SaaS M&A Deal Volume and Valuations

SaaS M&A continues to gain momentum in 2025, with record activity, strengthening buyer confidence, and steady valuations shaping a competitive market for founders. SEG’s SaaS industry research, including the annual and quarterly SaaS M&A Reports, tracks these shifts and what they mean for founders considering capital raises, strategic investments, or a potential exit in the coming years. The latest data offers a clear look at how buyer behavior, deal volume, and valuations are evolving as we move deeper into 2025.

SaaS M&A Deal Volume Trends

SaaS M&A remains one of the most active segments in software dealmaking, and the latest data show that momentum is continuing. In 2024, 2,107 companies were acquired, representing 61% of all software deal volume. That figure was the second-highest on record, just shy of the 2022 peak.

Strength has carried into 2025. In the third quarter alone, SaaS M&A hit a record 746 transactions, extending a three-quarter streak of 600-plus deals. SaaS is now on pace to exceed 2,500 transactions in 2025, which would mark a new annual record.

The acceleration reflects strengthening buyer confidence, pent-up demand, and improved financing. An expanding SaaS universe, combined with private equity firms selling businesses to return capital, has boosted deal supply and helped establish a durable baseline for future SaaS dealmaking.

Strategic vs. Private Equity Buyers

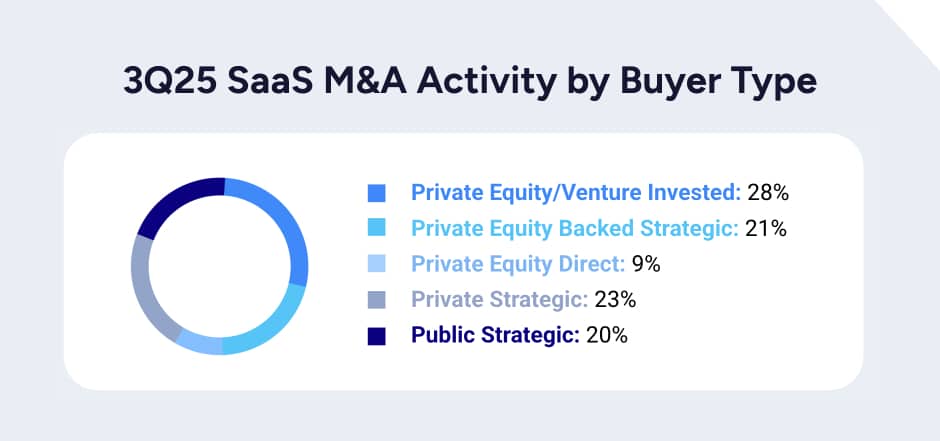

With deal volume at record levels, the mix of buyers behind this activity offers a clear view into who is driving the market in 3Q25.

Strategic and PE buyers remain highly active, supported by stable financing and a growing supply of quality targets. PE/VC-backed buyers accounted for 58% of all SaaS transactions. The data underscores the continued dominance of private equity capital in driving software M&A activity. Meanwhile, pure strategic buyers accounted for 42% of deals, pursuing acquisitions aligned with businesses showing growth opportunities in AI.

Learn More: Understand how strategic and financial buyers differ, and what each type means for your company’s outcome.

Vertical SaaS M&A Trends

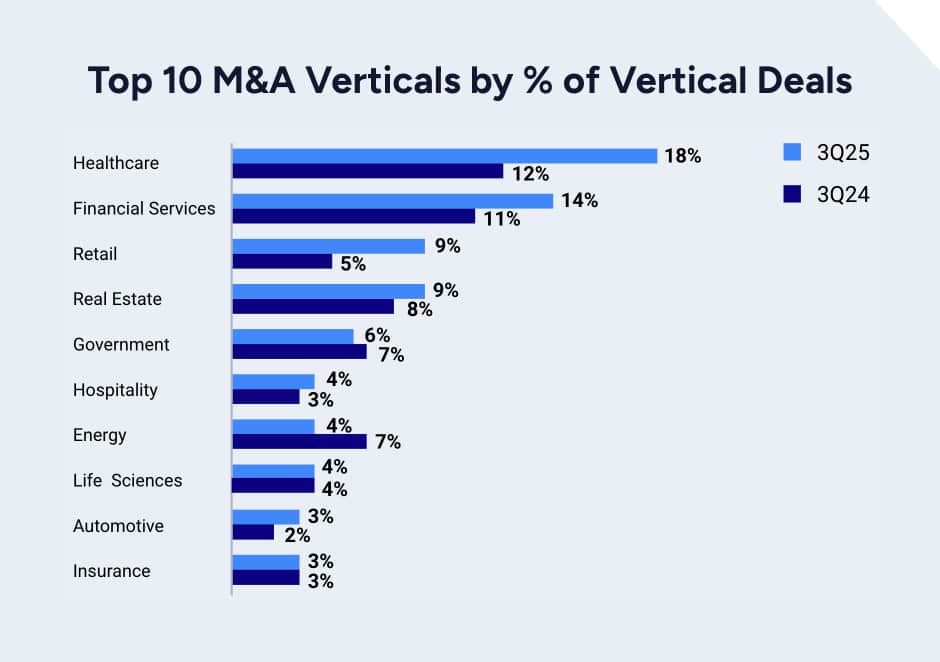

Amid this strong buyer engagement, vertical SaaS remained a clear focal point of dealmaking. Vertical SaaS leads SaaS M&A activity with 54% of all SaaS deals in 3Q25, up from 43% a year earlier. Buyers increasingly prioritize specialized, mission-critical platforms with embedded workflows. These businesses typically demonstrate high switching costs, durable retention, and strong cross-sell potential, making them especially attractive in any environment.

