M&A Due Diligence Checklists: Preparing 6 Areas of Your Software Business for a Successful Exit

The best way to prepare for due diligence in a software M&A transaction is to do the majority of the legwork beforehand. This means taking the time to gather the right documentation, external expertise, and support you need to succeed before diligence even starts.

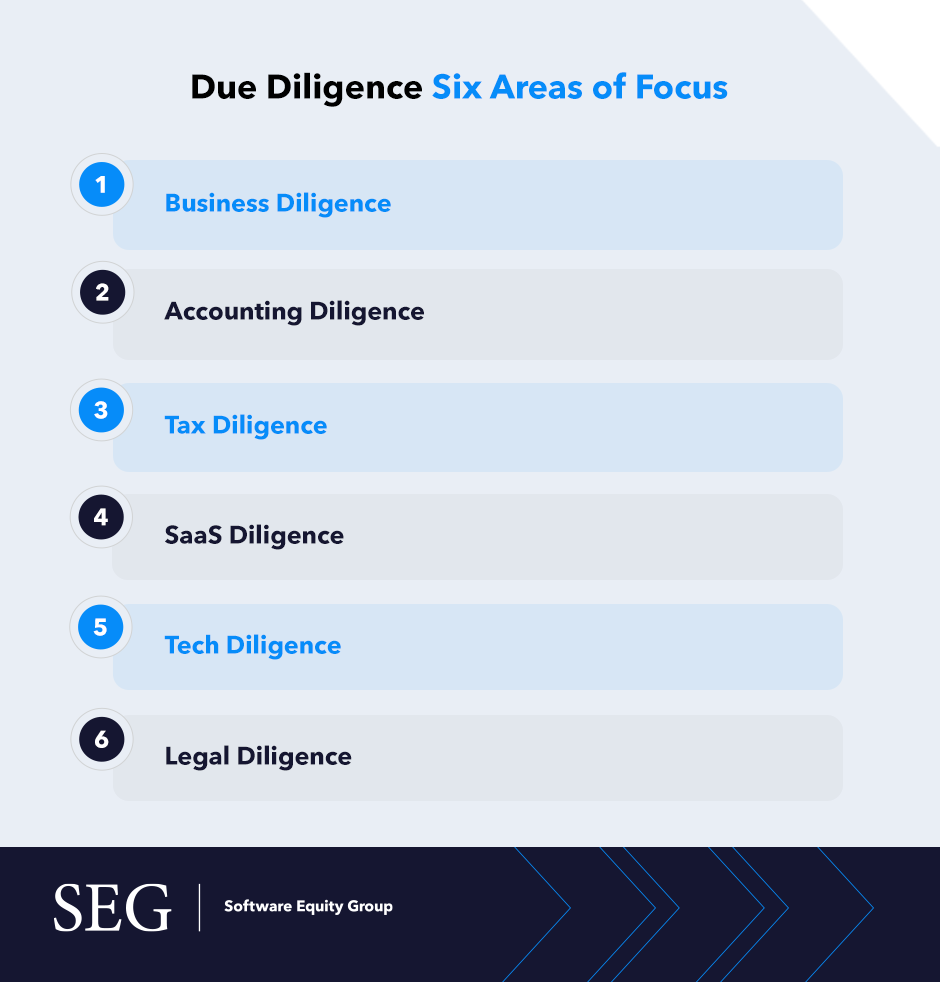

After helping software companies successfully go through due diligence for over 30 years, we’ve learned the easiest way to do this is to follow a comprehensive due diligence checklist. At SEG, we help our clients break down their due diligence process into six different areas of focus:

- Business Diligence

- Accounting Diligence

- Tax Diligence

- SaaS Diligence

- Tech Diligence

- Legal Diligence

Each area represents a unique and integral part of any software business that potential buyers will scrutinize during diligence. In this comprehensive checklist, we’ll dive into each area of diligence and its importance then provide an in-depth checklist to help you ensure you’re set up for success once an actual diligence process starts.

- 1. Business Due Diligence

- Priority Requests

- Sales & Marketing

- Financial

- Customer Support

- Development

- 2. Accounting Due Diligence

- General

- Income Statement

- Cash

- Accounts Receivable

- Contracts, Commitments, and Contingencies

- Additional Requests

- 3. Tax Due Diligence

- Priority Requests

- 4. SaaS Due Diligence

- Supplier/Asset Management

- Platform

- Connectivity

- Service

- Disaster Recovery

- Quality

- Security/Compliance

- Application

- Methodology and Processes

- Performance Management & Client Support

- 5. Tech Due Diligence

- Network

- Business Application Operations

- Help Desk Support

- 6. Legal Due Diligence

- Corporate Matters

- Litigation and Contingencies

- Insurance Matters

- Intellectual Property

- Property

- Regulatory Matters

- Labor and Employee Matters

- Material Contracts

1. Business Due Diligence

Business diligence includes all information regarding the core tenants of your business model and operations. It’s sometimes referred to as administrative diligence. Here are a few checklist items you should consider when conducting business due diligence.

