The Impact of Gross Profit Margin on SaaS Company Valuations

Revenue growth might catch a buyer’s eye, but gross margin reveals whether you’re building a scalable, efficient SaaS business or masking costly cracks in delivery. For that reason, private equity firms and strategic buyers weigh gross margin heavily when deciding what your SaaS company is really worth.

For SaaS leaders, understanding gross margin is about protecting profitability today and positioning your company for a stronger valuation at exit.

Read more to learn how gross margin shapes your software company’s value.

What Gross Margin Measures in SaaS

Gross margin simply looks at gross profit as a percentage of total revenue. In short, gross profit is what’s left to cover operating expenses and invest back into the business. Gross margin reflects how scalable your business is.

At its core, gross margin shows how efficiently your company turns revenue into profit after accounting for Cost of Goods Sold (COGS), which are the direct costs of delivering your product or service. Because software companies don’t rely on raw materials the same way manufacturers do, COGS are typically lower and gross margins higher. This efficiency is what makes gross margin a powerful metric in SaaS.

Calculating Gross Margin

Gross margin can be calculated with a straightforward formula:

Gross Margin = (Revenue – COGS) / Revenue

More specifically, gross margin is the percentage of revenue remaining after deducting the direct costs to deliver a company’s product.

Gross margin is different from net profit margin in that it accounts for only the expenses a company incurs to produce and sell an additional unit of its offering. Gross margin helps companies identify the true cost to produce each item of its output.

Additionally, the formula offers visibility into where software companies might be over-or under-spending so they can stay competitive.

What is a “Good” Gross Profit Margin in SaaS?

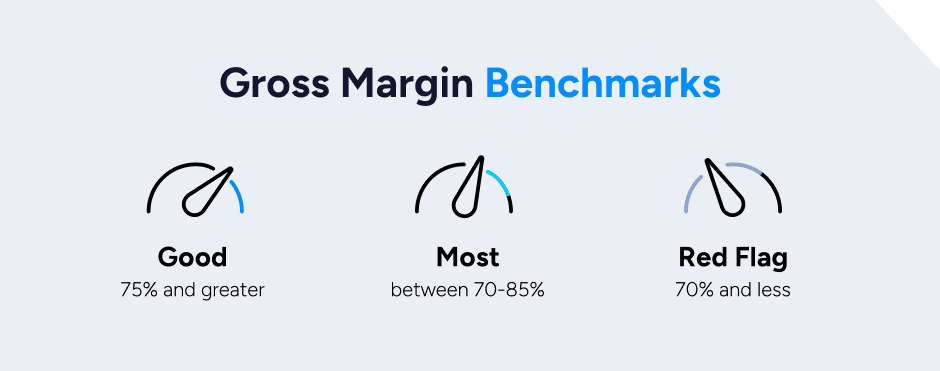

In the software space, companies with gross margins over 75% tend to outperform their peers, and most privately held software businesses we work with have gross margins in the range of 70% to 85%.

For software companies, a gross margin above 75% is attractive to buyers and investors because it signals scalability. Higher margins also free up capital to cover operating expenses and reinvest in the business. SaaS companies with strong unit economics can channel gross profit into sales and marketing to accelerate growth, or into research and development to meet demand for new features and modules.

Anything below 70% will prompt a potential buyer to take a deeper dive to understand what could be slowing gross margin expansion. If every new dollar of revenue requires nearly as much in costs to support it, the business doesn’t have the operating leverage SaaS companies need, which makes growth unsustainable.

SaaS companies with low gross margins (below 70%) might be experiencing:

- High delivery costs. They may be relying heavily on implementation teams, customer support, or infrastructure costs that scale linearly with revenue.

- Inefficient pricing or packaging. Low margins could mean that pricing is too aggressive in terms of discounts or underpricing tiers. It could also indicate that the company is struggling to capture the value of the product.

- Business model mismatch. The product may be too service-heavy or the business model more like a services company than a software company.

While high gross margins are desirable, they must be considered alongside customer retention rates. For example, if a company has strong customer retention but low gross margins, it could mean the company is over-investing in support or customer service.

According to our recent quarterly SaaS M&A and Public Market Report, gross profit margins remained one of the strongest value signals, with 56% of SaaS companies reporting margins above 70% and 17% exceeding 80%. Despite macro volatility, both average and median EV/TTM gross profit multiples held at 9.6x and 7.5x.

