- Company

Featured Resource

CLIENT STORYModern Message

To Real Estate

Giant RealPage

- Sectors

Featured Industry Report

EXPERT SERIESManufacturing Software

Report – Part 2

- Research

Featured Resource

FEATURED REPORTThe SEG 2024

Annual SaaS Report

- Tools

Featured Resource

WHITEPAPER20 Factors to Track When Valuing Your

SaaS Company

- Blog

The Impact of Net Retention on Valuation for Public SaaS Companies

An evaluation of select public SaaS companies to demonstrate the positive correlation between net retention and EV/Revenue ratio.

Revenue growth and retention are two of the most important financial metrics to buyers in the M&A market. Growth reflects a company’s ability to differentiate and compete to win new customers in the market. Retention illustrates the product value proposition and overall customer satisfaction which impacts the lifetime value of a customer and overall SaaS unit economics. SEG’s managing partner, Allen Cinzori, discussed the importance of retention for SaaS businesses in a joint webinar with SaaS Capital and ChurnZero: Understanding SaaS Growth and Retention Metrics.

At the onset of the COVID-19 pandemic, SEG surveyed 50 PE firms and 25 strategic buyers, asking which of these metrics is more important. The overwhelming response was retention and particularly, net retention(1). Considering SaaS companies did not exist in mass during the Global Financial Crisis, this economic recession serves as the first considerable test for SaaS companies’ ability to retain customers during a downturn.

Why Net Retention?

Gross retention is obviously very important too, as it demonstrates to buyers just how mission critical a company’s product truly is. However, net retention shows customers are continuing to find value in the product, while increasing product reliance and usage, thus driving higher customer lifetime value.

An interesting example to visualize the importance of net retention’s impact on valuation is viewing two companies as rowboats on a lake (“Boat A” and “Boat B”). Both boats carry three people in them and rest in the water at the same water line (ARR Growth). But in Boat A, the three people are feverishly bailing water out to remain afloat, while in Boat B, the three people are comfortably afloat.

In this metaphor, Boat B is clearly favored, as the company maintains strong net retention and does not need to chase new customers in order to retain or grow ARR to compensate for lost customers (or existing customers that are contracting/downgrading). On the other hand, Boat A has a constant struggle of replacing churned customers, effectively straining the entire organization, from sales to account managers to the executives. In a buyer’s mind, Boat A is a more risky investment and the buyer will likely not get a return on their investment.

