Meet the Top Strategic Buyers Acquiring Software Companies

If you’re a software company founder considering an exit or seeking a strategic partnership to support further growth, it’s important to be aware of the most active buyers in your industry. This knowledge is foundational to helping you tailor your strategies to today’s market.

However, it is essential to understand that not all strategic buyers are the same—some operate as holding companies, others pursue platform investments, and some are private equity-backed strategics. The following buyers are the most active, but they may not be the right fit for your company. How do you determine the best type for your business? We will cover that as well.

Read on to discover the leading strategic buyers in today’s market and their noteworthy acquisitions.

Why Strategic Buyers Want Software Companies

For strategic buyers, acquiring a high-growth SaaS company offers a fast track to new markets. By purchasing a company’s niche product, a strategic buyer gains access to an established customer base in a new segment, reducing the time and resources needed to attain organic growth. Additionally, they can often capitalize on synergies between the two companies’ software solutions, creating a more comprehensive suite of offerings that attracts new customers and boosts overall revenues.

Strategic buyers are looking to acquire companies in a way that helps progress their own business goals. They may be weighing whether an acquisition will more efficiently help consolidate market share and reduce their competitive set, add on to or improve their product offerings, or extend into new product types or verticals.

The most important factor, however, is strategic alignment. Strategic buyers typically acquire companies to integrate into their operations (although in some cases, the acquired company maintains a level of independence). When the business models perfectly complement each other, the combined entity can achieve a more efficient and synergistic operation.

What follows is a select list, according to our research, of the most active strategic buyers of software. The group includes public strategic, private strategic, and PE-backed strategic buyers.

LEARN MORE: Step #3 in How to Prepare an Exit Strategy: A Guide for SaaS Founders is to get to know the buyers in your space. Be sure to follow the other steps as well.

Meet the Top Strategic Buyers Investing in Software

Visma

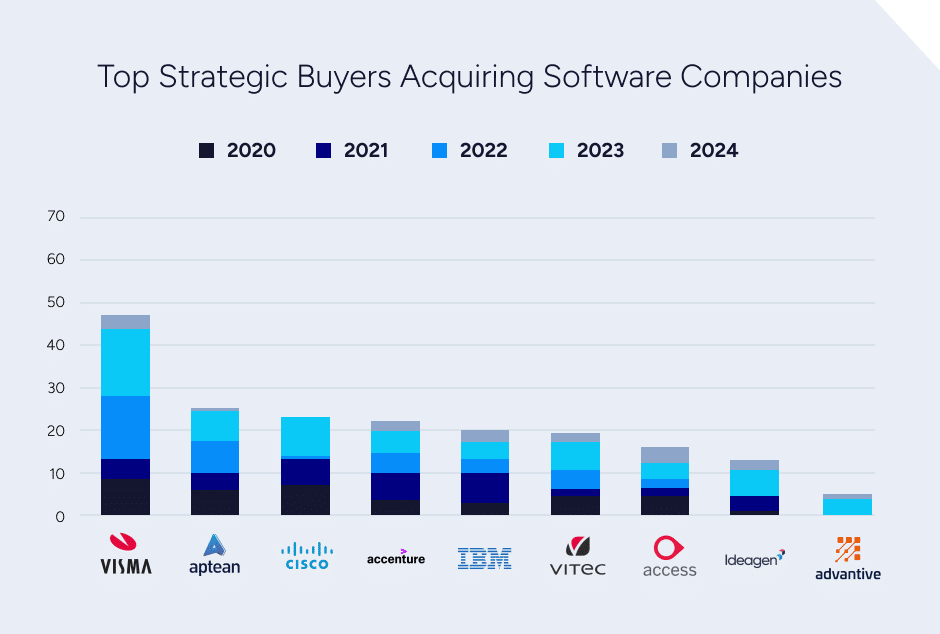

Visma is a developer of cloud enterprise software that digitizes core business processes in the private and public sectors, including accounting, ERP, procurement, payroll, and debt collection solutions. Visma is owned by Hg Capital, making it a PE-backed strategic buyer. With 15,700 employees and nearly two million customers worldwide, Visma is one of Europe’s largest software companies. The company made 12 software deals in the past 12 months ending June 30, including three in 2024. The company made 15 acquisitions in 2023.

