SaaS COGS Explained: Getting it Right & Why It Matters for Valuation

On paper, Cost of Goods Sold (COGS) seems straightforward. But in practice, it’s one of the most miscalculated metrics in SaaS finance. And buyers know it.

Should customer success COGS? What about hosting fees, integrations, or implementation teams?

Misclassify, and you distort your unit economics and gross profit. This can be a red flag for investors and strategic buyers evaluating your business. Potential buyers use the Cost of Goods Sold formula as an important factor in assessing a SaaS company’s scalability and financial stability.

Here’s what you need to know about COGS in software companies.

Why SaaS COGS Doesn’t Behave Like Traditional COGS

In layman’s terms, COGS is the sum of all the costs a company incurs to deliver its product or service to its customers. In many industries, COGS is a variable cost that grows as it sells additional units. In a business selling a physical product, for example, the amount spent on raw materials increases as more units are sold.

However, a factor unique to software companies is that COGS does not necessarily increase proportionally with sales growth. Because of the subscription-based business model of most SaaS companies, they don’t have to produce anything new each time a subscription is sold. Therefore, there could be little to no increase in COGS each time the company gains a new customer.

COGS vs. OpEx in SaaS: Getting the Classification Right

It’s important to distinguish between COGS and operating expenses (OPEX) like overhead, marketing, and other general administration costs. COGS should include only those expenses directly attributable to the production and delivery of the goods or services sold.

What Belongs in COGS for a Software Company

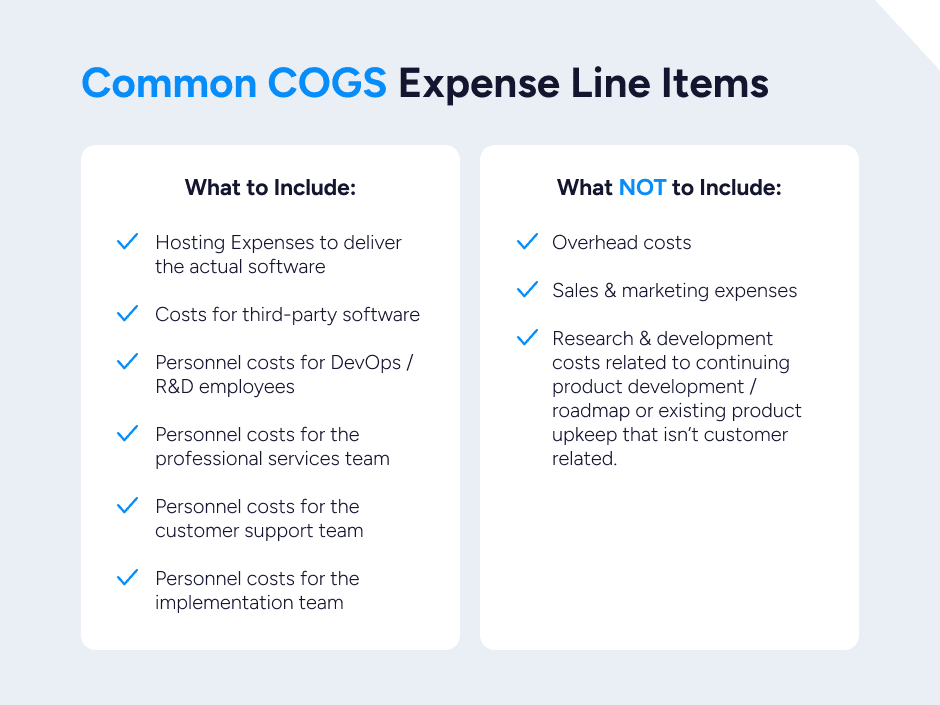

Software companies calculate COGS differently than traditional brick-and-mortar businesses. In SaaS, the focus is on expenses directly tied to delivering the product to customers. Common COGS line items include:

- Hosting and infrastructure: Cloud costs such as AWS, Azure, or Rackspace that enable the delivery of the application to customers.

- Embedded third-party software: Licensing or subscription fees for third-party tools integrated into the product and passed through to the customer, such as reporting engines, analytics modules, or software used to handle or implementation.

- Personnel tied directly to delivery: Compensation and benefits for teams that ensure the product runs for customers, including:

- DevOps or infrastructure engineers who manage servers, data centers, and cloud environments.

- Professional services teams that implement the solution for customers.

- Customer support staff responsible for servicing live accounts, as well as implementation and training activities(but not pre-sales solution consultants or success managers focused on retention/expansion).

- Support-based development teams dedicated to product maintenance and bug resolution that support ongoing customer operations.

