The Rule of 40: Understanding a Key Metric for SaaS Success

Buyers and investors use the Rule of 40 to assess a SaaS company’s financial health and growth potential.

For SaaS companies preparing for investment or acquisition, this benchmark has become a signal of financial discipline. It tells investors whether your growth is sustainable, your operations are efficient, and your business is mature enough to scale. A strong Rule of 40 score can help move your company to the top of a buyer’s list.

Learn how the Rule of 40 works, and its role in shaping your SaaS company’s valuation and exit potential.

What is the Rule of 40?

To put it simply, the Rule of 40 is a benchmark used by private equity investors and strategic buyers to measure how well a company balances profitability with growth. Under the Rule of 40, SaaS companies’ growth rate and profit margin should add up to 40% or more. Note that while the rule of thumb is 40%, your company may exceed this threshold.

The Rule of 40 caught the attention of the SaaS industry when Techstars’ Brad Feld, author of the popular blog Feld Thoughts, outlined “the minimum point of happiness.” He essentially announced a community baseline: Anything at or better than 40% is great.

How does the Rule of 40 impact company valuation?

Investors and buyers rely on the Rule of 40 to gauge whether a SaaS company is growing efficiently. Investors use it to screen out companies that are:

- Burning too much cash for their level of growth

- Operating inefficiencies

- Struggling with retention or high churn

- Market saturation

- Inefficient customer acquisition

Achieving a Rule of 40 score at or above 40% signals to prospective buyers that the company has long-term potential.

In the current M&A market, the ideal target is a SaaS company with breakeven or profitable growth and a Rule of 40 score of over 40. A company growing 40% with a 0% EBITDA margin is typically more appealing than one growing 80% with -40% margins.

Public SaaS companies with a strong Rule of 40 typically enjoy higher revenue multiples.

According to our recent quarterly SaaS M&A and Public Market Report, companies scoring high on the Weighted Rule of 40 (page 31) continue to command premium valuations, reflecting the market’s focus on durable, capital efficient growth. Our Rule of 40 Matrix (page 32) further highlights how the best-performing SaaS operators balance top-line expansion with profitability and why those achieving or exceeding 40% threshold consistently trade at the upper end of valuation ranges.

How do SaaS companies calculate the Rule of 40?

The Rule of 40 calculation considers two key financial metrics: growth rate and EBITDA margin.

Growth rate: For a SaaS business, growth rate is measured by comparing YOY changes in Annual Recurring Revenue (ARR) or Monthly Recurring Revenue (MRR). You can also use Total Revenue.

Profitability: We prefer EBITDA as the standard measurement for profitability. EBITDA strips out differences in interest expense, tax treatment, amortization, and depreciation, making EBITDA margin the best indicator for profitability when comparing SaaS businesses. However, some use net income or cash flow as measures of profitability.

ARR growth and EBITDA margin are the most common metrics used to assess a company’s profitability and growth, making them the preferred inputs for calculating the Rule of 40.

