Industrial Industry Trends Impacting FSM: Overcoming Headwinds, Leveraging Tailwinds, and Scaling for Success

Field Service Management (FSM) has long been essential for industries like Utilities, Telecommunications, Transportation & Logistics, Home Services, Construction, Manufacturing & Equipment, Oil & Gas, Healthcare, Facility Management, Energy, and so on.

FSM tools provide essential support by offering cloud-based platforms for efficient workforce scheduling, real-time communication, and mobile capabilities that allow field technicians to work more effectively on-site. SaaS’s subscription model reduces the need for significant upfront investments, allowing organizations to scale operations as needed and access the latest features and updates. This makes Software particularly well-suited for businesses aiming to keep pace with evolving technology while addressing workforce shortages.

However, as the demand for efficiency grows and the labor market faces unprecedented challenges, Manufacturing and Industrial organizations struggle to keep up with the demand for various roles. These dynamics are impacting the following areas:

- Equipment Installation and Maintenance

- Facilities Management

- Construction and Renovation

- Logistics and Supply Chain Management

- Quality Control and Testing

- Environmental Services

The challenges are twofold: In-house employees that do their work in the field (O&G is a good example), as well as any organization that cannot find enough in-house employees and must rely on 3rd party contracted support.

Industrial industry trends are driving significant shifts, presenting both opportunities and challenges for Field Service Management Software companies aiming to scale, differentiate, and position themselves for strategic exits or growth opportunities.

The Growth Imperative for Field Service Management Software

As demand for these solutions surges, FSM Software companies are navigating a highly competitive landscape. Industrial industry trends show that the labor market continues to experience significant shortages, particularly in skilled trades within Manufacturing and Construction, which creates a growing need for companies to streamline field operations through technology.

Labor Force Challenges Requiring SaaS-Based FSM Solutions

The U.S. labor market continues to struggle with shortages, as the labor force participation rate remains at 62.7%, below pre-pandemic levels, and leaving a gap of roughly two million workers. This shortage has been exacerbated by the “Great Resignation,” which saw over 50 million workers quit their jobs in 2022, and the ongoing retirement of older employees, particularly in skilled trades.

Sectors like Manufacturing are facing approximately 622,000 unfilled positions, while the Construction industry also struggles to match worker availability with demand across regions. These Industrial industry trends highlight the desperate need for efficient Workforce Management solutions, such as SaaS-based FSM, to optimize operations and mitigate the impact of labor shortages.

However, scaling your FSM Software platform while maintaining product innovation and customer satisfaction is no small feat. Continue reading for more guidance designed to help FSM Software Executives and their companies thrive.

Leveraging Modern Technologies in FSM

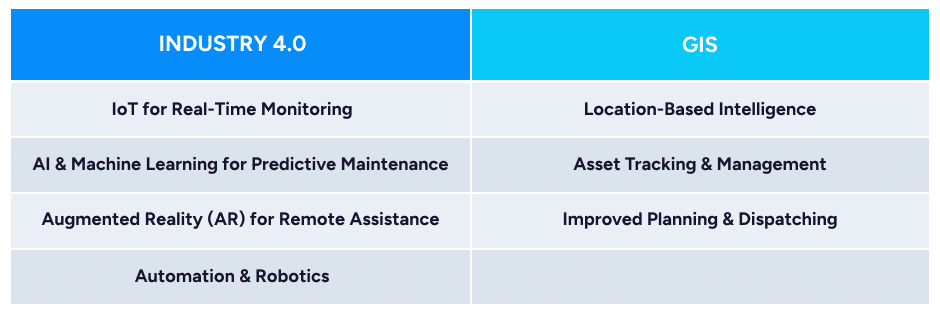

Modern technologies, including Industry 4.0 and Geographic Information Systems (GIS), are transforming FSM by providing advanced capabilities for data-driven decision-making, automation, and optimization. Here’s how they contribute to the best Field Service Management Software solutions:

Industry 4.0 Technologies in FSM

IoT for Real-Time Monitoring Combined with AI and Machine Learning for Predictive Maintenance.

The integration of IoT sensors into FSM allows for continuous monitoring of equipment and assets. These sensors collect data on equipment performance, detect anomalies, and send alerts for potential failures. Utilizing this tech, gone are the days of scheduled visits to the field, replaced by more accurate and effective visits when needed.

