How To Calculate SaaS Churn Rate Correctly (With Formulas and Examples)

Every SaaS company celebrates new customer wins, but that growth won’t stick if customers are quietly slipping away. Churn creates a hamster wheel effect, where sales must replace lost revenue before they can generate true growth.

Tracking churn provides a direct view into product-market fit, customer satisfaction, and long-term scalability. High churn indicates potential cracks, and low churn points to durable value.

In this article, we’ll examine the key churn metrics that reveal the health of your customer base. You’ll learn how to calculate and interpret them, why they matter for operational efficiency, and how investors and buyers view churn when evaluating your business.

What is Churn Rate in SaaS?

Churn is a measurement of the subscribers, clients, accounts, or customers a company loses over a period of time. For software businesses, churn typically refers to when subscriptions are canceled, and contraction refers to when they are decreased (in dollars spent). This metric is often expressed as a percentage rate. It can also be indicated by whole numbers, such as a report listing a churn of 250 subscribers or an annual recurring revenue (ARR) churn of $10,000.

How you manage churn affects your ability to attract quality investors and buyers. They interpret churn as a measure of customer satisfaction, stickiness, and scalability. Even strong topline growth won’t outweigh high churn if retention is weak because revenue becomes unstable.

Low vs. High SaaS Churn Rates: What They Reveal

For SaaS leaders, low churn means strong customer satisfaction. For buyers, it’s a sign of durable revenue and scalability that translates into stronger valuation multiples.

Common causes of high churn rates in SaaS include:

- Product adoption challenges: Customer never fully grasps the value of the software, which can happen if features are too complex, poorly communicated, or misaligned with their needs.

- Weak onboarding and training: If customers struggle to get started, they’re less likely to stick around. Without proper training, even great products can feel overwhelming.

- Gaps in ongoing engagement: Retention requires continuous communication, new ways to apply the product, and regular check-ins to keep customers invested in the relationship.

- Pricing misalignment: Over-discounting may bring in customers who were never the right fit, while unclear or high prices can erode trust. Customers are more likely to leave when cost outweighs the value they experience.

- Competitive pressures: If competitors offer stronger integrations, easier migrations, or more compelling pricing, customers are more likely to switch.

- Service and support gaps: Long response times, unresolved issues, or a lack of personalized support can frustrate customers and increase cancellations.

By contrast, low churn rates indicate:

- Customers are consistently realizing value and integrating the product into daily workflows.

- Onboarding, training, and ongoing success programs are effective.

- Pricing is aligned with perceived value, creating trust and predictability.

- The company’s competitive position is strong enough to retain customers even in a crowded market.

Ultimately, high churn is a red flag for buyers, and low churn builds confidence.

Churn as a Valuation Driver in SaaS M&A

While understanding churn is critical to building a healthy SaaS business, it takes on greater importance in the context of M&A. Prospective buyers closely examine churn to assess customer loyalty, forecast revenue, and evaluate long-term durability.

Companies that retain customers give acquirers confidence in a stable, recurring revenue stream. On the other hand, high churn can raise concerns for buyers about instability, which puts downward pressure on valuation multiples.

How to Calculate Churn Rates (4 Types) in SaaS

There are three types of churn:

- Customer (Logo), which highlights areas for improving loyalty

- Gross Dollar, which provides a clear view of recurring revenue losses

- Net Dollar, which considers both churn, downgrades, and upgrades

Here are the churn calculation formulas for each:

Here are the churn calculation formulas for each:

1. Customer (Logo) Churn

Customer churn, also known as logo churn, measures the number of customers lost over a specific time period. For SaaS businesses, it reflects the percentage or count of subscribers who discontinue their plans. Customer churn can be calculated for any defined period and plays a critical role in determining your customer lifetime value.

Customer churn rate = number of lost customers over a period / customers at the start of the period

Example Customer Churn Calculation for Software Companies:

Suppose your software company started with 5,000 subscribers and ended with 4,500 due to customer cancellations.

In this scenario:

- Customer Churn Rate = (5,000 – 4,500) / 5,000

- Customer Churn Rate = 500 / 5,000

- Customer Churn Rate = 0.10 or 10%

This results in a customer churn rate of 10%, indicating the percentage of subscribers lost during that period.

What is a good Customer (Logo) Churn Rate in SaaS?