One of the most striking examples was Rubrik, whose gross margin increased from 69% in 3Q24 to 78% in 3Q25, representing nearly a 9% year-over-year improvement. That gain coincided with a valuation surge, as Rubrik’s EV/TTM Revenue multiple almost doubled from 7.8x to 15.2x. As a new addition to the SEG SaaS Index™, Rubrik exemplifies the outsized valuation impact that comes with advancing into higher gross margin cohorts.

SaaS Company Example: How Gross Margin Impacts Valuation

Not surprisingly, the median gross margin for public SaaS companies was closely tied to above-average valuation multiples in our latest SaaS report. In the second quarter of 2025, gross margin was a key valuation driver, with >80% margin companies trading at a 105% premium to the SEG SaaS Index.

In the second quarter, 63% of public SaaS companies posted gross margins above 70%, and 23% cleared the 80% threshold. Companies above that market traded at a median EV/TTM revenue of 7.2x, compared with just 3.5x for those below 60%.

That shows the valuation implication of higher gross margins and the tipping point that 80% gross margin represents.

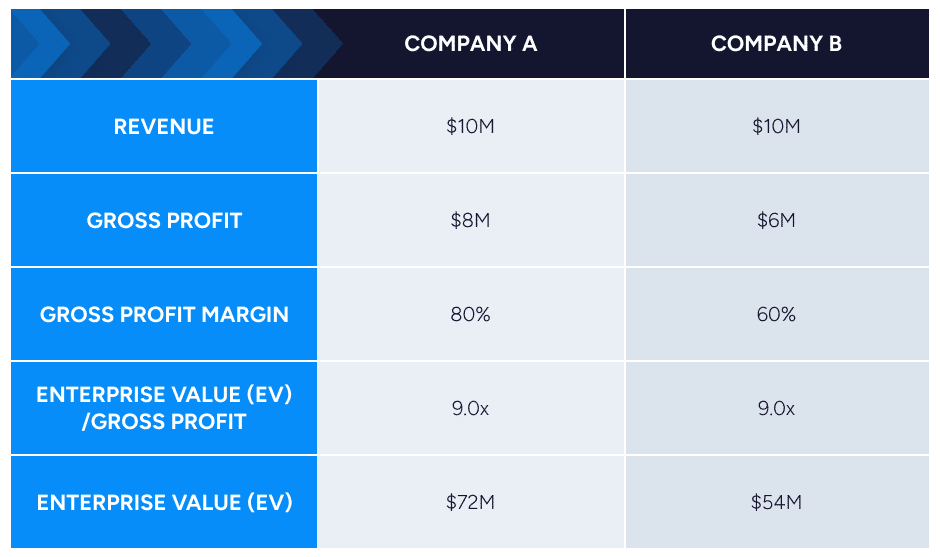

Let’s consider a gross margin example featuring two similar software companies, where one has a gross margin of 80% and the other just 60%. Assuming all else is equal, what is GPM’s impact on valuation?

Assume Company A is purchased for $72M. As a multiple of revenue, this would be 7.2x. As a multiple of gross profit, this would equate to 9.0x.

Now let’s look at Company B. Because Company B has the same revenue as Company A, it is easy to assume the 7.2x comparable multiple is appropriate, so Company B is also worth $72M.

However, in this example, Company B’s gross profit is significantly less than Company A’s. For every dollar of revenue Company A generates, 80 cents are available for operating expenses. In contrast, only 60 cents of every dollar of revenue generated by Company B are available for operating expenses. Because these figures are materially different, the better comparable for Company B to use is Company A’s 9.0x gross profit multiple.

Applying this multiple results in a valuation of $54M for Company B. This is not what Company B’s shareholders were hoping to hear. However, if Company B had a gross margin of 95%, these shareholders would likely be more than happy to use a gross profit multiple.

How to Improve Your SaaS Company’s Gross Margin

If your SaaS company has a gross margin below 60%, don’t panic. Here are some ways to improve this metric and potentially achieve a higher valuation.

1. Optimize COGS

Improving gross margin often starts with reducing the cost to deliver your product. For SaaS companies, that means:

- Streamline manual processes. Automate onboarding, customer support, and service workflows to reduce labor costs and improve consistency.

- Negotiate vendor costs. Hosting and infrastructure are major line items. Revisit contracts with cloud providers or optimize usage to avoid paying for unused capacity.

- Modernize architecture. A more efficient back-end can lower delivery costs and scale more smoothly as revenue grows.

- Outsource non-core functions. Consider third parties for customer support or administrative tasks, freeing your team to focus on higher-value activities.

2. Improve Product Efficiency

Gross margin improves when the product delivers value with less hands-on effort. The result: greater scalability. Key levers include:

- Enhance self-service features. Intuitive design, in-app guidance, and robust documentation reduce reliance on your support teams.