Select Visma 2024 Transactions

Notable recent deals include the May 2024 purchase of MyCompanyFiles, a provider of documents and information exchange software and related mobile applications for the accounting industry in France. The software provides features for data sharing, email notifications, permission management, reminders, web and mobile interfaces, collaboration, and dashboards.

Visma also made the January 2024 acquisition of Chaintrust, which provides accounting entry automation software, APIs, and related mobile applications for accounting firms in France.

In February 2024, Visma acquired InvoiceXpress, a developer of electronic invoicing software and related APIs for small businesses worldwide. InvoiceXpress’s software includes features for tax management, VAT reporting, billing management, payment processing, and budgeting.

Accenture

Accenture is one of the largest consulting firms in the world, with 750,000 employees and operations in 49 countries and over 200 cities. The company has made eight software deals in the last 12 months, including three in the first half of 2024. In 2023, they completed six transactions in 2023.

Select Accenture 2024 Transactions

Notable recent deals include the October 2023 acquisition of OnProcess Technology, a provider of AI-based supply chain management SaaS to businesses globally. The software provides features for reverse logistics, employee equipment retrieval optimization, insights, systems integration management, process automation, end-to-end reporting, and forecasting.

The Access Group

The Access Group develops business management software for organizations in the UK, Ireland, and the Asia-Pacific. The privately held company was founded in the UK in 1991 and today boasts 7,000 employees. The Access Group has made seven software acquisitions in the past 12 months, including four in the first half of 2024. It made four deals in 2023.

Select Access Group 2024 Transactions

Notable recent acquisitions include the June 2024 acquisition of SHR Group, a provider of AI-based revenue generation and management SaaS for businesses in the hospitality sector globally. The software provides features for distribution management, guest management, inventory management, reservation management, booking management, analysis, and CRM.

The Access Group also completed the May 2024 acquisition of Lavatech (dba inCase), a provider of legal management mobile applications and related software for businesses in the legal industry globally. The software provides features for case management, digital signature, identity check, forms and questionnaires, and messaging.

Cisco Systems

Cisco Systems is the leading provider of networking equipment and one of the largest software companies in the world. The public company was founded four decades ago and is headquartered in San Jose, California. It employs a global workforce of nearly 100,000 people.

Select Cisco Systems 2024 Transactions

Cisco has made 312 acquisitions throughout its 40-year history, including 11 software purchases in 2023. The company made five software deals over the last 12 months, but none in 2024 to date. Cisco’s notable recent acquisition include Oort, a global provider of cloud-native threat detection and response SaaS and related APIs.

Cisco’s September 2023 purchase of Splunk ($29B EV was one of the largest SaaS deals of the past year. The deal boasted an EV/TTM Revenue multiple of 7.5x. Splunk is a provider of machine-to-machine IT systems, cybersecurity, and application performance management software. Splunk was a privately held company from 2012 until its acquisition by Cisco. This transaction is an example of the “take private” acquisition trend that has been picking up of late.

Ideagen

Ideagen is a developer of compliance management software for multiple industry sectors including transportation, healthcare, and aerospace. The private company was founded in 1993 and is headquartered in Ruddington, United Kingdom. The company has 1,400 employees and has made 40 acquisitions since its inception.

Select Ideagen 2024 Transactions

Ideagen made six software acquisitions in 2023 and five in the last 12 months (including two in 2024).

Notable transactions include the $54M EV acquisition of Damstra Technology, a provider of integrated workplace management software and related mobile applications for businesses worldwide, in April 2024. The software provides features for access control, asset management, eLearning, and predictive analysis.

In September 2023, Ideagen acquired DevonWay, a developer of compliance and enterprise asset management (EAM) SaaS, APIs, and related mobile applications for businesses globally. The software offers features for operations management, work planning and control, dashboards, business intelligence, reporting, environmental health and safety, workforce management, and risk management.

SEG and Ideagen: Notable Deal with Shared Involvement

In May 2023, SEG advised Tritan Software in its acquisition by Ideagen. Tritan is a configurable, flexible and accessible maritime EHR solution. The acquisition by Ideagen will enable Tritan Software to expand its services and support to the maritime industry and further establish its collective position as a leading provider of Health and Safety software.