In 3Q25, Healthcare (18%) and Financial Services (14%) led vertical SaaS deal activity, followed by Retail and Real Estate (9% each). These categories reflect strong demand for domain expertise and mission-critical software.

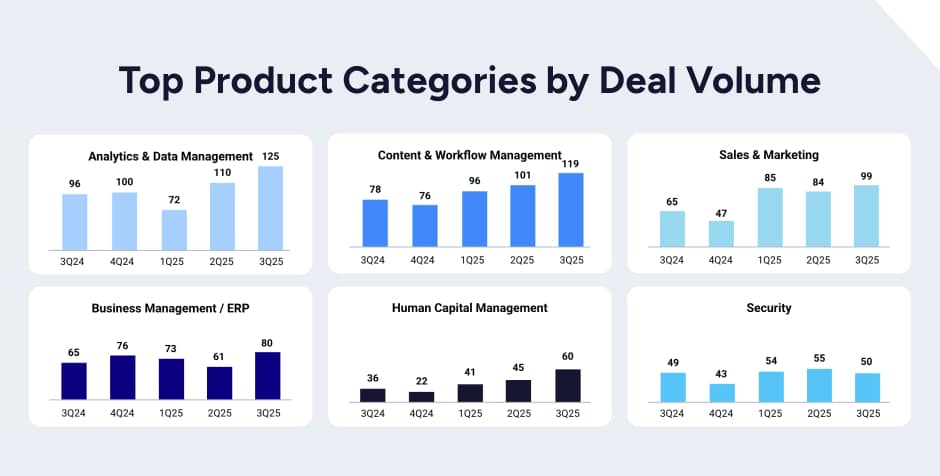

SaaS M&A Deals by Product Categories

Beyond vertical markets, product category-level activity also showed clear patterns in 3Q25. Analytics & Data Management led all SaaS product categories with 125 deals, extending its lead as the most active segment. Continued investment in AI infrastructure, data orchestration, and embedded intelligence is fueling this surge.

Content & Workflow Management followed closely with 119 deals, reflecting its central role in supporting collaboration, automation, and efficiency across industries. Sales & Marketing and Business Management also maintained steady activity with 99 and 80 transactions, respectively. Overall, buyers continue to prioritize scalable, embedded platforms that deliver measurable workflow impact and position organizations for AI expansion. These factors directly influence how private SaaS companies are evaluated in competitive M&A processes.

Companies that prove scalable, profitable growth can achieve better outcomes in competitive M&A processes. Hear from founders who worked with SEG to prepare for premium exits.

SaaS M&A Valuations

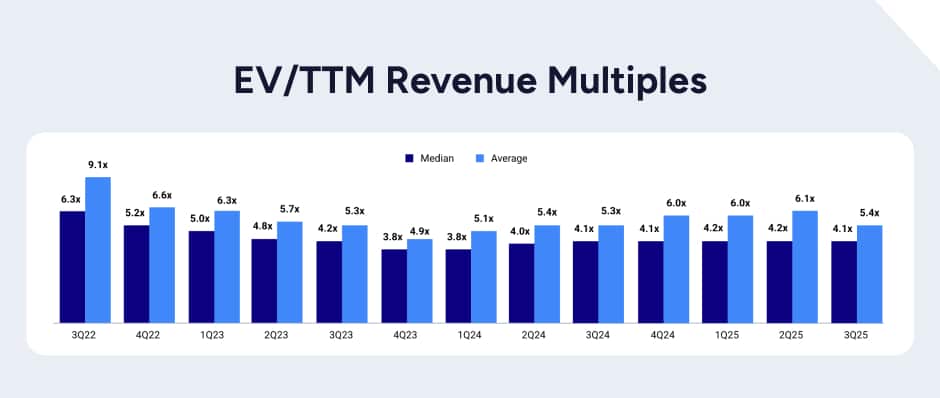

Median SaaS M&A valuations held steady in 3Q25 at 4.1x; the average was 5.4x, reflecting a balanced, disciplined market. Across the past four quarters, multiples have stayed within a consistent 4x to 6x range.

The full quarterly report looks more closely at how the public market influences private-market valuations over time. Because private market valuations typically trail public SaaS valuations by roughly four to eight months, the strength in public SaaS valuations in the third quarter is likely to foreshadow higher valuations ahead for private markets. This is particularly true for top-tier SaaS companies demonstrating efficient growth and solid margins.

Furthermore, A+ SaaS businesses still see outlier valuations transacting in the 15x-20x range. Some of the highest transacted multiples of the quarter included CyberArk Software at 22x, Nozomi Networks at 12.7x, and SlashNext at 10x EV/TTM revenue.

Learn more: Discover the 20 factors that can influence your valuation with SEG’s SaaS Scorecard.

What Market Momentum Means for Your SaaS Exit Timeline

When public markets move, private deal dynamics move with them. Founders who track these shifts and act before their competitors do will convert that momentum into long-term value.

Considering an exit now or in the near future? Let’s talk about your options.