For a SaaS company, 10% is a good benchmark. A lower logo churn rate is ideal, while higher rates may signal underlying issues. Your customer churn rate is influenced by your target market, product pricing and quality, user experience, and customer service. Because these factors vary widely within an industry, comparing your churn rate to companies of similar size, maturity, and market focus provides more meaningful insights than a broad industry comparison.

2. Gross Dollar Churn

Lost dollar churn looks only at revenue lost; gross dollar churn also accounts for downgrades.

Gross churn measures the revenue lost by your business on an annual basis due to cancellations or downgrades of recurring subscriptions. It encompasses both the lost dollar churn and any downgrades in ARR from customers who have downgraded their plans. This combined figure provides a comprehensive view of ARR erosion from existing customers.

Gross Dollar Churn = lost revenue from cancellations + lost revenue from downgrades / beginning revenue of period

Example Gross Dollar Churn Calculation for Software Companies:

Let’s say your software company began with $500,000 in ARR. You lost $20,000 due to customer cancellations and another $10,000 from downgrades. Gross dollar churn includes both these losses, providing a full view of the revenue contraction.

As a breakdown:

- Gross Dollar Churn = ($20,000 + $10,000) / $500,000

- Gross Dollar Churn = $30,000 / $500,000

- Gross Dollar Churn = 0.06 or 6%

This results in a gross dollar churn rate of 6%, reflecting the total revenue lost from cancellations and downgrades.

What is a Good Gross Dollar Churn in SaaS?

Using gross dollar churn alongside logo churn provides valuable insights into the types of customers who are churning. You might discover that a larger portion of churn comes from lower-priced subscribers rather than higher-value customers, or that downgrades are more common than outright cancellations. This detailed data enables better-informed business decisions.

For SaaS companies, a gross dollar churn rate of 15% or lower is generally recommended, as this metric is widely considered one of the most important indicators of retention health.

3. Net Dollar Churn

The net dollar churn rate reflects changes in recurring revenue resulting from subscription downgrades, upgrades, and cancellations. Many companies use tactics like cross-selling or upselling to existing customers to help offset losses from customer cancellations or downgrades.

This captures the ARR churn from existing customers, factoring in both revenue lost to cancellations and downgrades and revenue gained from customer upgrades. Net churn can be measured on an annual basis. To calculate your net dollar churn, use the following formula:

Net Dollar Churn = lost revenue from cancellations + lost revenue from customer downgrades or spending less – revenue gains from existing customers spending more

Example Net Dollar Churn Calculation for Software Companies:

Imagine your software company lost $5,000 in revenue from customer cancellations and an additional $2,000 from downgrades. However, you gained $10,000 from increased customer spending through upgrades.

In this example:

- Net Dollar Churn = $5,000 + $2,000 – $10,000

- Net Dollar Churn = –$3,000

This results in a negative net dollar churn of $3,000, which is a positive growth indicator for SaaS companies. Achieving negative net churn means your company is growing its revenue from existing customers, reducing dependency on acquiring new customers for growth.

Related Reading: How Net Retention Impacts Public Software Company Valuations & What Private Companies Can Learn

What is a Good Net Dollar Churn in SaaS?

A good net dollar churn rate is negative, meaning that revenue growth from existing customers (through upgrades or expanded usage) outweighs losses from downgrades and cancellations. A negative net churn indicates that your company can grow recurring revenue without relying solely on new customer acquisition, a strong indicator of product value and customer satisfaction.

For most SaaS businesses, aiming for net dollar churn of 0% or lower is considered healthy, while significantly negative net churn rates signal robust customer expansion and revenue retention.

4 Strategies to Reduce Churn Rates in SaaS

Churn rates measure growth and turnover in your customer base. Tracking them reveals where customers are disengaging and why, helping you refine onboarding, strengthen customer success, and ultimately preserve recurring revenue. But reducing churn is also a valuation driver. Buyers and investors reward companies that show durable revenue, efficient growth, and scalable retention practices.