Aptean

Aptean is a developer of Enterprise Resource Planning (ERP) software for the Manufacturing sector. Since its founding in 2012, the PE-backed company has made 69 acquisitions. Aptean is backed by private equity firms Clearlake Capital Group, TA Associates, Insight Partners, and Charlesbank Capital Partners. Aptean has 3,500 employees and is headquartered in Alpharetta, Georgia.

Select Aptean 2024 Transactions

Aptean completed seven deals in 2023 and four in the past 12 months (including one in 2024). Notable among these transactions, in February 2024 Aptean purchased Momentis Systems, a provider of ERP management software and related mobile applications to businesses in the global fashion, apparel, footwear, and accessories sectors. The software offers features for PLM, sales order management, sourcing and logistics, warehouse management, financial management, and business intelligence.

In November 2023, Aptean acquired 3T Logistics & Technology Group, a provider of AI and big data analysis-based transportation management SaaS for shippers and carriers in the UK. The software provides features for order management, planning, carrier communication, onsite control, freight audit, and payment, reporting, and information management.

SEG and Aptean: Notable Deals with Shared Involvement

Aptean acquired two of SEG’s clients, including Produce Pro, a provider of enterprise technology solutions built to support the specific needs of the fresh produce and perishables industries. The company is in the Business Management/ERP, Compliance Management, and Content & Workflow Management product categories, and serves the Manufacturing vertical. Produce Pro’s products are designed to serve its customers across the supply chain from production to distribution and are used by hundreds of food distributors, brokers, processors, and growers in North America. With the acquisition of Produce Pro, Aptean builds upon its award-winning Food & Beverage ERP offerings with additional functionality to serve the food distribution segment of the industry. Produce Pro will benefit from Aptean’s global scale, resources and technological expertise.

SEG also advised Aptean’s acquisition of V-Technologies, a leading provider of integrated shipping software solutions. V-Technologies is in the Analytics & Data Management, Content & Workflow Management, and Supply Chain Management product categories. The Company’s solutions provide the link between ERP, eCommerce platforms, and logistics companies resulting in faster, more efficient shipment processing and fulfillment.

IBM

With a legacy that spans the entire history of computing, IBM is one of the most recognized brands in the world. Founded in 1911, the global company today employs 282,200 people and remains headquartered in Armonk, New York, its home for the past sixty years.

Select IBM 2024 Transactions

IBM made four software deals in the past 12 months, including three in 2024 to date. The company completed four transactions in 2023.

IBM’s recent notable deals included the June 2023 purchase of Apptio, a provider of AI-based business management and ERP SaaS and related APIs for businesses in the U.S. The software provides features for financial management, budgeting, resource management, risk management, stream management, program management, forecasting, IT planning, reporting, and analytics.

Vitec Software

Vitec Software is a diversified software company that serves multiple industries, including the pharmaceutical, automotive, financial services, healthcare, real estate, and education sectors. The public company was founded in 1985 and is domiciled in Sweden. Vitec has 1,550 employees and has completed 54 acquisitions since its inception, including six software acquisitions in 2023.

Select Vitec 2024 Transactions

Vitec has completed four software deals in the past 12 months. The company completed six transactions in 2023.

Notable recent transactions include the June 2024 acquisition of BidTheatre, a provider of demand-side programmatic (DSP) advertising software for agencies, advertisers, and integrators in Sweden. The software provides features for user authentication, marketing, recommendations, supply side, targeting, optimization, campaign messaging, reporting, digital out-of-home (DOOH) advertising, and creative management.

Vitec also acquired LDC I-Talent Solutions in January 2024. LDC provides labor training and management software and APIs for businesses in the Netherlands. The software offers a range of features including career and study choice tests, interest, competencies, IQ, human type, 360-degree feedback, stress indicators, fitness, absenteeism, personality, motivations, and data relating to professions, education, vacancies, and job prospects.

Advantive

Founded in 2022, Advantive is a leading provider of mission-critical software for specialty manufacturing and distribution businesses. The company has 500 employees and is headquartered in Miami, Florida.

