Why High-Growth Software Companies Trust SEG to Lead Their M&A

A software CEO recently told us:

“I’ve had more inbound interest in the past six months than in the past six years.”

They’re not alone. Private equity firms and strategic buyers are reaching out to SaaS companies regularly. Their emails promise high valuations, seamless processes, and quick closes.

But behind the scenes, many of these offers evaporate before a deal is signed. Valuations get walked back, due diligence turns into an endless burden, and deals collapse because the buyer wasn’t the right fit.

This could happen for any number of reasons:

- Business performance issues, such as revenue or profits falling before the deal closes

- Economic conditions or industry headwinds, which may shift buyer priorities

- Misaligned expectations, with the seller expecting a higher price than buyers may be willing to pay

- Buyer-side issues, including struggling to find financing or not being serious about the deal in the first place

- Process challenges, such as when a seller isn’t ready for due diligence or is overwhelmed by the process, or the buyer and seller can’t agree on terms

- Due diligence red flags, which could include legal or regulatory concerns, financial discrepancies, or key employee retention concerns

If you’re a founder considering your next move or a financially backed CEO fielding increasing investor interest, you’re probably asking yourself:

“How do I separate real opportunities from the noise? And if I decide to pursue M&A, how do I avoid common pitfalls?”

You’re not alone if:

- You are unsure what your business is worth in today’s market

- You’ve been told you don’t need an advisor, but that feels risky

- You’re already stretched running the business and can’t afford distractions

- You want a partner who understands the software space and can protect your upside

At Software Equity Group (SEG), we’ve helped hundreds of CEOs navigate that exact moment guiding them to a successful outcome. Here’s what we’ve learned makes the difference.

What You Need from Your M&A Advisor

Here’s what you should expect in a M&A process from a firm that has your best interests in mind:

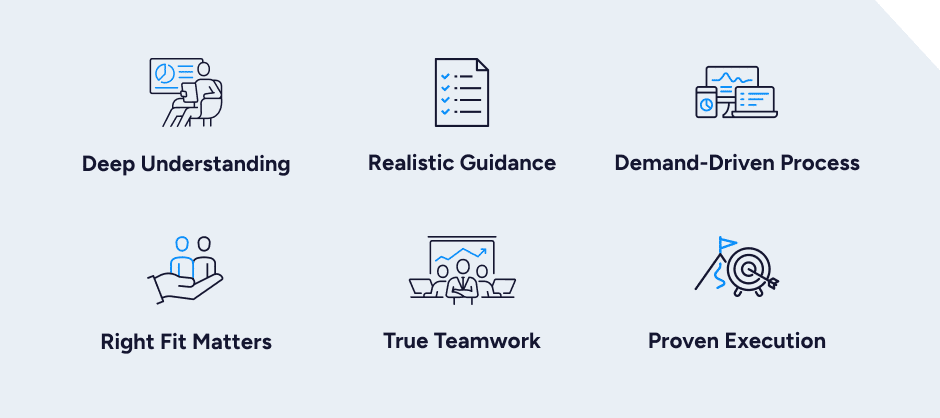

1. They should invest time in getting to know you upfront.

Too many advisors take a surface level look at your business and rush to market. But when they do that, they leave a lot on the table. The popular “The more you know …” campaign had it right. The more an advisor knows about your business at the start, the better you’ll come out on the other end.

A lack of preparation means sellers may enter negotiations without a clear understanding of their strengths, weaknesses and market positioning. When SaaS founders engage with Software Equity Group, we dig in, ask the hard questions, and understand your vision. The right preparation means fewer surprises down the road — and a process that works in your favor.

In some cases, we’ve developed relationships with SaaS company executives long before they were ready to sell or seek investment. We’ve served as mentors to founders and CEOs for years, helping them lay the right path for an eventual exit. We might uncover opportunities to improve the business that will lead to a better result; we may also, just as importantly, identify skeletons that can be addressed before we even get to the negotiation table.

For ClearPathGPS, that time we spent on the front end was invaluable.

