- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

How to Calculate Cost of Goods Sold (COGS) for SaaS Companies w/ Examples

While Cost of Goods Sold, or COGS as it’s known in the world of accounting, is a seemingly straightforward principle, it is frequently miscalculated by software company entrepreneurs. COGS is a key metric private equity investors and strategic buyers use to evaluate companies. It can be instrumental in measuring how well a company can scale and how much money is available to run a business.

Its components will vary by industry, and unfortunately, companies are sometimes left to figure out what should be included in their COGS on their own. For software companies in particular, the cost they incur to deliver their solutions to their customers can seem hard to pin down. So how can they proceed confidently in this space and use their best judgment to define their COGS? Here’s what software executives should know about COGS.

What is Cost of Goods Sold?

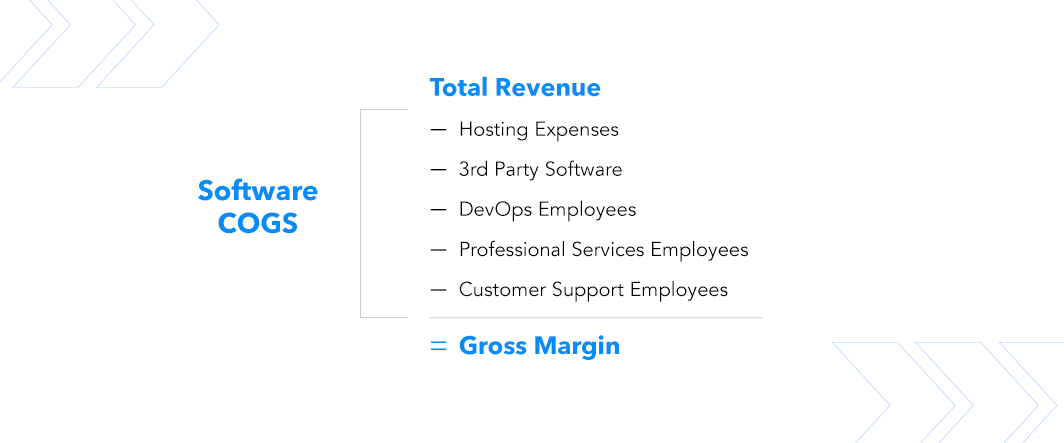

In layman’s terms, a software company’s COGS is simply the cost the company incurs to deliver its solution to its customers. It is, in summary, the sum of the expenses of creating a product or service. COGS is a variable cost that will grow as a software company sells more of its solutions.

The saying “You have to spend money to make money” is embodied by COGS, and the amount you spend on your business will likely be influenced by your industry. What makes software companies unique is that your COGS does not necessarily have to increase in correlation with your revenue. In a business selling a material product, your volume of sales requires you to increase the amount you spend on materials to produce said product. However, because a software company does not have to produce something new when it sells a new subscription, its COGS do not increase when it gains a new customer.

COGS is different from operating expenses (OPEX) like marketing and other general administration costs that don’t affect the actual production of your product. It includes infrastructure and customer support costs, aspects directly related to the product or service you’re administering, rather than those broader expenses associated with running your business as an entity. Modern software companies have limited expenses (not to mention fewer responsibilities) due to the ability to electronically deliver their product.

How to Find Costs of Goods Sold

Expenses to include in COGS are those directly attributable to the delivery of the goods sold by a company or the services provided. Speaking broadly, your COGS structure will likely include technical support, professional services, customer success, and developmental operations. These directly reflect what you spend building and supporting the software your business develops, not the maintenance of your business itself.