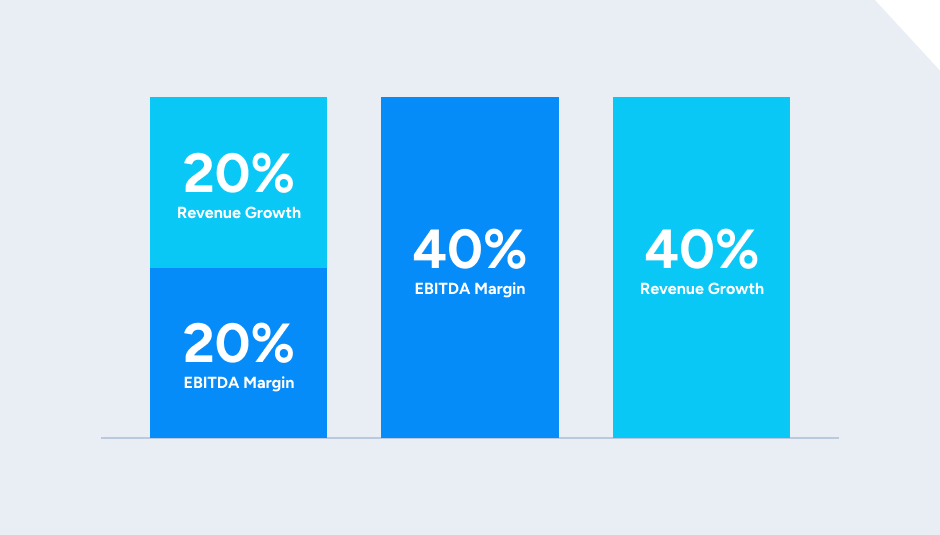

A company can reach 40% on a Rule of 40 basis in many ways. Let’s run through a few examples:

- 20% revenue growth + 20% EBITDA margin = 40%

- 0% revenue growth + 40% EBITDA margin = 40%

- 40% revenue growth + 0% EBITDA margin = 40%

READ MORE: Correctly Calculating EBITDA for Software Companies

When should a SaaS company use the Rule of 40 metric?

SaaS companies should use the Rule of 40 metric as a benchmark when it reaches scale and maturity, with consistent recurring revenue and a validated customer base. At this stage, the Rule of 40 can be used to gauge financial efficiency and how ready you are to scale. Some companies may sacrifice profitability to grow, while others may be very profitable but have not made investments in sales and marketing.

The Rule of 40 becomes most useful once a SaaS company reaches scale and maturity, with consistent recurring revenue and a validated customer base. However, the ideal mix of growth and profitability varies by stage. For early-stage companies with less than $5 million in ARR, high growth and low or negative EBITDA are the norm, as the priority is capturing market share and achieving product–market fit. In this phase, a Rule of 40 score well below 40% is acceptable as long as growth is rapid and customer retention is improving, and the score is trending upward over time. As companies approach $5 million in ARR, investors increasingly expect to see scores near 40%. For example, 60% growth paired with –20% EBITDA margins would meet the benchmark.

As a company moves into the growth stage, typically between $5 million and $20 million in ARR, investors expect to see robust growth paired with modest but improving EBITDA margins. The focus begins to shift toward more efficient operations and better unit economics, and the Rule of 40 score should trend upward, ideally approaching the 40% threshold. Once a company is scaled and matures, generally above $20 million in ARR, growth naturally slows, but EBITDA margins should rise significantly. At this stage, a company may reach or exceed a Rule of 40 score primarily through profitability, signaling operational stability and scalability.

For investors and buyers, the Rule of 40 is a shorthand way to assess whether a SaaS company’s growth is sustainable and achieved through operational discipline. By combining growth and profitability into a single percentage, it normalizes performance across companies of different sizes and models, making it easier to compare acquisition or investment targets on an apples-to-apples basis. This is why companies seeking investment or preparing for M&A should not only track their Rule of 40 score, but also understand what’s driving it, ensuring the number reflects durable business fundamentals rather than temporary spikes or one-off cost cuts.

What is the Weighted Rule of 40?

The Weighted Rule of 40 is a variation of the traditional Rule of 40 that adjusts the relative importance of growth and profitability. The higher the score, the more efficient the company is under that buyer or investor’s priorities. Here’s an example:

Weighted Rule of 40 = (1.33 * Revenue Growth) + (0.67 * EBITDA Margin)

In SEG’s Annual SaaS Report, investors favored SaaS companies with higher Weighted Rule of 40 percentages. For the most part, companies with a higher weighted Rule of 40 are rewarded with higher revenue multiples.

Public SaaS companies scoring greater than 40% on a Weighted Rule of 40 basis posted a median EV/Revenue multiple of 12.4x.High performers like CrowdStrike, MSCI, and Toast exemplify why this cohort earns a premium. These companies’ pair strong growth with disciplined margin control, which signals durability and capital efficiency.

