Understanding and Optimizing Unit Economics in SaaS: A Guide for Founders

Achieving profitable growth is the top priority for most SaaS businesses. So, naturally, business owners want to know the best way to get bigger faster, without undermining their financial stability by overspending. The answers are rarely obvious, but the secrets of growth can be revealed through the concept of unit economics.

Unit economics are a collection of metrics that can help business owners understand their financial performance on a per-unit basis. By tracking these metrics, companies can get a clearer picture of what’s contributing to business growth, whether that growth will result in profit, and how they can make adjustments to grow more efficiently. Put another way, unit economics can show companies how to get the most “bang for their buck” when it comes to spending on growth-focused activities such as sales and marketing.

Understanding unit economics is crucial for achieving long-term growth and profitability in the SaaS industry. In this post, we’ll cover the key points owners need to know to put these metrics to work for their businesses.

What Should SaaS Founders Consider When Evaluating Their Unit Economics?

The “units” in unit economics can be defined in different ways depending on what the business wants to examine, but most SaaS businesses look at each unit as a single customer. Ultimately, the main purpose of unit economics is to learn whether the company will earn more revenue from those customers than it costs to acquire them (the very definition of profitable growth).

Thus, the most important calculation in unit economics is to divide the lifetime value (LTV) of a customer (or segment of customers) by the customer acquisition cost (CAC). Read more about those metrics here. If LTV/CAC yields a number greater than one, it means that, over time, the company will make more from that customer than it costs to win their business. The higher the number (5x or greater), the more profitable that customer is for the SaaS company. Conversely, an LTV:CAC ratio of less than 1x means the customer relationship is unprofitable, and it may be a red flag telling the SaaS company to make some kind of correction.

The LTV:CAC ratio is often in conjunction with other important metrics included in unit economics, such as:

- SaaS magic number: The amount of annual recurring revenue generated for each dollar spent on sales and marketing (i.e., customer acquisition costs).

- Payback period: The number of months required to recoup the upfront customer acquisition costs.

- Gross margin: The percentage of revenue that exceeds the cost of goods sold.

- Churn and retention rates: Churn is the percentage of customers that cancel their subscriptions in a given time period. Retention is, of course, the opposite of churn.

A clear view of each of these metrics can help businesses fully understand where they’re making or losing money, and within what timeframe.

How Does Understanding and Optimizing Unit Economics Contribute to Long-Term Growth and Scalability?

Quite simply, when companies can win customers and hold onto them without spending much to do it, they are bound for profitability and growth. Unit economics can help SaaS businesses keep track of these factors and identify specific areas of strength or weakness. Moreover, companies can use this information to maximize their strengths and minimize their weaknesses, fine-tuning the business to become a well-oiled money-making machine.

For example, a SaaS company could use unit economics to examine two different customer segments: small-medium-sized businesses (SMBs) and large enterprises. The SaaS business may find that they spend the same amount on sales and marketing to win customers in each of these segments, but the LTV for enterprise customers is generally higher than for SMBs. In other words, enterprises create more profit for the company than SMBs. Based on this finding, the SaaS company could make one or more strategic adjustments:

- They could increase their sales and marketing investment to acquire more enterprise customers.

- They could raise prices for SMB customers or find ways to reduce the costs of acquiring them, either of which would make them a more profitable segment assuming no impact on retention.

- They could get out of the SMB market altogether and focus solely on selling to enterprises.

After making some changes to create a more efficient business model, the SaaS company would be in a much better position to scale up and achieve sustainable, profitable growth.

What are Common Mistakes in Evaluating Unit Economics?

Like any tool kit, unit economics are only useful to a business if they’re used correctly. Here are a few common ways things can go wrong.

- Incorrect calculations: In finance, calculations tend to build on each other. That is, one formula is used to arrive at a figure, which is then included in a different equation, and so on. If any of the foundational calculations include a mistake, such as not including all relevant expenses in customer acquisition costs, it can set off a chain reaction of incorrect and misleading data. Worse than being useless, bad data can lead business owners to make misguided strategy decisions with potentially disastrous consequences.