Priority Requests

The most important checklist items of diligence include business overview information pertaining to business operations as well as revenue. This includes information like historical income statements, an employee census, customer contracts, third-party contractors, sales booking data, detailed revenue tracing, and at-risk customers.

Sales & Marketing

A main function of business diligence is to get a sense of how well the company’s sales pipeline, sales compensation, and marketing efforts are working. Pricing books, average selling price, and historical sales productivity are all included in this area of business diligence.

Financial

Examining financials such as backlogged revenue, audited financials, balance sheets, cash flow, profit and loss statements, and the costs of business expenses are all included here. Additionally, details on historical or projected capital expenditures are also included.

Customer Support

Be sure to provide a full look into customer support incidents, calls, and resolution times here.

Development

The final section of business diligence takes a look at development as it pertains to the product architecture overall, including lines of code counts by product area, development backlog, development staff allocation by skill set, and product roadmap. Custom solutions in the customer base as well as third party software packages will also need to be shared here.

2. Accounting Due Diligence

Accounting due diligence involves reporting around all the financial areas of the business in greater detail, including cash flow, customer contracts, income statements, expenses, liabilities, and other related requests. Consider these 11 areas with checklist items for accounting due diligence.

General

Account diligence includes taking a look at the broad overview of how the company is performing. This means providing annual financial statements, detailed financial statements, access to historical audit work papers, a description of any significant or unusual accounting controls, and copies of the top five customer and vendor contracts.

Income Statement

When it comes to income statements, during accounting diligence the company will need to provide the full billing register for the last three years, a breakdown of costs and goods sold, operation expenses by department, cost of services by department, and a narrative description of the company’s policies and procedures relating to revenue recognition as well as terms of sale.

Cash

In regard to cash, during diligence, the seller should provide all documentation related to bank reconciliations, agreements, and indentures related to borrowing money or mortgaging any company assets.

Accounts Receivable

To ensure the company is being paid by customers, a full ledger of accounts receivable is examined here. This can include doubtful accounts balance, a receivable aging report, significant receivable balances over 90 days from invoice, bad debts write-offs, and policies and procedures relating to payment terms, credit policies, and reserving accounts receivable.

Contracts, Commitments, and Contingencies

Any and all contracts and financial commitments will be examined during diligence. The documentation provided should include copies of all payment schedules, future commitments, current purchase and sale commitments, and all outstanding litigation claims (formal or informal).

Additional Requests

Along with everything above, during accounting diligence, buyers will want information regarding credit memos, invoices and deposits, property and equipment valued over $1,000, and management and shareholder expenses. Additionally, all invoices, balance sheet accounts, monthly revenue, and deferred revenue calculation worksheets should be shared.

In addition to the areas above, other areas of accounting diligence include:

- Accounts payable

- Prepaid expenses and other assets

- Deferred revenue

- Property, plant & equipment and depreciation

- Accrued liabilities

3. Tax Due Diligence

Tax due diligence is one of the more straightforward areas of examination during an M&A deal and is typically handled by tax experts. It involves reporting all relevant tax information over the last few years, as well as providing any relevant documentation for federal forms.

Priority Requests

The main requests regarding tax diligence encompass providing information related to any and all documentation and personnel as they relate to tax matters. In essence, this includes all copies of federal, state, local, and foreign income tax returns filed for all open tax years, as well as all exceptions, contingencies, liabilities, rulings, and outstanding items as they relate to taxes.

Tax diligence also includes all tax information regarding employment status and compensation, as well as contractors and any additional forms filed for employees across the company.

4. SaaS Due Diligence

SaaS companies have unique areas that need to be disclosed in a due diligence process. Since the software component is the main driver of any software M&A transaction, SaaS diligence is one of the most important areas of diligence to be prepared for. This includes relevant information about the software platform, service, security and compliance, and any relevant methodology and processes.

Supplier/Asset Management

Buyers will want to get an overview of all suppliers and services as they relate to the software, as well as examine with more scrutiny where control lies within those relationships. For example, service level contracts, contract terms and end dates, change of ownership clauses, and provisioning cycles should all be provided. Additionally, buyers will want to know all information regarding key assets, outstanding disputes, and hosting/facility management agreements.

Platform

When it comes to the software platform itself, SaaS companies will be asked to provide all details regarding information like the make and model of servers the service runs on, memory required, and disk storage required. It is also a good idea to have information on how the service is monitored in real-time, support personnel alerts, printing requirements (if any), and all documentation for operational procedures.

Connectivity

This part of SaaS diligence seeks to understand how users connect to the software or service (e.g. the network architecture, bandwidth, protocols, user percentage of bandwidth, etc.).

Service

How does the service work in the eyes of the customer and from the backend of the business? Provide documentation around customer expectations, scheduled downtime, how services interact, reporting, and vendor software. Sellers should also help the buyer understand the service by providing data flow diagrams, service infrastructure outlines, user interface types required, and recovery/restart procedures for application failure scenarios.

