Fill out the form and we’ll discuss…

- Multiples and interest

- Buyer dynamics and priorities

- Valuation insights

The best deal will most likely occur when there are multiple bidders giving you, the seller, leverage and the best opportunity for a favorable deal and successful transaction.

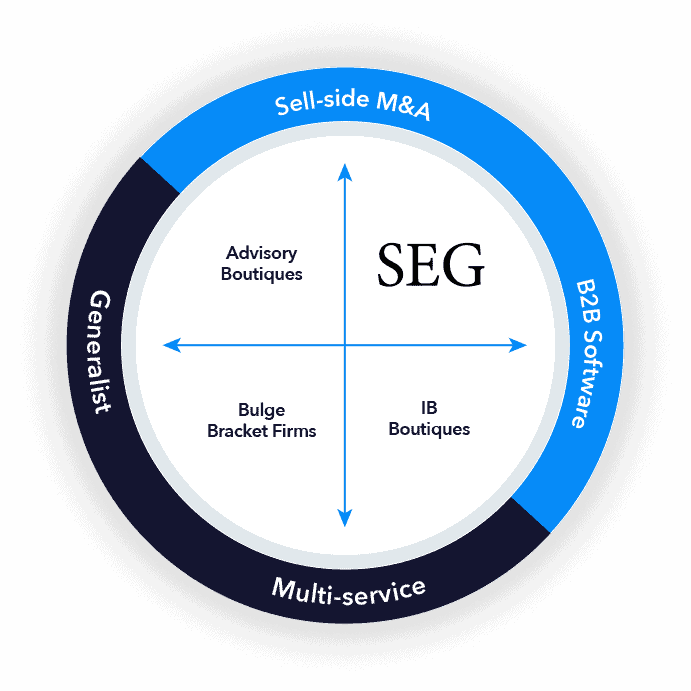

We advise bootstrapped & financially backed software entrepreneurs who want to sell a majority interest to a strategic buyer or private equity investor. Our high-touch process supports you at every stage in the M&A process, and our deep network coupled with our commitment to your success ensures you walk away with the best possible outcome.

LET'S TALK

Our impeccable reputation for running a rigorous process coupled with our tactful and effective negotiation skills within our domain expertise, leads to positive outcomes for our private equity and venture capital backed clients.

LET'S TALK

Selling your software company is probably the most important business transaction of your life. You deserve an experienced team who is dedicated to your success, provides unbiased advice, and is more concerned about your outcomes than their fees. You deserve SEG!

Most clients choose to run a broad process, so they have full support during the entire M&A transaction. This starts with analyzing the market and business, creatively positioning their company to broad array of highly curated buyers, driving a competitive environment, negotiating a great transaction at maximum value, and navigating them successfully through any mishaps.

GET STARTEDIn a targeted strategic process, we help entrepreneurs reach out to fewer, hand-picked potential buyers. This is ideal for software companies that already have existing offers and want to create a competitive environment to maximize purchase price and options.

Experience is often what wins during M&A negotiations. Buyers want to get the best deal, and they have experience and teams behind them working to make that happen. SEG’s strategic, direct negotiation services include negotiating on terms, price, and options to improve the outcome and provide you a high assurance of deal closure.

If you have already agreed to price and terms with a buyer and would like to ensure the highest likelihood of close, SEG can help. We will manage this critical stage of the M&A process, including the multiple work streams and parties necessary to successfully navigate due diligence, allowing you to focus on running your business.

We are incredibly fortunate to advise software entrepreneurs from a wide range of sectors; from specialized businesses like blood donation technology to rapidly growing industries like MarTech, PropTech, FinTech & EdTech.

The SEG team is experienced in a variety of product categories and verticals across the software landscape. Read about the deals we’ve done in each sector.