“SEG really came in and took the time to know our business at another level of detail so they could really frame what they thought the competitive landscape might look like for us running a process,” said ClearPathGPS Co-Founder Chris Fowler.

His co-founder, Steve Wells, agreed. “Chris and I were literally blown away at the level of effort, detail, and just acumen that they showed throughout this process. The attention to detail, knowing our numbers almost better than we did at some points, and ability to represent them back in consumable ways for the potential buyers and people looking at the business.”

2. You need realistic expectations, not a sales pitch

Some firms inflate valuations to win your business, only for you to face retrades later. Unrealistic expectations can also frustrate leaders, you’re likely to be discouraged by delays, due diligence and extended negotiations.

We’ve seen deals fall apart because of misaligned expectations. In one case, a financially backed SaaS company chose another firm because they provided a better valuation upfront than we guided. However, the process failed because the expected valuation did not align with reality. After a year, the CEO came back to Software Equity Group; we then took the deal across the finish line for them.

Knowing what to expect upfront – and what is the most likely result for your individual business – will keep the deal intact.

Software Equity Group uses its more than 24 years of M&A market research, insights and tools exclusively focused on the software industry to set realistic, data-driven expectations from the start.

“What I think a lot of people don’t understand is there is a lot that goes into the process well before you start talking to potential buyers. SEG was able to frame the company in a way that frankly we had never thought about. I appreciated that SEG put together what we thought was a realistic number that turned into being a very realistic number that we actually exceeded,” said Robert Johnson, former CEO and founder of TeamSupport. TeamSupport received investment from Level Equity.

We have created a proprietary methodology to evaluate software companies and assess their readiness for exit. (What’s your valuation potential? Start your assessment now.)

Learn more about what buyers consider in our report: 20 Factors to Track When Valuing Your Software Company.

3. You deserve a process that creates demand and maximizes value

A great exit isn’t just about finding one buyer — it’s about creating competition. We consider market demand, competitive positioning, financial performance and more to achieve a leading first-pass success rate, consistently securing and surpassing the valuation multiples our clients want.

This starts with a Confidential Information Memorandum (CIM), which is a critical step in the preparation phase for any liquidity event. The CIM tells the story of your business – where it came from, what it is today, and its potential. We make the case for why your business is an exciting opportunity. Every business is unique, and the CIM should reflect that.

CIMs take time to produce. It’s not as simple as repurposing your existing marketing message. Your prospective buyers are looking for something different: What’s in it for them? Our goal is to generate interest from the right buyers, leading to higher valuations and better terms.

Here’s what Dr. Jacquelyn Kung, Founder & Former CEO of Activated Insights, said of her experience with Software Equity Group:

“SEG does a couple things which helps create a competitive tension. The first is signaling to the market that a process is being run and what the timeline is for that process. When you know all the dates in advance as a buyer, you know it’s a serious process. ”

See the Activated Insights story.

4. You should choose the best advisor for your business, not just the lowest bidder.

M&A advisors offer their services under a variety of fee structures:

- Retainer fees, which can ensure commitment from both sides and covers deep early-stage advisory work

- Success fees, which are a percentage of the final transaction value

- A hybrid model, which is a combination of retainer and success fees

The biggest mistake a founder or CEO can make is choosing an advisor based on price alone. Focusing on the cost to the exclusion of expertise, network and track record can lead to a lower valuation or even a failed deal.

The wrong partner may spend less time on your deal, and may lack the industry sector expertise needed to maximize valuation and find the right buyer. The wrong fit may also result in less post-deal support and guidance to navigate considerations such as earnouts, integration and taxes.

The right partner on the other hand helps your company scale successfully post-transaction. At Software Equity Group, we’re focused on that long-term success, and not just a short-term payout.

Would you invest $0.90 for a strong chance at winning $200? Of course you would – the math is obvious. Similarly, when evaluating potential advisors, the numbers are clear. The tangible value the right partner will bring to the table will far exceed your initial investment.

5. You need a team that works together instead of competing for deals

Many firms operate on an “eat what you kill” model, where individual bankers prioritize their own commissions. They may also assign inexperienced advisors to give them an opportunity to close a deal.