- Overestimating lifetime value: LTV is one of the key metrics in unit economics, but how does a business actually know how long a customer will remain loyal and continue to produce revenue? Established companies should rely on historical averages, while new ventures may want to be conservative in their estimates.

- Inconsistency in how units are defined. Most SaaS businesses count customers (as opposed to products) as units. This may be simple when customers are individual consumers, but it can get complicated when dealing with commercial customers. What if one commercial customer has multiple accounts spread across various locations? Do you count the whole company as one customer, or each separate office, or every individual user within the customer company? Without consistency, unit economics calculations can quickly go awry, which is why it’s best to pick one method and stick with it.

- Not segmenting customer data. As we discussed earlier, using unit economics to compare and contrast different types of customers can show companies where to focus their efforts to achieve maximum profitability. If a company only looks at its customer base as a whole, they’re not taking advantage of the full potential of unit economics to drive strategic business decisions.

How Does Unit Economics Impact the Attractiveness of a SaaS Company for Potential Acquirers?

While unit economics provide a valuable set of tools to SaaS business owners, they’re also of great interest to potential buyers in the SaaS market. Whether it’s a private equity firm or a strategic buyer, they will rarely acquire a company simply because it has amassed a large customer base. Buyers also want to see that the acquisition target is making data-driven decisions to operate profitably, or at least achieve profitability in the near future.

For that reason, unit economics are something potential buyers will examine closely in any acquisition deal. The metrics not only give buyers a window into the company’s current level of efficiency, but they may also reveal areas where some easy changes or additional investment could produce desirable results. A SaaS company that can prove it can acquire and serve new customers for less than the revenue it collects will have much more success at the negotiating table.

Best Practices for Improving Unit Economics in SaaS Business

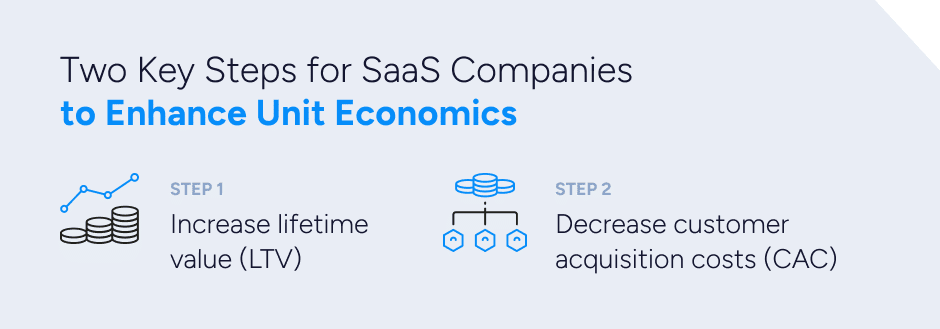

At the most fundamental level, a business that wants to improve its unit economics can do two things:

- Increase lifetime value (LTV)

- Decrease customer acquisition costs (CAC)

To increase lifetime value, the company must take in more revenue per customer. Raising prices could be a viable strategy, provided the price hike won’t drive away too many otherwise satisfied customers. Alternatively, some companies find ways to upsell add-on services. However, the company could also consider ways to reduce churn, focusing on the reasons customers leave and improving their experience so they continue using the software longer.

To decrease customer acquisition costs, companies either need to spend less on sales and marketing or increase the effectiveness of those functions. For example, a deeper analysis of customer analytics could help many companies more accurately target the right prospects and improve the conversion rate. Meanwhile, taking advantage of automated sales and marketing platforms may provide a lower-cost alternative to human-driven sales.

Understanding Unit Economics for Your Exit Strategy

Mastering unit economics isn’t a skill to be acquired overnight, but SaaS business owners willing to build on their foundational knowledge will find it a worthwhile investment of time. Unit economics can provide valuable insights about sales efficiency and profitability, enabling executives to chart a direct course toward business growth and, ultimately, build a more attractive acquisition target.

When it comes time to consider your exit strategy, the experienced advisors at SEG can help you optimize your unit economics and put your company’s best foot forward in an M&A transaction. Reach out today to get started.