CrowdStrike’s exceptional growth, high margins, and industry-leading retention in the rapidly expanding cybersecurity market reflect deep product–market fit and a defensible competitive moat. MSCI benefits from a diversified, subscription-heavy customer base that drives steady growth and consistent profitability. Toast, despite operating in a competitive vertical, has achieved rapid revenue expansion and improving unit economics in the competitive restaurant tech space demonstrate differentiated solutions with proven adoption and scalable growth potential.

In today’s market, where investors value “efficient growth,” companies in this >40% cohort are rewarded not just for scale, but for the balance and resilience of their operating models .

To learn more about today’s buyer preferences, download a copy of our State of SaaS M&A: Buyers’ Perspectives Report for insights on what is driving buyer and investor activity.

How does the Weighted Rule of 40 differ from the standard calculation?

The Weighted Rule of 40 places different emphasis on revenue growth and EBITDA margin, typically weighting growth more heavily than profitability for younger companies and vice versa for mature companies. This adjusted weighting helps reflect the priorities at different stages of business development.

Because of this, the Weighted Rule of 40 gives a more nuanced view by recognizing that not all growth and profitability are valued equally especially in different stages of a company or economic cycles. For example, in leaner times, profitability may matter more.

Is a higher Rule of 40 always better?

Not necessarily. While a higher Rule of 40 indicates a strong balance of growth and profitability, it’s also important to consider other factors such as market conditions, competitive landscape, and company-specific strategies.

A higher Rule of 40 is better in the following cases:

- When strong revenue growth and profit margins indicate efficient and scalable growth

- When both metrics contribute meaningfully. For example, 30% growth and 15% EBITDA margin. This indicates a well-run SaaS business.

- For mature companies, when a high Rule of 40 usually aligns with better valuation multiples.

On the other hand, a high Rule of 40 can be misleading when the metrics are out of balance. For example, a company growing 80% with -30% EBITDA margin. The Rule of 40 is equal to 50, but a heavy cash burn can be unsustainable.

However, one-time anomalies such as a big customer win or a cost cut may temporarily inflate the score, giving a false sense of efficiency.

The Rule of 40 is just one factor investors consider; they want to understand what’s behind the score and whether it’s repeatable.

What are some common pitfalls when using the Rule of 40 in SaaS?

This tool is helpful, but it may fail to guide leaders on how best to balance the sometimes-competing priorities of growth and increased profitability. Pitfalls could include:

- Overemphasizing growth or profitability at the expense of the other

- Ignoring the importance of sustainable practices

- Failing to adapt the metric to a company’s specific situation

Other pitfalls include inconsistent inputs or time frames and mixing EBITDA with other measures of profitability. Quality of revenue also matters; for example, a company may grow 40%, but if 25% of customers churn annually, the business is unstable.

Can the Rule of 40 be used in financial forecasting?

The Rule of 40 isn’t a forecasting tool, but it can be used to inform and evaluate financial forecasts, especially for recurring-revenue businesses such as SaaS. By setting targets for growth and profitability that align with the Rule of 40, companies can develop more balanced and realistic financial plans.

How does the Rule of 40 compare to other SaaS efficiency metrics?

The Rule of 40 balances growth and profitability. It’s useful for quickly assessing whether a SaaS business is operating efficiently in aggregate. But it doesn’t offer the diagnostic power of more targeted metrics like the CAC Payback Period, which tells you how quickly you recover customer acquisition costs, or LTV:CAC, which helps you assess the long-term profitability of growth.

The Rule of 40 is helpful for investor readiness, but SaaS leaders should pair it with other metrics to understand what’s driving or dragging down performance.

Putting the Rule of 40 into Play

Weighted or not, the Rule of 40 metric can serve as a handy measuring tool when evaluating the health of a SaaS business and establishing a plan to grow.

If you have questions about this topic or want to discuss other KPIs that matter to buyers and investors in more detail, contact Software Equity Group today.