Artificial Intelligence and machine learning within Field Service Management Software can predict when equipment is likely to fail based on historical data and real-time sensor inputs. By enabling these predictive maintenance processes, organizations can reduce downtime and extend asset life. This allows organizations to schedule maintenance proactively, reducing emergency repairs and improving service reliability.

Augmented Reality (AR) for Remote Assistance.

AR can be used to assist field technicians by overlaying digital instructions on physical equipment through smart glasses or mobile devices. This helps technicians perform complex repairs without needing on-site expert supervision, enhancing productivity.

In FSM, drones are commonly used for inspecting hard-to-reach areas such as power lines, pipelines, or wind turbines. For example, a drone can quickly survey a large area of power lines for damage after a storm, capturing high-resolution images or video. This allows technicians to assess the situation remotely, reducing the need for time-consuming and potentially hazardous manual inspections before repairs are scheduled.

Automation and Robotics.

Robots and drones are being used for tasks like inspections or remote monitoring in hazardous environments, reducing the need for human presence and improving safety.

In a wind turbine repair, a technician equipped with AR glasses can view 3D models overlaid on the actual equipment, guiding them through the repair steps. Remote experts can also see the technician’s view and provide real-time instructions by highlighting parts or adding annotations. This approach ensures faster, more accurate repairs without the need for on-site expert presence.

GIS for Enhanced Field Service Management

Location-Based Intelligence.

GIS technology is used to provide geospatial insights for better decision-making. It helps in optimizing routes, identifying efficient paths for technicians, and visualizing the location of assets, jobs, or customers.

Asset Tracking and Management.

GIS can integrate with FSM platforms to map the locations of critical infrastructure, such as utility lines, pipelines, or telecommunications towers. This facilitates quicker response times during maintenance or emergencies and ensures that field teams can easily locate and assess assets.

Improved Planning and Dispatching.

GIS enhances dispatching capabilities by factoring in real-time traffic conditions, technician locations, and job priorities. This results in more efficient scheduling and reduced travel times, helping organizations meet tight service level agreements (SLAs).

The Key Challenges for FSM Software CEOs

To grow successfully, FSM Software CEOs must stay ahead of both Industrial industry trends and technology trends like Industry 4.0. While also striving to embrace predictive analytics, and ensure their platform integrates with technologies like GIS to offer advanced data insights and optimization. These can be placed into the following buckets:

- Staying Ahead of Competitors: With new entrants constantly emerging, FSM Software companies need to differentiate through advanced features, integrations with emerging technologies like IoT and AI, and superior user experiences.

- Balancing Innovation and Scalability: As you add features to meet customer demand, ensuring the platform remains scalable and user-friendly is crucial, especially as customers expect seamless operations even during high-growth periods.

M&A Activity and What it Means for FSM SaaS CEOs

As FSM SaaS companies grow, many Founders and CEOs find themselves at a crossroads: Should they continue scaling independently, raise additional capital, or explore a strategic exit through M&A? The FSM Software space has seen significant M&A activity in recent years, driven by the growing demand for digital transformation in Field Service Operations.

Consider these notable examples:

- Salesforce’s Acquisition of ClickSoftware for $1.35 billion (2019): This acquisition enhanced Salesforce’s workforce optimization tools, leveraging predictive AI and IoT features—an area that FSM Software companies can’t afford to ignore.

- ServiceTitan’s Acquisition of Aspire Software for $1 billion (2021): With a focus on landscaping services and route optimization through GIS, this deal illustrates how vertical specialization can drive strategic acquisitions.

- FieldAware’s Acquisition by GPS Insight (2021): GPS Insight acquired FieldAware to create a more comprehensive FSM and fleet management solution, integrating geospatial data for better field operations.

- Trimble’s Acquisition of AgileAssets (2021): Trimble enhanced its infrastructure management offerings, particularly for public sector clients, by acquiring AgileAssets, which brought GIS and asset management capabilities.

For mid-market FSM Software companies, the appetite for acquisitions remains strong, especially as larger Software platforms and PE firms seek to expand their FSM portfolios. Understanding the valuation drivers in the FSM Software space—such as recurring revenue, customer churn rates, and growth potential—will help Software Executives position themselves for an attractive exit.

