Due Diligence Best Practices: The Critical Dos & Don’ts for Software Sellers

Holding responsibility for a successful due diligence process is daunting. After all, due diligence often represents one of the final steps before a merger or acquisition is complete. Mess up here, and it could mean starting from scratch.

While the nitty-gritty of due diligence is mostly handled by legal and accounting teams, overall due diligence strategy should be a team effort with a trusted advisor. It’s too important to tackle on your own.

So what is the best approach to due diligence during M&A? What are critical areas of focus? What are critical mistakes to avoid? Let’s jump in.

What is Due Diligence?

In a typical M&A deal, due diligence is the point in the process where sellers share all relevant information about a business with a potential buyer in order to move forward with the deal. In SEG deals, the majority of information has already been shared before reaching this stage to avoid any unwanted surprises (more on the importance of this later).

For sellers, the goal is to get through due diligence without any adjustments to the price or terms of the deal. For buyers, the purpose of due diligence is to ensure all risks are accounted for and all potential value has been correctly interpreted.

Companies typically bring on lawyers, accountants, tax experts, company leaders, and others to examine company data including financial records, liability obligations, company processes, intellectual property, and more. Due diligence is arduous and involves input from all areas of a business.

When Does Due Diligence Begin?

In M&A, typically due diligence begins after an LOI (letter of intent) is signed. Due diligence is confirmatory in SEG processes, meaning that the buyer is simply making sure everything checks out and all established expectations are correct.

However, since due diligence is when all the cards are finally laid out on the table, it is the most vulnerable stage of the M&A process for a seller. It is imperative that no new information of material nature is shared at this stage of the process to avoid a re-trade.

Continuing the daily operations of a business while also conducting proper due diligence is a major challenge. Not knowing the right questions to ask, lack of expertise, and sunk costs can all add up over the due diligence process. Often, sellers experience deal fatigue when all these separate challenges compound.

Rather than going it alone, we recommend seeking out an M&A expert to navigate the new territory with you. An advocate and someone with real experience can be a lifesaver when you need it most.

The Importance of Due Diligence

Perhaps nothing illustrates the importance of due diligence more than what happens when due diligence goes wrong, as it did with HP’s acquisition of Autonomy in 2012. HP purchased Autonomy for $11.1 billion, hoping to move away from hardware and enter the more profitable arena of computer software.

However, HP committed a major due diligence oversight — failing to notice inaccurate income statements, balance sheets, cash flows, and relevant footnotes. HP was then sued by shareholders in federal court for negligence. The cost of HP’s due diligence fumble? A loss of $5 billion (almost half of the purchase price).

A good due diligence process matters. Not only does it prevent major buyer oversight like in the case of HP and Autonomy, but it also helps the seller get the best deal possible. Here are a couple of reasons why due diligence is important for all M&A transactions:

- Due diligence helps the seller avoid a re-trade, where the buyer renegotiates the price or terms of the deal.

- Due diligence is a win-win for both buyer and seller — the buyer feels more comfortable with the purchase, and sellers can push the deal through the finish line.

With so much at stake, a good due diligence process is critical to any M&A deal. Getting the process right, from start to finish, should be a top priority for all involved.

Sell Side Due Diligence Dos & Don’ts

Knowing where to start with due diligence can be daunting. However, these due diligence best practices will give you a proper foundation to build on throughout the M&A process. If you follow these practical “do’s and don’ts,” you’ll be sure to start off on the right foot.

DO: Think about due diligence from day one.The same day your company decides to consider an exit plan is the day you should start preparing for due diligence. The more time you give yourself to prepare, the better you’ll be able to discover and deal with potential problems that buyers will uncover in due diligence. After all, the sooner you know what needs to be disclosed or cleaned up, the sooner you can work to actually resolve those problems or mitigate concerns through positioning. Remember, due diligence can make or break a deal. Do not underestimate it. | DON’T: Use diligence as the time to bring up “skeletons in the closet.”The last thing you need in a due diligence process is for the buyer to uncover information that gives them an excuse to re-trade the deal. At the due diligence stage in the process, the seller should ensure no skeletons pop up, be it financial or otherwise.

By planning for diligence from the very beginning, you can get in front of any problems and position them accurately. A good rule of thumb? The buyer should already have about 80% of all relevant information before due diligence ever happens. |

DO: Hold the buyer to your diligence milestones.Make sure you mandate that the buyer adheres to diligence milestones agreed to in the LOI. This means holding the buyer to the timeline you’ve already established. If the buyer doesn’t keep the timeline, the seller has leverage to get out of exclusivity. | DON’T: Be afraid to stick to the terms of your agreements.If you’re the seller, it’s easy to feel like you’re at a disadvantage during diligence. However, that doesn’t mean you should be a pushover when it comes to the terms you set down in your agreements. Make sure to stick to your guns if the buyer asks for wiggle room. Remember, they’ve done this before and are just trying to get the best deal possible. You should do the same. |

DO: Respond to all requests quickly.We can’t reiterate this point enough: time kills deals. Going through diligence quickly is important to ensure the success of the deal. This means getting organized with your information and internal teams, as well as communicating quickly with the buyer. It’s a lot to handle on your own, but a necessary component of a successful diligence process. | DON’T: Assume a request for information will go away.Responding with the right information when it’s requested keeps diligence moving along. All requests are valid and won’t be rescinded. |

