Net Working Capital in SaaS M&A: Why It Matters More Than You Think

Negotiations around Net Working Capital (NWC) in M&A could delay an acquisition from closing or impact how much you ultimately take away from the deal.

That’s because calculating NWC and determining a normalized level for a SaaS business is more nuanced than it appears. Get it wrong, and you risk leaving money on the table. Get it right, and you protect more of your proceeds.

Read on to learn more about NWC in M&A, what it can include, and how an M&A advisor can help you negotiate more favorable terms to maximize your proceeds.

What Is Net Working Capital in Software Businesses?

At its simplest, NWC measures the short-term financial health of a business. It shows how much capital you have available, or could have in the near term, to cover your obligations.

While there are exceptions, a positive NWC is generally a sign of liquidity, while a net-zero or negative NWC may indicate pressure meeting obligations. But in SaaS, it’s not always that straightforward. Deferred revenue, accounts receivable, and prepaid expenses can shift NWC in ways that make a negative balance look healthier than it seems or a positive balance less impressive than it appears. For example:

- A positive NWC may suggest liquidity, but in SaaS it could also mean you’re carrying excess receivables instead of collecting cash.

- A negative NWC driven by high deferred revenue may indicate strong customer prepayments and healthy demand.

Working Capital vs. Net Working Capital in SaaS

Working capital is calculated by subtracting all current assets minus all current liabilities, serving as a broader measure of a company’s liquidity. Net working capital is a more refined version of this calculation. It excludes certain current assets like cash and current liabilities like short-term debt items unrelated to operations. This ensures that only operational components are considered.

This is crucial for determining the true working capital needs of the business post-acquisition so that the acquiring company has an accurate understanding of what is needed to continue operations smoothly.

How to Calculate Net Working Capital in SaaS M&A

Most M&A transactions are completed on a cash-free, debt-free basis. This means the seller keeps all cash remaining on their balance sheet at closing and must pay off all long-term or interest-bearing debt. The deal is simpler this way.

In a cash-free, debt-free transaction, the standard net working capital calculation is:

Net Working Capital (NWC) = FFCurrent Assets (less cash) – Current Liabilities (less debt)

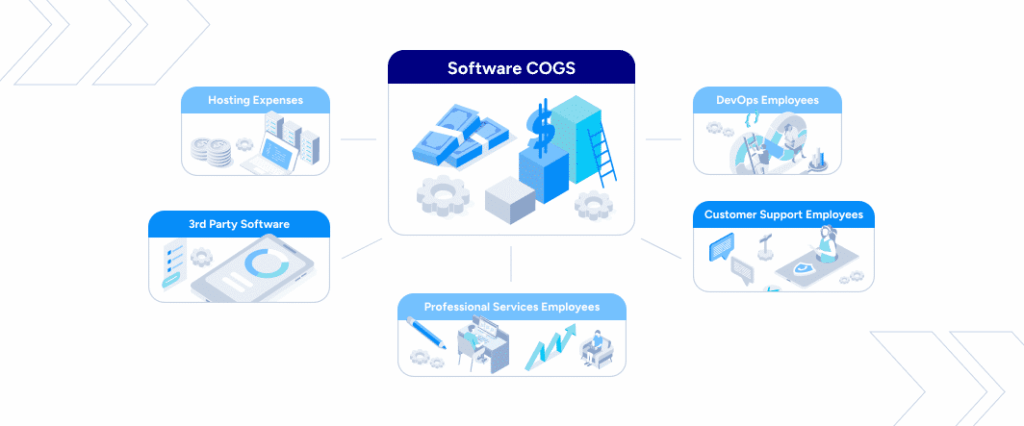

Current assets for a software business typically include cash, accounts receivable, undeposited funds, prepaid expenses, inventory, and other similar short-term assets.

Current liabilities for a software business typically include accounts payable, accrued expenses, credit card payables, payroll liabilities, short-term (12 months or less) deferred revenue, and other similar short-term liabilities.

Buyers don’t want to write one check for the acquisition itself and immediately write another check to keep the business afloat. As part of the acquisition, you (the seller) and the buyer agree on a target NWC at closing, typically included in the buyer’s letter of intent (LOI). This agreement helps assure the buyer that the acquired business will be in a healthy financial position.

At closing, any difference between the target NWC and actual NWC could result in a dollar-for-dollar adjustment to the purchase price, which has a direct impact on proceeds from the sale.

Negotiating the target and actual NWC is where some acquisition deals get stuck.

Up for Negotiation: Why M&A Deals Get Stuck on NWC

The target NWC is typically based on a “normalized” level of working capital. In theory, this sounds straightforward. In practice, it quickly gets complex after buyers and sellers start debating what should (and shouldn’t) count as cash, debt, assets, or liabilities. These definitions aren’t fixed. They are up for negotiation.