Example from the SEG SaaS Index

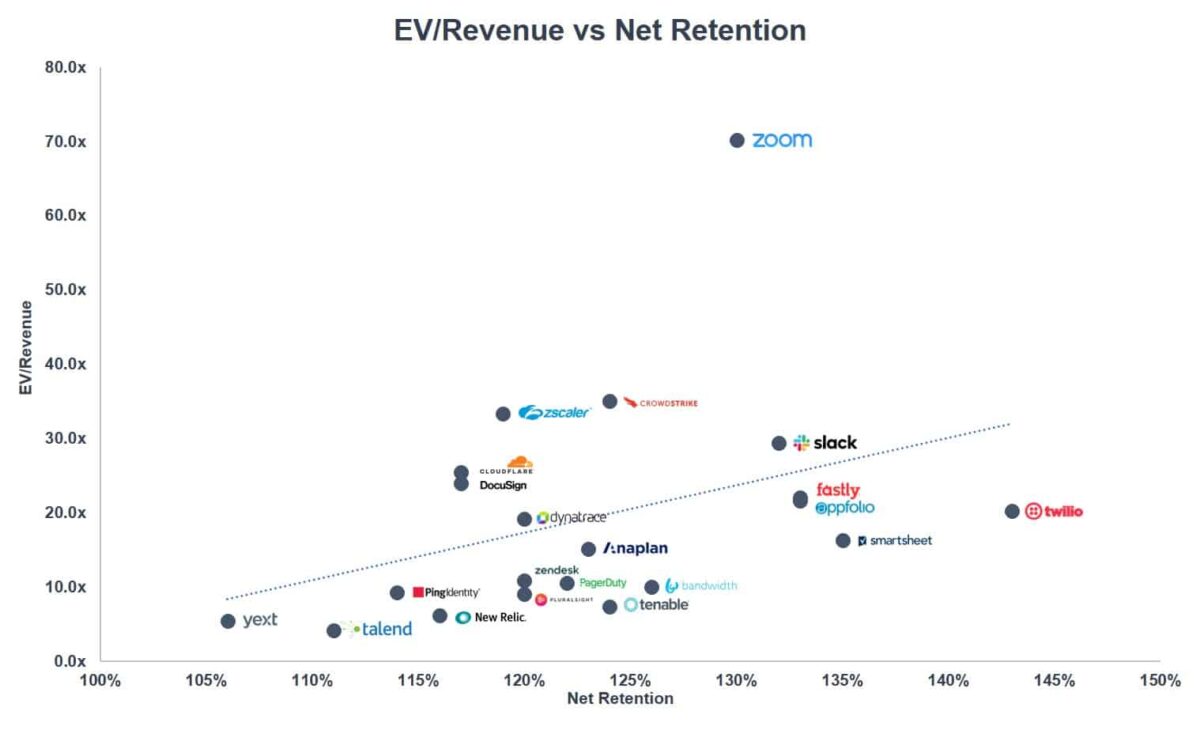

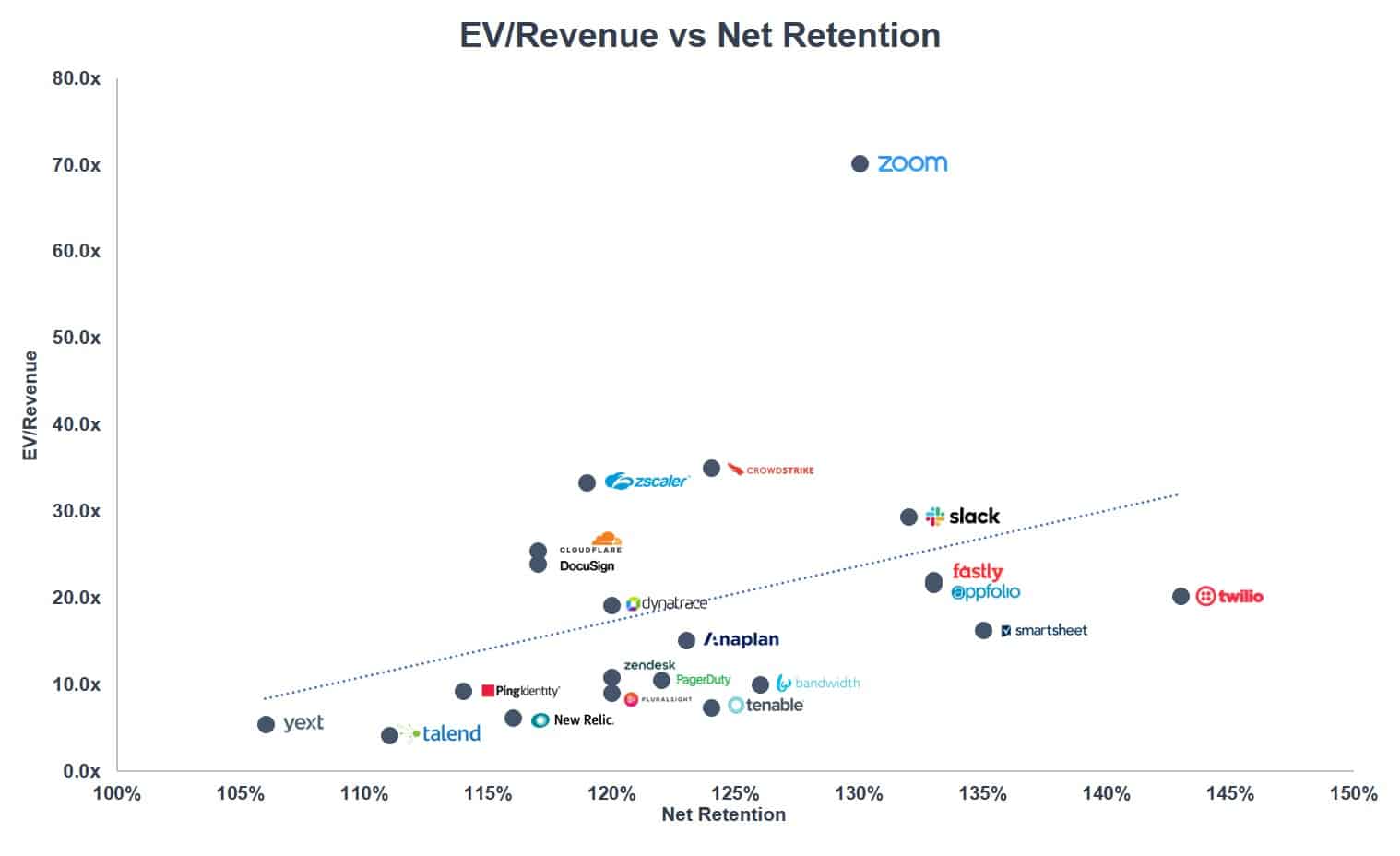

The SEG SaaS Index, which tracks 90+ publicly traded SaaS companies, provides robust insight into trends in the SaaS market. The graph below plots net retention against EV/Revenue ratio for 21 notable companies in the SEG SaaS Index(2).

Analysis

The companies in the chart above all achieved net retention of 100% or greater and saw corresponding high multiples as a result. The average EV/Revenue multiple for this cohort was 19.3x(3), and 16.7x when excluding the outlier, Zoom. Furthermore, companies with a net retention of 130% or greater posted an average EV/Revenue multiple of 21.9x. All impressive results, considering the average EV/Revenue multiple for the SEG SaaS Index was 8.8x at the end of 2Q20.

Of the companies tracked, Twilio had the highest net retention rate of 143%. This strong net retention is a major reason why the company boasts a 20.3x EV/Revenue multiple, 130.6% over the 2Q20 SaaS Index median. Smartsheet follows close behind with an impressive 135% net retention. The company’s 16.3x EV/Revenue multiple was high, yet not the highest multiple of the cohort due to the company’s reported missed billings in a recent earnings call (see more in our recent Earnings Blog).

The companies with the top five highest EV/Revenue multiples include Zoom (70.2x), Crowdstrike (35.0x), Zscaler (33.4x), Slack (29.4x), and Cloudflare (25.5x). These companies boasted an average net retention of 124%.

One company with a lower than average multiple, yet high retention rate, is Talend. Talend’s 4.2x EV/Revenue multiple is not reflective of the company’s 111% net retention rate but may be representative of the company’s slowing revenue growth (33.3% in 2Q19 vs. 19.2% in 2Q20).

Generally, the graph clearly demonstrates a positive correlation between net retention and EV/Revenue ratio. This proves that companies that are able to retain and grow within their customers, particularly in the face of a recession, are rewarded with higher multiples.

Conclusion

While the COVID-19 downturn might not be in the rearview, the data seems to support businesses providing mission critical applications can expect to drive high net retention and survive the recession – potentially even thrive. In fact, most companies in the SEG SaaS Index exhibited a stunning EV/Revenue multiple rebound during COVID-19, attributed largely to these companies’ ability to maintain net retention above 100%.

To learn more about the importance of net retention, read our recent blog: SEG Net Retention Wave.

(1) Net Retention is based on latest disclosed metrics as of 6/4/20 and is the net dollar expansion rate and net dollar retention rates.

(2) The chart plots latest disclosed net retention rates for 21 public SaaS companies against the company’s EV/Revenue on 6/4/20.

(3) EV/Revenue multiples posted as of 6/4/20.