5 Costly Errors to Watch Out for in M&A Due Diligence

Due diligence is the pivotal checkpoint in an M&A process, during which you share vital information about your business with potential buyers/investors.

Our approach to this point in the process is confirmatory, meaning that by this stage, interested parties should not receive any significant new revelations. Because of this, the due diligence phase remains a critical milestone laced with potential pitfalls. With our extensive experience guiding numerous clients through this process, we have witnessed firsthand the challenges that can arise.

When done right, due diligence is a win-win for both parties in an M&A deal. The buyer feels confident about the deal and its risks, while the seller makes the process smoother for an optimal result.

In this blog post, we are sharing common scenarios where mistakes occur during due diligence, equipping you with insights to navigate this crucial phase of the M&A journey with confidence.

1. Lack of Seller Preparedness

Lack of seller preparedness is a significant stumbling block in M&A in general, often stemming from a lack of experience or emotional attachment to the company. For sellers who have never negotiated an M&A deal, the process can be overwhelming and vastly different from other business negotiations you may have undergone. The intricacies of M&A negotiations, including the volume of documentation requests, the depth of inquiries into every aspect of the business, and the complexity of deal terms, can catch unprepared sellers off guard.

What’s more, this lack of M&A experience can leave sellers vulnerable to accepting less-than-ideal offers, particularly in their first-time M&A experiences without advisors’ guidance. Sellers may be unaware of market norms, valuation methodologies, or M&A-specific negotiation tactics, making them susceptible to undervaluing their business or agreeing to unfavorable terms. Without the expertise of M&A advisors to provide guidance and advocate on their behalf, sellers may inadvertently accept deals that fail to maximize the value of their company.

2. Battling Deal Fatigue

A common reason M&A deals fail is because of deal fatigue. Deal fatigue occurs when both parties in a negotiation experience a lag in momentum. It occurs when individuals begin to feel frustrated, helpless, or worn out due to what appears to be an endless negotiation process. Some common events that lead to deal fatigue include:

- Changing business conditions

- Complex deal structures

- Inaccurate information

When founders experience deal fatigue, one of two scenarios typically occurs. First, the seller might compromise their ideal terms to move the deal forward (not ideal). Second, the deal ends entirely because neither party can accurately negotiate or move through the process in a beneficial manner (even less ideal).

One way to preemptively avoid death by deal fatigue is by having a third party manage a deal. At SEG, our M&A advisors work to manage all communications, monitor consumption of materials and push against delays, schedule regular status updates, and advocate for the seller at all costs.

3. Focusing on the Deal Over Your Business

When M&A deals overshadow core business operations, there is a problem. While the diligence process is intensive, it should never come in the way of what matters most—bringing value to your customers.

Founders who stop focusing on their customers to focus on a deal are in danger of two fatal “deal killers”: losing big customers and missing financial projections. Either of these is enough to give a potential buyer a reason to pause the process.

To keep the business running while going through M&A due diligence process, focus on the following:

- Separate the M&A process from business operations

- Create a dedicated deal team

- Implement structures focused on keeping the customer experience at 100%

- Do not neglect your culture

- Continue to recruit and retain top talent

4. Buyers & Investors Uncover Hidden Issues

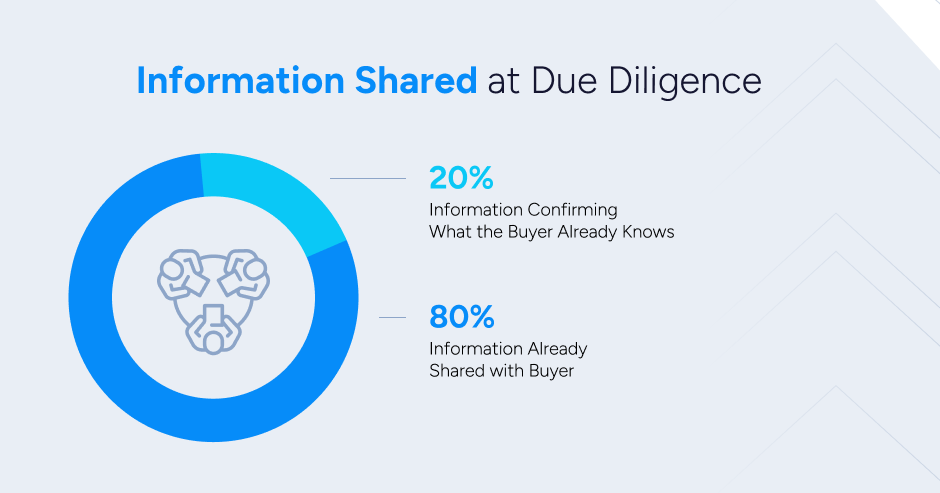

The revelation of new information about a company during due diligence can be a deal-breaker for most buyers or investors. In our experience, 80% of all information should be shared between buyer/investor and seller prior to due diligence. The other 20 percent should confirm what the buyer or investor already knows.

Sellers should conduct thorough internal assessments and due diligence reviews before negotiations to avoid such pitfalls. By preemptively addressing potential issues and ensuring full disclosure of pertinent information, you minimize the risk of them encountering deal-breaking surprises later. This proactive approach helps establish transparency and builds trust between the parties involved.

5. Timing Missteps that Lead to Stalling

M&A deals often falter due to a lack of momentum, as buyers, particularly PEs, are driven to complete transactions swiftly. Time is of the essence in the M&A landscape, and delays can significantly impact the deal’s success. To avoid this mistake, be ready to…

Make timely decisions. Having trusted advisors or a reliable sound board in place can facilitate prompt decision-making, ensuring that opportunities are not missed due to indecision.

Strike the right balance between focusing on your business and the deal itself. Spending too much time on one aspect at the expense of the other can derail the transaction.

Understand the timing involved in sharing information and initiating negotiations to progress through each stage of the deal. This is essential for maintaining momentum and maximizing the likelihood of success.

Keep Your Company Ahead of the M&A Due Diligence Process

At Software Equity Group, we aim to avoid any of these fatal errors during the M&A process with our clients. We prepare sellers for due diligence by thinking about the preparations from day one.

M&A advisors like our team strive to do the work so clients can focus on their business. This means getting ahead of any “bad” information, sharing the right information with the buyer/investor ahead of time, and doing the daily work required to keep momentum charging forward at every stage until close.

Navigating the deal process can be overwhelming. If you are considering accepting an inbound offer or seeking a buyer or investor for your business, talk to our team of experienced M&A advisors. Schedule a conversation with us to manage the M&A process with confidence.