What’s considered “normal” also varies by situation. Each side will push for terms that serve their interests. In SaaS, a normalized NWC is often based on a historical average (three, six, nine or 12 months) to capture the ongoing needs of the business. But some buyers may argue it should be tied to a certain number of months of operating expenses or even set at zero.

Other elements of net working capital may also be debated:

Seasonal Changes in Revenue

Seasonality can complicate how NWC is measured in SaaS. If your business experiences predictable peaks and troughs in revenue or expenses, looking at a longer historical period may provide a more accurate baseline. On the other hand, if the business has recently changed course (such as entering a period of rapid growth), a shorter timeframe may better reflect current needs. Breaking down trends account by account is important for capturing the true NWC profile of a SaaS business.

LEARN MORE: More Than a Number: SaaS Pricing Models and Strategies

Deferred Revenue

Deferred revenue is another common point of contention. This account reflects money collected in advance of delivering your product or service, typically within 12 months. In our view, short-term deferred revenue should be included in NWC for a SaaS business. However, buyers often argue it should be treated as a debt-like item because it represents an obligation to deliver future services. This difference in treatment can materially affect the agreed target NWC.

Payroll Liabilities

Payroll liabilities also require careful treatment. Routine payroll expenses should be counted as liabilities in the NWC calculation. Accrued bonuses, however, are different: Because they result from management decisions made before the transaction, they are more appropriately treated as debt. Drawing this line in negotiations helps avoid disputes about what belongs in working capital vs. debt adjustments.

In any case, the target NWC should reflect the factors most relevant to the business as it operates today. By proactively analyzing NWC with your banker and accounting advisor, you’ll enter negotiations with a stronger position in the M&A process.

How NWC Affects the SaaS Seller’s Proceeds

Arriving at a fair target NWC is critical because it could affect how much you make from the sale. If the NWC left in the business at closing is less than the target NWC, the buyer will expect compensation. If it’s above, the purchase price will increase.

Here’s what to expect:

- Estimate at Closing: The seller provides an estimate of NWC as of the closing date.

- True-Up Period: Over the next 60-90 days, the buyer reviews the books and adjusts the purchase price to reflect the actual NWC.

- Escrow Holdback: A small portion of the purchase price is held in escrow to cover any adjustments.

- Final Distribution: Once the true-up is complete, remaining escrow funds are released to the selling shareholders.

| Negotiated NWC Target | $500,000 | Negotiated amount of NWC to remain in business at close |

| Estimated NWC at Close | $600,000 | Estimated at close by Seller |

| NWC Adjustment | $100,000 | Added to initial purchase price at closing |

| Actual NWC at Close (at true-up) | $590,000 | $10K paid out from seller’s NWC escrow to buyer since Actual NWC was $10K lower than Estimated NWC. The remainder of the escrow is then distributed to the shareholders. |

NOTE: In some transactions, the deal may include a “collar,” which allows for some flexibility in the NWC target, so the burden of making minor adjustments can be avoided at closing time. For example, if the final NWC at closing time falls anywhere within the negotiated collar range, no adjustments will be made.

Net Working Capital FAQs

Why is NWC important in a SaaS M&A transaction?

For buyers, it ensures the business has enough capital to keep operating smoothly after the acquisition. As a result, it has a direct impact on the final sale price.

How does NWC affect the seller’s proceeds?

The purchase price is adjusted dollar for dollar by comparing the closing NWC to the agreed-upon target NWC. Less than the target reduces proceeds; more than the target increases them.

What is the true-up period in the context of NWC?

This is a 60-90 day window post-closing where actual NWC is compared with the estimate made at close. The purchase price is then adjusted based on the difference.

What role does escrow play in NWC adjustments?

A portion of the purchase price is typically held in escrow to cover NWC discrepancies discovered during the true-up period. Whatever remains after adjustments is released to sellers.

How can seasonal fluctuations affect NWC calculations?

Seasonal swings in billings or expenses can distort averages for SaaS companies. In these cases, buyers and sellers may use longer historical periods or adjust the timeframe to reflect current trends.

How should SaaS deferred revenue be treated?

This is often a sticking point in SaaS deals. Short-term deferred revenue (services owed within 12 months) is usually included in NWC, but some buyers push to treat it as debt.

How can a SaaS founder prepare for NWC negotiations?

Work with your banker and accounting advisors well before a deal to understand your company’s NWC profile. Being proactive helps prevent surprises and strengthens your leverage.

Enlist Expert M&A Support

Reaching an agreement on your NWC is one of the most important steps to ensuring a fair outcome for both the buyer and the seller. Because there are so many nuances, working with an experienced M&A advisor that specializes in SaaS can reduce surprises at closing, minimize adjustments to the purchase price, and help the process move more smoothly.

For more than 30 years, SEG has specialized in SaaS M&A, guiding emerging and established companies through successful transactions. Read to see what opportunities may be ahead for your business? Contact us today to schedule your complimentary assessment.