- Invest in usability. A product that’s easier to adopt and navigate lowers training and support costs, while improving customer satisfaction.

- Standardize where possible. Minimize expensive one-off customizations by creating tiered packages or modular add-ons that scale consistently.

- Reduce implementation drag. Streamlining onboarding and integrations shortens time-to-value and lowers delivery cost.

3. Efficient Scale Support and Delivery

As your customer base grows, support and delivery costs can quickly spiral if they expand with revenue. The key is to reduce ticket volume at the source. A well-built knowledge base and intuitive self-service tools give customers what they need without waiting on your team. Layer in AI chatbots and automated service tools to handle routine requests. Just as important, set customers up for success from the beginning with clear onboarding and training.

When customers know how to use your product well, they’re less likely to lean on your support teams later. The result is a delivery model that scales smoothly without chipping away at gross margin.

4. Increase Pricing Without Raising Costs

Pricing is one of the best levers for expanding gross margin. A well-designed tiered model lets you capture more from customers who see the most value, without significantly increasing delivery costs.

If your product is sticky, don’t be afraid to raise prices to better reflect your value. Buyers are more open to increases than you think. Another approach is to introduce premium features or usage-based add-ons that boost average revenue per user while keeping costs stable.

In each case, stronger pricing discipline signals to investors your business can grow profitably.

5. Focus on High-Margin Customer Segments

Not all customers contribute equally to gross margin. The most profitable are often those who get significant value from your product yet require minimal support. Segment your customer base, and prioritize sales and marketing toward these high-margin groups to grow revenue without proportionally increasing costs.

You can also upsell existing customers into higher-tier plans or cross-sell complementary services to raise revenue per account while keeping delivery costs flat. This will compound gross margin gains and demonstrate to buyers that growth is disciplined and scalable.

6. Scale Talent Strategically

One mistake many young software companies make is growing too fast. Scaling teams too quickly or maintaining large groups in non-essential areas can drive up costs without adding proportional value.

Instead, align team size and skillsets with the company’s current stage, ensuring every role ties back to growth or customer value. For customer-facing functions like support and success, track efficiency closely and design incentives that reward cost-conscious behavior without undermining service quality.

A lean, focused team structure keeps operating costs in check and strengthens gross margin as the business matures.

7. Reduce Customer Churn

Few metrics matter more to buyers and investors in an M&A process than customer retention. Customer churn is the rate at which customers leave your business or spend less.

High customer churn erodes gross margin by shrinking revenue and driving up customer acquisition costs. Every lost customer means more time and money spent replacing them, which drags down profitability.

The foundation of lower customer churn is product quality and customer satisfaction, but the work starts with onboarding. Help customers quickly realize value to reduce support costs, boost engagement, and increase loyalty.

8. Understand the profitability of your company’s revenue streams.

Ben Murray of The SaaS CFO writes about the importance of understanding which revenue streams are contributing most to a company’s gross profit. SaaS businesses sometimes incorporate ongoing services into their business models. While this should prompt a deeper exploration into scalability, these added services often result in exceptionally strong gross retention and net retention rates.

We recommend calculating gross margin for each product and service your company offers. Your software offerings may have higher gross margins than your services, but services may be essential depending on the nature of your product, industry, or vertical. The key is to find the right balance between the software and services your company offers.

Uncover the SaaS Metrics That Drive Your Valuation

Gross margin is just one of several metrics that determine your valuation and go-to-market readiness. To see where your company stands in your software vertical, check out the Interactive SEG SaaS Scorecard™, a confidential tool designed for software companies.

The Scorecard highlights your company’s strengths, flags areas for improvement, and equips you with the strategic direction you need to enhance your company’s value.

Gross margin is a critical lens, but it’s only part of the bigger picture. What matters is how well your business tells a story of efficiency, scalability, and long-term growth. Tools like the SEG SaaS Scorecard™ and real-world preparation help leadership teams shift from reactive to intentional.

When Bigfoot first reached out to SEG, we worked closely to identify strengths, as well as areas of improvement to prepare the EAM/CMMS solution to sell. CEO Paul Lachance said the time spent doing so was invaluable:

“They spent their time with us and taught us some really valuable lessons not only about the process but what we needed to focus on as an organization to get ourselves ready for the process, including, what would a possible acquirer be looking for. They didn’t have to do this, and they did. That really impressed me and my partners.”

The sooner you understand where your strengths lie and where to shore up weaknesses, the more control you’ll have over the outcome of your eventual exit.