DO: Go into diligence with competitive tension.Adding some healthy competition to the mix beforehand can help the seller keep the deal moving. As we mentioned above, the seller has the least leverage during due diligence. Without some momentum, re-trades on price or terms can pop up seemingly out of nowhere. If possible, make sure to start the due diligence process after bringing multiple parties to the table. That way, you have leverage to protect against re-trades, and can add some urgency of your own to move the deal through. | DON’T: Assume you’re in the home stretchDiligence is the stage of the process when potential buyers can still find material issues if not uncovered prior. Ideally, the buyer finds nothing new of material nature, but sometimes things can come out of left field. If the buyer finds additional material risk and tries to re-trade, you may not end up with the deal you had hoped for. By running a competitive process, you should have enough leverage in this stage to negotiate for better terms or even fall back to another potential buyer, ensuring you get the best deal for yourself and your business. |

DO: Use a due diligence checklist.Our six-part checklist is a great place to start. We link to individual checklists in each area that are available for free download. We recommend using these checklists now to prepare at least 80% of documentation beforehand. That way, your team is less stressed and you can feel more prepared during the process. Remember, gathering all these documents will take time. And, as we said above, time is of the essence. Using an M&A advisor to help you gather and organize these items can be an advantage. | DON’T put unnecessary items in the data room.It’s important to provide the right data at the right time. Providing additional data that wasn’t requested can slow the process down as the buyer processes them. “Your due diligence efforts should be limited to information that’s relevant to the deal itself. The goal is to make sure you’re making a profitable decision,” writes Jonathan Herpy at Forbes. “Anything in excess of that just makes the process cumbersome.” |

DO: Hire the right team of advisors.Most sellers don’t know where to start when it comes to preparing for due diligence. Trying to muddle through on your own can have disastrous consequences between re-trades, buyers dropping out, or the sunk cost of time and resources away from the business. Bringing on the right team to help with legal, accounting, and every other area of diligence is a must for software companies going through the process for the first time. By relying on a partner who’s been there and done that, sellers can make sure the due diligence process is simple and straightforward rather than a massive headache. Having an M&A advisor who’s been there before can give sellers peace of mind and help them get the most out of a deal. | DON’T: Try to do diligence on the cheap.The old adage “you get what you pay for” is as true in software M&A as it is anywhere else. The right team will pay for itself during diligence by providing the necessary expertise and support at every step in the process. |

Due Diligence Challenges

One of the most common reasons why M&A deals fail is underestimating the process. For software M&A, that includes underestimating how much time and effort are required to undergo the full due diligence process, the emotional toll diligence can take, and how to respond when buyers want to re-trade.

Diligence takes time

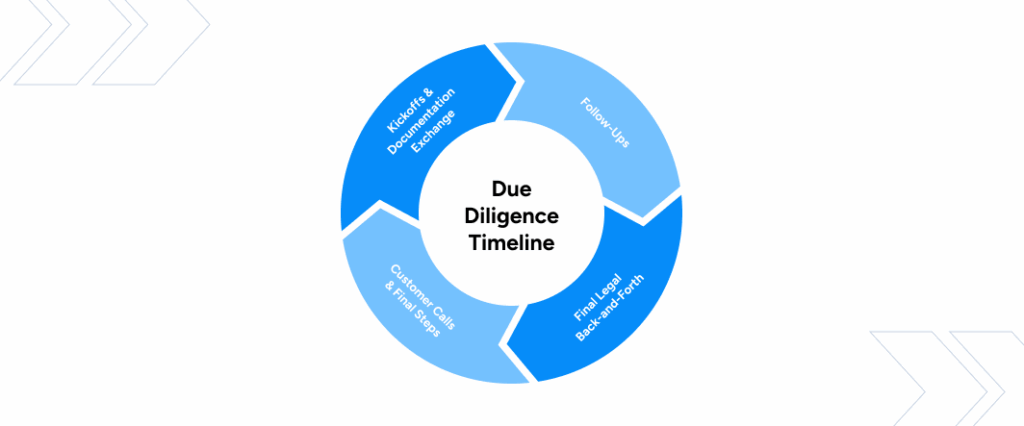

The due diligence process can take anywhere from 30, 60, or 90 days. As we’ve mentioned, timing is of the essence. Time kills deals in the due diligence portion of proceedings because it’s the part of the deal when the seller has the least leverage. By not acting in a timely manner, sellers might lose their chance altogether.

By not having due diligence documents prepared beforehand, deals can drag on and create unnecessary friction between your actual business and the process of selling it. Not only that, but not being prepared often means increased costs as companies scramble to hire accountants, lawyers, tax experts, etc., to meet their buyer’s demands.

Increased time means increased costs when it comes to due diligence.

The emotional toll of diligence

Many software founders are unprepared for the emotional and physical toll diligence can take. Getting frustrated about the process can complicate relationships, or not focusing enough on the business can lead them to miss financial projections and lose key customers. Add in a lengthy diligence process to the mix, and you’ve got a recipe for burnout and exhaustion.

Buyers want to negotiate key terms

One of the biggest challenges during diligence in a software M&A deal is that buyers are inherently at an advantage because they’ve gone through this process before. Buyers have a dedicated team of professionals in their corner running the process, and their goal will always be to purchase for the best price and terms possible.

Some common negotiation points include:

- Price

- Terms

- Deal structure

- Salaries and use tax

- Indebtedness definitions, etc.

In order to avoid death by a thousand papercuts, sellers need to make sure they’re ready to deal with buyers from the start. Waiting for it all to come to a head during diligence is an added challenge most sellers aren’t equipped to handle.

At Software Equity Group, we bring 30 years of experience in M&A services to the table. We know just how important due diligence is to get right to avoid re-trades and to ensure a deal is successful. Reach out to discuss how we can help your company through an M&A process, or check out our comprehensive due diligence checklist to learn more.