Preparing Your Field Service Management Software for a Strategic Exit

If you’re considering a strategic exit, preparation is key. The decision to sell your FSM Software company isn’t just about timing the market—it’s about ensuring your business is ready for acquisition and positioned to maximize value.

Key Areas to Focus On:

- Financial Health: Again, ensure you have strong recurring revenue, low churn, and high customer satisfaction, as these metrics will be scrutinized by potential acquirers.

- Operational Efficiency: Streamline your operations so that your platform can scale effortlessly. This includes having robust customer support processes, efficient onboarding, and a roadmap for product development.

- Market Positioning: Demonstrate your platform’s ability to evolve with new technologies. Highlight how your company is incorporating AI-driven features, predictive maintenance, and GIS into your FSM solutions to address key industry challenges.

Many FSM Software companies are also finding success in expanding into new verticals—such as “Smart Cities” or Healthcare—to broaden their market potential and increase their attractiveness to buyers.

Case Studies: Successful FSM Software Exits with SEG

At SEG, we’ve helped numerous SaaS companies navigate their strategic options and execute successful exits. For Field Service Management Software companies, we understand that the market is evolving quickly, and staying competitive requires the right blend of innovation, growth, and strategic planning. We also do our best to provide granular insights on Industrial industry trends to keep you informed at every level.

Here’s an example of a recent client’s exit in the FSM space.

Ion Wave Technologies Acquired by GTY Technology

Ion Wave Technologies, a company providing procurement and bid management software, successfully exited through a strategic acquisition with GTY Technology. Through careful planning and market positioning, we helped Ion Wave maximize its valuation by showcasing its ability to integrate new technologies like predictive analytics and its strong foothold in Public Sector verticals.

The Strategic Value of M&A for FSM Software Companies

FSM Software companies that embrace M&A as a growth strategy often find themselves positioned to expand faster, integrate new technologies, and capture greater market share. Whether you’re considering acquiring another Software company to bolster your capabilities or positioning your own company for acquisition, understanding the M&A landscape is crucial.

The current demand for Field Service Management Software solutions makes this an opportune time for CEOs to explore their options. M&A can provide access to capital, new markets, and the technological advancements needed to stay competitive in a rapidly changing industry.

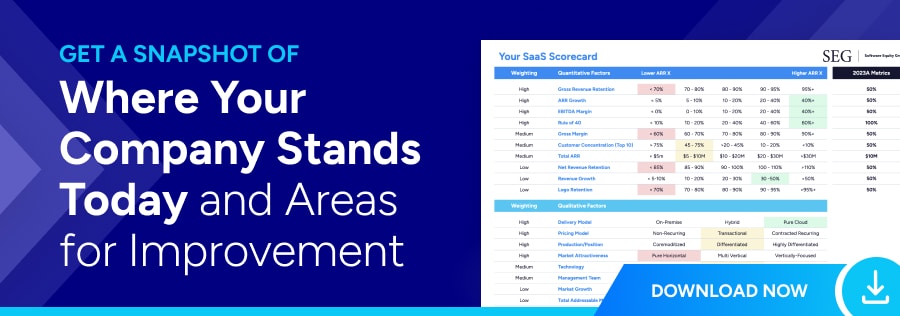

Navigating the Next Phase for Your FSM Software Company

As the FSM Software market continues to evolve, companies encounter both challenges and opportunities. CEOs are tasked with making strategic decisions at every turn. To take the guesswork out of your next move, utilize our Interactive SEG SaaS Scorecard. This proprietary tool offers a real–time snapshot of your company’s current standing based on today’s key metrics. Simply input your data—no information is saved—and instantly receive actionable feedback aligned with the same scorecard framework we use to guide our clients. If you’re considering your options—whether it’s raising capital, merging, or preparing for a potential exit—let’s start a conversation. We can help you evaluate your Manufacturing Software company’s readiness and ensure you’re taking the steps needed to maximize value and secure your company’s future in this competitive market.

If you’re considering your options—whether it’s raising capital, merging, or preparing for a potential exit—let’s start a conversation. We can help you evaluate your Manufacturing Software company’s readiness and ensure you’re taking the steps needed to maximize value and secure your company’s future in this competitive market.