Digital Transformation and Operational Efficiency

- Economic pressures, labor challenges, and reshoring initiatives drive the need for operational efficiency.

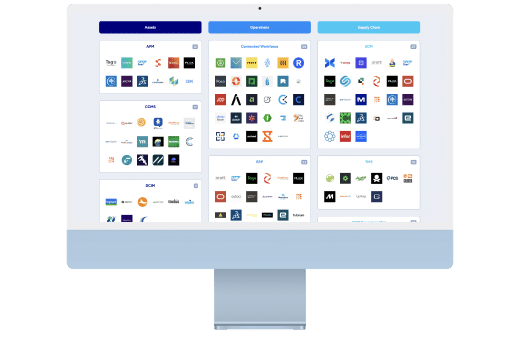

- Manufacturers are leveraging SaaS solutions to streamline operations and adapt to industry challenges.

- Resiliency and redundancy in supply chains gain prominence in boardroom discussions.