How Much ARR Do You Need to Attract Strategic Buyers & PE Investors?

As a tech entrepreneur, you know a big liquidity event for your company can be life-changing. Because of the potential upside, it might be tempting to start looking for a potential buyer before your company is really ready.

To achieve your goals and get the most value for your company, it is important to be patient. Helping your company reach the right size and scale will not only ensure your business is healthy, but it will get the attention of private equity (PE) investors and strategic buyers who will ultimately help you achieve a competitive offer.

If your goal is to sell your company, what size do you need to be to start attracting interest and competitive offers? Is there a magic number you can track that will immediately trigger multiple highly competitive offers to acquire your company?

At Software Equity Group, we’ve been helping companies through the M&A process for more than 30 years. From our experience, we’ve seen a clear benchmark for companies looking to get potential buyers excited about a purchase, though it is not a hard and fast rule.

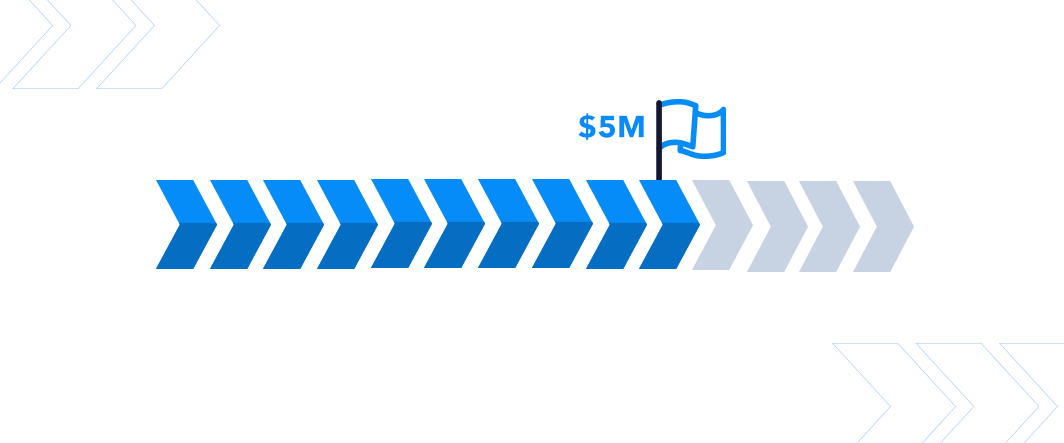

In the past, that line used to be right around $10M of annual recurring revenue (ARR), but that number has come down in recent years. Right now, sellers start to get buyers interested at around $5M SaaS ARR. Achieving this level of scale signifies enough product-market fit and removes enough early execution risk to signal to the buyer community that your company is an attractive acquisition target.

Let’s look at why $5M ARR is the benchmark and what you need to do to prepare for and attract buying interest if you’re below or above that bar.

What Are Your Options Under $5M SaaS ARR?

In theory, a strategic buyer will be interested in a highly strategic purchase at any size. So if your company is currently below $5M ARR, you could still draw some interest from potential buyers who see a highly strategic rationale in the purchase.

At this stage of your business, if someone is going to acquire your business, they will likely be an adjacent strategic acquirer or a private equity (PE) backed strategic purchaser. They’re interested because they see your business as an attractive addition to theirs and a good fit for their growth plans.

At this size, potential buyers see you as less of a company and more of a product. Buyers recognize that a lot still needs to be done to scale your product and their offers will reflect that.

Should I sell my company if I’m below $5M ARR?

Below this benchmark, it is less likely that you’ll have a competitive buying process, which means a lower probability of maximizing the value of your company. However, if your company is subscale and you still feel like it’s the right time to sell, it’s definitely possible.

Identify and network with the companies who would be most likely interested in a highly strategic purchase of your company. This way you can drive interest in the acquisition.

You could receive an acceptable offer, but at this level, you’ll have better success scaling your company and preparing for a future liquidity event rather than focusing on an immediate sale.

What should I do to prepare my company to sell?

If you’re below $5M SaaS ARR, there are a lot of things you can do to grow your business and prepare for a future acquisition. Since most PE investors won’t look at your company until it starts to scale, you have time to get things in order and be prepared when they do start showing interest.

First, create a plan outlining how you will get to $5M ARR. Detail the steps you’ll need to take and what needs to happen to set your business up for this kind of success. This will help you down the road when you’re ready to start pitching the value of your company to prospective buyers.

Have a conversation with a mergers and acquisitions (M&A) advisor. Even if you’re not ready to sell yet, they can help you make sure you’re on a good path to maximize the outcomes down the road when you do achieve scale and start getting interested buyers.

When Your Company Is Above $5M ARR

If you’ve hit the $5M SaaS ARR benchmark, you’ve reached critical mass in the eyes of the buyer community. Broadly speaking, we start to see companies of this size get the attention of the right buyers who will help you drive a competitive acquisition process and outcome. At this size, companies have proven they are more than simply a good product, but rather a strong company that can provide prospective buyers with a clearer path to value.

If you’ve reached this stage and are ready to talk to prospective buyers, you’ll need to be able to show how and why your company will be a valuable asset. Be prepared to not only show your current value but also be able to pitch your plans for future growth.

What should I do to prepare my company to sell?

Just getting to $5M ARR and then stopping (not that you would) won’t be attractive to buyers. There are several ways you can continue to invest in your company and help generate interest (and more competitive offers) from potential buyers.

Hitting $5M ARR and then having a roadmap to share with prospective buyers on how you’ll get to $7 or $10M SaaS ARR, with strong customer retention, a pathway to profitability, and exciting unit economics, will drive interest from potential buyers and stronger offers.

- Retention: Scaling annual recurring revenue needs to happen on top of a consistent base of recurring revenue from established clients. Any plans for scaling your company to a higher ARR will carry more weight when you show you have a client base that you continue to grow value from over time.

- Profitability: Potential buyers will want to see if you’re profitable and as, in the current market, there isn’t a lot of appetite for high-burn businesses. So if you aren’t currently profitable, have a plan in place to get there.

- Unit economics: This is how you measure the efficiency of selling your products. Prospective buyers want to see a low cost of acquisition for clients compared to the revenue generated from the sale. Companies looking to acquire a business will be excited when they see the cost of acquisition going down and revenue going up, especially for companies in growth stages. If your unit economics aren’t exciting yet, create a plan that will help you turn them around.

- Roadmap: How is your roadmap doing? Are you hitting targets and providing valuable updates that will help you leverage more value from existing customers? Use your roadmap as a tool to show prospective buyers that you have the ability to continue to scale the business.

Buyers and investors will be excited once you start scaling toward and beyond the $5-10M ARR mark. Having the plans and information ready to show how the company can continue to grow will ensure your company gets the most competitive offers from both financial and strategic buyers.

At this stage, having an experienced M&A partner will help you navigate the acquisition process and the offers you receive. They will help you make sure you have the right data to share with prospective buyers ready alongside the plans you’ve built for scaling and increasing profitability.

A Partner Will Help You Be Ready

Whether you’re at $1M, $5M, or $10M ARR, there are things you can be doing right now within your company to prepare for a liquidity event. Every company interested in a sale will benefit from buttoning up its plans and getting ready to show interested investors its roadmap for scaling.

While you can have a successful sale while still below $5M ARR, plan to reach that benchmark before you start to garner really competitive interest. Once you reach the $5M ARR mark, make sure you have a qualified M&A advisor who can help you prepare your company for a competitive offer.

Learn more about our services by talking with a team member today.