Select Advantive 2024 Transactions

Advantive completed three software deals in the last 12 months, including one in 2024 to date. The company made four acquisitions in 2023.

Notable recent deals include the September 2023 acquisition of Proplanner, a provider of PLM and Manufacturing Execution Systems (MES) SaaS and related APIs for businesses globally. The software provides features for time estimation, work measurement, material and logistical planning, advanced planning and scheduling, streamlining workflow, and consumption management.

SEG and Advantive: Notable Deals with Shared Involvement

Advantive has made two acquisitions of companies advised by SEG, including VeraCore, a leading SaaS order and warehouse management provider for top fulfillment companies and third-party logistics providers (3PLs). VeraCore develops software in the Business Management/ERP, Content & Workflow Management, Supply Chain Management product categories, and services the Manufacturing vertical.

SEG also advised Pepperi, a leading omnichannel B2B sales platform for wholesalers and distributors, which Advantive acquired in July 2024. This acquisition furthers Advantive’s mission of driving transformational outcomes for its customers by strengthening its international footprint and providing a purpose-built solution for a unified commerce experience that connects mobile field sales, B2B eCommerce, and back-office management.

To view more software M&A deals, visit the SEG SaaS M&A Deal Database™.

A Quick Look at Strategic Buyer Activity

In our most recent Quarterly SaaS M&A and Public Market report, we explore the rebound of the strategic buyer in software company acquisitions. Pure strategic buyers are made up of a combination of privately held acquirers (18.7% of deals) and publicly traded companies (23.1% of deals). Strategic buyers accounted for 41.8% of 2Q24 deals compared to 38.7% in 2Q23.

PE-backed strategic buyers remain the most active buyer type in the market, even with a slight YOY decline. This group’s continued dominance is driven by their unique ability to leverage product synergies, the ample capital available for M&A through their financial sponsors, and their insulation from the real-time valuation pressures that public companies face.

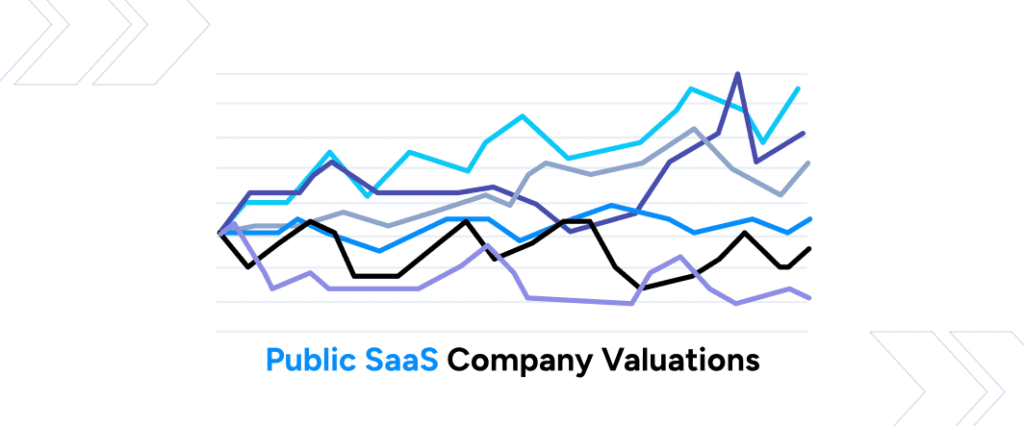

Another noteworthy trend is the resurgence of public SaaS strategic buyers. After pulling back on acquisitions in recent years due to a challenging stock market environment, these buyers are now more active, spurred by rebounding stock prices and a more stable economic climate. This shift suggests that as market conditions improve, public strategics are re-entering the M&A space with renewed vigor, contributing to the overall dynamic landscape of software acquisitions.

Your Company’s Exit Opportunities with Strategic Buyers

Have you researched which strategic buyers are actively interested in your industry? Each buyer has a unique focus and acquisition strategy. Are you noticing the buying signals that suggest now might be the ideal time to engage? Are you building relationships with the right prospects? Don’t be on the outside looking in—reach out to us, and we will help you evaluate the landscape and uncover the best opportunities for your business.