Disaster Recovery

On that note, buyers will want to know the plan in the case of a disaster scenario for the software. Some information to provide here: your company’s disaster recovery (DR) offering, recovery time objectives, customer contract/SLAs related to DR, DR documentation, DR exercises, and backup and recovery mechanisms.

Quality

Quality service level agreements, quality objectives, and quality measurements are all included here. Providing descriptions of the service architecture that handles software, hardware, and power failures (as well as software and hardware upgrades) helps give a picture of quality here.

Security/Compliance

Security and compliance are increasingly scrutinized areas of diligence. Providing descriptions regarding the physical and logical security of the service, as well as detection plans and processes are all great to gather before diligence. After all, information about vulnerabilities, protecting data, and the company’s audit history are vital to ensure the security of the business and service.

Application

Think of this section of SaaS diligence as the application deep dive. Including everything from messaging data flows to application architecture, documentation around your application is crucial to helping the buyer understand how it works (backend and frontend), how customers pay for it, how you built it (proprietary software, open source, etc.), how you secure it, and what the future looks like in terms of upgrades, maintenance, and reliability.

Methodology and Processes

In this area of SaaS diligence, you’ll need to provide descriptions of your company methodology as it relates to life-cycles, change management, escalation management, problem management, and new client implementation.

Performance Management & Client Support

Finally, SaaS diligence will require you to share how you measure application/service performance and the standard reports that go along with that, both internally and externally. Similarly, client support hours, escalation procedures, helpdesk tools, and technology will all be examined.

5. Tech Due Diligence

Tech due diligence looks very similar to the SaaS due diligence checklist but entails reporting on all information surrounding business application operations rather than the software the company is selling.

The following sections have very similar information as SaaS diligence, except in regard to business applications/internal software, provided:

- Supplier/Asset Management (who supplies services for internal operations rather than the service/software provided by the company)

- Platform (how internal business applications are run)

- Disaster Recovery (how internal IT requests are dealt with in case of an emergency situation)

- Quality (how quality objectives are measured and determined, etc.)

- Security/Compliance (including a BCP, or business continuation plan, in case of emergencies or breaches)

- Methodology and Processes (descriptions of all internal methodologies and processes related to business tools and usage)

Network

When it comes to Tech diligence, it is necessary to describe the network architecture of the environment, including bandwidth, protocols, user requirements, and telephone switch technology/tools to support the user base.

Business Application Operations

Similar to the software application operations, for Tech diligence, sellers will be asked to compile all required internal business applications, their expected availability, maintenance windows, supporting infrastructure, user interfaces, and recovery/restart procedures. Additionally, engineering/technical support job descriptions for those supporting the internal Tech environment should be provided.

Help Desk Support

Similar to client support, help desk hours, on-call support, and any help desk tools and applications to keep track of incidents should be documented and shared.

6. Legal Due Diligence

Conducting legal due diligence ensures all liabilities, insurance, litigation, and intellectual property matters are considered as they relate to the business and employees. Similar to tax diligence, these items are typically conducted by a legal team.

Corporate Matters

Corporate legal diligence entails providing legal information regarding the corporate structure chart, a certificate of incorporation and bylaws, minutes of meetings, jurisdictions where the company owns real estate, and agreements related to the control and ownership of the company.

Additionally, any profit interest plans, stock option plans, intercompany services and agreements related to the corporate structure should be provided. In essence, compile anything corporate and legally binding here.

Litigation and Contingencies

Buyers should be in the know about any pending, threatened, or outstanding litigation against the company. This includes descriptions and all related legal documents involved in those processes.

Insurance Matters

When it comes to insurance, a summary of the company’s insurance coverage, claims, and worker’s compensation claims that are pending or historical should be provided.

Intellectual Property

This is one of the most important areas of legal diligence for a SaaS due diligence process. Any and all documentation relating to the company’s intellectual property rights (patents, trademarks, copyrights, trade secrets, etc.) need to be compiled and shared. This also includes all employees and contractors who developed the IP, source code used, and any threatened infringement.

Without proving sufficient IP ownership, diligence is likely to fail. Preparing this (and keeping IP in mind from the start) is crucial to a successful diligence process.

Property

This section is straightforward: buyers will want the seller to provide all documentation regarding any real estate owned or leased by the company, including agreements, locations, and material personal property.

Regulatory Matters

This includes any government approvals, permits, or filings in regard to a regulatory authority.

Labor and Employee Matters

This section refers to providing any legal documentation related to company obligations to employees and labor. Some of these include health, welfare, insurance, bonuses, compensation, NDAs, non-competes, indemnification agreements, and schedule of compensation paid.

Material Contracts

Finally, any and all material contracts related to the borrowing of money or mortgaging should be compiled and documented during legal diligence. This includes any agreements or guarantees of obligations, especially in contracts with outside groups, partners, or suppliers.

Download SEG’s free Diligence Checklist.

As you can see from the list above, preparing for diligence is arduous and intensive. If you’re feeling overwhelmed about upcoming diligence or how to start preparing today, we can help. At SEG, we have the right expertise to execute diligence successfully. Learn more about our services here to see how we can help.