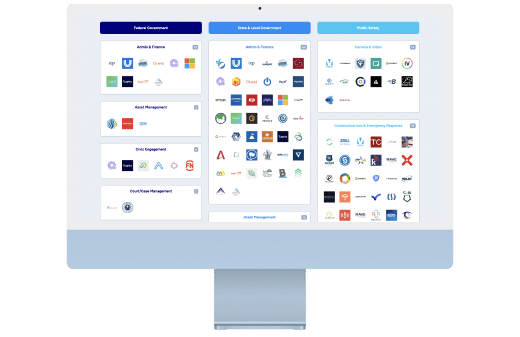

Technological Revolution with the Infrastructure Investment and Jobs Act (IIJA):

IIJA is more than investment in physical infrastructure (roads, bridges and otherwise), funding can also be used for investment in digital infrastructure to modernize antiquated systems and processes. Some of the many examples include:

- Business Process Automation and Workforce Transformation: Governments can drive automation and workforce transformation using cloud-based tools and applications with integrated artificial intelligence (AI) and robotic process automation (RPA) capabilities.

- Enterprise Asset Management: IIJA funding can support investments in platforms for data collection and analysis in areas such as inspections, repairs, predictive maintenance, and smart-city initiatives.

- Integration: IIJA funds can be invested in cloud-based business technology platforms to connect disparate applications, acting as an integration hub for data sharing.