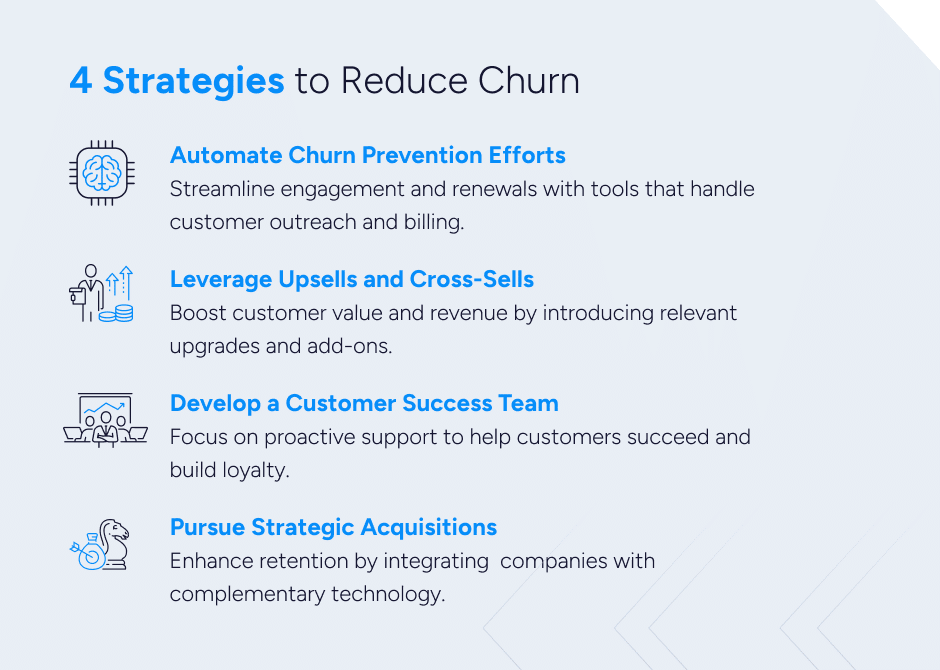

Here are four strategies that improve churn rates and increase value:

1. Automate Churn Prevention Efforts

Take advantage of tools that can reduce churn, freeing up your team’s time and resources. Most CRM software, for instance, can automate personalized customer outreach, allowing for consistent engagement without manual effort. Additionally, specialized applications for SaaS companies streamline subscription and revenue management tasks such as renewals, billing, and customer data, all of which reduce churn and improve customer retention.

Why buyers care: Automation demonstrates scalability. Investors want businesses that don’t rely solely on adding headcount to maintain retention. Scalable systems can continue without linear cost increases.

2. Engage in Upselling and Cross-Selling

Focus on selling upgrades and additional services to existing customers. Research indicates that increasing the share of wallet with current customers is more cost-effective than acquiring new customers. By introducing customers to the benefits of new features or higher-tier plans tailored to their needs, you enhance the value they receive while generating additional annual recurring revenue.

Why buyers care: Expansion revenue increases Net Revenue Retention (NRR). An NRR above 110% is a strong valuation driver because it proves the business can grow without depending on new customer acquisition.

3. Establish a Customer Success Team

Unlike a traditional support team that functions as a help desk, a customer success team is proactive, working directly with customers to ensure they achieve their goals using your product. This includes comprehensive onboarding and training, ongoing account management to identify and address potential issues, and actively gathering customer feedback to enhance the customer experience continually. A customer success team anticipates customer needs and fosters stronger, lasting relationships.

Why buyers care: Predictable retention tied to a structured success program gives buyers confidence in revenue durability. It reduces risk in due diligence and supports higher valuation multiples.

4. Acquire Companies with Complementary Tech

If your software integrates well with another company’s technology, acquiring that company could reduce churn for both businesses. By adding complementary features to your suite, you can better meet customer needs and create a stickier relationship, increasing long-term retention. An acquisition also provides an opportunity to merge customer success teams to enable faster and more comprehensive support.

Why buyers care: Strategic M&A that strengthens retention makes your company more attractive to future buyers. Buyers reward sticky platforms that control more of a customer’s spend and workflow.

Keep Customers, Keep Value

Consistently low churn rates show that customers are loyal and a revenue base is durable, two qualities buyers value. The reliability not only boosts valuation multiples but also instills confidence, creating leverage for a smoother, more competitive M&A process.

While some churn is inevitable, companies that actively measure, analyze, and address it will stand out. The payoff is stronger unit economics in the near term and a higher likelihood of commanding a premium valuation at exit.

Ready to see where you stand? Use our Interactive SEG SaaS Scorecard to evaluate your churn performance next to other key metrics. It will show you how your business stacks up to market standards and real where you can create the most value.