways, revenue growth and EBITDA margin are most commonly used to gauge a company’s profitability and growth, making this simple equation the way to calculate Rule of 40.

When to Use the Rule of 40

The Rule of 40 can be a useful metric when comparing SaaS companies. While the Rule of 40 assesses the health of SaaS companies by considering revenue growth and profitability, in addition to merely measuring each component individually, this metric is also a normalizing factor.

Some companies may sacrifice profitability to grow, while others may be very profitable but have not made investments in sales and marketing. This calculation allows buyers and investors to normalize these factors across acquisition or investment targets.

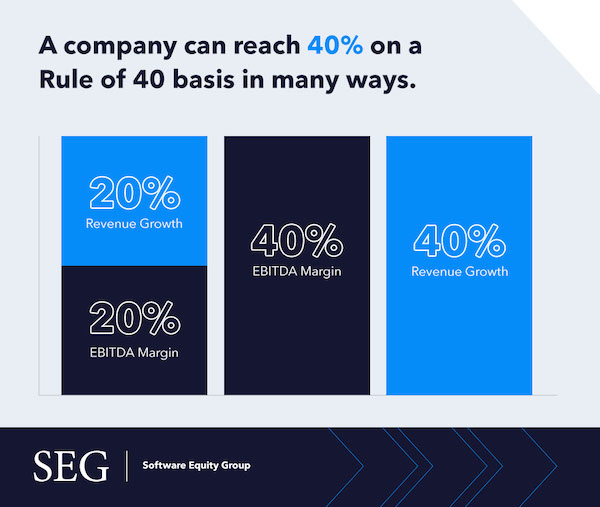

A company can reach 40% on a Rule of 40 basis in many ways. Let’s run through a few examples:

- 20% revenue growth + 20% EBITDA margin = 40%

- 0% revenue growth + 40% EBTIDA margin = 40%

- 40% revenue growth + 0% EBITDA margin = 40%

However, as helpful of a tool as the Rule of 40 is, it can fail to guide management on how to best balance the often competing priorities of rapid growth and increased profitability.

Software Equity Group recently convened a group of private equity investors on a webinar to understand what they are looking for in potential SaaS investments. When asked specifically about the Rule of 40 and whether the preferred weighting was towards growth or profitability, the consensus was that growth was more important for smaller SaaS companies.

The Weighted Rule of 40

Given buyers’ recent preference for growth over profitability, especially for smaller companies, there is an increasing shift toward a weighted Rule of 40. The Weighted Rule of 40 gives twice the weighting to growth than profitability.

Weighted Rule of 40 = (1.33 * Revenue Growth) + (0.67 * EBITDA Margin)

This new weighting aligns with the increased focus on growth, particularly for smaller SaaS companies, prioritizing growth over profitability as they work to achieve scale. It also provides better guidance on how management should think strategically about pricing and resource allocation.

As companies grow to scale, they will be challenged to maintain the same outsized growth rates. As such, they should consider an alternate weighting that prioritizes EBITDA margin over growth. A revised weighting for mature SaaS companies provides improved guidance on how management should formulate strategic and operational objectives.

Weighted Rule of 40 for Public SaaS Companies

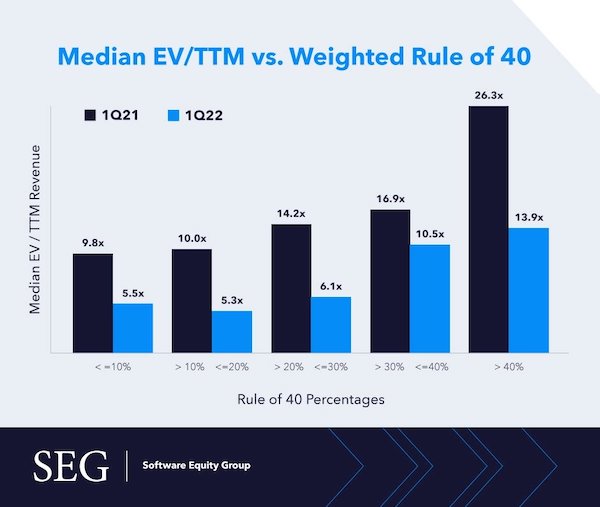

As evidenced by SEG’s 2021 Annual SaaS Report, investors favored SaaS companies with higher Weighted Rule of 40 percentages. For the most part, companies with a higher weighted Rule of 40 are rewarded with higher revenue multiples.

In recent quarters, SEG has observed investors valuing growth over profitability, which is why we analyzed the Index using a Weighted Rule of 40.

Public SaaS companies scoring greater than 40% on a Weighted Rule of 40 basis posted a median EV/Revenue multiple of 22.4x. These high-performing companies include Okta, Adobe, Zoom, Twilio, and Datadog. Further, each cohort above 10% on a Weighted Rule of 40% basis posted greater median EV/Revenue multiples compared to 4Q19, indicating that investors favored growth stocks in 2020.

The Rule of 40 is a popular tool for SaaS companies for comparison purposes. As strategic buyers and investors increasingly look to growth and net retention as key indicators of valuation, a Weighted Rule of 40 is also an effective tool for SaaS companies to focus their resources and boost their future valuation.

Putting the Rule of 40 into Play

The Rule of 40, weighted or not, can serve as a handy measuring tool when evaluating the health of your business and establishing a plan to keep growing. If you have any questions regarding this topic or would like to discuss other KPIs in more detail, contact Software Equity Group today.