- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

Using a Sales Pipeline for Revenue Predictability

What is a sales pipeline and how can it be used for revenue predictability?

Understanding your company’s sales pipeline and how it impacts your long-term financial success is incredibly important for software businesses.

A company’s pipeline highlights each prospective customer opportunity within the sales cycle. A well-established sales pipeline strategy offers better visibility into potential sales forecasts. Sales pipelines also provide insight into the most successful segments, segments that churn (and why), and the kinds of customers your organization most attracts. By leveraging historical trends, businesses can also set realistic forecasts based on past sales quotas, win rates, sales pipeline coverage ratios, and weighted pipelines. This blog outlines how to effectively use a sales pipeline for predicting ARR.

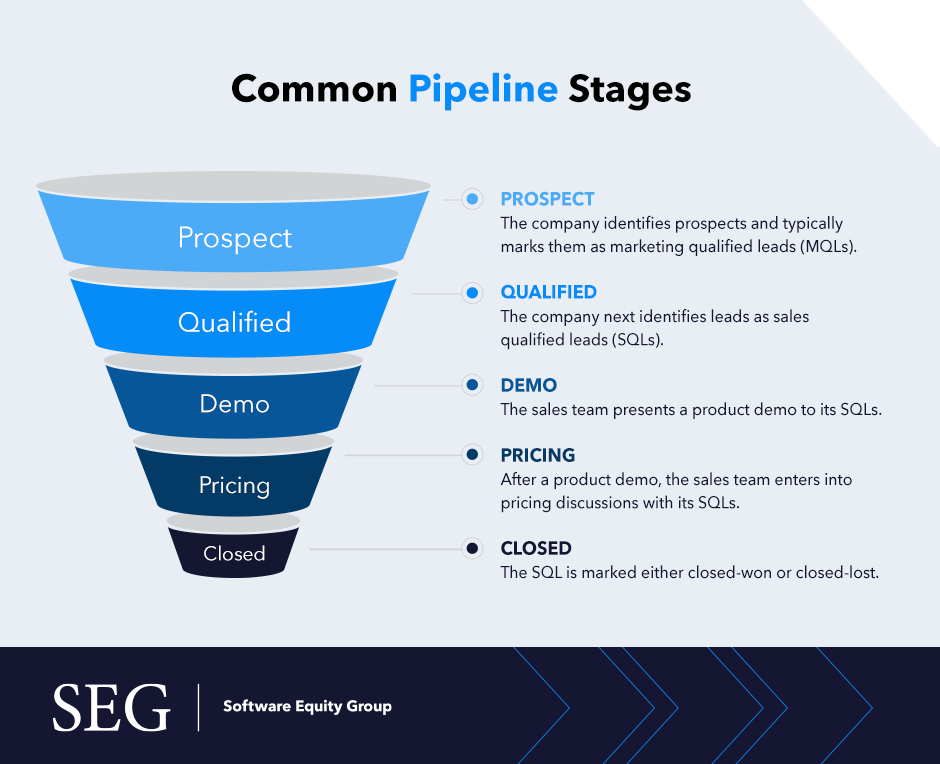

Understanding the Stages of the Sales Pipeline

Although each industry differs slightly, most sales pipelines consist of a few standard stages. Understanding the “velocity of movement” between each stage is valuable for identifying overall financial health. How quickly customers move through the sales funnel indicates their likelihood to buy and helps companies understand where customers are at each stage. Here are some of the most common stages of the sales pipeline:

- Prospect: In this stage, the company identifies prospects and typically marks them as marketing qualified leads (MQLs). This is also the stage at which most sales teams will enter customers into the pipeline.

- Qualified: The company next identifies leads as sales qualified leads (SQLs).

- Demo: In this stage, the sales team presents a product demo to its SQLs.

- Pricing: After a product demo, the sales team enters into pricing discussions with its SQLs.

- Closed: This is the final stage of the sale in which the SQL is marked either closed-won or closed-lost.

Categorizing leads into different designations helps sales and marketing teams prioritize customers who are most likely to buy. Alternative campaigns like nurture emails can be put into place for customers a little further down the funnel to ensure they don’t completely fall out of the pipeline.

Calculating Pipeline Coverage Ratios

Sales pipelines can come in handy for a variety of reasons. Some effective uses of a sales pipeline include weighting certain customer stages and measuring overall coverage. Both of these strategies can help organizations identify underperforming customer segments and determine whether changes need to be implemented. Addressing operational inefficiencies is a great benefit when developing a sustainable and effective sales pipeline.

Pipeline coverage is a ratio used by the sales team to measure how much ARR is covered in the unweighted pipeline compared to the target new ARR they need to hit. This is calculated by dividing the pipeline ARR over a certain period by the target new ARR for the same period.

Pipeline Coverage = Pipeline ARR / Target New ARR

Using the historical data for a weighted pipeline and target new ARR for the same period helps companies understand how their coverage ratios change over time. Knowing what causes these changes can help organizations set realistic coverage ratios for current and future pipelines. This, in turn, results in better visibility for projected target ARR (and the likelihood of actually reaching those goals).

Example:

If a company has the following pipeline ARR and has a target new ARR of $810,000, the coverage ratio is $2,430,000 / $810,000 = 3.0x.

| Pipeline Stage | Potential ARR |

| Prospect | $900,000 |

| Qualified | $720,000 |

| Demo | $360,000 |

| Pricing | $270,000 |

| Close | $180,000 |

| Total | $2,430,000 |

For most enterprise SaaS companies, Software Equity Group often sees ratios in the 3x to 5x realm. This average value can provide a good baseline when calculating your company’s sales pipeline ratio.

Understanding How to Weight Your Sales Pipeline

Weighted sales pipelines can help organizations determine which areas of the funnel deserve the most attention from sales and marketing teams. Depending on your company’s overarching goals, identifying “hot” leads or nurturing prospects a few months out from buying can help determine strategy and set your company up for a more sustained revenue stream. A weighted sales pipeline can be calculated by applying a probability percentage for each stage in the pipeline and multiplying it by the respective ARR in each stage.

Example:

Using the same company pipeline and target new ARR from the example above, if a company has the following probability percentages and ARR allocated for each stage in its sales pipeline for the quarter, its weighted pipeline is $909,000. If the company has a target new ARR for the quarter of $810,000, the sales team is likely to meet, and potentially exceed, the target new ARR.

| Pipeline Stage | Potential ARR | Probability Closing | Weighted Potential ARR |

| Prospect | $900,000 | 15% | $135,000 |

| Qualified | $720,000 | 30% | $216,000 |

| Demo | $360,000 | 50% | $180,000 |

| Pricing | $270,000 | 80% | $216,000 |

| Close | $180,000 | 90% | $162,000 |

| Total | $2,430,000 | – | $909,000 |

Using a weighted approach toward your sales funnel can help your company build strategies for all the major stages of a customer’s journey. Many CMOs tend to overspend on bottom-of-the-funnel prospects and ignore existing buyers who might be missing an upsell opportunity. Paying attention to retention can actually pay more dividends in the long-run since it increases metrics like LTV (long-term value).

Overall, tracking the sales pipeline gives a company more visibility into its sales process. Most importantly, this analysis will enable the company to set a realistic forecast and sales quota. If you have any questions about the sales pipeline and how to use it for revenue predictability, please don’t hesitate to reach out.