SaaS companies sometimes vary in what they include, but the guiding principle should be consistency and defensibility. Only costs directly attributable to production and delivery should be classified as COGS.

What Not to Include in SaaS COGS

Equally as important is knowing what SaaS companies should leave out. COGS should never include expenses that don’t directly support product delivery, such as:

- Overhead costs. Rent, insurance, utilities, and other administrative expenses support the business as a whole but aren’t tied to delivering the software itself. Including them in COGS would understate gross margin and blur the line between product costs and operating costs.

- Sales and marketing expenses. Commissions, marketing campaigns, and promotional spend are part of customer acquisition and revenue generation, not product delivery. These fall under OpEx and should remain separate so buyers can clearly see the efficiency of both customer acquisition and product delivery.

- Research and development costs. While R&D is critical for long-term growth, it doesn’t directly contribute to delivering the current product to customers. Expenses such as salaries for engineers or R&D amortization should be excluded from COGS. Misclassifying them can make it look like your product is more expensive to deliver than it really is, depressing gross margin unnecessarily.

COGS should only reflect what it takes to deliver your product to customers today. Everything else including keeping the lights on and building tomorrow’s roadmap should stay in OpEx.

How COGS Impacts SaaS Company Valuations

Private equity investors and strategic buyers heavily scrutinize COGS when evaluating potential acquisitions.

SaaS companies with optimized COGS command higher valuation multiples because of the impact of COGS on metrics. Here’s where a lower COGS impacts valuations:

- Higher Gross Profit Margins: For example, a company with an 85% gross profit margin will generally be valued higher than one with a GM of 70% because it retains more revenue as profit. According to our recent quarterly SaaS M&A and Public Market Report, gross margins remained one of the clearest value signals in Q3, with 56% of SaaS companies reporting margins above 70% and 17% clearing the 80% threshold. Despite macroeconomic volatility, the average and median EV to trailing-12-month gross profit multiples remained stable at 9.6× and 7.5×, respectively. That margin discipline is driving premium valuations for companies that keep COGS lean and scalable.

- Cash Flow: Efficiently managed COGS can significantly improve a company’s cash flow. This capital can then be reinvested into growth initiatives, product development, or improving customer experience, factors that make the company more attractive to buyers.

- Scalability: Buyers look for companies that can scale efficiently. If a SaaS company can grow its customer base without proportionally increasing COGS, it signals the company has a scalable business model.

- Long-Term Viability: A well-managed COGS structure reflects a SaaS company’s operational efficiency and long-term viability. Investors prefer companies that have a clear understanding and control over their cost structures as it indicates sound financial management.

Company Example: The Impact of COGS on Valuations in SaaS

Because gross margin is directly tied to COGS, the way a company manages delivery costs has a material impact on SaaS valuations.

Let’s consider a bootstrapped software company we’ll call “Company A.” Company A is a provider of project management software and has grown steadily to $6 million in annual recurring revenue (ARR) driven by strategic product development and customer-focused innovation.

Company A’s COGS is low due to its efficient use of cloud infrastructure and streamlined implementation and support processes. By investing early in scalable technology and automation, Company A has maintained a healthy gross margin of 75%.

This efficiency shows strategic buyers and investors that the business can scale profitably: growing revenue without costs rising in lockstep. It also reflects disciplined cost management and sound business strategy, qualities associated with durable, high-value SaaS companies.

Lower COGS also tends to correlate with higher valuation multiples. Company A’s healthy gross margins position it to command a stronger EV/ARR multiple than peers carrying heavier delivery costs.

For context, in the second quarter of 2025, gross margin was a key valuation driver, with >80% margin companies trading at a 105% premium to the SEG SaaS Index median. In the second quarter, 63% of public SaaS companies posted gross margins above 70%, and 23% cleared the 80% threshold. Companies above that market traded at a median EV/TTM revenue of 7.2x, compared with just 3.5x for those below 60%.

For Company A, this cost discipline has strengthened its appeal to potential buyers and demonstrates how managing COGS translates into higher valuations and greater market credibility.

We recently hosted Ben Murray, founder of The SaaS CFO, for a webinar where he shared common mistakes (including with COGS), metrics you should track, and how SaaS companies can tell a better financial story. Watch the conversation now on-demand.

COGS and the Path to Better Valuation

Accurately forecasting COGS is critical for SaaS leaders who want to demonstrate efficiency, scalability, and financial discipline to strategic buyers and private equity investors. Missteps in classification or cost management can distort gross margin and undermine valuation.

SEG works with SaaS leaders to uncover the drivers behind their COGS, cut unnecessary expenses, and increase margins and valuation. Thinking about a strategic exit or growth investment? Let’s talk.