LEARN MORE: Understanding the SaaS Financial Model: Key Concepts and Methods

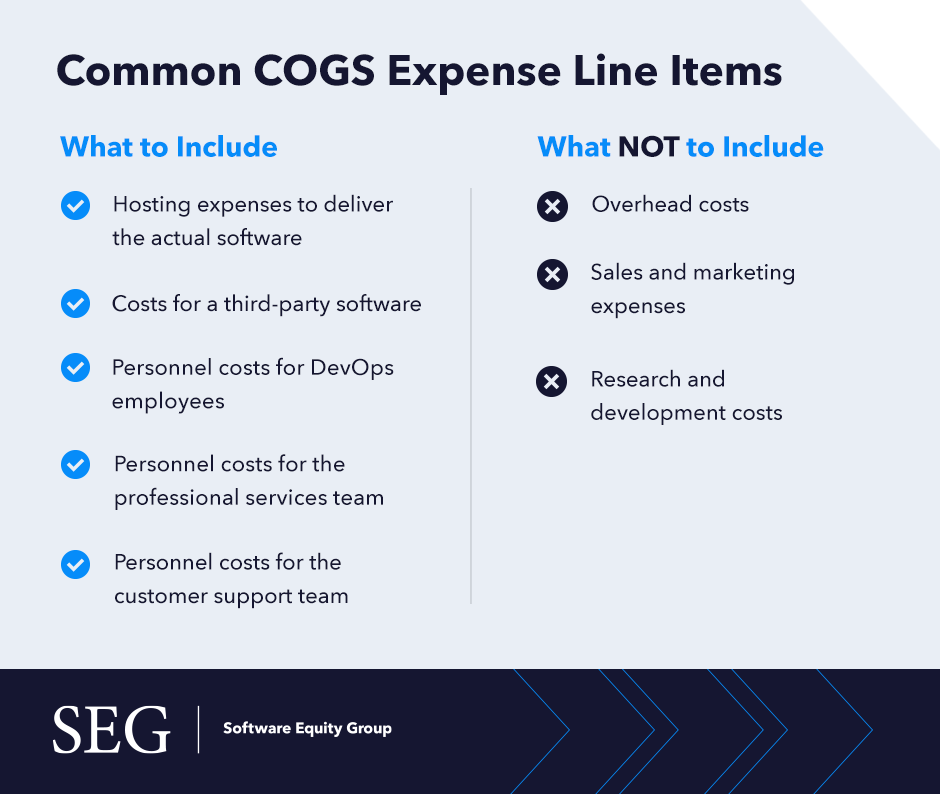

Common COGS expense line items for software companies include:

- Hosting expenses to deliver the actual software. Think cloud-based application subscriptions like Rackspace or AWS expenses.

- Costs for a third-party software that is part of the product delivered to customers. This could be a third-party expense for a reporting software application used in the company’s product and delivered to the customer.

- Personnel costs for DevOps employees responsible for managing and running the servers and data center delivering the SaaS application to customers. This includes their salaries.

- Personnel costs for the professional services team responsible for getting a customer live on the product. This includes the employees’ assigned implementation, consulting, data migration, and training duties.

- Personnel costs for the customer support team responsible for providing ongoing support to customers once they are live on the application.

Expenses to NOT Include in COGS

Software companies will inherently have different COGS line items than a brick-and-mortar shop. Beyond the expenses necessary to produce their software, not many company costs are considered COGS.

Software entrepreneurs should avoid including OPEX and other indirect expenses such as:

- Overhead costs. The amount you spend just to operate your business should not be included in the calculation of the product. These include general administration costs like rent.

- Sales and marketing expenses. This means no commissions should be counted as COGS. Software entrepreneurs should remember any product management expenses or customer success costs are not considered COGS.

- Research and development costs. Specifically, R&D amortization costs should not be counted as COGS.

Cost of Goods Sold Example

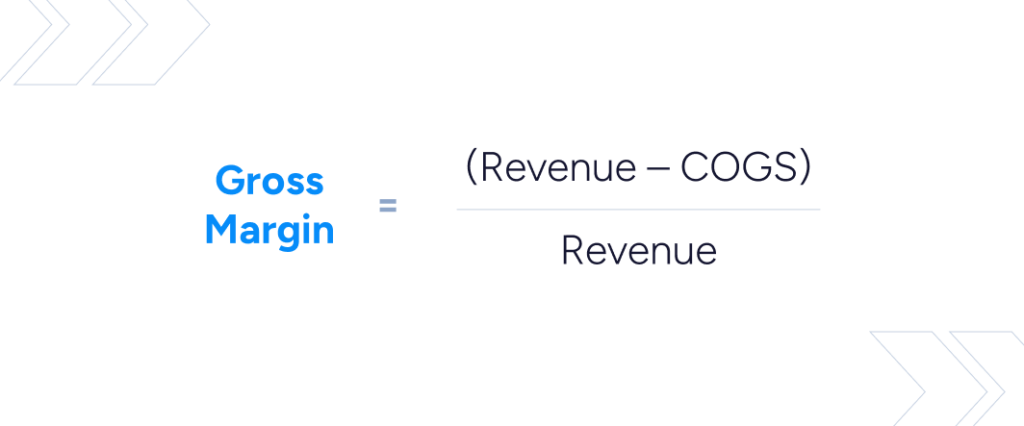

As an example, revenue minus COGS is gross profit. If a company has $10M of revenue and $2M of COGS, the gross profit is $8M. The gross profit margin is 80%. More than likely, if this company grew revenue to $20M, the gross profit margin would remain close to 80% and COGS would be $4M. Gross profit would be $16M. Gross profit minus operating expenses is net income or profit.

As a company grows, we often see some economies of scale in COGS, so the gross profit margin naturally increases. However, because COGS are largely variable costs, the increase is typically not too material.

So, with just this basic understanding, which company is more valuable all else equal: a company with 70% or 85% gross profit margin? It should be obvious that a company with 85% gross profit margin is far more valuable. But by how much, exactly?

Over a five-year period, and with a 20% revenue growth rate, Company A is able to generate $22M more of cash flow for operations, which can be used to drive additional growth, improve product, or distribute profits. Company A could easily fetch one turn of revenue or more on a revenue multiple basis over Company B.

Frequently, SEG comes across software business operators who claim they have more than 90% gross profit margin. This is a certain cautionary flag. While these operators have a deep understanding of their business, many are not aware of the necessary inputs to properly calculate COGS and, therefore, have a poor sense of the business’s gross profit margin.

Properly Forecasting the Cost of Goods Sold for a SaaS Company

Working with an advisor like SEG can help software entrepreneurs identify how to cut unnecessary expenses and determine a strategy to operate and grow more efficiently. Because your company’s COGS are always changing, working with an advisor can help you correctly forecast them so you can adjust your trajectory accordingly and increase the value of your business.

If you would like help understanding how COGS can affect your business’ valuation and taking action to higher gross margins, SEG can help. The experts at SEG can provide guidance on optimizing the resources you already have to increase your gross profit margin.

If you have any questions about COGS, please don’t hesitate to reach out to our team.