- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

The Essential 6 Factors for Software Founders Planning an Exit

When it comes to evaluating a software company, PE investors and strategic buyers focus on certain criteria that can make or break a deal. These six factors we’re about to delve into are not just essential considerations; they are the very yardsticks that potential acquirers use to gauge the value of a software business. Whether you are considering an exit in the near future or down the road, understanding these critical factors is key to attracting the attention and interest of those who can drive your company toward a successful exit strategy.

What Market Does the Company Serve?

The first step in the journey to a successful transaction is understanding the market you serve. When software executives reach out to us regarding selling a majority of their business, the first thing we want to know about is the market and product category. Key questions include whether the company caters to a vertical or horizontal market, the total addressable market (TAM), the evolving market dynamics, and the specific market pain points the company addresses.

Moreover, a deep understanding of the company’s customer base is essential. This insight provides invaluable data on annual recurring revenue (ARR) trends, customer types (consumer or business), customer size (small, medium, or enterprise), customer acquisition strategies, and more. Software executives and CEOs should meticulously analyze their market and customer base to optimize their efforts, targeting the most lucrative and sustainable customer segments.

How Modern is the Software?

A critical aspect that software acquirers examine is the modernity of a company’s technology offering. A visit to the company’s website often offers insights into the state of its product technology. Key factors include the age of technology, whether it is legacy/on-premise or SaaS/cloud-based, customer satisfaction with the user interface (UI) and user experience (UX), and the size of the customer support department. Neglecting technology investments can impact the purchase price and deter potential buyers.

How Strong are the Unit Economics?

When evaluating a software company, one of the most crucial factors is its unit economics. This entails a thorough assessment of customer adoption, new customer acquisition rates, sales and marketing expenditures, average ARR trends, and customer retention rates.

Retention rates, in particular, can be deciding factors for buyers. Strong net retention (greater than 100%) signals customer satisfaction and loyalty, leading to expansion within the customer base. Conversely, poor retention may indicate underlying issues with the product, onboarding process, or customer support. Conducting customer surveys can provide valuable insights into addressing market pain points and improving retention.

Is the Company Financially Healthy?

The financial health of a software company plays a pivotal role in attracting potential buyers and investors. Key financial metrics include ARR & revenue size, overall growth rates, gross profit margin (GPM), profitability, and the percentage of recurring revenue.

- Size/Scale – A company’s size relative to its age often reflects its performance and market adoption.

- Gross Profit Margin (GPM) – In the case of SaaS-based businesses, a GPM of at least 75% is favorable, signifying potential for higher profits and reinvestment.

- Profitability – In light of our recent survey results, it’s evident that while growth remains a vital aspect, profitability has gained importance. Rather than solely prioritizing growth and reinvestment to capture market share, there is a growing emphasis on sustainable profitability. This shift in perspective aligns with market dynamics that value not only rapid expansion but also the ability to deliver consistent and healthy bottom-line results.

- Recurring Revenue – In today’s subscription-driven landscape, a minimum of 70% recurring revenue is desirable, reducing risk and appealing to buyers and leaders alike.

Benchmarking against industry standards can guide executives in improving their company’s financial health. To learn more about benchmarks and additional factors important in valuing software companies, read our whitepaper.

How Strong is the Team Culture?

Beyond the market, technology, and financials, team culture holds significant sway in the success of an exit strategy. It signifies stability, talent retention, innovation, collaboration, and alignment with values. A strong team culture enhances the company’s reputation, reduces post-acquisition risks, and fosters a positive transition, making it an essential consideration for potential buyers seeking long-term success and growth through acquisition.

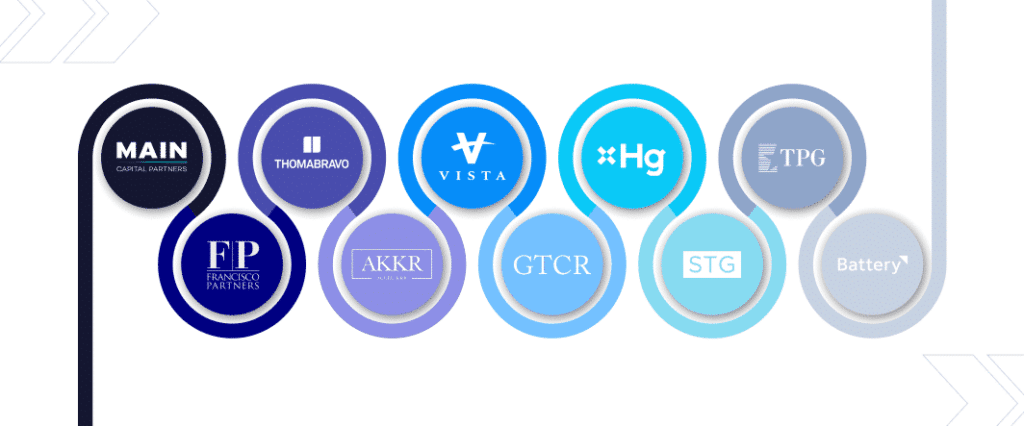

Who is in the Buyer Universe?

To identify the ideal buyer, we assess our network of potential buyers, including private equity investors and strategic buyers (public, private, and private equity-backed). We also consider non-traditional buyers and industry leaders. Each potential buyer is evaluated based on factors such as their interest in the company as a platform investment, valuation criteria, enthusiasm for the opportunity, and alignment with the company’s financial profile and future objectives.

If you are contemplating a future exit, it’s beneficial to compile a list of your top 15 ideal buyers, outlining key attributes for each, and proactively engage with them through corporate development or industry research.

These six factors are key in evaluating software companies, not just for software M&A advisors like ourselves, but for strategic buyers and investors. As a software company executive, it is critical to know these factors before going into a process.

Software Equity Group often provides informal strategic guidance and advice to business owners in the years preceding a liquidity event. If you’d like to discuss any of these six factors above, potential acquirers, or valuation guidance, we’re here to help.