At Software Equity Group, our entire team is invested in your success, not just closing a deal. We help with every part of the transaction, from valuation to marketing to negotiations. We have a sense of shared responsibility for your success. This gives your company deeper support. It also provides access to more specialists, making buyer engagement more credible and effective. We’re committed to collaboration.

We also have team members who have gone through the M&A process on the other side of the aisle: SEG helped our companies exit, and now we’re helping others go through the same process.

“SEG was not only the most knowledgeable of the SaaS space, but they were also the firm I could trust the most,” said Mike Lang, president of FullCount, which was sold to 365 Retail Markets. “I can often tell when someone is bluffing, and the team at SEG was honest, personable, and trustworthy in the sales process, and that carried through the entire project.”

6. You should expect a team that delivers and not just one that promises to deliver

We’ve been told that most investment banks close fewer than 50% of their deals. Software Equity Group has a 90%+ success rate because we run a structured, competitive, and high-integrity process. We only take clients on that we feel strongly will have a successful outcome.

We are a boutique M&A advisor by design. Our model is intentionally selective. We work with fewer than 20 clients a year so we can stay deeply involved in every deal and deliver highly personalized guidance throughout the process.

For Tad Fallows, whose business iLab Solutions was acquired by Agilent Technologies, working closely with SEG paid off. “We achieved an outcome that exceeded my objectives, both in financial terms and in the long-term success of our employees and customers. I know without a doubt that retaining SEG was the highest ROI investment we ever made as a company.” Our process works because it’s built for B2B software companies. Whether you’re bootstrapped and scaling or backed by investors with high expectations, we know what it takes to navigate a successful transaction.

Software Equity Group’s approach includes:

- Getting to know you and your business in-depth before moving the process forward. This takes time but is the foundation for everything that follows.

- Acting as a sounding board for how best to internally approach an M&A process with employees, clients, and other stakeholders

- Analyzing and presenting information and data to buyers

- Building competitive tension with selected buyers

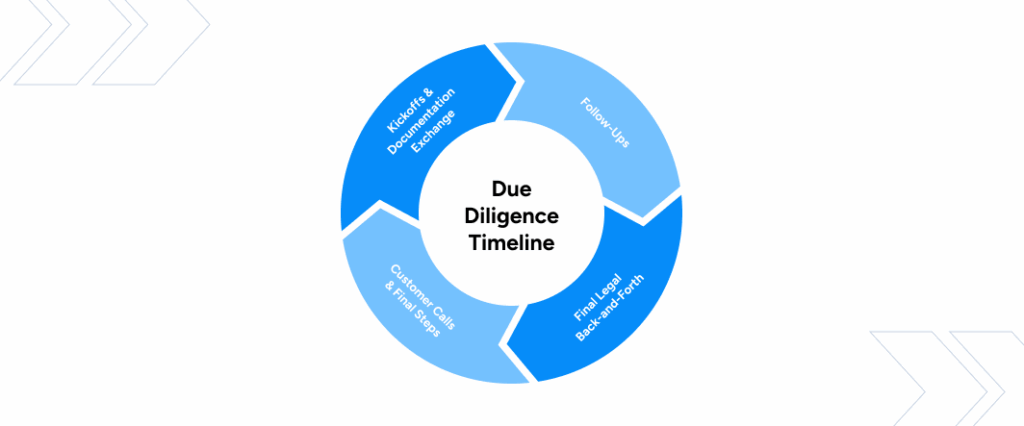

- Leveraging the right resources at the right stages before going into due diligence to avoid red flags, re-trading, or the deal falling apart

- Negotiating key deal terms to ensure that the transaction is fair, transparent, and acceptable to all parties

- Ensuring buyers are doing the appropriate level of diligence to understand business dynamics

- Considering more than just valuation, knowing many of our sellers want to preserve their legacy and ensure a successful future not just for them but for their team and customers

What’s Next? Your Process Starts Here.

If you’re weighing your options or fielding inbound interest, now is the time to get strategic. Let’s have a conversation. No pressure, just insight because making the right move starts with knowing your options.

Get in touch with us or explore our latest SaaS M&A insights here.