SEG’s acclaimed research reports began in 2001 to help software executives, venture capitalists, and private equity investors worldwide stay informed on the software industry. This page brings SEG’s research to life in an interactive and digestible way and serves as a tool to provide high-quality insights for industry professionals in real time.

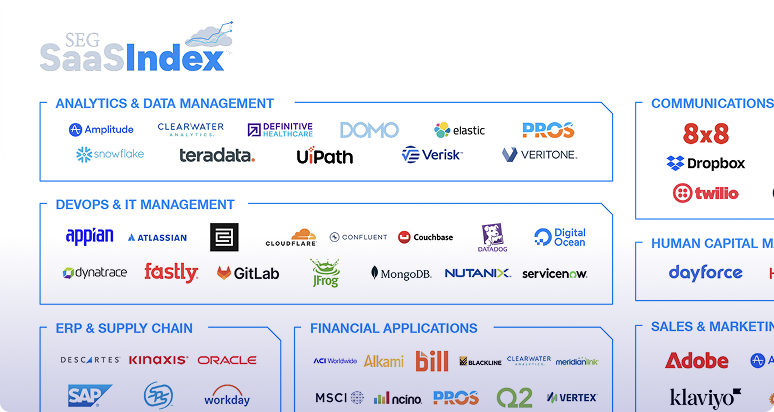

The SEG SaaS IndexTM was founded in 2006 and today comprises approximately 100+ publicly traded companies that primarily offer solutions via the cloud. The Index is updated every quarter depending on acquisitions, IPOs, readily available financial data, and changes in business models. Interact with the charts below to see how public SaaS companies perform and how the SEG SaaS Index compares to other major indices.